With U.S. markets struggling, is now the time to go global?

Here’s the case for keeping a little international exposure in your investing.

U.S. stocks have been the envy of the world since 2010, generating nearly 4 times the returns of their international counterparts.

But since April 2, President Trump’s tariff policies have dragged down U.S. stocks and left investors unnerved. Does this mean the U.S. market is toast? Certainly not, but it does signal a potential shift in foreign investment, which means that if you haven’t already, now may be the time to consider diversifying globally. And we can help on that front.

Hello, world. We're here to invest.

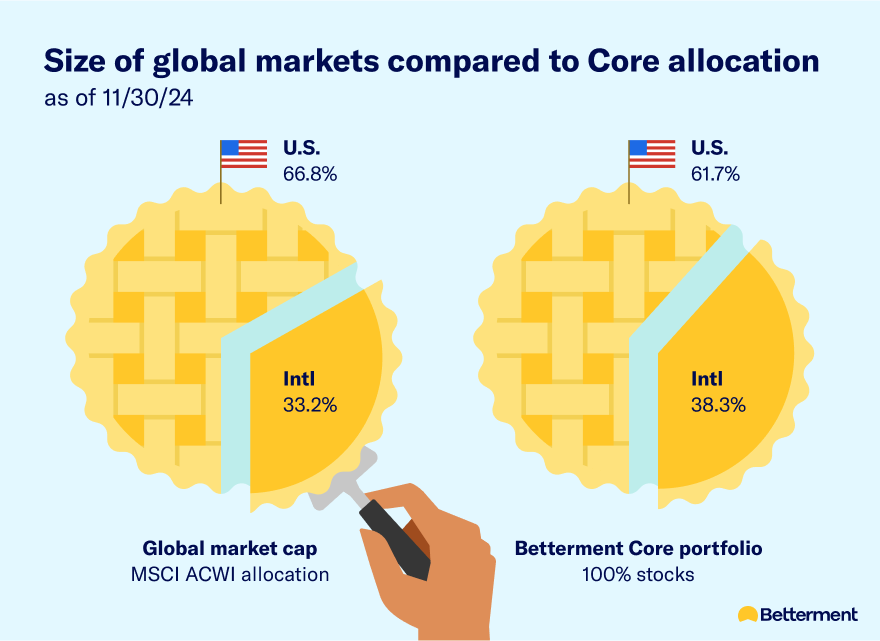

The U.S. market is big, but it’s not the only game in town. Hundreds of billions of dollars in assets trade hands in international markets each day. It's why the Betterment Core portfolio, built on the idea that more diversification equals less risk, roughly mirrors the relative weights of global markets.

Like we mentioned above, the U.S. market has been on an absolute tear the past 15 years, and even more so since 2020. This record winning streak has fueled our home bias, or the tendency for American investors to favor American markets. But history shows a pendulum that typically swings back and forth every 5 to 10 years. International markets outperformed in the 2000s, for example, and they saw a huge spike in the late 80s.

So what’s an investor to do?

If you're investing for the long term, the odds are good the U.S. market will hit at least one extended rough patch in that time. And in that scenario, a globally-hedged portfolio will very likely smooth out your returns from year to year. We’re seeing this start to play out in 2025, with the Betterment Core portfolio and its global diversification outperforming many common U.S.-only funds.

As of 5/2/2025. Betterment Core composite actual time-weighted returns: 10.52% over 1 year, 12.35% over 5 years, and 7.30% over 10 years as of 5/2/2025. Composite performance calculated based on the dollar weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net fees. Performance not guaranteed, investing involves risk.

As of 5/2/2025. Betterment Core composite actual time-weighted returns: 10.52% over 1 year, 12.35% over 5 years, and 7.30% over 10 years as of 5/2/2025. Composite performance calculated based on the dollar weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net fees. Performance not guaranteed, investing involves risk.

That being said, diversification is a sliding scale. There is no pass/fail, no good or bad. If you’re looking for a little more international exposure, but not to the extent of one of our pre-built portfolios, you can invest in our Flexible portfolio and tailor your allocation as you see fit.

But if you’re less experienced in investing, and simply want an option that requires less work, then let us do the recalibrating for you. We update our pre-built portfolios annually, finetuning our U.S. and international exposures based on the latest long-term projections. We can’t predict when the global tides will turn, but we can make sure you don’t miss out when they do.