As reported on your 1099-DIV, your Betterment accounts may have earned foreign-sourced income via dividends, resulting in foreign taxes. This is due to the fact that your taxable investment accounts may be invested in foreign stock and bond ETFs, since Betterment’s portfolio is globally diversified.

When filing your tax return, you may be required to report foreign-sourced income, which means you’ll need to report the total of all the foreign-sourced dividend income that you earned. Betterment has calculated this figure for you, which you can find on your Supplemental Tax Statement in the Documents section of your account under the Tax Forms tab.

Please note that while most customers will receive a Supplemental Tax Statement, a small subset of customers will not, due to various holdings that are not generally included in our main portfolio strategies here at Betterment. If you did not receive a Supplemental Tax Statement and you need more help, visit our contact page.

There are certain circumstances under which you may not be required to report your foreign-sourced income in detail, especially if the following are true:

- All your foreign-taxed income was 1099-reported passive income, such as interest and dividends, and all dividends came from stock you owned for at least 16 days

- You are a single filer who paid $300 or less in foreign taxes, or you are a married joint filer who paid $600 or less in foreign taxes

If you have questions about how to claim a foreign tax credit, please reach out to your tax advisor or your tax preparation service for further information regarding your specific situation.

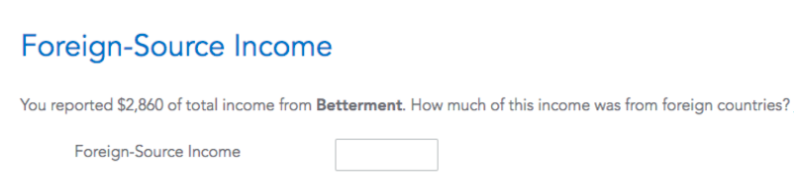

If you are required to report your foreign-sourced income in detail and you’re using TurboTax, entering your foreign ordinary dividend amount is likely to look like this:

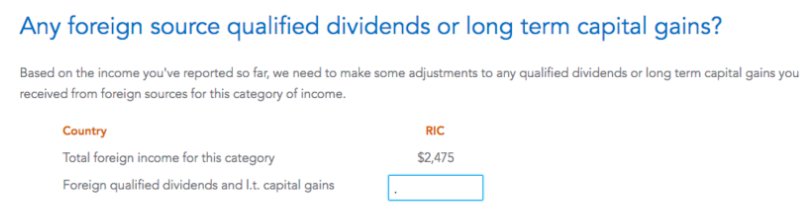

If you’re using TurboTax, entering your foreign qualified dividend amount is likely to look like this:

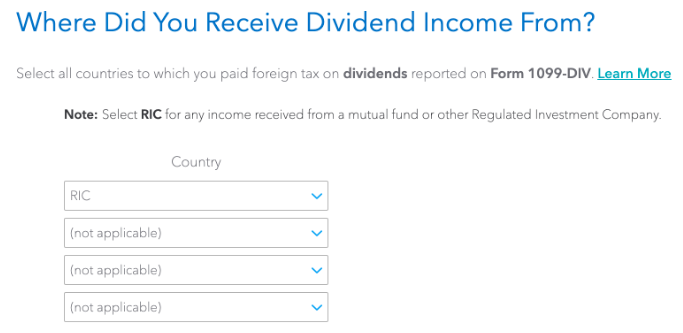

A related step—which tax software will likely prompt you to answer—is to identify which foreign country your income came from. If all of your foreign-sourced income resulted from investments with Betterment, because we use regulated investment products (ETFs), you can simply report this income as “RIC”—a regulated investment company.

Here’s an example of how this question is asked in TurboTax:

Please consult a qualified tax professional and refer to IRS Publication 514, IRS Form 1116, and IRS Publication 17 to determine the rules that apply to your individual tax situation.

TurboTax is a registered trademark of Intuit, Inc.

HR Block is a registered trademark of HRB Innovations, Inc.

TaxAct is a registered trademark of TaxAct Holdings, Inc.

Quicken is a registered trademark of Intuit, Inc.

Third party tax softwares mentioned are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. If you use third party tax software, you'll be subject to the applicable terms and conditions of use for those products, including a separate privacy policy. You should read and understand all applicable terms for these tax softwares before using them.