Are stocks stuck in AI’s orbit?

Big Tech buoyed the market in 2025—We look at whether the trend will continue, and why the key to wealth remains unchanged.

Key takeaways

- The race to build AI pushed U.S. stocks higher in 2025, even as valuations crept toward bubble territory.

- The technology’s long-term impact could be revolutionary, but its short-term profits may struggle to justify Big Tech’s recent spending spree.

- Trying to time a market downturn, however, can mean missing out on meaningful gains.

- To scratch the itch for action, consider diversifying globally, investing with a safety net, and dialing in a risk level you can live with.

Stocks rallied in 2025, much of it on the back of Big Tech companies racing to develop transformative AI.

But all of those businesses’ investments in AI infrastructure—fueled more by expectations than present-day profits—have turned up the volume on talks of an AI bubble emerging. Artificial intelligence could very well revolutionize our economy, but potentially not before the market loses patience with this early round of investing and valuations come back down to earth.

So what’s an everyday investor to do? Before we suggest a few simple ways to better position yourself for the future, it can help to understand how big this AI boom may be historically-speaking, the bets behind it, and why timing its peak is so hard.

The simple metric hinting at too much AI hype

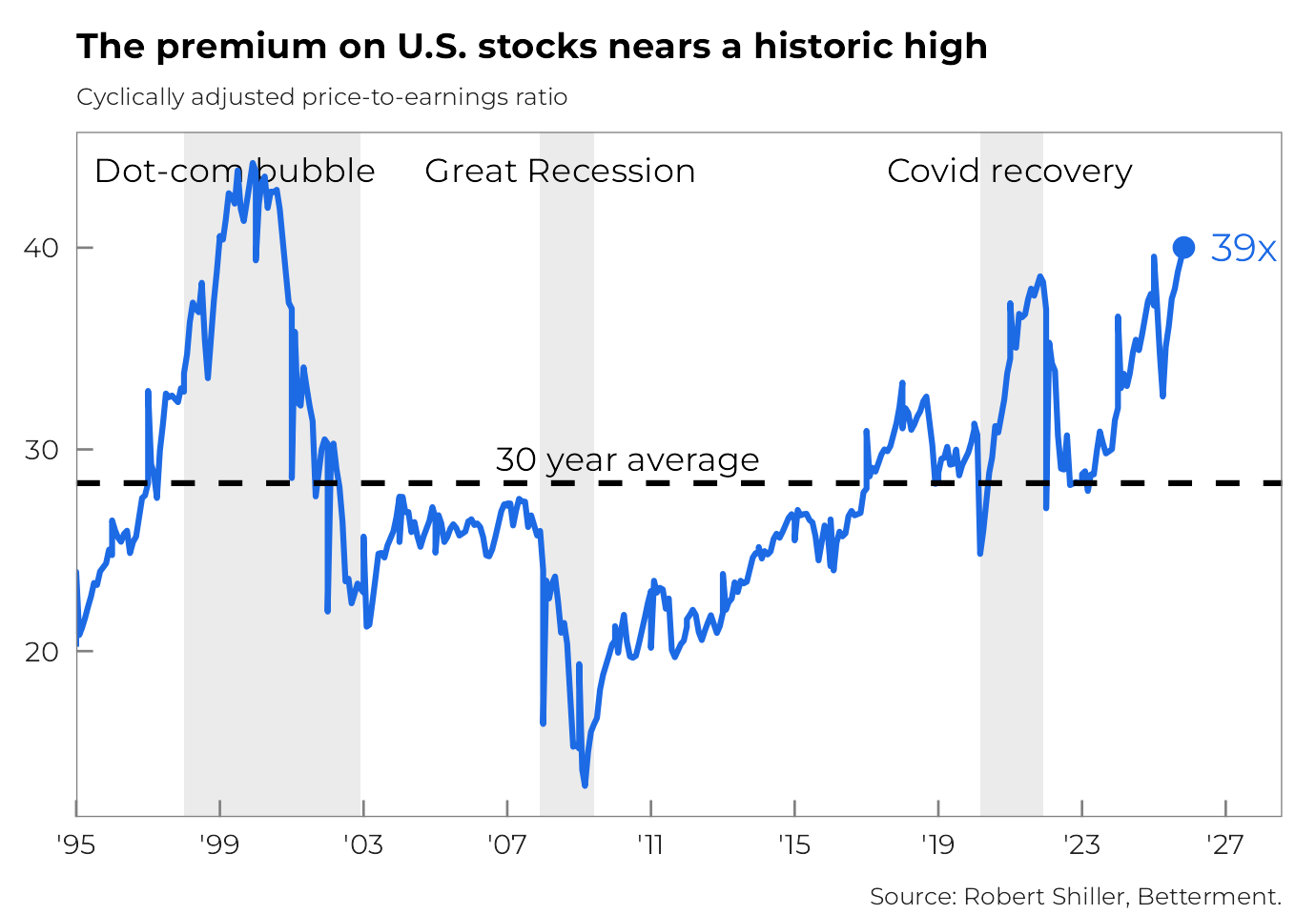

One of the most fundamental ways to size up whether an asset or market is overvalued in the present moment is its price-to-earnings (P/E) ratio. How much are people paying for it, in other words, relative to its current profits?

If this ratio gets high enough, investors start to ask themselves whether such a steep cost is worth it for a piece of those earnings. Sometimes they seek out better deals—a big reason why international stocks outperformed in 2025—and sometimes they simply keep paying the premium. But that investing crucially becomes more and more pinned on the hopes of hypothetically larger profits down the road, not the earnings generated today.

So just how big are those AI hopes right now, and how relatively expensive is it for a share of the U.S. stock market’s earnings? We’re not at dot-com bubble levels, but we’re getting close.

Investors are incredibly bullish on the promise of AI, influenced in no small part by the hundreds of billions being invested by the AI companies themselves. It’s an arms race to secure the processing power they believe will be needed to power the promised AI revolution.

