A rollover gives your money a better home

Moving your retirement accounts into a Betterment IRA can save you on high fees and hassle.

We make it easy to make the most of your retirement.

An estimated 1 in 5 U.S. workers have left behind or forgotten retirement accounts.1 See how rolling them over into an active Betterment IRA can benefit you:

-

Automated investing.

We make investing easy by putting it on autopilot, handling all the trading, rebalancing, and dividend reinvesting, so you don’t have to. -

Painless transfers.

For many providers, rolling over funds to Betterment is completely automated. For others, we have a team to help minimize the effort and paperwork involved. -

Retirement tools at your fingertips.

We build you a personalized plan, calculate how much to save, and adjust as life changes.

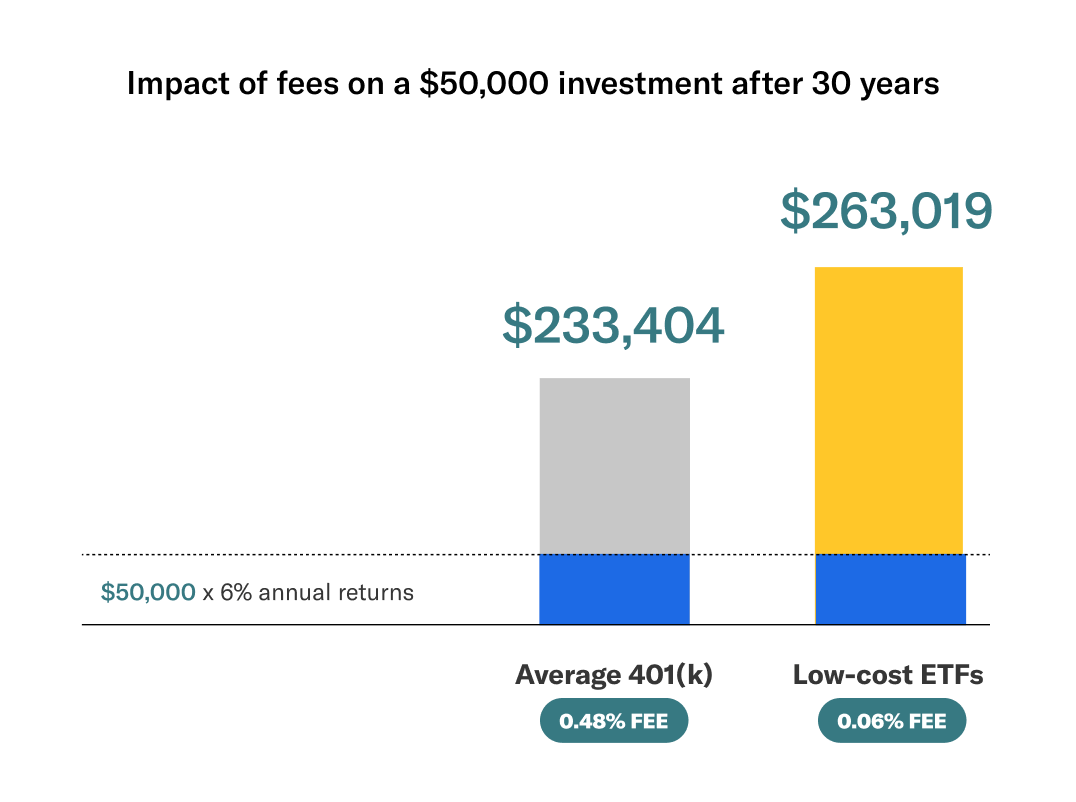

Lower fees today can mean more money tomorrow.

A 401(k) with even a modest fee may cost you tens of thousands of dollars over time. The savings from rolling into a managed Betterment IRA of low-cost exchange-traded funds (ETFs) can add up to a more comfortable retirement.

Assumed 0.25% management fee with hypothetical 6% annual return. Image to illustrate the potential impact of fees on performance and does not reflect the performance of Betterment.

Betterment’s Licensed Concierge Team offers support for individuals transferring assets to Betterment of $20,000 or more, and receives incentive compensation based on assets brought to or invested with Betterment. Betterment’s revenue varies for different offerings (e.g., Betterment Digital and Premium, Cash Reserve) and consequently Team members have an incentive to recommend the offering which results in the greatest revenue for Betterment. The marketing and solicitation activities of these individuals are supervised by Betterment to ensure that these individuals act in the client’s best interest.

Still have questions?

-

After opening your account, you’ll answer a couple of questions, and we’ll determine if you can automatically roll over your account. If not, you’ll receive an email with the full, personalized instructions (how the check should be issued and where it should be sent) to complete your rollover.

Please note that Traditional funds must be rolled over into a Traditional IRA and Roth funds must be rolled over into a Roth IRA. If you aren't sure which type(s) of funds you have, contact your current provider. You can always convert a Traditional IRA into a Roth IRA after the rollover. -

You can roll over a 401(k), 403(b), or IRA to Betterment.

-

Generally, it takes 7-10 business days after the funds have left your old provider for the funds to appear into your Betterment account. This includes mail time, processing, and time for the funds to settle. You will be notified via email as soon as the funds appear in your Betterment account.

-

Betterment does not charge a fee when you rollover an account to us. Our management fee is $4 a month or 0.25% annually. This gives you all the benefits of our automated technology: hands-off investing, expert-built portfolios, and guidance to help you grow your retirement.

Learn more about pricing