A portion of the dividend income from your municipal bond ETF holdings may be exempt from state income tax, depending on your state’s tax laws. Betterment has calculated this for you, based on your state of residence listed within your account. Simply head to the Documents section of your account and then click the Tax Forms tab to download your Supplemental Tax Statement, which will contain this figure.

Most customers who receive a 1099-DIV or 1099 B/DIV from Betterment will also receive a Supplemental Tax Form. If you do not, you can contact our Support Team for alternative documentation to assist with your tax filing.

If you’ve moved and your state of residence on file with us was incorrect, and you wish to calculate your state-specific percentages of your municipal bond ETF holdings, please consult materials from the fund provider. To help, here are some resources below to find more specific information about the holdings of various municipal bond funds which may be used in your portfolio.

Nationwide Municipal Bond ETFs

- TFI: SPDRS Tax Exempt Interest by State

- Go to the “Document” tab.

- Scroll down to the “Tax Documents” section.

- Click on “SPDR ICI Tax Summary (Secondary).”

California State-Specific ETF

New York State-Specific ETF

For TurboTax Users

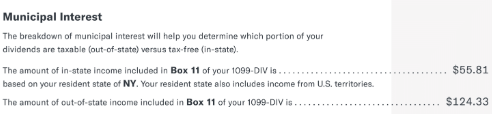

If you are importing a 1099-DIV and Box 11 (Exempt Interest Dividends) is not $0, TurboTax will show you a screen which asks: “Choose the state where your tax-exempt dividends came from.”

From the dropdown, select “More Than One State.”

Example using Supplemental Tax Statement:

For the out-of-state portion of dividend income, choose any state other than your resident state.