Betterment Editors

Meet our writer

Betterment Editors

Betterment’s editorial team draws on decades of combined experience to bring you clear, practical points of view on personal finance, investing, and long-term wealth. Together, we demystify money decisions, help you size up options, and share the knowledge needed to build wealth with confidence and ease.

Articles by Betterment Editors

-

![]()

How we keep your Betterment account and investments safe

How we keep your Betterment account and investments safe Jan 15, 2026 11:00:00 AM So you can invest with peace of mind All investing comes with some risk. But that risk should be based on the market, not your broker. That’s why we safeguard both your Betterment account and your investments with multiple security measures, all so you can log in and invest or save with peace of mind. Here’s a sampling. Four ways we keep your Betterment account safe Two-factor authentication Two-factor authentication (2FA) adds an extra layer of security to your account, like an extra lock on a door. Besides your regular password, 2FA requires a second form of verification such as a code texted to your phone (good) or one served up by an authenticator app like Google Authenticator (even more secure). This helps ensure that even if someone manages to get hold of your Betterment password, they still can't access your account without a second form of verification. Encryption Every time you interact with us, whether on our website or our app, your data is protected by encrypted connections. This means that the information transmitted between your device and our servers is scrambled in a way that only we can understand. Password hashing When you create a password for your Betterment account, it's not stored in plain text. Instead, we use a process called hashing, which converts your password into a unique string of characters. This way, even if our systems were breached, your actual password would remain unknown and unusable by unauthorized parties. App passwords Connecting third-party apps to your Betterment account (or vice versa) unlocks several benefits. You can easily track your net worth on Betterment, for example. Or quickly import your Betterment tax forms to certain tax prep software. When a third-party app asks for your Betterment credentials, instead of using your regular login, we ask you to create a password specifically for that app. In the scenario the third-party app’s connection is compromised, you can easily revoke its read-only access to your Betterment account. Note that some apps may use the OAuth standard, which lets you use your regular login while maintaining a similar level of security as an app password. TurboTax is one such example. Four ways we keep your investments safe Easy verification of holdings Transparency is one of our key principles, so we make it easy to verify everything is in its right place. We not only show each trade made on your behalf and the precise number of shares in which you’re invested, we also list each fractional share sold and the respective gross proceeds and cost basis for each. You can find all this information in the Holdings and Activity tabs for each of your goals. Independent oversight We regularly undergo review by independent auditors. This means auditors reconcile every share and every dollar we say we have against our actual holdings. They also spot check random customer accounts and verify that account statements match our internal records. And they ask questions if anything is even a penny off. No commingling of funds Your funds are kept separate from Betterment’s operational funds. This means that your investments are held in your name and are never mixed with our company finances. In the unlikely event we face financial difficulties, your assets remain secure and untouched. SIPC insurance To add another layer of protection, your Betterment securities are insured by the Securities Investor Protection Corporation (SIPC). This insurance covers up to $500,000 per customer, including a $250,000 limit for cash claims. While SIPC doesn’t protect against market losses, it does provide a safety net in case of a brokerage failure. An explanatory brochure is available upon request or at sipc.org. How you can help Be on the lookout for suspicious phone calls, texts, and emails (odd-looking URLs, typo-riddled messages, etc.) and know that Betterment will never ask you for your password or 2FA code except when logging in or editing your personal information in the app. Use a strong, unique password for your account. If you receive any unexpected or suspicious communications or have questions, please email fraud@betterment.com. -

![]()