Chips ahoy – How one tech giant’s expense is another’s earnings

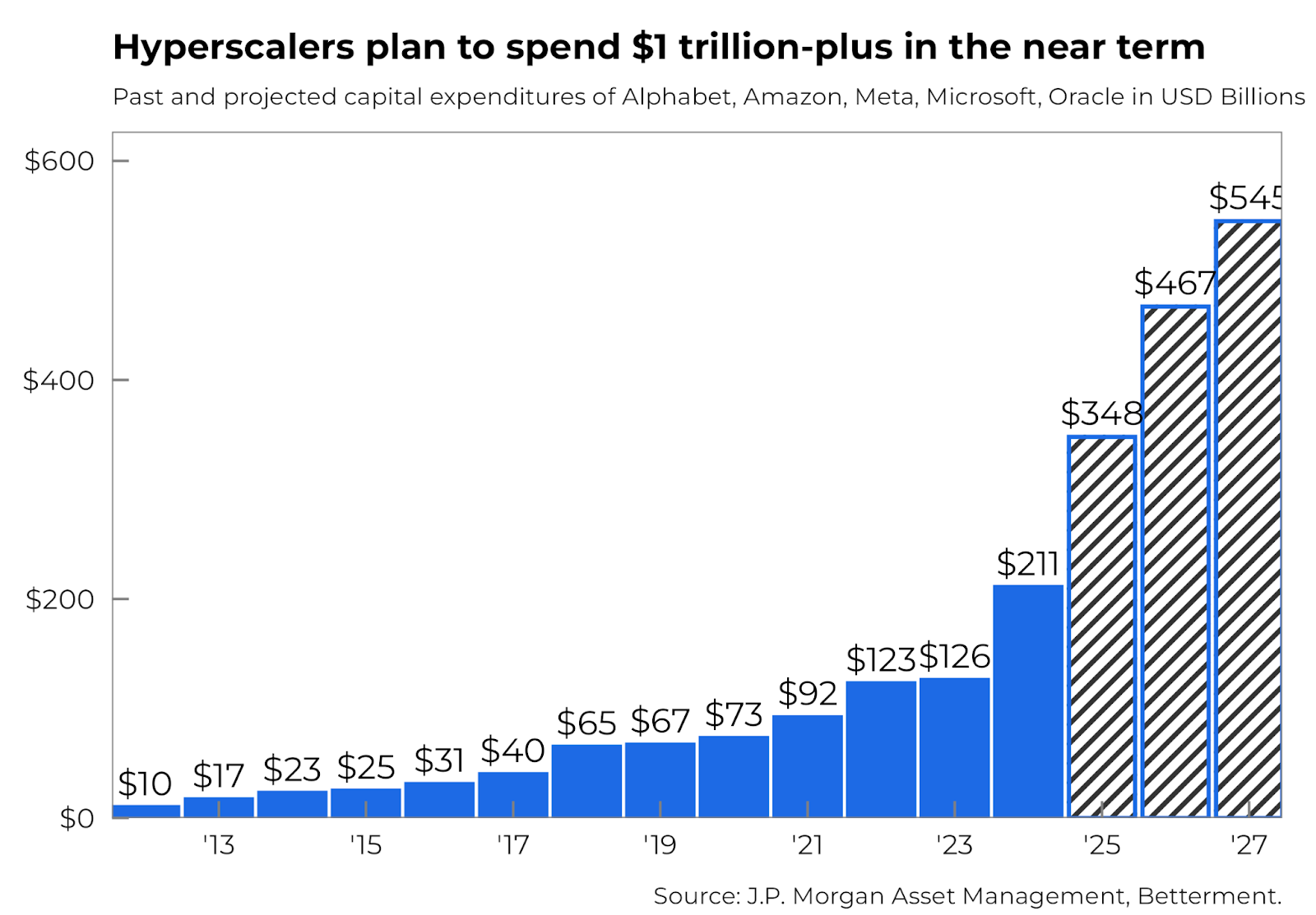

Training and delivering AI to market isn’t cheap. It requires sophisticated computing provided by power-hungry data centers. Many of the biggest tech companies, also known as “hyperscalers,” also provide this cloud computing infrastructure—and their spending on it is set to skyrocket in the coming years.

These capital expenditures support market-wide earnings growth in a couple ways. Most directly, they drive the profits of the companies selling the computer chips that power AI. It’s no coincidence that Nvidia, the biggest chip company and benefactor of this spending, is currently the most valuable company in the S&P 500.

The second way they support earnings growth is a little more indirect. And that’s because these big purchases are treated as investments, with the expense being spread out over time instead of immediately subtracted from the earnings of the companies doing the buying.

This leads to the key question behind the AI bubble debate:

Can all these chips and data centers deliver revenue in the next few years before the full bill comes due and eats into Big Tech’s earnings?

Many analysts argue no, there’s no way the trillions of investments can pay off that quickly. Others, however, believe demand for computing power will remain strong, and point out all this spending is still small relative to our economy’s overall size.

Whichever path we head down, however, no one knows exactly how fast we’ll get there. And therein lies the danger of trying to time a market peak. You could just as easily exit too early.

Why timing bubbles can get you into trouble, and what to do instead

