Take on More Control with Flexible Portfolios

For experienced investors looking to tweak asset class weights, we offer a Flexible portfolio option.

Let’s say you’re an experienced investor. You’re already a Betterment customer—or you’re considering becoming one. You dig our personalized approach to automated investing, but you’d like to get granular with your portfolio’s specific asset class weights.

Well, our Flexible portfolio option lets you do just that. It starts with our Core portfolio’s distribution of asset classes before handing over the wheel to you, so to speak. In the process, you get access to additional asset classes including Commodities, High Yield Bonds, and REITs.

If all of this sounds a little overwhelming or confusing, you should probably consider sticking with one of our expert-built, curated portfolio options. But for those comfortable with the added risk, research, and responsibility in general that comes with managing your own portfolio, a Flexible portfolio may be a good fit. Keep reading for more details on the pros, cons and other considerations of this option.

The benefits of a Flexible portfolio

You get a sound start with the Betterment portfolio strategy

Our investing advice has several layers, and the portfolio we recommend to you is just one of them. At the core is our approach to building a diversified, risk-efficient portfolio strategy and our cost-aware selection of ETFs. A Flexible portfolio lets you benefit from this approach and start with the asset class weighting we believe comprises a diversified portfolio, but gives you the final say in those weights.

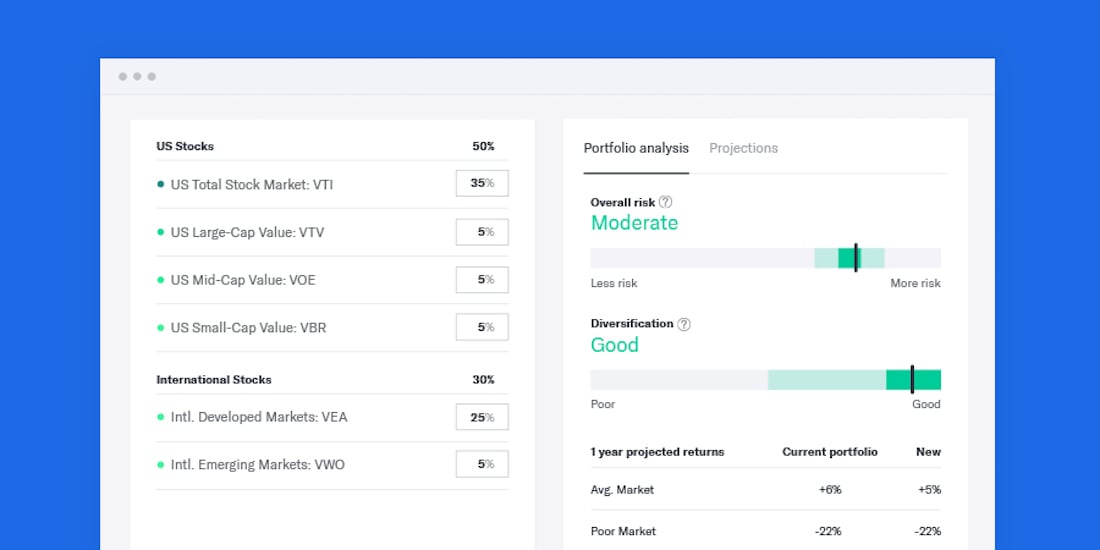

You get principled feedback on your Flexible portfolio

You can tweak the asset class weights, but we’ll still rate the diversification and relative risk of those tweaks before any investment changes are actually made. We want any customer with a Flexible portfolio to better understand the risks of the changes they’re considering. This also lets you experiment with different weights in theory before putting them into practice.

For illustrative purposes only

You can still benefit from our automation and tax optimization

Although the use of a Flexible portfolio means your preferences may deviate from our portfolio recommendation, you still get access to our automated investing and tax features. These include things like automatic rebalancing and Tax Loss Harvesting+. Altering or removing asset classes altogether, however, may impact the effectiveness of tax-saving strategies.

The drawbacks of a Flexible portfolio

Adjusting an investment portfolio requires careful consideration, experience, and a higher level of effort beyond choosing one of our preset portfolio strategies. Your performance may be better or worse than the performance of those portfolio strategies with a comparable level of risk.

And beyond the potential for diminished tax-saving strategies, choosing a Flexible portfolio also disables the Auto-adjust feature. This feature automatically “glides” your portfolio to a lower overall risk level as you get closer to the end date of your goal. Without it, you’ll be responsible for manually maintaining the appropriate allocation of stocks and/or bonds and its corresponding risk level.