Three steps to size up your emergency fund

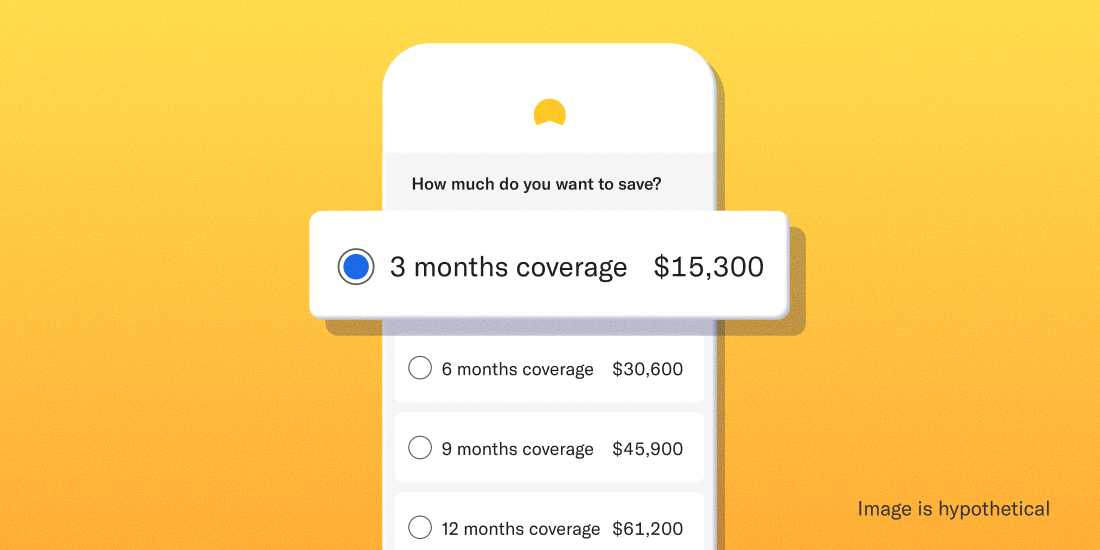

Three steps to size up your emergency fund Dec 3, 2025 6:00:00 AM Strive for at least three months of expenses while taking these factors into consideration. Imagine losing your job, totaling your car, or landing in the hospital. How quickly would your mind turn from the shock of the event itself to worrying about paying your bills? If you’re anything like the majority of Americans recently surveyed by Bankrate, finances would add insult to injury pretty fast: Only around 2 in 5 Americans would pay for an emergency from their savings In these scenarios, an emergency fund can not only help you avoid taking on high-interest debt or backtracking on other money goals, it can give you one less thing to worry about in trying times. So how much should you have saved, and where should you put it? Follow these three steps. 1. Tally up your monthly living expenses — or use our shortcut. Coming up with this number isn’t always easy. You may have dozens of regular expenses falling into one of a few big buckets: Food Housing Transportation Medical When you create an Emergency Fund goal at Betterment, we automatically estimate your monthly expenses based on two factors from your financial profile: Your self-reported household annual income Your zip code’s estimated cost of living You’re more than welcome to use your own dollar figure, but don’t let math get in the way of getting started. 2. Decide how many months make sense for you We recommend having at least three months’ worth of expenses in your emergency fund. A few scenarios that might warrant saving more include: You support others with your income Your job security is iffy You don’t have steady income You have a serious medical condition But it really comes down to how much will help you sleep soundly at night. According to Bankrate’s survey, nearly ⅔ of people say that total is six months or more. Whatever amount you land on, we’ll suggest a monthly recurring deposit to help you get there. We’ll also project a four-year balance based on your initial and scheduled deposits and your expected return and volatility. Why four years? We believe that’s a realistic timeframe to save at least three months of living expenses through recurring deposits. If you can get there quicker and move on to other money goals, even better! 3. Pick a place to keep your emergency fund We recommend keeping your emergency fund in one of two places: cash—more specifically a low-risk, high-yield cash account—or a bond-heavy investing account. A low-risk, high-yield cash account like our Cash Reserve may not always keep pace with inflation, but it comes with no investment risk. Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. FDIC insurance provided by Program Banks, subject to certain conditions. Learn more. An investing account is better suited to keep up with inflation but is relatively riskier. Because of this volatility, we currently suggest adding a 30% buffer to your emergency fund’s target amount if you stick with the default stock/bond allocation. There also may be tax implications should you withdraw funds. Your decision will again come down to your comfort level with risk. If the thought of seeing your emergency fund’s value dip, even for a second, gives you heartburn, you might consider sticking with a cash account. Or you can always hedge and split your emergency fund between the two. There’s no wrong answer here! Remember to go with the (cash) flow There’s no final answer here either. Emergency funds naturally ebb and flow over the years. Your monthly expenses could go up or down. You might have to withdraw (and later replace) funds. Or you simply might realize you need a little more saved to feel secure. Revisit your numbers on occasion—say, once a year or anytime you get a raise or big new expense like a house or baby—and rest easy knowing you’re tackling one of the most important financial goals out there. -

![]()

