Dana Karlson

Meet our writer

Dana Karlson

Sr. Manager Copy & Content

Dana Karlson oversees content for Betterment at Work and Betterment Advisor Solutions. She joined Betterment in 2021, beginning on the Retail team before expanding her leadership across Betterment at Work and Betterment Advisor Solutions. She brings more than 20 years of experience in journalism and marketing. Previously, she was a senior editor at Condé Nast and British Sky Broadcasting in London, and has worked with finance and consumer brands on content strategy and brand storytelling.

Articles by Dana Karlson

-

![]()

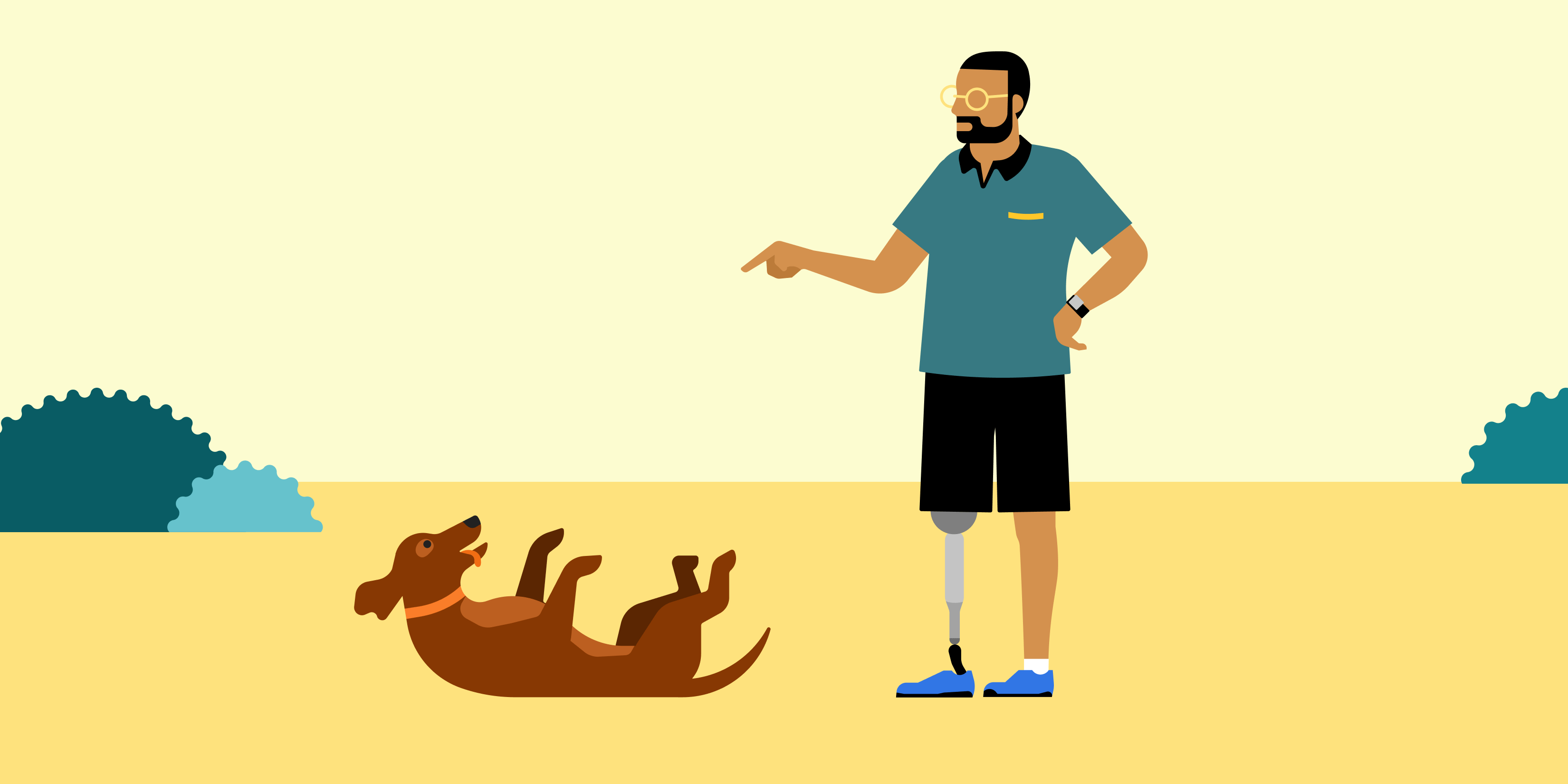

Rolling over is more than a dog trick

Rolling over is more than a dog trick Jan 6, 2026 9:00:00 AM Three reasons why rolling over 401(k)s from former employers may make sense. Do you have money sitting in 401(k) accounts from former employers? If so, you’re not alone. Recent research estimates that there are more than 29.2 million “forgotten” 401(k) accounts, holding approximately $1.65 trillion dollars. Are any of those dollars yours? If so, you might want to consider rolling old 401(k)s into your Betterment 401(k) – here’s why: 1. Get a comprehensive view of your retirement savings When you have accounts here, there and anywhere, it’s hard to get a handle on where you stand. By rolling them over to your Betterment account and consolidating your retirement assets in one place, you can ensure your portfolio is appropriately diversified, monitor your progress, and rest assured that your investments aren’t competing or canceling each other out. 2. Potentially reduce fees Every 401(k) plan comes with fees. If you have multiple 401(k)s, you are paying fees for all of those accounts. Betterment has fees too—but our portfolios use exchange-traded funds (ETFs) that are generally low cost. 3. Access personalized financial advice and service Whether you want to talk investment strategy or review your retirement account, Betterment has CERTIFIED FINANCIAL PLANNER® professionals and a customer support team that’s easy to reach when you need them. Your plan may include complimentary access to our team of CFPs® or you can book a call for a one-time fee. Other options Since you have access to a Betterment 401(k) through your employer, it could make sense for you to roll old 401(k)s into your Betterment 401(k) for all the reasons outlined above. But you do have other options: Leave it where it is. Roll it into an IRA (Individual Retirement Account), either with Betterment or another financial institution. Cash it out – this will come with taxes and potentially fees, and your money will no longer be invested (and potentially growing) for your retirement. Ready to roll? In just a few clicks, you can start the rollover process to Betterment and be set up with an appropriate investment strategy for you. You’ll receive a personalized set of rollover instructions via email, with no paperwork required by us. Have a different kind of account to roll over? No problem. You can roll over qualified retirement plans to Betterment using the same simple process. If you've already claimed your account, you can click here to start your rollover. If you have any questions along the way, our team is ready to help: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

