What’s an IRA and how does it work?

Learn more about this investment account with tax advantages that help you prepare for retirement.

An Individual Retirement Account (IRA) is a type of investment account with tax advantages that helps you prepare for retirement. Depending on the type of IRA you invest in, you can make tax-free withdrawals when you retire, earn tax-free interest, or put off paying taxes until retirement.

The sooner you start investing in an IRA, the more time you have to accrue interest before you reach retirement age. But an IRA isn’t the only kind of investment account for retirement planning. And there are multiple types of IRAs available. If you’re planning for retirement, it’s important to understand your options and learn how to maximize your tax benefits.

If your employer offers a 401(k), it may be a better option than investing in an IRA. While anyone can open an IRA, employers typically match a portion of your contribution to a 401(k) account, helping your investment grow faster.

In this article, we’ll walk you through:

- What makes an IRA different from a 401(k)

- The types of IRAs

- How to choose between a Roth IRA and a Traditional IRA

- Timing your IRA contributions

- IRA recharacterizations

- Roth IRA conversions

Let’s start by looking at what makes an Individual Retirement Account different from a 401(k).

How is an IRA different from a 401(k)?

When it comes to retirement planning, the two most common investment accounts people talk about are IRAs and 401(k)s. 401(k)s offer similar tax advantages to IRAs, but not everyone has this option. Anyone can start an IRA, but a 401(k) is what’s known as an employer-sponsored retirement plan. It’s only available through an employer.

Other differences between these two types of accounts are that:

- Employers often match a percentage of your contributions to a 401(k)

- 401(k) contributions come right out of your paycheck

- 401(k) contribution limits are significantly higher

If your employer matches contributions to a 401(k), they’re basically giving you free money you wouldn’t otherwise receive. It’s typically wise to take advantage of this match before looking to an IRA.

With an Individual Retirement Account, you determine exactly when and how to make contributions. You can put money into an IRA at any time over the course of the year, whereas a 401(k) almost always has to come from your paycheck. Note that annual IRA contributions can be made up until that year’s tax filing deadline, whereas the contribution deadline for 401(k)s is at the end of each calendar year. Learning how to time your IRA contributions can significantly increase your earnings over time.

Every year, you’re only allowed to put a fixed amount of money into a retirement account, and the exact amount often changes year-to-year. For an IRA, the contribution limit for 2025 is $7,000 if you’re under 50, or $8,000 if you’re 50 or older. For a 401(k), the contribution limit for 2025 is $23,500 if you’re under 50, or $31,000 if you’re 50 or older. These contribution limits are separate, so it’s not uncommon for investors to have both a 401(k) and an IRA.

What are the types of IRAs?

The challenge for most people looking into IRAs is understanding which kind of IRA is most advantageous for them. For many, this boils down to Roth and/or Traditional. The advantages of each can shift over time as tax laws and your income level changes, so this is a common periodic question for even advanced investors.

As a side note, there are other IRA options suited for the self-employed or small business owner, such as the SEP IRA, but we won’t go into those here.

As mentioned in the section above, IRA contributions are not made directly from your paycheck. That means that the money you are contributing to an IRA has already been taxed. When you contribute to a Traditional IRA, your contribution may be tax-deductible. Whether you are eligible to take a full, partial, or any deduction at all depends on if you or your spouse is covered by an employer retirement plan (i.e. a 401(k)) and your income level (more on these limitations later).

Once funds are in your Traditional IRA, you will not pay any income taxes on investment earnings until you begin to withdraw from the account. This means that you benefit from “tax-deferred” growth. If you were able to deduct your contributions, you will pay income tax on the contributions as well as earnings at the time of withdrawal. If you were not eligible to take a deduction on your contributions, then you generally will only pay taxes on the earnings at the time of withdrawal. This is done on a “pro-rata” basis.

Comparatively, contributions to a Roth IRA are not tax deductible. When it comes time to withdraw from your Roth IRA, your withdrawals will generally be tax free—even the interest you’ve accumulated.

How to choose between a Roth IRA and a Traditional IRA

For most people, choosing an Individual Retirement Account is a matter of deciding between a Roth IRA and a Traditional IRA. Neither option is inherently better: it depends on your income and your tax bracket now and in retirement.

Your income determines whether you can contribute to a Roth IRA, and also whether you are eligible to deduct contributions made to a Traditional IRA. However, the IRS doesn’t use your gross income; they look at your modified adjusted gross income, which can be different from taxable income. With Roth IRAs, your ability to contribute is phased out when your modified adjusted gross income (MAGI) reaches a certain level.

