Three ways it can pay to automate your investing

Our managed offering adds value beyond a DIY approach. Here’s how.

Key takeaways

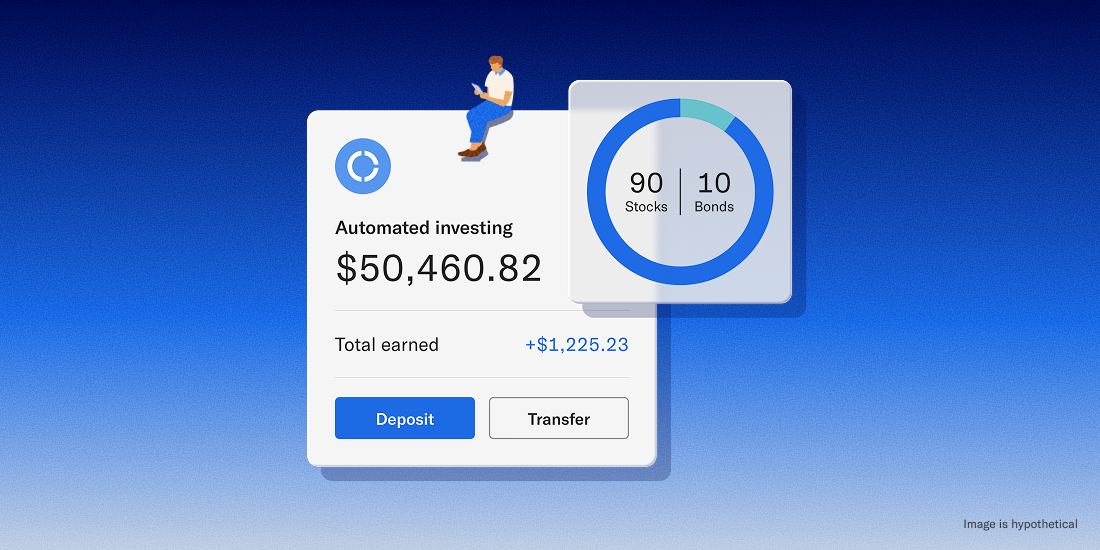

- Portfolio construction is just the beginning. Betterment’s automated investing is designed to help you manage risk, maximize returns, and minimize leg work.

- Tax-smart features help you keep more of what you earn. Fully-automated Tax Coordination and tax-loss harvesting seek out efficiencies hard to replicate by hand.

- Navigation helps keep your goals on track. Automated rebalancing, effortless glide paths, and recurring deposits make it easier to stay the course through market ups and downs.

- Peace of mind is part of the return. Automation frees up time and headspace, letting you live your life instead of worrying about your portfolio.

With the arrival of self-directed investing at Betterment, you can choose from thousands of individual stocks and ETFs on your own, including the very same funds we research and select for our curated portfolios.

So if you can now buy the same low-cost investments, why pay someone (i.e., us) to manage them for you?

It’s a fair question, and to help answer it, it helps to understand why our portfolio construction is just the beginning of the story.

It's not just the Betterment portfolio you see today, but the one you see tomorrow (and in the weeks, months, and years that follow) that captures the full value of our expertise and technology. The ongoing optimization and evolution of your portfolio, in other words, is where our automated investing really shines.

Sometimes the benefits are tangible. Sometimes they’re emotional. But regardless of how you frame it, we’re constantly working in the background to deliver value in three big ways.

- Tax savings: keeping more of what you earn

- Navigation: keeping your investing on-track

- Calm: keeping your sanity—and your spare time

1. Tax savings: keeping more of what you earn

One of the most reliable ways to increase your returns is lowering the taxes owed on your investments. And here's the first way Betterment’s managed portfolios can pay off. Our trading algorithms take tax optimization to a level that’s practically impossible to replicate on your own.