Self-directed investing, the Betterment way

Self-directed investing, the Betterment way Nov 11, 2025 7:00:00 AM See what makes Betterment’s self-directed investing different from the rest. Plus, get three tips to help develop your own investing strategy. Key takeaways We surveyed our customers and learned that 75% of them use self-directed investing elsewhere, but many want it alongside their automated investing—so we built it the Betterment way. With Betterment, you can invest your way, buying and selling thousands of stocks and ETFs with no commissions. Manage your automated portfolios, cash accounts, and self-directed trades together on one platform for a fuller view of your finances. Unlike other investing apps, Betterment’s tax impact preview lets you see the impact of a sale before you trade, so there are no tax surprises. Invest smarter with these three tips: set clear goals, plan for taxes, and keep emotions out of your investing. Recently, we surveyed our customers and learned that 75% of them use some form of self-directed investing. That was eye-opening. While our automated investing tools are designed to take the work out of wealth building, many people still want the option to pick and manage certain investments on their own. So we asked ourselves: how can we bring self-directed investing to life—the Betterment way? Our answer: combine our award-winning platform with a customer-first experience to let you buy and sell thousands of stocks and ETFs with no commissions. With Betterment’s self-directed investing, you’ll get more investing choices, the ability to see all of your investments in a consolidated place, and tax insights you won’t find anywhere else. Investing your way, all in one place Not everyone invests for the same reason. We know this because we continually solicit feedback from our customers. Some customers told us they want to invest in companies they believe in. Others find it intellectually rewarding to follow markets and make trades. And many simply like having more control over their portfolio. With Betterment’s self-directed investing, you can get that flexibility while keeping everything on one platform. Manage your automated portfolios, cash accounts, and self-directed trades side by side, with technology designed to give you a clear view of your financial life. Tax insights you won’t get anywhere else Here’s where we’re really different than the typical “stock trading” platforms. Self-directed trading often means more frequent buying and selling, which can bring a hefty and unexpected tax bill at the end of the year that catches people off guard. In fact, when we asked our customers about their biggest challenge with self-directed investing on other apps, the top answer was “managing tax implications.” We solved that challenge. At Betterment, you’ll see a tax impact preview before you sell a stock or ETF. That preview includes how the sale could affect your taxes, and even potential wash sales. A wash sale occurs when you sell a security at a loss and then repurchase the same or a substantially identical security within 30 days before or after the sale, disallowing the tax deduction for that loss. With our tax impact preview, there are no surprises or guesswork. Just clear tax insights to help you make smarter decisions. (See how tax impact preview works.) Three tips to get started with self-directed investing Self-directed investing provides you with the choice to invest your way. But you get to decide what “your way” means. To help, here are three steps to get started: Have a clear goal before you trade: Don’t just buy because something looks hot or is in the news. Ask yourself: Am I investing for long-term growth, short-term income, diversification, or some other reason? Having a clear purpose can help you avoid making impulsive trades. Think about taxes before you sell: Selling a stock or ETF can trigger capital gains taxes. Short-term gains (for investments held less than a year) are usually taxed at a higher rate than long-term gains. Using tools that preview your tax impact before you trade—like Betterment’s—can help you avoid surprises. Avoid emotional trading: Markets move fast. It’s easy to panic-sell when prices dip or chase a stock that’s soaring. Instead, set rules for yourself—like only initiating a trade at pre-set price targets or sticking to a dollar-cost averaging plan—so emotions don’t dictate your decisions. Plus, at Betterment, your trades are queued for execution and not made immediately, but they are made in a timely manner, limiting your ability to try to “time the market.” -

![]()

What’s an IRA and how does it work?

