-

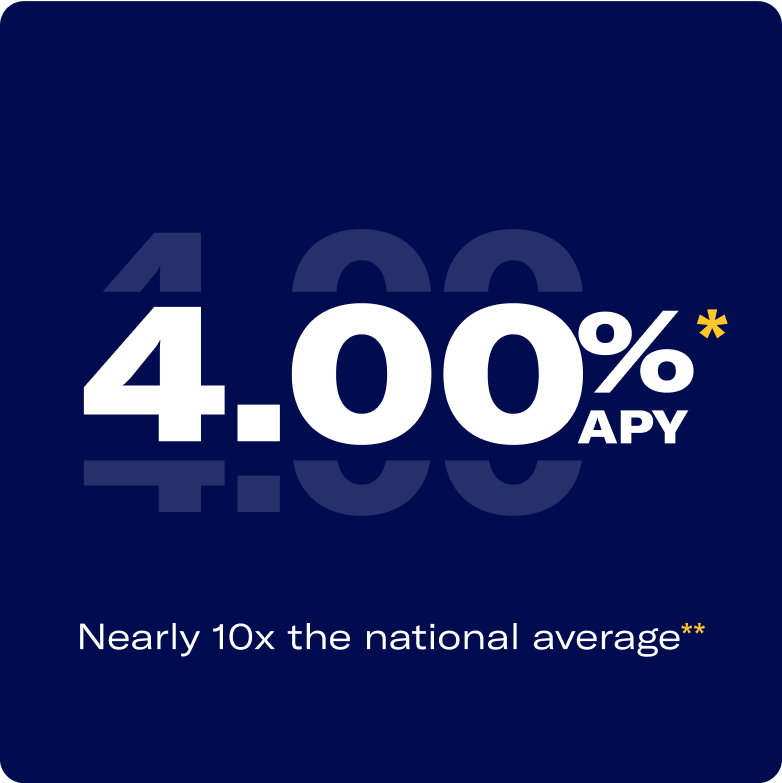

Boost your savings up to 4.50% APY* (variable) for 3 months with a qualifying deposit in your first cash account. New customers only. Terms apply.

Claim your offer -

Results for the long term

Since its launch, our Core portfolio has delivered over 9% composite annual time-weighted returns after fees.** Learn more

**As of 12/31/2024, and inception date 9/7/2011. Composite annual time-weighted returns: 12.7% over 1 year, 7.9% over 5 years, and 7.8% over 10 years. Composite performance calculated based on the dollar-weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net of fees, includes dividend reinvestment, and excludes the impact of cash flows. Past performance not guaranteed, investing involves risk.

Start with our most popular accounts.

-

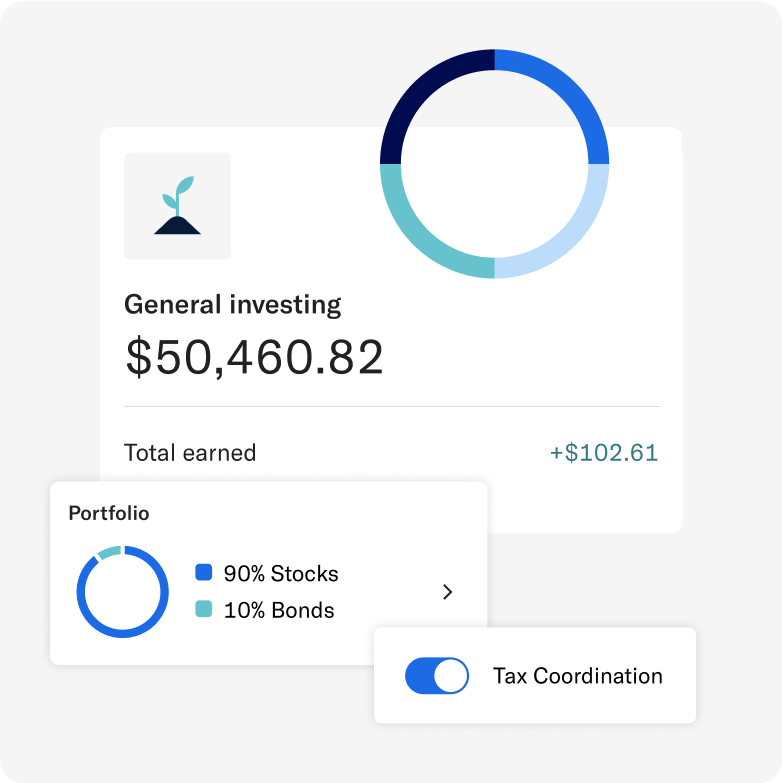

Save more in taxes

We use tax-loss harvesting to turn market dips into tax savings In fact, Nearly 70% of customers using tax-loss harvesting covered their taxable advisory fees through estimated tax savings. -

Ongoing optimization

We monitor your investments, rebalance your portfolio, and reinvest dividends to help maximize your returns.