Take our Tax Coordination feature, which uses the flexibility of our portfolios to locate assets strategically across Betterment traditional IRAs/401(k)s, Roth IRAs/401(k)s, and taxable accounts. This mathematically-rigorous spin on asset location can help more of your earnings grow tax-free.

Then there’s our fully-automated tax-loss harvesting, a feature designed to free up money to invest that would've otherwise gone to Uncle Sam. Our technology regularly scans accounts to identify harvesting opportunities, then goes to work. It’s how we harvested nearly $60 million in losses for customers during the tariff-induced market volatility of Spring 2025.

Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more.

Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more.

It’s also a big reason why nearly 70% of customers using our tax-loss harvesting feature had their taxable advisory fee covered by likely tax savings.1 And with the upcoming addition of direct indexing to Betterment’s automated investing, our harvesting capabilities will only continue to grow.

1Based on 2022-2023. Tax Loss Harvesting (TLH) is not suitable for all investors. Consider your personal circumstances before deciding whether to utilize Betterment’s TLH feature. Fee coverage and estimated tax savings based on Betterment internal calculations. See more in disclosures.

2. Navigation: keeping your investing on-track

It’s easy to veer off-course when managing your own investing. Life happens, calendars fill up, and the next thing you know, your portfolio starts to drift.

When you pay for automated investing, however, you not only get our guidance upfront, you benefit from technology designed to get you to your destination with less effort. As markets ebb and flow, for example, we automatically rebalance your portfolio to maintain your desired risk level. And the “glide path” that automatically lowers your risk as your goal nears? It just happens in eligible portfolios. No research or calendar reminders needed.

Our management also helps steer your investing toward a time-tested path to long-term wealth. Most of our portfolios are globally diversified so you take advantage when overseas markets outperform. And we encourage recurring deposits so you buy more shares when prices are low.

Our management also helps steer your investing toward a time-tested path to long-term wealth. Most of our portfolios are globally diversified so you take advantage when overseas markets outperform. And we encourage recurring deposits so you buy more shares when prices are low.

Recent research by Morningstar helps quantify the value of this “dollar-cost averaging” approach. They found investors lost out on roughly 15% of the returns their funds generated due in large part to jumping in and out of the market. Betterment customers using recurring deposits, meanwhile, earned nearly ~4% higher annual returns.2 It turns out it’s easier to stay the course with a little help.

2Based on Betterment’s internal calculations for the Core portfolio over 5 years. Users in the “auto-deposit on” groups earned an additional 0.6% over the last year and 1.6% annualized over 10 years. See more in disclosures.

3. Calm: Keeping your sanity—and your spare time

Our automation can save you time—two hours for each rebalance alone3—but the value of automating your investing is more than just time saved. It’s quality time spent. How much of your finite energy, in other words, are you spending worrying about your money? We can’t erase all of your anxiety, but our team and our tech can empower you to build wealth with confidence and ease, with an emphasis on the ease.

3Based on internal data for a client with one account subject to Betterment’s TaxMin methodology and no other tax features enabled. Betterment will not automatically rebalance a portfolio until it meets or exceeds the required account balance.

Between market volatility and a constant barrage of scary headlines, the world is stressful enough right now. There’s little need to add portfolio optimization and upkeep to the list. That is, of course, unless you enjoy it. But many of us don’t. The majority of Betterment customers we surveyed said they hold most of their assets in managed accounts, with self-directed investing serving as a side outlet for exploration. That’s why we offer both ways to invest at Betterment.

The payoff is personal

Investing performance and price are often measured down to the hundredth of a percentage point. That’s “zero point zero one percent” (0.01%), also known as a “basis point" or "bip" for short. Here at Betterment, it’s our mission to make every one of the 25 bips we most commonly charge worth it. We measure our portfolio’s performance after those fees, so you see what you’ve really earned. And we don’t stop there. With direct indexing and fully paid securities lending coming soon to automated investing, you’ll get even more ways to make your money work harder.