What is a glide path in a 401(k)?

What is a glide path in a 401(k)? Oct 6, 2025 9:00:00 AM Learn how Betterment’s glide path guides your 401(k) from stocks to bonds—balancing growth and security as you near retirement. Picture saving for retirement like taking a long flight. At the beginning of your journey, the plane climbs high and cruises at full speed—that’s your portfolio invested more aggressively in stocks to help your money grow. But as you get closer to your destination (retirement), the plane gradually descends for a smooth landing—that’s your portfolio shifting toward bonds and stability. That gradual shift is called a glide path. How a glide path works A glide path is the built-in strategy that shifts your investments over time. When you’re younger, your portfolio is more aggressively invested in stocks, which historically provide higher growth in comparison to bonds. As you get closer to retirement, the glide path automatically moves your portfolio toward a more conservative mix with more bonds, to help protect your savings. When you’re closer to retirement or have already retired, there’s less time for stocks to recover after a selloff before you may need to make withdrawals. ETF portfolio vs. target date fund glide paths When saving for retirement, you might come across target date funds (TDFs). Target date funds package a glide path into a single fund based on the year you plan to retire. Please note: Your employer may have opted to provide a lineup of mutual funds to invest in that includes TDFs. At Betterment, we also offer expert-built portfolios that rotate between multiple exchange traded funds (ETFs) over time, enabling a glide path. That means your investments still shift from more stocks to more bonds as you approach retirement, but your journey is personalized, so it adjusts to your needs rather than sticking to a fixed path. Why Betterment’s glide path matters Saving for retirement can feel overwhelming, but you don’t have to manage everything on your own. Whether you use a Betterment-built portfolio or a target date fund, a glide path adjusts your portfolio as you move through different stages of life. It’s designed to keep you growing when you have time on your side and protect what you’ve built as retirement gets closer. Here’s how it helps: Automatic adjustments: You don’t need to rebalance on your own, because your portfolio adjusts for you. Personalized portfolios: Your Betterment 401(k) account uses a diversified portfolio that’s built to handle turbulence—so you don’t have to worry about every bump along the way. Retirement readiness: glide paths help balance growth when you’re younger with stability as you near your destination: retirement. Every retirement journey is different, but we’re here to help you take off with confidence, adjust as you go, and arrive at retirement prepared for the next chapter. -

![]()

401(k) contribution strategies: Dip or dive in?