What’s an IRA and how does it work? Nov 7, 2025 7:00:00 AM Learn more about this investment account with tax advantages that help you prepare for retirement. An Individual Retirement Account (IRA) is a type of investment account with tax advantages that helps you prepare for retirement. Depending on the type of IRA you invest in, you can make tax-free withdrawals when you retire, earn tax-free interest, or put off paying taxes until retirement. The sooner you start investing in an IRA, the more time you have to accrue interest before you reach retirement age. But an IRA isn’t the only kind of investment account for retirement planning. And there are multiple types of IRAs available. If you’re planning for retirement, it’s important to understand your options and learn how to maximize your tax benefits. If your employer offers a 401(k), it may be a better option than investing in an IRA. While anyone can open an IRA, employers typically match a portion of your contribution to a 401(k) account, helping your investment grow faster. In this article, we’ll walk you through: What makes an IRA different from a 401(k) The types of IRAs How to choose between a Roth IRA and a Traditional IRA Timing your IRA contributions IRA recharacterizations Roth IRA conversions Let’s start by looking at what makes an Individual Retirement Account different from a 401(k). How is an IRA different from a 401(k)? When it comes to retirement planning, the two most common investment accounts people talk about are IRAs and 401(k)s. 401(k)s offer similar tax advantages to IRAs, but not everyone has this option. Anyone can start an IRA, but a 401(k) is what’s known as an employer-sponsored retirement plan. It’s only available through an employer. Other differences between these two types of accounts are that: Employers often match a percentage of your contributions to a 401(k) 401(k) contributions come right out of your paycheck 401(k) contribution limits are significantly higher If your employer matches contributions to a 401(k), they’re basically giving you free money you wouldn’t otherwise receive. It’s typically wise to take advantage of this match before looking to an IRA. With an Individual Retirement Account, you determine exactly when and how to make contributions. You can put money into an IRA at any time over the course of the year, whereas a 401(k) almost always has to come from your paycheck. Note that annual IRA contributions can be made up until that year’s tax filing deadline, whereas the contribution deadline for 401(k)s is at the end of each calendar year. Learning how to time your IRA contributions can significantly increase your earnings over time. Every year, you’re only allowed to put a fixed amount of money into a retirement account, and the exact amount often changes year-to-year. For an IRA, the contribution limit for 2026 is $7,500 if you’re under 50, or $8,600 if you’re 50 or older. For a 401(k), the contribution limit for 2026 is $24,500 if you’re under 50, or $32,500 if you’re 50 or older. These contribution limits are separate, so it’s not uncommon for investors to have both a 401(k) and an IRA. And as a side note for those 50 or older, starting in 2026, 401(k) catch-up contributions must go into a Roth 401(k) specifically if you received more than $145,000 in FICA wages (salaries, commissions, etc.) the prior year. What are the types of IRAs? The challenge for most people looking into IRAs is understanding which kind of IRA is most advantageous for them. For many, this boils down to Roth and/or Traditional. The advantages of each can shift over time as tax laws and your income level changes, so this is a common periodic question for even advanced investors. As a side note, there are other IRA options suited for the self-employed or small business owner, such as the SEP IRA, but we won’t go into those here. As mentioned in the section above, IRA contributions are not made directly from your paycheck. That means that the money you are contributing to an IRA has already been taxed. When you contribute to a Traditional IRA, your contribution may be tax-deductible. Whether you are eligible to take a full, partial, or any deduction at all depends on if you or your spouse is covered by an employer retirement plan (i.e. a 401(k)) and your income level (more on these limitations later). Once funds are in your Traditional IRA, you will not pay any income taxes on investment earnings until you begin to withdraw from the account. This means that you benefit from “tax-deferred” growth. If you were able to deduct your contributions, you will pay income tax on the contributions as well as earnings at the time of withdrawal. If you were not eligible to take a deduction on your contributions, then you generally will only pay taxes on the earnings at the time of withdrawal. This is done on a “pro-rata” basis. Comparatively, contributions to a Roth IRA are not tax deductible. When it comes time to withdraw from your Roth IRA, your withdrawals will generally be tax free—even the interest you’ve accumulated. How to choose between a Roth IRA and a Traditional IRA For most people, choosing an Individual Retirement Account is a matter of deciding between a Roth IRA and a Traditional IRA. Neither option is inherently better: it depends on your income and your tax bracket now and in retirement. Your income determines whether you can contribute to a Roth IRA, and also whether you are eligible to deduct contributions made to a Traditional IRA. However, the IRS doesn’t use your gross income; they look at your modified adjusted gross income, which can be different from taxable income. With Roth IRAs, your ability to contribute is phased out when your modified adjusted gross income (MAGI) reaches a certain level. If you’re eligible for both types of IRAs, the choice often comes down to what tax bracket you’re in now, and what tax bracket you think you’ll be in when you retire. If you think you’ll be in a lower tax bracket when you retire, postponing taxes with a Traditional IRA will likely result in you keeping more of your money. If you expect to be in a higher tax bracket when you retire, using a Roth IRA to pay taxes now may be the better choice. The best type of account for you may change over time, but making a choice now doesn’t lock you into one option forever. So as you start retirement planning, focus on where you are now and where you’d like to be then. It’s healthy to re-evaluate your position periodically, especially when you go through major financial transitions such as getting a new job, losing a job, receiving a promotion, or creating an additional revenue stream. Timing IRA contributions: why earlier is better Regardless of which type of IRA you select, it helps to understand how the timing of your contributions impacts your investment returns. It’s your choice to either make a maximum contribution early in the year, contribute over time, or wait until the deadline. By timing your contribution to be as early as possible, you can maximize your time in the market, which could help you gain more returns over time. Consider the difference between making a maximum contribution on January 1 and making it on December 1 each year. Then suppose, hypothetically, that your annual growth rate is 10%. Here’s what the difference could look like between an IRA with early contributions and an IRA with late contributions: This figure represents the scenarios mentioned above.‘Deposit Early’ indicates depositing $6,000 on January 1 of each calendar year, whereas ‘Deposit Late’ indicates depositing $6,000 on December 1 of the same calendar year, both every year for a ten-year period. Calculations assume a hypothetical growth rate of 10% annually. The hypothetical growth rate is not based on, and should not be interpreted to reflect, any Betterment portfolio, or any other investment or portfolio, and is purely an arbitrary number. Further, the results are solely based on the calculations mentioned in the preceding sentences. These figures do not take into account any dividend reinvestment, taxes, market changes, or any fees charged. The illustration does not reflect the chance for loss or gain, and actual returns can vary from those above. What’s an IRA recharacterization? You might contribute to an IRA before you have started filing your taxes and may not know exactly what your Modified Adjusted Gross Income will be for that year. Therefore, you may not know whether you will be eligible to contribute to a Roth IRA, or if you will be able to deduct your contributions to a Traditional IRA. In some cases, the IRS allows you to reclassify your IRA contributions. A recharacterization changes your contributions (plus the gains or minus the losses attributed to them) from a Traditional IRA to a Roth IRA, or, from a Roth IRA to a Traditional IRA. It’s most common to recharacterize a Roth IRA to a Traditional IRA. Generally, there are no taxes associated with a recharacterization if the amount you recharacterize includes gains or excludes dollars lost. Here are three instances where a recharacterization may be right for you: If you made a Roth contribution during the year but discovered later that your income was high enough to reduce the amount you were allowed to contribute—or prohibit you from contributing at all. If you contributed to a Traditional IRA because you thought your income would be above the allowed limits for a Roth IRA contribution, but your income ended up lower than you’d expected. If you contributed to a Roth IRA, but while preparing your tax return, you realize that you’d benefit more from the immediate tax deduction a Traditional IRA contribution would potentially provide. Additionally, we have listed a few methods that can be used to correct an over-contribution to an IRA in this FAQ resource. You cannot recharacterize an amount that’s more than your allowable maximum annual contribution. You have until each year’s tax filing deadline to recharacterize—unless you file for an extension or you file an amended tax return. What’s a Roth conversion? A Roth conversion is a one-way street. It’s a potentially taxable event where funds are transferred from a Traditional IRA to a Roth IRA. There is no such thing as a Roth to Traditional conversion. It is different from a recharacterization because you are not changing the type of IRA that you contributed to for that particular year. There is no cap on the amount that’s eligible to be converted, so the sky’s the limit for those that choose to convert. We go into Roth conversions in more detail in our Help Center. -

