When’s the best time to invest for retirement? Now.

Should you start saving for retirement? Unless you are on one of those richest-people-in-the-world lists - then the answer is, most likely, yes.

From paying the rent or mortgage, credit card bills, student loans, daily living expenses - there are a lot of things competing for your money’s attention! The idea of saving for retirement can easily be pushed to the backburner for all of those other - completely understandable! - reasons. But we’re here to say - hold the phone. Even a little bit into a 401(k) can make a huge difference for your retirement.

Rock and roll

When a rock rolls down a hill, it goes faster and faster on its way down. It has something to do with momentum and physics – we’re not scientists here, we’re investment professionals. But the same concept applies to your 401(k) - not because of physics, but because of compounding interest.

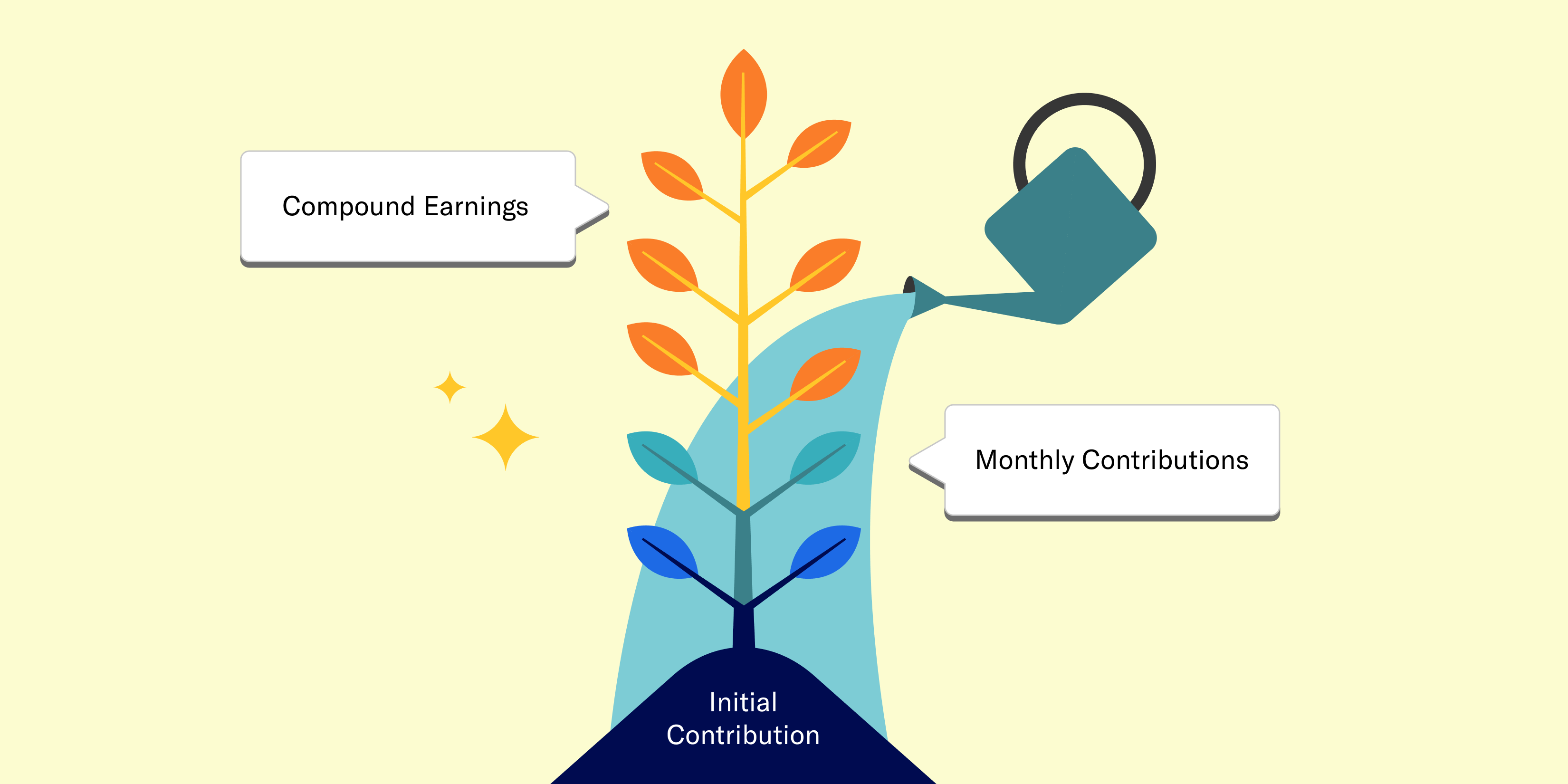

Compounding interest means that not only are your original dollars growing based on potential stock market gains, but that newly earned money also grows whenever the stock market goes up!

Give compounding time to shine

If the magic of compounding interest isn’t enough to get you going right away, there is one other factor to consider.

If someone starts saving 6% of their paycheck at age 25, they are expected to end up with more money at age 65 than someone who contributes 10% starting at age 40. And here’s the real kicker - the person who’s doing 10% starting at age 40 will put in more of their own dollars, and is still expected to end up with less by the time they reach age 65. How is that possible? The 6% contributions had more time to grow – more time to roll down that hill gathering speed – or in this case – money.

If you already have an account, log in today to view your contribution rate and consider giving it a bump – even a 1% increase can make a difference in your retirement years!

Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch:

Send us an email: support@betterment.com

Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET