Getting Started

-

![]()

How auto-enrollment in a 401(k) plan works: Benefits & what it means for your retirement savings

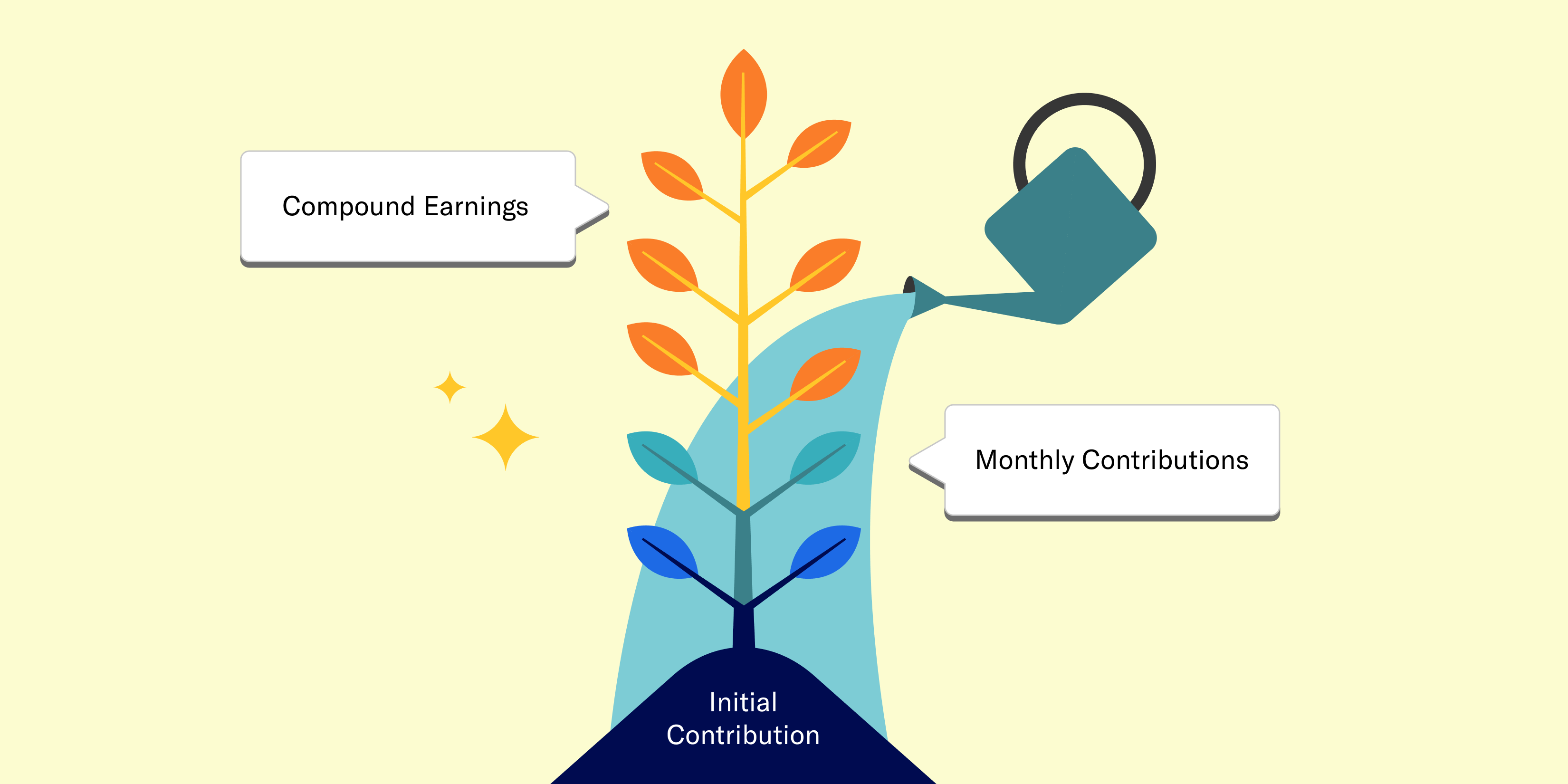

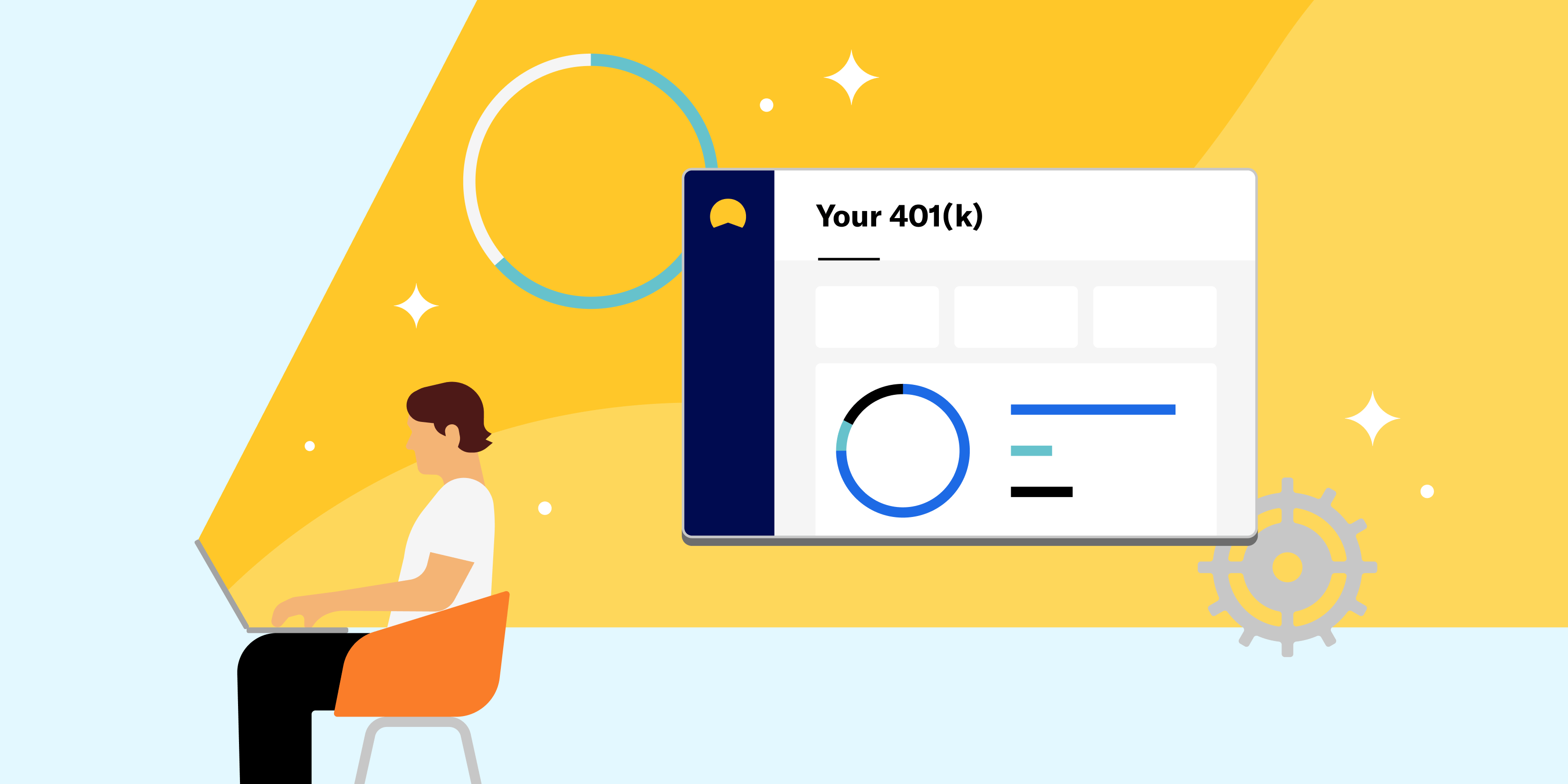

How auto-enrollment in a 401(k) plan works: Benefits & what it means for your retirement savings The best time to start saving for retirement is…now. Features like auto-enrollment and auto-escalation make it easy to save for your golden years with little effort on your part. If you’re unfamiliar with these features, keep reading to see how they can help you start saving today for tomorrow. While auto-enrollment and auto-escalation have been around for years, some employers are now required to turn on these features due to SECURE 2.0, legislation aimed at helping employees save for retirement. These features are designed to automatically enroll employees into their company’s 401(k) plan and increase contributions over time. So, how does auto-enrollment work, and what does it mean for your retirement savings plan? Scroll down to learn more about: What is auto-enrollment Benefits of auto-enrollment How to check if you've been auto-enrolled in your company’s 401(k) Changing your contribution rate How Betterment at Work can help you optimize your saving strategy What is auto-enrollment in a 401(k)? There are plenty of reasons why people hesitate to set money aside for retirement—daily