If all of this is making you a little uneasy, you’re not alone. The thought of an upcoming market correction can be scary.

But reeling in your investments to avoid future losses can be costly. You could just as easily miss out on the growth that’s made stocks one of the most reliable builders of wealth for centuries.

Look back at the dot-com bubble itself. The “irrational exuberance” line that came to define it was coined a full three years before the market peaked. The S&P 500 more than doubled in that time.

This is why the key to building wealth is keeping a long-term mindset. It’s easier said than done, so here are three concrete steps you can take today to better position yourself and your investing for the future:

- Diversify globally. Big Tech is by far the biggest slice of the U.S. stock market. Our globally-diversified portfolios help mitigate this risk by dedicating roughly a third of their allocation to international markets, the same markets that surged ahead in 2025 and outperformed for a decade after the dot-com bubble.

- Invest with a safety net. Having a healthy emergency fund makes it less likely you’ll need to touch your investments. It can also help you sleep more soundly at night.

- Accept your own appetite for risk. Our automated investing can suggest a target allocation of stocks and bonds, gliding that risk level down as your goal nears. But there’s no shame in craving a little less volatility. You can turn off this auto-adjust feature and manually bump up your allocation of bonds by a few percentage points. This will lower your expected returns, but sometimes it’s all you need to scratch the itch for action.

Most importantly, remind yourself that however AI’s fortunes unfold in the years ahead, wealth is built over decades, not dictated by the daily headlines.