If you’re eligible for both types of IRAs, the choice often comes down to what tax bracket you’re in now, and what tax bracket you think you’ll be in when you retire. If you think you’ll be in a lower tax bracket when you retire, postponing taxes with a Traditional IRA will likely result in you keeping more of your money. If you expect to be in a higher tax bracket when you retire, using a Roth IRA to pay taxes now may be the better choice.

The best type of account for you may change over time, but making a choice now doesn’t lock you into one option forever. So as you start retirement planning, focus on where you are now and where you’d like to be then. It’s healthy to re-evaluate your position periodically, especially when you go through major financial transitions such as getting a new job, losing a job, receiving a promotion, or creating an additional revenue stream.

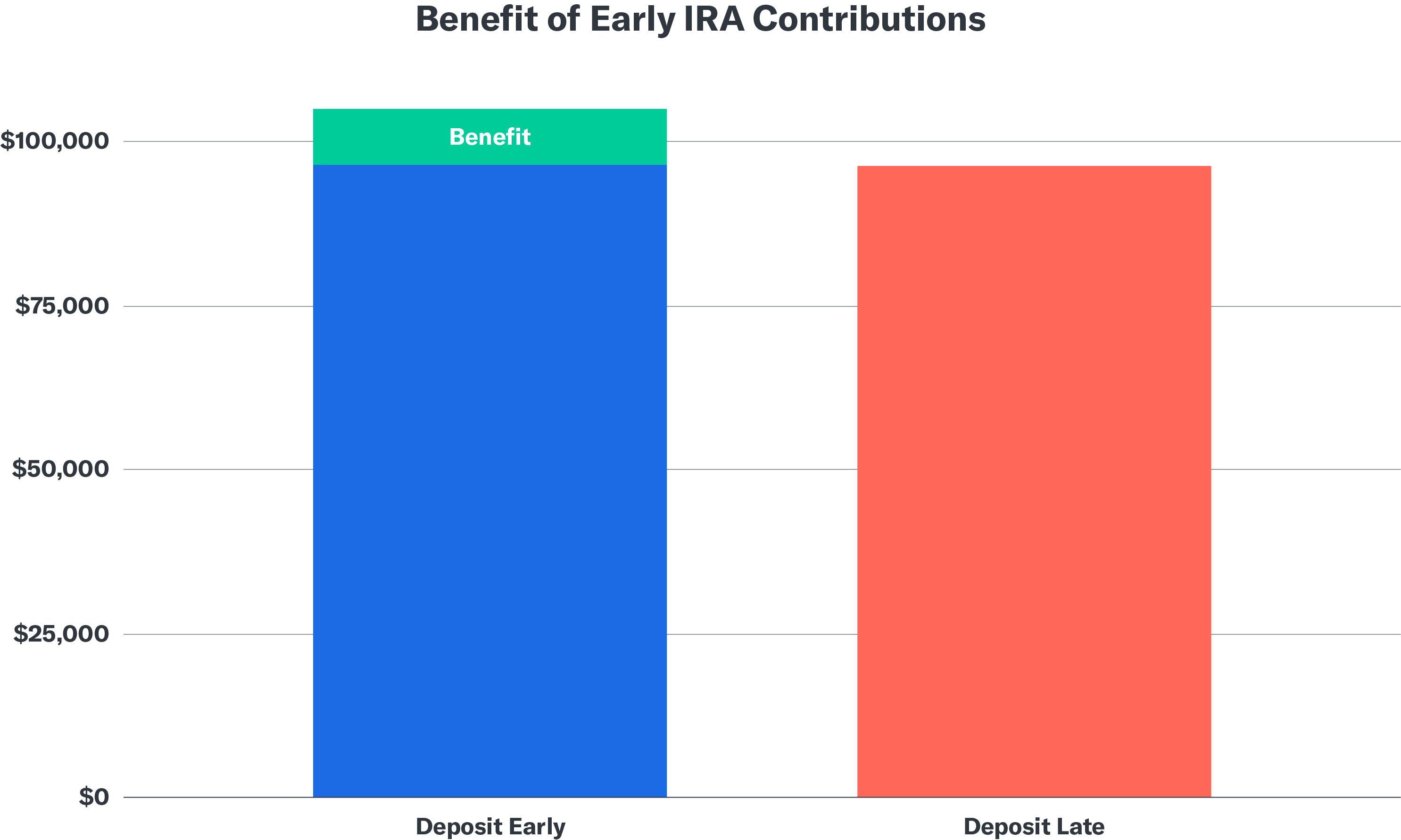

Timing IRA contributions: why earlier is better

Regardless of which type of IRA you select, it helps to understand how the timing of your contributions impacts your investment returns. It’s your choice to either make a maximum contribution early in the year, contribute over time, or wait until the deadline. By timing your contribution to be as early as possible, you can maximize your time in the market, which could help you gain more returns over time.