expenses, not knowing how much to save, not knowing how to sign up, to name a few— but auto-enrollment can make it easy to get started. Companies will auto–enroll new hires at a default rate—typically 3-8%—which you can adjust at any time. Once your money is in the market, you’ll benefit from a little thing called compound interest: The interest your money earns also accrues interest over time. Let’s explore other ways auto-enrollment makes saving for retirement easy… Benefits of auto-enrollment in a 401(k): Automatically save for retirement: Starting a new job can be overwhelming with so many new benefits to consider (healthcare, life insurance, etc), but with auto-enrollment, you can start saving for retirement immediately without having to take any action. Employer match contributions: If your employer offers a match, auto-enrollment ensures you won’t miss collecting this sweet financial boost. Tax advantages: Good news! Since 401(k) contributions are made pre-tax, this lowers your taxable income —which can help you hold onto more of your hard-earned cash. Early and consistent long-term saving: You can stay on track with minimal effort, thanks to auto-escalation. If you’re auto-enrolled, your default rate will increase 1% each year, to a maximum set by your employer (no greater than 15%), unless you adjust the contribution rate yourself. Whenever you log in and adjust your contribution rate, auto-escalation is turned off. By incrementally upping your contribution rate, auto-escalation ensures you’re saving more over time—and simplifies the decision-making process. How to check if you’ve been auto-enrolled in your company’s 401(k): If you’ve never logged in before, you’ll first have to activate your account. Visit betterment.com/accountaccess to get started. Once you’re in, you can see the status of your account by selecting the “Retirement” goal from the left-hand side of the screen. Click on “Activity” to review your past contributions. It’s a good idea to monitor your contribution rate, and increase it when you can. Many experts recommend contributing 10–15% of your paycheck towards retirement so you have enough to live on. 10-15% may sound like a lot, so start with anything you’re comfortable with. Many auto-enrollment plans enroll employees at a low contribution rate, like 3% – but it’s important to keep in mind that that’s just a starting point. The point of auto-escalation is to keep it moving into that sweet spot of 10-15% over time. As always, Betterment is here to help you confidently plan for retirement, with the tools and resources you need to make smart decisions for your money. Remember, small, consistent contributions can really add up. With auto-enrollment and auto-escalation, you can put your savings on auto-pilot, so you can focus on the rest of your life. -

![]()

