How to use our products across your financial life:

Step 1 Tell us what you want to do with your money.

Open a no-fee checking account? Save for your weekly groceries? Invest for a dream retirement with your partner or spouse? No matter what you have in mind, from practical spending to big investing dreams, we’re here to help you make it real.

Step 2 We’ll build your account.

Based on what you tell us, we’ll provide some recommendations and set up your ideal account. You can start with one product (like Checking), or go all in. Whatever you choose, it’s easy to add more and customize your account in the future.

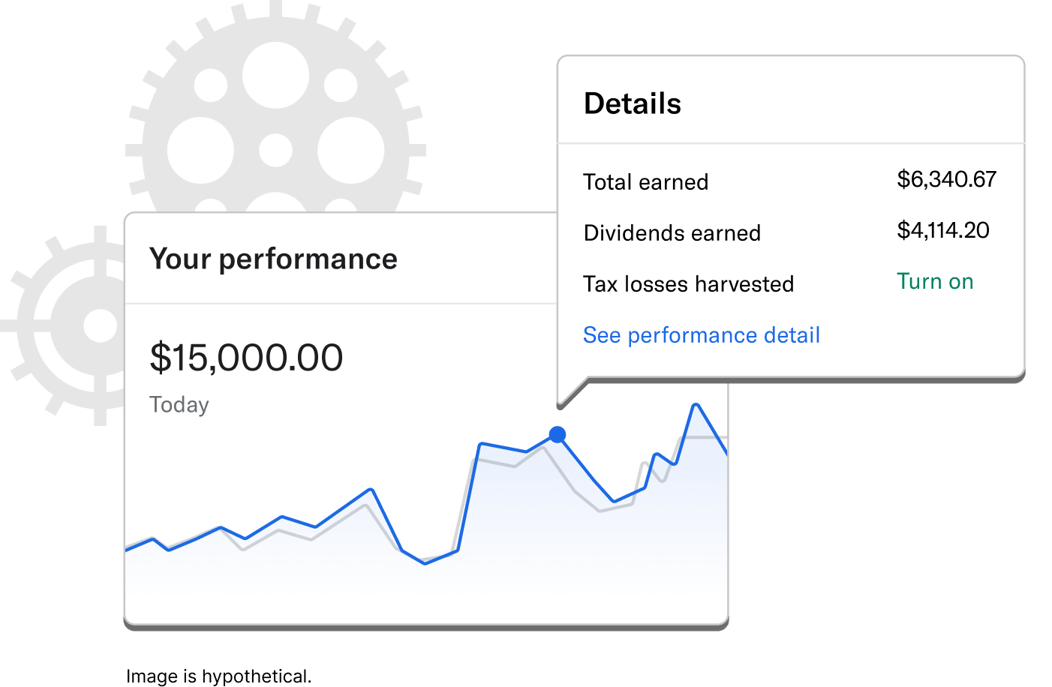

Step 3 Our technology gets to work.

We strive to optimize every dollar you spend, save, and invest with us. Our technology manages your money and aims to helps you earn more. As your money grows and your priorities change, we evolve with ongoing advice and updates to help you stay on track.

Step 4 Save. Withdraw. Spend. Cheers!

Some of our favorite features:

-

Socially Responsible Investing

Our Socially Responsible Investing can help you invest to make an impact and grow your savings.

-

Recurring deposits.

A very popular feature. You can set up separate recurring deposits for each goal or account.

-

Tax-Loss Harvesting+.

This tax-smart tool can automatically helps you offset losses when the market drops once you turn it on.