Your Betterment experience has just undergone a major upgrade

A better way to manage your money is here.

Your Betterment experience has just undergone a major upgrade, built around one idea: making managing your money more flexible and intuitive.

We’ve redesigned how your accounts and goals work together, so you can organize your money the way that makes the most sense for you.

What changed—and why?

We’ve always believed in goal-based investing. It’s what sets Betterment apart. But in the past, each goal in Betterment was tied to a single account. That worked when needs were simpler. But you asked for more flexibility to reflect your financial life, and we’ve delivered.

Now, by separating account data from goal advice, we’ve created space for more personalized guidance, clearer navigation, and more flexibility for you and your money.

Now, by separating account data from goal advice, we’ve created space for more personalized guidance, clearer navigation, and more flexibility for you and your money.

What you’ll see that’s new today:

A cleaner design:

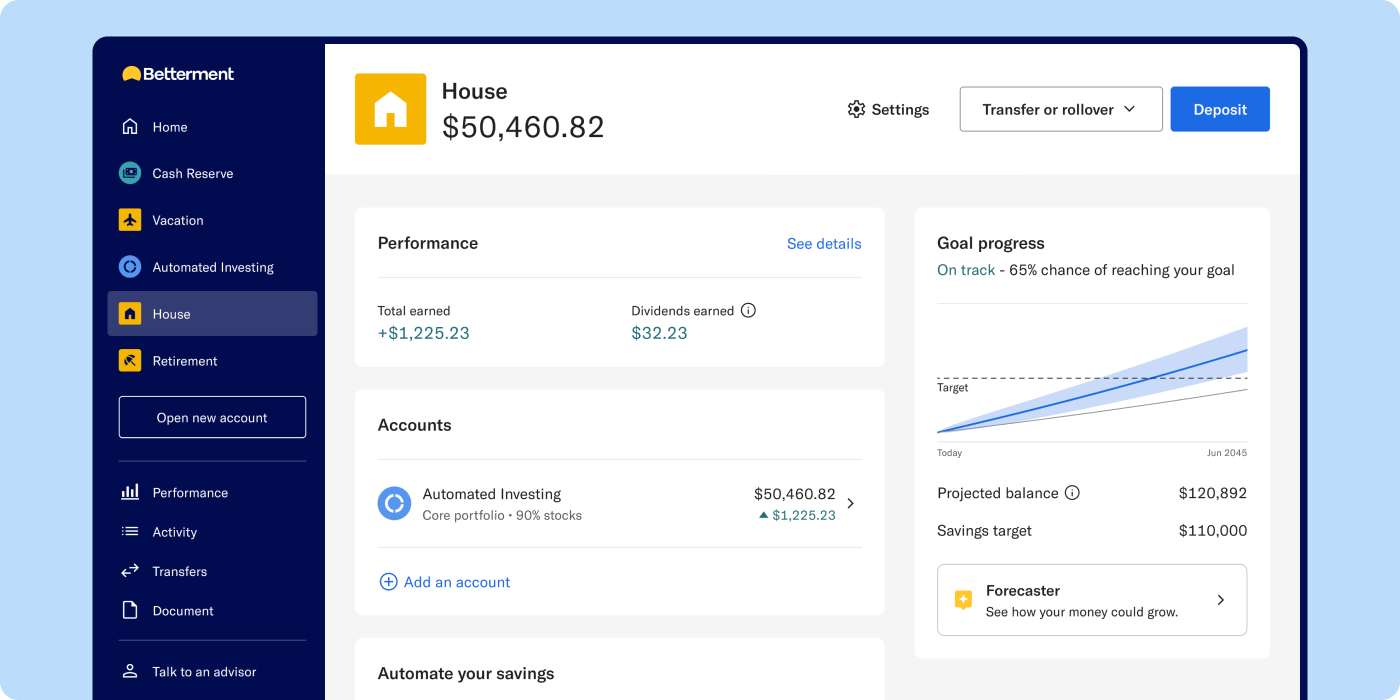

A modern look that surfaces what matters most—no more digging through tabs. A dedicated page for each goal:

A dedicated page for each goal:

Get personalized advice, projections, and next steps, all in one place. A streamlined overview of single accounts:

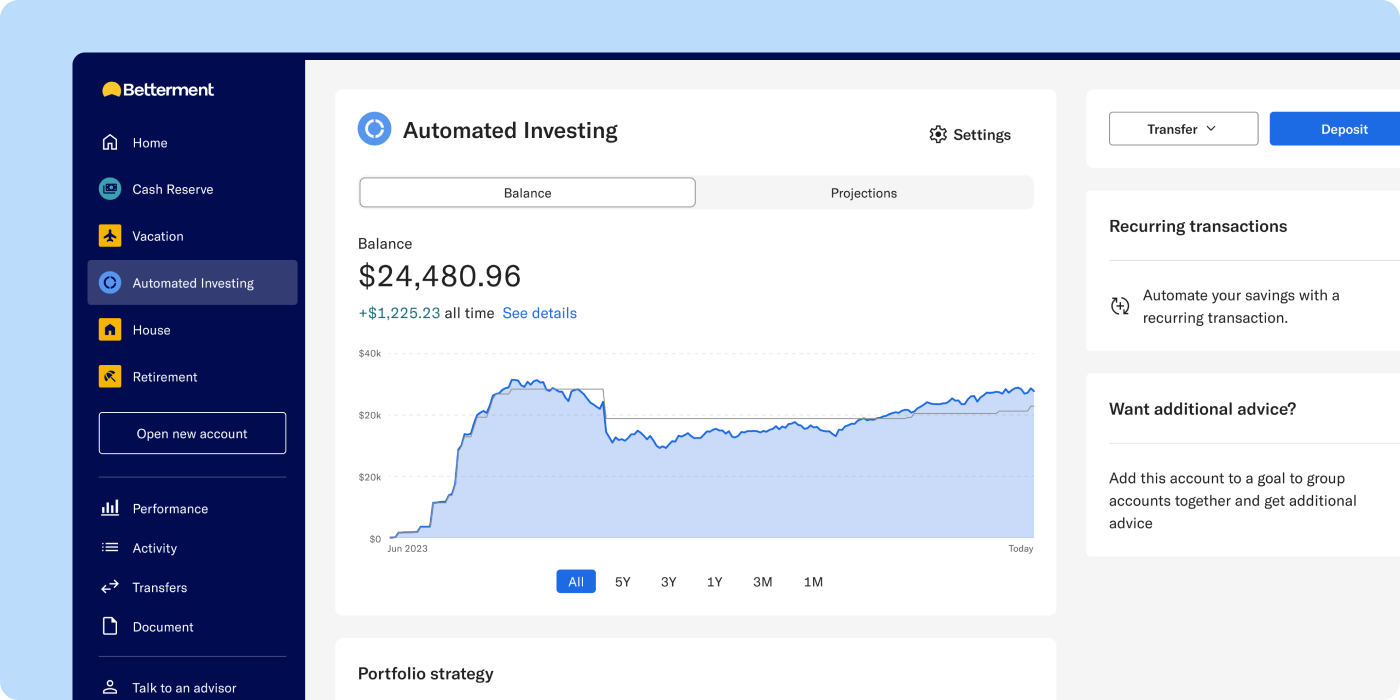

A streamlined overview of single accounts:

See balances, holdings, and performance clearly, while being able to click through directly to access account details. A dedicated goal forecaster:

A dedicated goal forecaster:

Get insights in one place to see how actions may affect future earnings. And as a BONUS:

And as a BONUS:

Your Activity Page got an upgrade 🔄

Enjoy a clearer window into trades, transfers, and transactions.

And we’re just getting started.

We’re already building the next phase of features to make your Betterment experience more powerful and flexible.

- Multiple accounts in one goal: Get combined advice across different account types and tax treatments.

- Smarter, goal-specific advice: We’ll help you optimize every dollar for what you care about most.

- Shared goals: Soon, you’ll be able to co-own a goal with another Betterment user.

- More tailored investing guidance: Tell us your goal, and we’ll recommend the best path to get there.

A faster, more user-friendly Betterment experience.

To better fit your financial needs, we’ve separated account data from goal-based advice to give you more control and a better sense of ownership over your account. Whether you're planning for retirement, building an emergency fund, or simply growing your wealth through automated investing, Betterment is now better built for how you’ll manage your money. Smarter tools, personalized advice, and goal-based investing—all working together for you.