How employer 401(k) matching works and why it matters

How employer 401(k) matching works and why it matters Learn how employer 401(k) matching can boost retirement savings, and why this benefit is essential for a secure financial future. A 401(k) match is one of the most valuable benefits employers offer—yet many employees don’t really understand how it works, or how to take advantage of it. In 2023, 68% of U.S. employees surveyed in our Retirement Readiness Report received a 401(k) match—of those who didn’t, a whopping 92% named it as the benefit they’d most like to receive. So, what makes a 401(k) match so enticing? Below, we’ll explore: Different types of 401(k) matches How to make the most of a 401(k) match Vesting schedules How Betterment can help you take advantage of your employer match What is a 401(k) match? A 401(k) match is when employers contribute to your 401(k), matching a percentage of your salary—to help grow your retirement savings. But not all matches are created equal. Knowing what kind of match your employer offers is important, and there are a few variations, including: Dollar-for-Dollar Match: The employer matches each dollar contributed to the 401(k), up to a specified percentage. This amount varies by employer but typically ranges from 3-6% of the employee's salary. Here’s an example: Jack makes $80,000/ year, and puts $8,000 annually into his 401(k), which is 10% of his salary. His employer contributes up to 3% of his salary, or $2,400. Jack’s total contribution for the year, with the employer match, is: $10,400. Partial Match: The employer matches a percentage of the employee’s contributions. For example, the employer might match 50% of contributions, up to 6% of the employee’s salary. Let’s take a look, using Jack’s $80,000 salary: Jack contributes 10% of his salary, or $8,000. 6% of his salary is $4,800. If his employer contributes 50% up to 6% of his salary, the employer contribution is: $2,400/ year. Jack’s total contribution, with the employer match, is: $10,400. Tiered Match: The employer matches a percentage of contributions up to a limit, then offers a different percentage above that threshold. For example, the employer might match 100% up to 3% of the employee's salary, and then 50% on the next 3%. Jack contributes 10% of his $80,000 salary to his 401(k), which is $8,000 per year. His employer matches 100% of the first 3%, which is $2,400, plus 50% on the next 3%, which is $1,200. The employer contribution is $3,600 for the year. Jack’s total contribution, with the employer match, is $11,600. 401(k) Match on Student Loan Payments: With new SECURE 2.0 legislation, employers can now make 401(k) contributions based on qualified student loan payments. This means your student loan payments can unlock retirement savings—even if you’re not contributing directly to your 401(k). Over the last decade, student loan debt has increased by 56%, making it harder for many to save for retirement. Betterment is proud to have been the first to offer a 401(k) match on student loan payments. If Jack earns $80,000 per year and pays $500 per month toward his student loans, totaling $6,000 annually. His employer offers a 100% match on contributions up to 4% of his salary—whether he allocates contributions solely to student loan payments or splits them between student loan payments and 401(k) contributions. Based on Jack’s payments, his employer will contribute $3,200 per year directly to his retirement plan. How to maximize your employer match Once you’ve determined what type of 401(k) match your employer offers, you’ll want to make sure you’re getting the most out of it. Here are some things to keep in mind: Get started as soon as possible: First, you’ll need to claim your 401(k) if you haven’t already. The sooner you start saving, the longer your contributions will have to grow, compounding over time (think of it as a snowball rolling downhill). Contribute enough to get the full 401(k) match: Don’t leave money on the table. Although some experts recommend contributing 10–15% of your paycheck, you can start smaller, increasing when it works for you. Pro tip: If you get a raise, you might want to consider increasing your contributions. Review vesting schedules: Some employers require you to stay with the company for a certain time before the matched funds are completely yours. We’ll dig into more on that below. Traditional vs. Roth 401(k) contributions with a 401(k) match If your employer offers a traditional 401(k) and a Roth 401(k), you can choose where to put your money. With Betterment, employer matching contributions go into a traditional 401(k), but this can vary with other plan providers. These contributions are tax-deferred. You won’t have to pay taxes on them until you withdraw the funds in retirement. Understanding vesting schedules You’ll want to read up on your company’s vesting schedule, so you know when you fully “own” your employer’s contributions to your 401(k). Immediate vesting means there is no waiting period. Once the employer contributions land in your account, they are fully yours. If you leave the company, you can take 100% of the matched contributions with you. With graded vesting, you gradually gain “ownership” over the employer match contributions. For example, you might get 25% after the first year, 50% after the second, and so on. Understanding your company’s vesting schedule is critical for making long-term career decisions. If your employer contributes to your 401(k), Betterment can help you track contributions, optimize your saving strategy, and ensure you’re making the most of your match. Ready to get started? Claim your account at betterment.com/accountaccess. Want to check to see if your employer offers a match? Log in to review your account. -

![]()