401(k) contribution strategies: Dip or dive in? May 1, 2025 9:00:00 AM Learn how front-loading and dollar-cost averaging work in a 401(k), and what factors to consider when planning your retirement contributions. Contributing to a 401(k) is one of the most effective ways to build long-term wealth, especially when you factor in tax advantages and the potential for employer matching. But how you contribute can make a meaningful difference. Some investors choose to front-load their 401(k)—contributing as much as possible early in the year to maximize time in the market. Others stick with the more common approach: dollar-cost averaging (DCA), spreading contributions evenly throughout the year. Which strategy is more effective? Understanding the tradeoffs can help you make the most of your 401(k). Let's take a closer look. What is front-loading? Front-loading involves making your 401(k) contributions as early in the calendar year as possible, ideally maxing out your contributions within the first few months. By front-loading, your money is invested sooner, giving it more time to potentially grow. The longer your contributions are in the market, the more opportunity they have to benefit from compound interest—where your earnings generate their own earnings over time. Even small differences in timing can add up significantly over the long run. What is dollar-cost averaging? Dollar-cost averaging is when you contribute the same amount to your 401(k) each paycheck throughout the year. This spreads your investments across different market conditions and can reduce the impact of short-term volatility. It's the default approach for most 401(k) participants since contributions are often tied to payroll deductions. Potential downsides of front-loading Timing your employer match: Some employers match contributions on a per-pay-period basis. If you front-load and stop contributing mid-year, you could forfeit part of the match. Check your employer’s match policy before committing to this strategy. Cash flow: Contributing heavily early in the year requires more liquidity. You’ll need to ensure you have the budget flexibility to absorb a smaller paycheck. Timing the market: Front-loading exposes your investments to the market conditions at the beginning of the year. If the market dips shortly after, you may see short-term losses. Additional considerations Alternative investment opportunities If you are able to save more each paycheck, you’ll need to work out whether front-loading your 401(k) is the best use of those funds. Depending on your personal financial circumstances, you may consider paying down high-interest debt, building up your emergency savings, or saving for another non-retirement goal. Payroll and plan restrictions Some 401(k) plans have rules that prevent you from contributing too much in a single period or may not allow large lump-sum contributions. Check with your HR department or plan administrator to understand the rules of your plan. Which strategy is right for you? It depends on your financial situation, risk tolerance, and employer plan structure: If you have the cash flow and your employer matches annually (or would offer to complete your match as if you had contributed throughout the year, known as a “true-up”), front-loading could give your money more time to grow. If you prefer a hands-off, lower-risk approach or want to ensure consistent employer matching, dollar-cost averaging may be the better choice. Some investors even opt for a hybrid approach—contributing more than the minimum early in the year, but not so much that they lose out on any employer match. Final thoughts Front-loading your 401(k) can be a powerful way to take advantage of compounding and time in the market, but it requires careful planning and consideration of your employer’s match policy. Meanwhile, dollar-cost averaging provides steady progress toward retirement with built-in risk management. Whichever strategy you choose, the most important thing is to contribute consistently and make the most of your 401(k)'s benefits. -

![]()

What is a Required Minimum Distribution?

What is a Required Minimum Distribution? Apr 14, 2025 9:00:00 AM In exchange for all of the tax advantages 401(k)s provided during your accumulation years, by law, you will need to start taking distributions from your account at a certain age. 401(k) plans can help you save for retirement in a tax-advantaged way. However, the Internal Revenue Service (IRS) requires that you start taking withdrawals from their qualified retirement accounts when you reach the age 73 (in 2025). These withdrawals are called required minimum distributions (RMDs). Why do I have to take RMDs? In exchange for the tax advantages you enjoy by contributing to your 401(k) plan, the IRS requests collection of taxes on these amounts when you turn 73. The IRS taxes RMDs as ordinary income, meaning withdrawals will count towards your total taxable income for the year. Generally, the IRS collects taxes on the gains in retirement accounts such as 401(k)s. However, if Roth 401(k) account assets are held for at least 5 years, Roth 401(k) funds are not taxed. Because there are taxes being paid to the government, these distributions are NOT eligible for rollover to another account. How much do I have to withdraw? RMDs are calculated based on your age and your account balance as of the end of the previous year. To determine the required distribution amount, Betterment divides your previous year’s ending account balance by your life expectancy factor (based on your age) from the IRS’ uniform lifetime table. If you had no balance at the end of the previous year, then your first RMD will not occur until the following year. Additionally, if you have taken a cash distribution from your 401(k) account in any given year you are subject to an RMD, and that distribution amount is equal to or greater than the RMD amount, that distribution will qualify as the required amount and no additional distribution is required. Does everyone who turns 73 need to take an RMD? Reaching the age requirement in a given year doesn’t mean that you have to take an RMD. Only those who reach the age requirement in a given year AND meet any of the following criteria must take an RMD: You have taken an RMD in previous years. If so, then you must take an RMD by December 31 of every year. You own more than 5% of the company sponsoring the 401(k) plan. If so, then you must take an RMD by December 31 every year. You have left the company (terminated or retired) in the year you turned 73. If so, then the first RMD does not need to occur until April 1 (otherwise known as the Required Beginning Date) of the following year, but must occur consecutively by December 31 for every year. Example: John turned 73 on June 1, 2022. John also decided to leave his company on August 1, 2024. He has been continuously contributing to his 401(k) account for the past 5 years. The first RMD must occur by April 1, 2025. The next RMD must occur by December 31, 2025 and every year thereafter. You are a beneficiary or alternate payee of an account holder who meets the above criteria. If you are 73 and still employed, you do NOT need to take an RMD. What are the consequences of not taking an RMD? Failure to take an RMD for a given year will result in a penalty of 25% of the amount not taken on time by the IRS. How do I take an RMD? Betterment will automatically process your RMD if we see that you are over the required age and no longer actively employed with your employer. If you have the option to take an RMD - age 73 but still employed - your employer can provide you with a form to submit a request. If you have a linked bank account on file, the RMD will be deposited into that account; if we do not have a bank account on file, a check will be mailed to the address in your account.