Based on 2022-2023. Tax Loss Harvesting (TLH) is not suitable for all investors. Consider your personal circstances before deciding whether to utilize Betterment’s TLH feature. Fee coverage and estimated tax savings based on Betterment internal calculations. See more in disclosures

Pick from our expert built portfolios

Core Portfolio

Innovative Technology

Broad Impact

Climate Impact

Social Impact

-

$0 fees

Forget any monthly or maintenance costs—what you earn is what you keep. -

$2M FDIC insurance

Enjoy up to $2million ($4million for joint accounts) FDIC insurance with our program banks, subject to certain conditions. FDIC-insured up to $2M is 8x what most firms offer. -

Move money with ease

Easily transfer cash to your investing account, set up recurring savings, and withdraw funds anytime you need.

Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. FDIC insurance provided by "Program Banks", subject to certain conditions. Learn More .

The standard insurance amount of $250,000 per depositor, per insured bank, is provided by the FDIC and is subject to FDIC requirements.

-

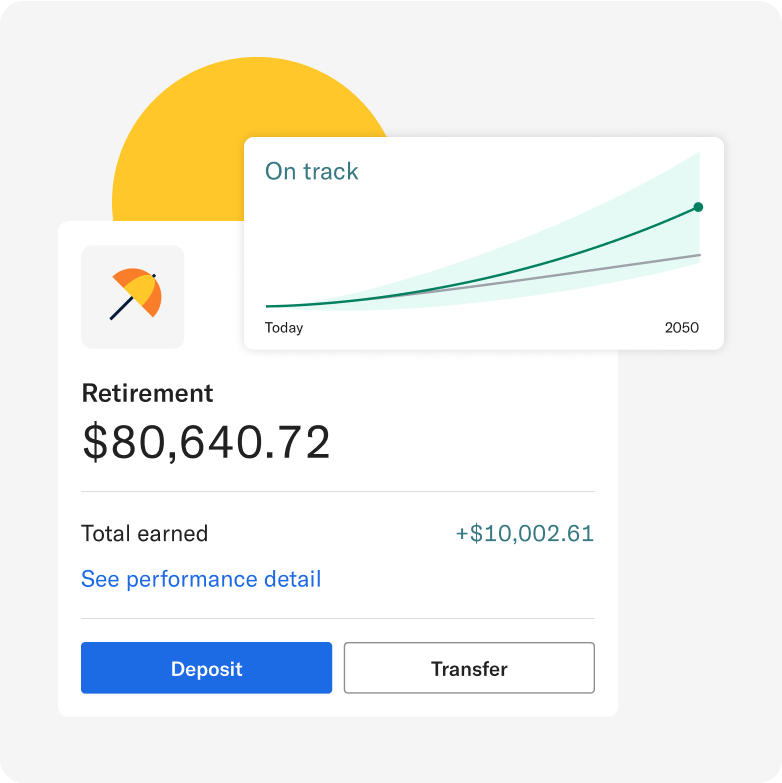

Tax benefits

We coordinate your retirement accounts for maximum tax efficiency, helping you save on taxes and grow your returns.

-

Retirement planning

We build you a personalized plan, recommend how much to save, and adjust as needed.

As the largest independent digital investment advisor, see what customers say about Betterment

Excellent place to make your money work for you.”

It's a good "set-it-and-forget-it" investing tool for my family."

Saves the stress and hassle of managing retirement savings myself"

I like the different types of accounts offered on Betterment, the high APY on the [cash] account compared to traditional banks, and how easy it is to check my accounts on the mobile app."

Want to know how you can make the most of your money? Take our quiz.

Still have questions?

-

Betterment helps you manage your money through cash management, guided investing, and retirement planning. We are a fiduciary, which means we act in your best interest.

We'll ask a bit about you when you sign up. We'll also gather information when you connect your outside accounts. Then, we'll help you set financial goals and set you up with investment portfolios for each goal.

For your long-term financial needs (like retirement, next year's vacation, or a down payment), our investment strategy utilizes low-cost ETFs (exchange-traded funds) and an adjustable risk profile based on your goal type and how long you plan to invest.

For your daily saving and spending, you can use our cash management products that include Checking (which is offered by nbkc bank, Member FDIC) and Cash Reserve, a high-yield cash account.

-

Customer support team members are available five days per week to answer questions about your account.

If you want in-depth financial advice, you can talk to a licensed advisor by phone for an additional cost. Our Premium plan provides you with unlimited access and costs an additional 0.40% on your invested balances (with a minimum investing account balance requirement of $100,000).

-

Betterment Securities is a Member of SIPC, which protects securities of its members up to $500K (including $250K for claims for cash). Explanatory brochure available upon request or at www.sipc.org. What you should remember is that the SIPC does not protect against market changes in your investing account.

Individual Cash Reserve accounts have FDIC insurance up to $2 million and joint Cash Reserve accounts offer up to $4 million in FDIC insurance once funds are deposited into our program banks†.

Funds deposited into Checking are FDIC-insured up to $250,000 for individual accounts and up to $250,000 per depositor for joint accounts, provided by nbkc bank, Member FDIC. Explore further details about FDIC insurance.

-

Our team of investing experts make decisions about our portfolio strategies and fund selection with the help of an external committee of economists, PhDs, and industry experts.

More than just a portfolio management team, our experts work to develop improvements to our Tax Smart technology, our cash analysis tools, and other advanced strategies.