Investing in Your 20s: 4 Major Financial Questions Answered

Investing in Your 20s: 4 Major Financial Questions Answered When you're in your 20s, you may be starting to invest or you might have some existing assets you need to take better care of. Pay attention to these major issues. For most of us, our 20s is the first decade of life where investing might become a priority. You may have just graduated college, and having landed your first few full-time jobs, you’re starting to get serious about putting your money to work. More likely than not, you’re motivated and eager to start forging your financial future. Unfortunately, eagerness alone isn’t enough to be a successful investor. Once you make the decision to start investing, and you’ve done a bit of research, dozens of new questions emerge. Questions like, “Should I invest or pay down debt?” or “What should I do to start a nest egg?” In this article, we’ll cover the top four questions we hear from investors in their twenties that we believe are important questions to be asking—and answering. “Should I invest aggressively just because I’m young?” “Should I pay down my debts or start investing?” “Should I contribute to a Roth or Traditional retirement account?” “How long should it take to see results?” Let’s explore these to help you develop a clearer path through your 20s. “Should I invest aggressively just because I’m young?” Young investors often hear that they should invest aggressively because they “have time on their side.” That usually means investing in a high percentage of stocks and a small percentage of bonds or cash. While the logic is sound, it’s really only half of the story. And the half that is missing is the most important part: the foundation of your finances. The portion of your money that is for long-term goals, such as retirement, should most likely be invested aggressively. But in your twenties you have other financial goals besides just retirement. Let’s look at some common goals that should not have aggressive, high risk investments just because you’re young. Emergency fund. It’s extremely important to build up an emergency fund that covers 3-6 months of your expenses. We usually recommend your emergency fund should be kept in a lower risk option, like a high yield savings account or low risk investment account. Wedding costs. According to the U.S. Census Bureau, the median age of a first marriage for men is 29, and for women, it’s 27. You don’t want to have to delay matrimony just because the stock market took a dip, so money set aside for these goals should also probably be invested conservatively. A home down payment. The median age for purchasing a first home is age 33, according to the the National Association of Realtors. That means most people should start saving for that house in their twenties. When saving for a relatively short-term goal—especially one as important as your first home—it likely doesn’t make sense to invest very aggressively. So how should you invest for these shorter-term goals? If you plan on keeping your savings in cash, make sure your money is working for you. Consider using a cash account like Cash Reserve, which could earn a higher rate than traditional savings accounts. If you want to invest your money, you should separate your savings into different buckets for each goal, and invest each bucket according to its time horizon. An example looks like this. The above graph is Betterment’s recommendation for how stock-to-bond allocations should change over time for a major purchase goal. And don’t forget to adjust your risk as your goal gets closer—or if you use Betterment, we’ll adjust your risk automatically with the exception of our BlackRock Target Income portfolio. “Should I pay down my debts or start investing?” The right risk level for your investments depends not just on your age, but on the purpose of that particular bucket of money. But should you even be investing in the first place? Or, would it be better to focus on paying down debt? In some cases, paying down debt should be prioritized over investing, but that’s not always the case. Here’s one example: “Should I pay down a 4.5% mortgage or contribute to my 401(k) to get a 100% employer match?” Mathematically, the employer match is usually the right move. The return on a 100% employer match is usually better than saving 4.5% by paying extra on your mortgage if you’re planning to pay the same amount for either option. It comes down to what is the most optimal use of your next dollar. We've discussed the topic in more detail previously, but the quick summary is that, when deciding to pay off debt or invest, use this prioritized framework: Always make your minimum debt payments on time. Maximise the match in your employer-sponsored retirement plan. Pay off high-cost debt. Build your emergency fund. Save for retirement. Save for your other goals (home purchase, kid’s college). “Should I contribute to a Roth or Traditional retirement account?” Speaking of employer matches in your retirement account, which type of retirement account is best for you? Should you choose a Roth retirement account (e.g. Roth 401(k), Roth IRA) in your twenties? Or should you use a traditional account? As a quick refresher, here’s how Roth and traditional retirement accounts generally work: Traditional: Contributions to these accounts are usually pre-tax. In exchange for this upfront tax break, you usually must pay taxes on all future withdrawals. Roth: Contributions to these accounts are generally after-tax. Instead of getting a tax break today, all of the future earnings and qualified withdrawals will be tax-free. So you can’t avoid paying taxes, but at least you can choose when you pay them. Either now when you make the contribution, or in the future when you make the withdrawal. As a general rule: If your current tax bracket is higher than your expected tax bracket in retirement, you should choose the Traditional option. If your current tax bracket is the same or lower than your expected tax bracket in retirement, you should choose the Roth option. The good news is that Betterment’s retirement planning tool can do this all for you and recommend which is likely best for your situation. We estimate your current and future tax bracket, and even factor in additional factors like employer matches, fees and even your spouse’s accounts, if applicable. “How long should it take to see investing results?” Humans are wired to seek immediate gratification. We want to see results and we want them fast. The investments we choose are no different. We want to see our money grow, even double or triple as fast as possible! We are always taught of the magic of compound interest, and how if you save $x amount over time, you’ll have so much money by the time you retire. That is great for initial motivation, but it’s important to understand that most of that growth happens later in life. In fact very little growth occurs while you are just starting. The graph below shows what happens over 30 years if you save $250/month in today’s dollars and earn a 7% rate of return. By the end you’ll have over $372,000! But it’s not until year 5 that you would earn more money than you contributed that year. And it would take 18 years for the total earnings in your account to be larger than your total contributions. How Compounding Works: Contributions vs. Future Earnings The figure shows a hypothetical example of compounding, based on a $3,000 annual contribution over 30 years with an assumed growth rate of 7%, compounded each year. Performance is provided for illustrative purposes, and performance is not attributable to any actual Betterment portfolio nor does it reflect any specific Betterment performance. As such, it is not net of any management fees. Content is meant for educational purposes on the power of compound interest over time, and not intended to be taken as advice or a recommendation for any specific investment product or strategy. The point is it can take time to see the fruits of your investing labor. That’s entirely normal. But don’t let that discourage you. Some things you can do early on to help are to make your saving automatic and reduce your fees. Both of these things will help you save more and make your money work harder. Use Your 20s To Your Advantage Your 20s are an important time in your financial life. It is the decade where you can build a strong foundation for decades to come. Whether that’s choosing the proper risk level for your goals, deciding to pay down debt or invest, or selecting the right retirement accounts. Making the right decisions now can save you the headache of having to correct these things later. Lastly, remember to stay the course. It can take time to see the type of growth you want in your account. -

