A quick overview of getting your portfolio started at Betterment based on your financial goals.

Is your portfolio set up correctly?

Let’s talk about how you can feel sure your investments are set up for success at Betterment.

If you’re like most investors, your investments may have previously been managed in one big bucket.

That’s the way traditional brokers work, but it may not work for you as an investor. Instead, you should have multiple personalized portfolios built around your specific goals. Let’s take a look at how you can build your portfolios using our goal-based investment system here at Betterment.

Goals in priority order

*Image is for illustrative purposes only

Like most of us, you are likely saving for multiple financial goals at the same time. Your financial goals might be retirement, college, a house, and more. Each of your goals has its own time horizon, priority, and savings requirements.

If your money is lumped together, it can be hard to manage effectively or invest at the appropriate risk level. Instead, each goal should have its own portfolio and its own risk level. Some will be short-term and conservative, like an emergency fund goal, and others will long-term and aggressive, like your retirement plan. Some will be flexible, for instance, a vacation, and others, not so much.

For your retirement planning, we’ll help you choose the right tax-advantaged accounts to use: your 401(k) plan through work, an IRA, or a Roth IRA.

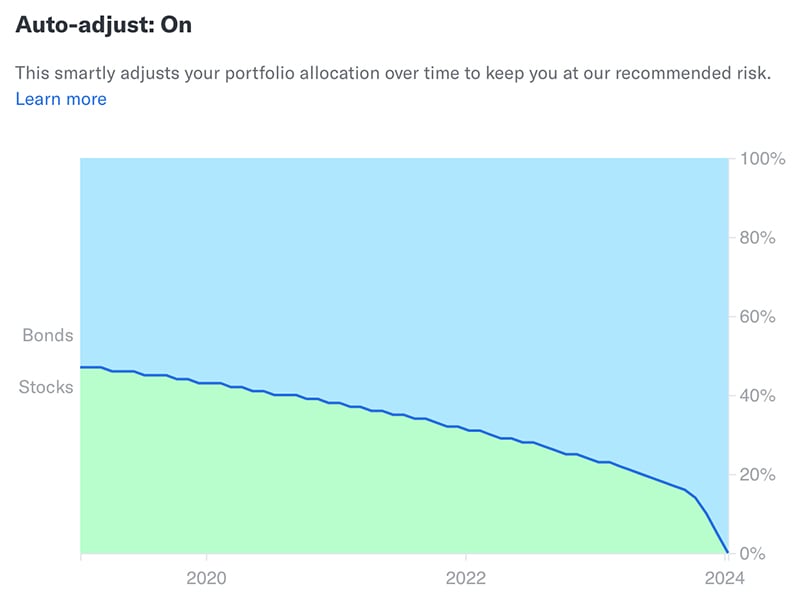

Once your goals are set up, Betterment will also manage them over time. We’re set up to invest every dollar you deposit by investing in fractional shares; we’ll reinvest your dividends, and we’ll even decrease your risk automatically as your goal’s target date approaches.

Preview of how Betterment automatically adjusts over time

*Image is for illustrative purposes only

*Image is for illustrative purposes only

When you set up your goals, we will recommend what we believe is the best portfolio for you. If you’re a more hands-on investor, Betterment has multiple portfolio options for you to choose from, including a factor-based portfolio strategy from Goldman Sachs, bond-only portfolios from BlackRock, or you can build your own. Invest your money according to your preferences.

Choosing a portfolio strategy

Get started today by setting up the investment goals that will help you get on track toward a better financial future.

Related Articles