Understanding your Betterment 401(k)

A new financial platform can seem like a lot. We explain how to access your information, connect external accounts, set up your 401(k), and more.

Video Transcript

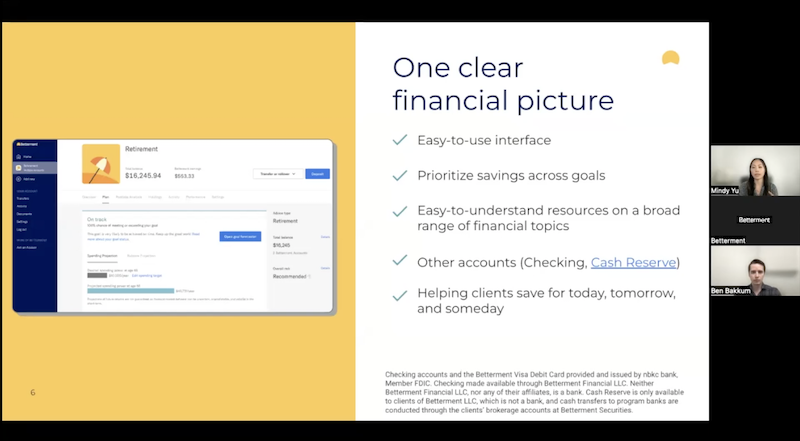

This is the home overview. The left hand side here, you'll see your navigation, so all the different accounts you have, your retirement 401(k) accounts will live up here as well as all your other transactional document settings and so forth here on the left hand side.

Your home overview will give you all your accounts with us here at Betterment, your investment performance here as well. And then also any external connected accounts you may wish to connect.

You can follow that flow and that'll take you right to it.

We're going to click into our retirement or 401(k) goal and show you some basic functions. So this sample account does currently have a balance. This person has contributed both to a Roth and a traditional account. And currently, they're contributing 6% of their income on a per pay period basis.

So let's say we're going to go and up that. Maybe we got a promotion or a raise, and we want to increase this. Let's change it to 8%.

Please do keep in mind, as I mentioned before, you can also contribute as a flat dollar. You'll just toggle between the top here, and you can input that amount that works best for you. And again, this is per pay period so what you want to contribute on that paycheck.

We're going to go back to the percent and set it to 8, we'll click approve and we'll go back to our page. As you can see, the prompts are going to ask for my approval a couple of times, so I always encourage folks to navigate, click around. You're not going to change anything too dramatically, but certainly feel free and comfortable to navigate and explore the site.

This new rate, as you've made the change, will get sent to your plan administrator to update their records, update payroll. Please do keep in mind it may take one payroll cycle in order to update your rate. As you can see here, our new annual contribution amount is $4,800 so this is calculating based on some inputs that you did during the sign up, how much you'll be saving on a 12 month period.

This is not how much you have saved for this current year. This is solely on a rolling 12 month forward outlook.

So if we change this again to 10%, this would show $6,000.

Some of the key features here under the plan is that projected retirement spending and outlook for you. Our current setup right now says we're a little bit off track and we're shy of what we want to be saving.

One of the more fun things I find is if you click open goal forecaster, you'll get this pop up, which you can change some of these inputs such as how early or late you want to retire, the location at which you'll be retiring as well as your annual contributions and how much you want to be spending. This look would change as you change those inputs to give you direction on how well you're saving.

So let's say I want to retire earlier.

I'm going to move to a lower cost of living, and I'm also going to increase my annual contributions to almost our recommendation.

You can see here, we went from 20% chance of meeting our goal to upwards of 66%.

Let's say we change our retirement age to 67. So we're going to work an additional 6 years under this scenario. We're now on track.

We're having 85% chance of meeting or exceeding our goal and this graph here is showing you your balances over that time and certain projections of that as well. So feel free to come in here, click around, change some inputs or as your plan in years change, you can always come in here and adjust your plan. This other tab of how to save is a great way to understand other options available to you not just through the 401(k) but also outside of that--how best can you be increasing your savings for retirement.

Again, these are all recommendations, but certainly insights to follow if you so wish.

We're going to exit out of that and just keep our account set up as it is.

We're going to go here to the portfolio analysis tab. From here, this is where you can look at your target allocation as well as the portfolio or where your money is invested.

If you want to see more granular data of each fund that your money is invested, you can click the holdings tab here, which will give you that breakout but we're not going to go through that today. Under the portfolio analysis, we're going to have a recommendation for you for your target allocation. All employees are defaulted into our Betterment Core Portfolio but if you wish to change your strategy, you can just come in here and click edit and our various other portfolios that you wish to explore are available to you.

Just click select portfolio, and it will pop up and give you some direction and our recommendation through that. Again, another great place to click around and explore, but we're not going to go into too much detail today.

Looking at our target allocation, you can see Betterment's recommendation is 90% stocks. This is due to the time horizon as our current age, our time to retirement taking into account. So we're a little conservative here in our current settings.

Well, if you want to adjust that, we'll click adjust and we'll be taken to a page here to set your risk level. What we mean by risk is how much up and down can you take within the markets. So what are those likely returns, negative and positive that really to take on. If you have a long time horizon, a riskier allocation, more stocks versus bonds can be beneficial.

If you're closer to retirement or have a lower time horizon, a less risky allocation will be a benefit to you. You can follow our recommendation here on the left that will guide you through what may be best for you. Right now we're showing very conservative in our current scenario. So let's click 90% and move that up to Betterment's recommendation.

You'll see now some changes to the likely one year returns as well as the annual average return. Maybe we want to take on a little more risk. We'll update that to 93.

We're still within that recommendation. So as you can see, the sliding scale here is how you can change how risky you are in that account.

One neat feature is our auto adjust here for those that want to be even more hands off. You can enable this feature.

And what it will do is smartly adjust your portfolio allocation over time to keep you at that recommended risk level.

Shown a different way, we're going to click over here to this tab.

And again, my time horizon is quite long in this scenario so you'll see this plateau for about 10, 15 years or so. At that point, we're going to start de-risking this portfolio slowly over time towards you meeting that goal.

So what it's going to do is as you near retirement, as you near the end of that goal, we're going to take away risk. We're going to preserve the capital and the contributions you've made in order to have this in your account later on.

For our purposes, we're going to save this down. We always ask for feedback of what maybe prompted this, we'll skip for now, and then our target allocation is going to change.

It may take a day for the funds to adjust and get reallocated, but just keep in mind that it'll show immediately here.

One of the last key areas I'd like to show today is the activity tab.

This will show all your payroll contributions, all the actions that are happening within your account. If you're curious to know how much you've contributed for the year, you can always come in here and click view details.

It'll show you what you've contributed as well as potentially any employer contributions that have been made. These are not always guaranteed, but we'll be focusing here on the left. It'll show you a breakdown of what you've contributed both into your traditional or Roth or any funds that you have rolled over as well. So if you're ever curious, come in here and click and you can see what you've done for the year or you can see your total contributions under this section.

.png)