![]()

Welcome to Your 529 Education Savings Benefit

Welcome to Your 529 Education Savings Benefit Use this step-by-step guide to get started We’re excited you’re here and ready to get set up with a 529! You can enroll in a new 529 plan, select plan-specific investments, connect existing 529 accounts, and automate payroll deductions all within the Betterment app. Use the step-by-step guide below to get started. Setting up a new 529 Get started Log in to your account, and choose: Add new goal. Click on 529 Plan. Answer a few questions about your savings goals. Choose your 529 plan Betterment will display one or more 529 plans you might be interested in based on your location, your beneficiary’s age, and any income tax benefits that may be available to you. You can pick one of those, or review all other options. If you choose a plan that can be integrated within the Betterment experience, you’ll move on to the steps below. Note that integrated 529 accounts and their plans are not managed by Betterment and instead are held and managed by program administrators of each 529 plan. If your selected plan is not eligible to integrate, you can still access and connect it to Betterment manually, and take advantage of Betterment’s other products alongside your education savings account. Select a portfolio Within each plan, there are two types of investment options: Choose a portfolio that’s managed for you by the plan investment manager and automatically adjusts over time. Choose to manage your own portfolio to reflect your time frame and desired risk level. This option gives you more direct control. Enroll in a plan Complete paperwork: Confirm details about yourself and any beneficiaries. All set! Check out your new goal in your Betterment dashboard! Connecting an existing 529 account Get started Log in to your account, and choose: Add new goal. Click on the 529 Goal. Click on Connect an existing 529 (If you choose a plan that can be integrated within the Betterment experience, you’ll move on to the steps below. Note that integrated 529 accounts and their plans are not managed by Betterment and instead are held and managed by program administrators of each 529 plan. If your selected plan is not eligible to integrate, you can still access and connect it to Betterment manually, and take advantage of Betterment’s other products alongside your education savings account.) Tell us your account number. Read and sign our Terms and Conditions. Authorize Betterment to access your account. In the Betterment app, you will now see your 529 plan in your dashboard. Set up contributions Navigate to set up contributions or deposits. You have two ways to contribute toward your 529 account: through payroll deductions or by linking a bank account within Betterment: Payroll deductions (post-tax): These payments are eligible for an employer match, if your employer offers one. Select Payroll deduction to have contributions automatically come out of your paycheck. Choose a 529 account to contribute to. Decide how much money you want to contribute per pay period. Review and approve your contribution rate. Linked bank account: Select Linked bank account Choose a 529 account to contribute to. Decide how much you want to contribute and at what frequency. Review and approve your contribution rate. Dashboard overview Overview tab: View all of your 529 accounts and balances. Note that payments typically take 5-7 days to process. Activity tab: See your Betterment payment activity. Settings tab: See your 529 account details and link your Betterment account directly to your 529 plan account in order to navigate back and forth seamlessly. -

