Betterment now offers solo 401(k) accounts. In addition to the investment advisory fees associated with your personal account, Solo 401(k) accounts will also have an annual platform fee of $100 (which is waived for 2025).

Self-employed?

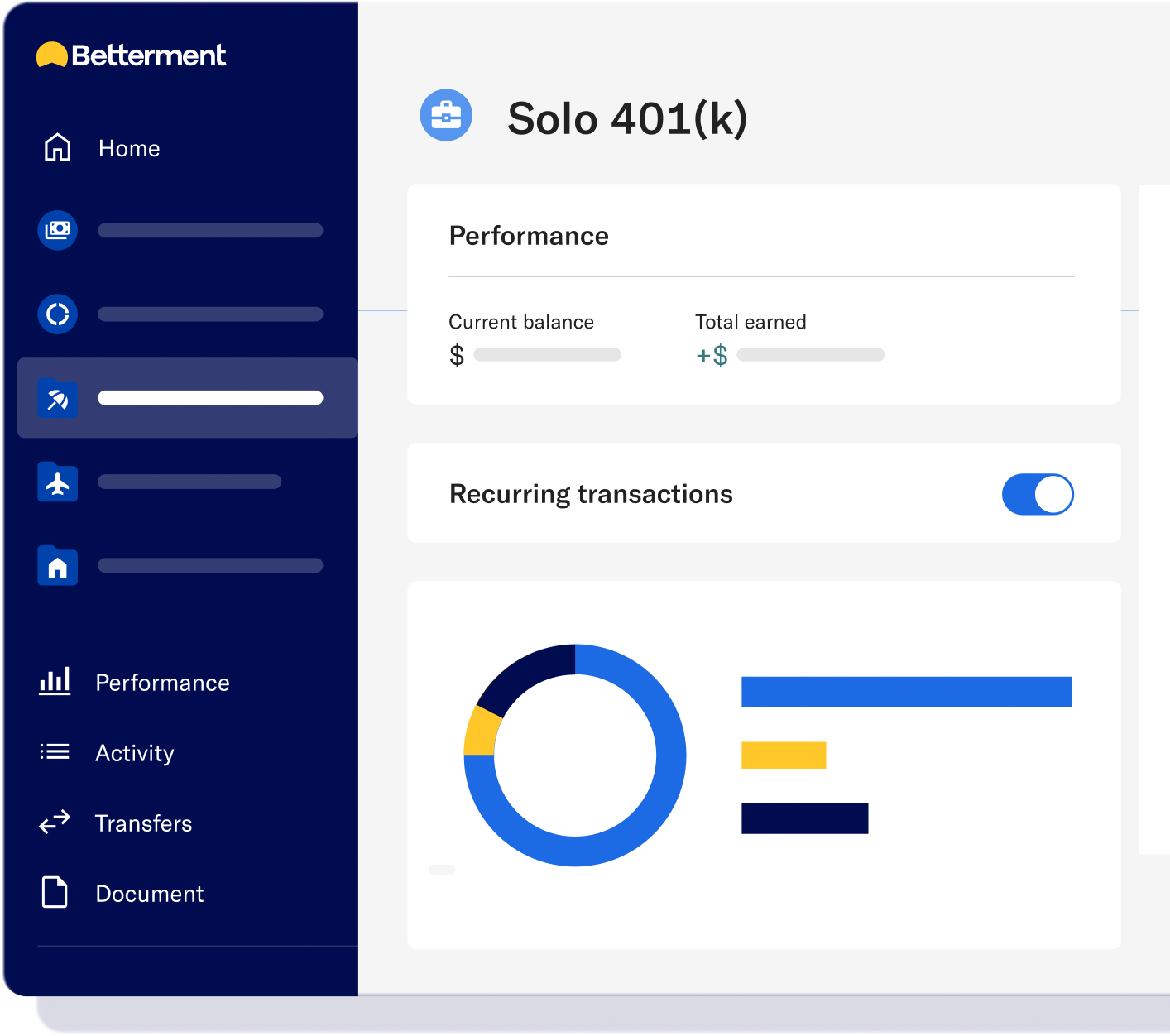

Meet your solo 401(k)

If you’re a freelancer, sole proprietor, or side-income earner,

save more for the future with the retirement account built just for you.

Schedule a call

The go-to plan for go-getters.

-

Contribute up to $70,000

Save up to $70,000 (not including catch up) in 2025 as both employer and employee. You can even contribute alongside a traditional employer 401(k). -

Get $1,500 in tax credits

You can qualify for a $500 tax credit per year for 3 years, for a total of $1,500 for including auto-enrollment. -

Pick traditional or Roth—or both

Choose pre-tax (traditional) for immediate tax savings, or after-tax (Roth) for tax-free growth. Or enjoy the best of both worlds. -

Double your household savings

Add an eligible spouse at no extra cost and boost your contributions even more.

Retirement made easy.

![]()

Simple setup with financial experts.

When you’re ready, we’ll open your account digitally, no paperwork involved. We can even help roll over your old retirement accounts.

![]()

100% digital experience.

No forms. No mailing checks. Manage and fund your account completely online. We’ll track your contributions automatically to simplify tax time.

![]()

Automate growing your retirement.

We invest your solo 401(k) in a globally diversified portfolio, handling all the trading, rebalancing, and dividend reinvesting for you.

Still have questions?

-

-

Yes, you can contribute to both the traditional (pre-tax) and Roth (after-tax) components of a single solo 401(k) plan in the same year, as long as your combined elective deferrals do not exceed the annual employee contribution limit for that year. This strategy, which requires the Solo 401(k) plan to permit both types of contributions, allows for tax diversification.

-

If you know that you’d like to add your spouse to your solo 401(k), we can include them during the initial account set up conversation.

If you’re adding a spouse after the account has already been created, or if you need to remove a spouse from the account, please reach out to our Support team for assistance.

-

No, you do not need an LLC or an S Corp to qualify for a solo 401(k); you can open one as a sole proprietor, partnership, single-member LLC, or a corporation as long as you are self-employed and your business has no employees other than yourself and your spouse. The key requirement is that the business is structured to generate active business income from self-employment.

-

If you’re looking to consolidate retirement plans into your solo 401(k), you can start that process by clicking the “Transfer or Rollover” button in your account, selecting “Rollover to Betterment,” then select your solo 401(k) as the account you’d like to roll funds into. Once you answer a few questions about the account that you’re moving, you’ll get instructions or any paperwork necessary to take the next step.

If you’re planning on transferring more than $20,000, our Licensed Concierge team may be able to help!