Should you pack up and roll over your old accounts?

From rollovers to transfers, deciding whether to make a move boils down to a few factors.

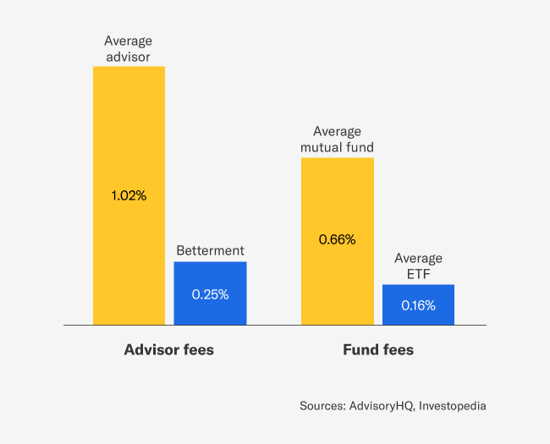

Some advisors are less than forthcoming about the fees tied to their services or the investments they choose. So ask questions, and consider it a red flag if they don’t make it easy to understand your all-in costs.

Returns

Here’s where things get tricky, because comparing apples-to-apples returns between different providers and their various portfolios can be difficult. Some may be selling apples, while others may be selling a low-cost, globally-diversified assortment of fruit.

But you can level-set somewhat by comparing portfolios with 1) similar allocations of stocks and bonds and 2) similar levels of diversification. U.S. equities have outperformed international markets since the Great Recession, but those tables were turned for extended stretches in the 80s, 90s, and 2000s, and they very well could turn again.

Personalization

For many investors, it’s important to know what they’re investing in—and to feel excited about it. So if your old 401(k)’s “2050 Target Date Fund” doesn’t exactly set your heart aflutter, try scoping out alternatives. It’s why we build easy-to-understand portfolios appealing to a wide range of interests from socially responsible investing to innovative technology. Each one can be customized to your specific target date and easily updated when life happens and circumstances change.

Goal alignment

Consolidating more of your retirement accounts under the same roof unlocks several benefits. Asset location, as previously covered, is one. Asset allocation, or the ratio of different asset types like stocks and bonds, is another. It’s best when accounts serving the same goal add up to your preferred asset allocation, and that can be hard to accomplish when they’re spread across multiple advisors. At Betterment, you can nest multiple accounts under the same goal and easily set one asset allocation for all of them.

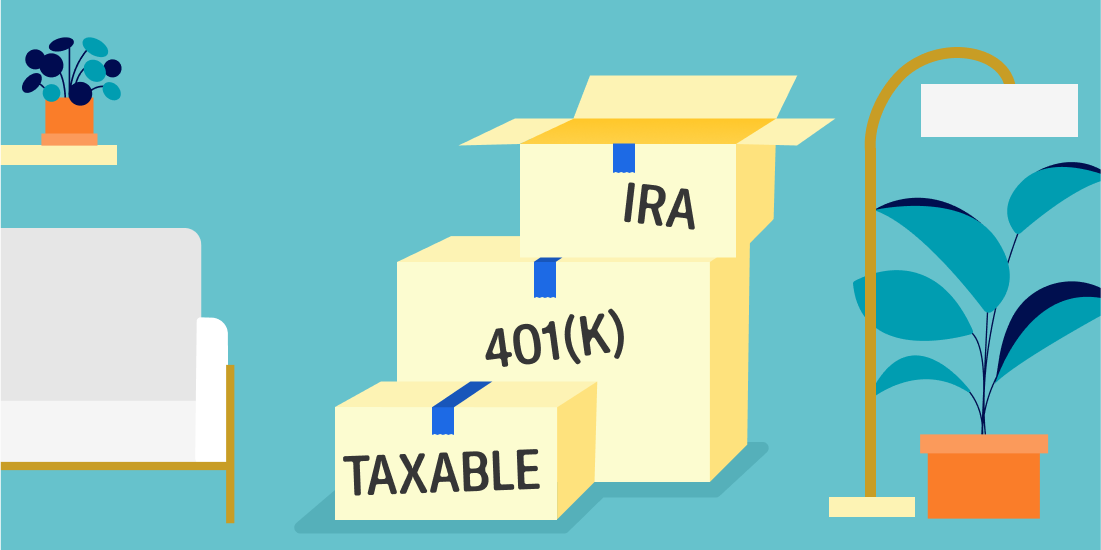

II. Special considerations for tax-advantaged accounts

If you’re considering moving tax-advantaged accounts like 401(k)s, 403(b)s, and IRAs, keep a few more things in mind.

Account compatibility – Deciding what kind of account to move to can make for a dizzying decision, but in a nutshell:

- Roth accounts must be moved to a fellow Roth account.

- Traditional IRAs typically move into traditional IRAs. Exceptions include some cases of backdoor Roth conversions.

- 401(k)s can flow into either a 401(k) or IRA.

Here’s a simplified version of the IRS’s infamous rollover chart to help:

| Roll to | |||||

| Roth IRA | Trad. IRA | Trad. 401(k) | Roth 401(k) | ||

| Roll from |

Roth IRA |

✓ | X | X | X |

|

Trad. IRA |

✓ | ✓ | ✓ | X | |

|

Trad. 401(k) |

✓ | ✓ | ✓ | ✓ | |

|

Roth 401(k) |

✓ | X | X | ✓ | |

Some important qualifiers depend on your exact move, so we suggest studying the full chart carefully. A big one to call out is that any traditional (i.e. pre-tax) funds moved to a Roth (i.e. after-tax) account must be included in your taxable income for that year and taxed accordingly. It’s one reason why we highly recommend working with a tax advisor, especially if your specific case isn’t so cut and dry.

Access – After you leave a job, your 401(k) from that job is still yours, and you can still change its investments, but you can no longer contribute to that specific 401(k) account.

Avoiding taxes – In most cases, you can move tax-advantaged accounts to a new provider and pay zero dollars in taxes, but if you simply cash them out and pocket the money before the age of 59 ½, those funds are subject to a 10% early withdrawal tax on top of ordinary income tax, with few exceptions.

III. Special considerations for taxable accounts

Moving taxable accounts potentially comes with (surprise, surprise) tax implications. The first thing to do is suss out which of your old assets can be moved “in-kind” to a new provider. This means the new provider is able to accept the new assets, either slotting them into your new portfolio as-is or selling them on your behalf and reinvesting the proceeds.

Some assets first need to be sold before you can transfer the funds. In these cases, you can first work with a new provider (like us!) and a tax advisor to estimate the potential tax hit. Then, if you decide to move ahead, you’d work with your old provider to liquidate those assets before transferring the funds.

IV. A sneak peek of how we make moving easier

The process of actually packing up and making a move can be complicated. It doesn’t help that it takes two advisors to tango, and your old provider may not make things easy. But we do everything possible on our end to help streamline the process.

That includes letting you quickly initiate a transfer or rollover in the Betterment app. Some transfers can be serviced entirely online, whereas other transfers and most rollovers require some paperwork.

If you’re considering moving $20k or more, our Licensed Concierge team is available at no cost to walk you through all the considerations above, size up whether a move is in your best interest, and should you decide to switch, help move your old assets to Betterment.

Because whether moving to a new house or a new advisor, it never hurts to have a little help.