![]()

How to pick a 401(k) contribution rate

How to pick a 401(k) contribution rate Your 401(k) contribution rate - also known as a deferral rate or savings rate - is a key part of a successful retirement strategy. You’ve taken that first step and have set up your Betterment 401(k) account - well done! One important piece to consider next is your contribution rate - how much from each paycheck will go into your account? With your Betterment 401(k), you could use a percentage or a fixed dollar amount, whichever you prefer. Here are a few other things to consider: Were you automatically enrolled? Many employers choose to automatically enroll their employees in the plan with a default contribution rate of 3% – if you're not sure, please check with your employer or take a look in your Retirement goal. Keep in mind, whatever the default contribution rate is, it’s just a starting point. You can (and probably should) increase that contribution rate at any time in your account. At least a decade without a paycheck Most experts recommend contributing 10%–15% of your paycheck to have enough to last you through retirement - which could be 20-30 years considering how long people are living! If you retire at age 65, with a healthy lifestyle and no major risk factors, you could live well into your 80s or 90s. That means you'll want to set yourself up for living off your personal savings and investments for about 20 years! Starting small is better than nothing If 10-15% of your paycheck sounds absurd to you right now - deep breath, think of that as something to aim for. You can start with something smaller, maybe 5 or 6%, and slowly but surely increase your savings rate every year – your birthday? Give yourself a gift and increase it by 1%. Your work anniversary? Cheers to you, bump it up again. And those 1% increases can actually be a big deal. Go for the max Because of its tax benefits, the IRS sets a limit on how much you can put into your 401(k) every year. So you could aim to contribute as much as the IRS allows! For people 50 and over, the limit is higher, which is referred to as “catch-up contributions.” And if you really want to be an over-achiever, you can also contribute to an IRA, an individual retirement account, to save even more. Tax considerations With your Betterment 401(k), you can make contributions into a traditional 401(k) account and/or a Roth 401(k). There are tax benefits to both: Traditional 401(k): Contributions are deducted from your paycheck before taxes are withheld, which can lower your taxable income. Both your contributions and investment earnings are “tax-deferred,” meaning you won’t pay taxes on what you contributed to the account as well as any earnings until you withdraw the money at retirement. In other words, save on taxes now, pay taxes later. Roth 401(k): Contributions are made with after-tax dollars so your withdrawals—both the contributions and earnings—are tax-free once you decide to retire (minimum age, 59½), and as long as you’ve held the Roth account for at least five years. In other words, pay taxes now, no taxes later. Remember that you can use both! Say you want to contribute 10% towards your retirement? You can put 5% into a traditional 401(k) and 5% into the Roth 401(k). This is one way you can balance your tax exposure. If you already have your account set up, log in today to adjust your contribution rate or reassess your traditional and Roth contributions. Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

When’s the best time to invest for retirement? Now.

