Get help tackling your student loans

Video Transcript

Introducing Student Loan Management by Betterment. As an employee, you'll be able to connect your student loans, make additional payments that may be eligible for an employer loan match, and view your student loans right alongside your 401(k). Let's dive in.

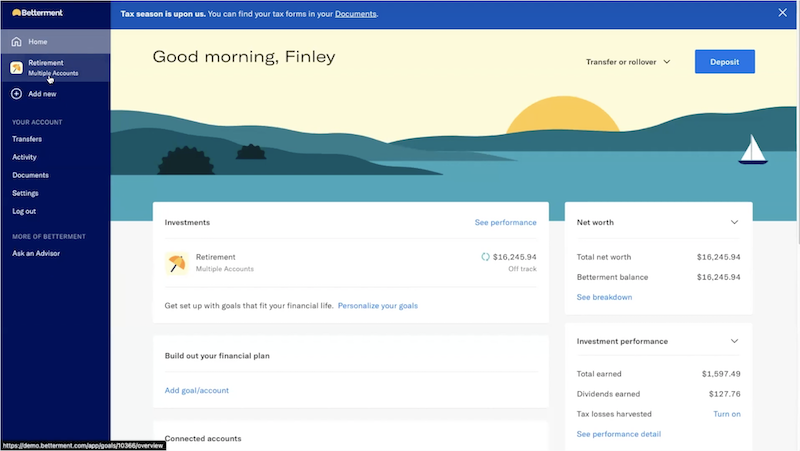

The first step is to connect your student loan. Log in to your Betterment account and navigate to Add a New Goal.

Select the Manage Student Loans Goal.

Click through and identify your loan servicer.

Enter your username and password in order to finalize connecting your student loan. Click on View My Account to see your new goal.

You can set up a one-time payment using a bank account or a recurring payment via your paycheck. If you aren't eligible for a match, you also have the option to set up a recurring payment using a bank account. For the purposes of this demo, we'll select Setup a Recurring Payment to get started on making contributions directly from your paycheck.

Similar to how you set up a contribution rate for your Betterment 401(k), decide on a percentage or dollar amount deduction from your paycheck to be contributed as an additional monthly payment toward your student loans. Take advantage of the Projection Planning feature to help you visualize how much money and time you can save with your additional contributions.

Confirm which loan you'd like to pay off first. Betterment will provide an allocation recommendation based on the highest level of impact.

Take advantage of the resources available in the Student Loan Management tool. In the Overview tab, you'll be able to see your recurring payments, pay-off progress, loan cost projections, and payment history. If you are eligible for a match through your employer, you'll be able to ensure you're making progress against the eligible amount.

In the Loans tab, you will find a breakdown of your connected loans and financial advice from Betterment based on analysis of four factors; interest rates, balance, loan type, and loan status. Click in and view details at the loan level as they relate to interest rate, principal, and more.

Lastly, here in the Settings tab, you can customize your student loan management goal by changing the picture, name, or deleting the goal entirely. Take advantage of all the features available to you through student loan management and start making progress against your student debt today.