Consider the difference between making a maximum contribution on January 1 and making it on December 1 each year. Then suppose, hypothetically, that your annual growth rate is 10%. Here’s what the difference could look like between an IRA with early contributions and an IRA with late contributions:

This figure represents the scenarios mentioned above.‘Deposit Early’ indicates depositing $6,000 on January 1 of each calendar year, whereas ‘Deposit Late’ indicates depositing $6,000 on December 1 of the same calendar year, both every year for a ten-year period. Calculations assume a hypothetical growth rate of 10% annually. The hypothetical growth rate is not based on, and should not be interpreted to reflect, any Betterment portfolio, or any other investment or portfolio, and is purely an arbitrary number. Further, the results are solely based on the calculations mentioned in the preceding sentences. These figures do not take into account any dividend reinvestment, taxes, market changes, or any fees charged. The illustration does not reflect the chance for loss or gain, and actual returns can vary from those above.

This figure represents the scenarios mentioned above.‘Deposit Early’ indicates depositing $6,000 on January 1 of each calendar year, whereas ‘Deposit Late’ indicates depositing $6,000 on December 1 of the same calendar year, both every year for a ten-year period. Calculations assume a hypothetical growth rate of 10% annually. The hypothetical growth rate is not based on, and should not be interpreted to reflect, any Betterment portfolio, or any other investment or portfolio, and is purely an arbitrary number. Further, the results are solely based on the calculations mentioned in the preceding sentences. These figures do not take into account any dividend reinvestment, taxes, market changes, or any fees charged. The illustration does not reflect the chance for loss or gain, and actual returns can vary from those above.

What’s an IRA recharacterization?

You might contribute to an IRA before you have started filing your taxes and may not know exactly what your Modified Adjusted Gross Income will be for that year. Therefore, you may not know whether you will be eligible to contribute to a Roth IRA, or if you will be able to deduct your contributions to a Traditional IRA.

In some cases, the IRS allows you to reclassify your IRA contributions. A recharacterization changes your contributions (plus the gains or minus the losses attributed to them) from a Traditional IRA to a Roth IRA, or, from a Roth IRA to a Traditional IRA. It’s most common to recharacterize a Roth IRA to a Traditional IRA.

Generally, there are no taxes associated with a recharacterization if the amount you recharacterize includes gains or excludes dollars lost.

Here are three instances where a recharacterization may be right for you:

- If you made a Roth contribution during the year but discovered later that your income was high enough to reduce the amount you were allowed to contribute—or prohibit you from contributing at all.

- If you contributed to a Traditional IRA because you thought your income would be above the allowed limits for a Roth IRA contribution, but your income ended up lower than you’d expected.

- If you contributed to a Roth IRA, but while preparing your tax return, you realize that you’d benefit more from the immediate tax deduction a Traditional IRA contribution would potentially provide.

Additionally, we have listed a few methods that can be used to correct an over-contribution to an IRA in this FAQ resource.

You cannot recharacterize an amount that’s more than your allowable maximum annual contribution. You have until each year’s tax filing deadline to recharacterize—unless you file for an extension or you file an amended tax return.

What’s a Roth conversion?

A Roth conversion is a one-way street. It’s a potentially taxable event where funds are transferred from a Traditional IRA to a Roth IRA. There is no such thing as a Roth to Traditional conversion. It is different from a recharacterization because you are not changing the type of IRA that you contributed to for that particular year. There is no cap on the amount that’s eligible to be converted, so the sky’s the limit for those that choose to convert. We go into Roth conversions in more detail in our Help Center.

Start planning for retirement with Betterment

Whether you’ve never invested a dime or you already have an IRA and a 401(k), Betterment is here to help manage your investments. Answer a few questions, and we’ll recommend how much you need to save each year and which accounts are best for you to contribute to - including whether you should use a Traditional or Roth IRA. Within your Betterment account, you can sync existing accounts, make adjustments to your portfolio, and let us handle the rest. We’ll worry about the details, so you don’t have to.