When’s the best time to invest for retirement? Now. Should you start saving for retirement? Unless you are on one of those richest-people-in-the-world lists - then the answer is, most likely, yes. From paying the rent or mortgage, credit card bills, student loans, daily living expenses - there are a lot of things competing for your money’s attention! The idea of saving for retirement can easily be pushed to the backburner for all of those other - completely understandable! - reasons. But we’re here to say - hold the phone. Even a little bit into a 401(k) can make a huge difference for your retirement. Rock and roll When a rock rolls down a hill, it goes faster and faster on its way down. It has something to do with momentum and physics – we’re not scientists here, we’re investment professionals. But the same concept applies to your 401(k) - not because of physics, but because of compounding interest. Compounding interest means that not only are your original dollars growing based on potential stock market gains, but that newly earned money also grows whenever the stock market goes up! Give compounding time to shine If the magic of compounding interest isn’t enough to get you going right away, there is one other factor to consider. If someone starts saving 6% of their paycheck at age 25, they are expected to end up with more money at age 65 than someone who contributes 10% starting at age 40. And here’s the real kicker - the person who’s doing 10% starting at age 40 will put in more of their own dollars, and is still expected to end up with less by the time they reach age 65. How is that possible? The 6% contributions had more time to grow – more time to roll down that hill gathering speed – or in this case – money. If you already have an account, log in today to view your contribution rate and consider giving it a bump – even a 1% increase can make a difference in your retirement years! Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

Getting started with your Betterment 401(k)

Getting started with your Betterment 401(k) Your employer chose Betterment as its 401(k) provider - so come on in and be invested for your future. Traveling around the world. Taking up a new hobby. Spending more time with family and friends. Whatever your retirement dreams are, a 401(k) can help you make them a reality. And luckily for you, your employer chose Betterment to manage its 401(k) plan. Top 3 perks of a 401(k) Participating in your employer’s 401(k) plan is a good idea for many reasons – here are the top three. With a 401(k), you can: Contribute via convenient, automatic payroll deductions (one less thing to think about!). Save on taxes, whether those savings happen today with a traditional 401(k) or at retirement with a Roth 401(k) (and the cool thing is that you can use both!). Invest more than with other retirement vehicles (individual retirement accounts (IRAs) have lower caps on how much you can put in). All said, saving for retirement with a 401(k) is basically a no-brainer. Without a regular paycheck in retirement, you’re going to rely on your own savings. And we’re not talking about cash-under-the-mattress savings or even safe-in-the-bank savings - but invested savings, which is what you get with a 401(k). (Why is it so critical to invest for long-term goals, rather than simply saving money in the bank? To tackle one word: Inflation.) Top Betterment features Betterment offers several features to help you pursue your retirement goals: Goal based – Your 401(k) will automatically be a “Retirement” goal on the Betterment platform (you could add additional goals for other things if you want). Our goal-based platform looks at your timeline until retirement and the desired amount you want to save, to help you invest in an expert-built portfolio. Low cost – Our approach uses low-cost exchange-traded funds (ETFs) so more of your money stays invested in your account. High tech –Certain portfolio strategies and goal types are automatically rebalanced and adjusted over time, and our tax-smart tools are available to you at no added management fee. Personalized – Betterment helps you work towards your long- and short-term financial goals with personalized advice. It’s easy to get started Betterment will contact you via email to set up your account via a secure link that’s unique to you. If you haven’t received an invitation from us to set up your account, please contact us. Once you’ve set up your account, be sure to set a contribution rate to help you pursue your goals (although starting with anything is far better than nothing!) and you’ll want to initiate a rollover of any old 401(k)s into your new Betterment 401(k). Were you automatically enrolled in your plan? If so, you still need to set up your account with a username and password. If your employer has determined an automatic contribution rate for your organization, know that you can adjust this in your account at any time. Betterment strives to make saving and investing for retirement easy. But we know you still might have questions, so we’re here to help: Explore our 401(k) employee resources Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET