As reported on your 1099-DIV, your Betterment account may have earned U.S. Government interest income due to bond dividends. This is because your taxable investment accounts may be invested in U.S. Government bonds through bond ETFs, per Betterment’s advice.

Generally, the U.S. Government interest portion of a fund dividend income is exempt from state and local income taxes. However, there are some states (NY, CT, and CA) that have an “asset test” which requires 50% of the fund’s assets to be U.S. Government bonds to qualify for a percentage of the fund’s income to be exempt from state and local income taxes.

When filing your state tax return, you may be required to determine the percentage of the dividend related to U.S. Government interest. Betterment has calculated this figure for you, which you can find on your Supplemental Tax Statement in the Documents section of your account under the Tax Forms tab.

Please note that while most customers will receive a Supplemental Tax Statement, a small subset of customers will not, due to various holdings that are not generally included in our main portfolio strategies here at Betterment. If you did not receive a Supplemental Tax Statement and you need more help, please contact Support.

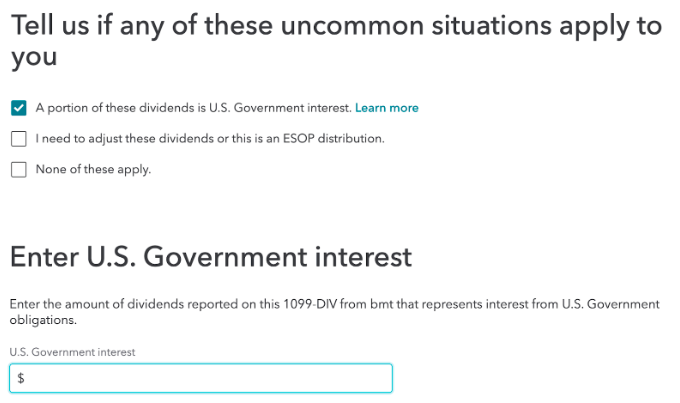

If you’re using TurboTax, entering your U.S. Government ordinary dividend amount is likely to look like this:

TurboTax is a registered trademark of Intuit, Inc.

HR Block is a registered trademark of HRB Innovations, Inc.

TaxAct is a registered trademark of TaxAct Holdings, Inc.

Quicken is a registered trademark of Intuit, Inc.

Third party tax softwares mentioned are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. If you use third party tax software, you'll be subject to the applicable terms and conditions of use for those products, including a separate privacy policy. You should read and understand all applicable terms for these tax softwares before using them.