![]()

Your Betterment experience has just undergone a major upgrade

Your Betterment experience has just undergone a major upgrade Aug 18, 2025 9:57:03 AM A better way to manage your money is here. Your Betterment experience has just undergone a major upgrade, built around one idea: making managing your money more flexible and intuitive. We’ve redesigned how your accounts and goals work together, so you can organize your money the way that makes the most sense for you. What changed—and why? We’ve always believed in goal-based investing. It’s what sets Betterment apart. But in the past, each goal in Betterment was tied to a single account. That worked when needs were simpler. But you asked for more flexibility to reflect your financial life, and we’ve delivered. Now, by separating account data from goal advice, we’ve created space for more personalized guidance, clearer navigation, and more flexibility for you and your money. What you’ll see that’s new today: A cleaner design: A modern look that surfaces what matters most—no more digging through tabs. A dedicated page for each goal: Get personalized advice, projections, and next steps, all in one place. A streamlined overview of single accounts: See balances, holdings, and performance clearly, while being able to click through directly to access account details. A dedicated goal forecaster: Get insights in one place to see how actions may affect future earnings. And as a BONUS: Your Activity Page got an upgrade 🔄 Enjoy a clearer window into trades, transfers, and transactions. And we’re just getting started. We’re already building the next phase of features to make your Betterment experience more powerful and flexible. Multiple accounts in one goal: Get combined advice across different account types and tax treatments. Smarter, goal-specific advice: We’ll help you optimize every dollar for what you care about most. Shared goals: Soon, you’ll be able to co-own a goal with another Betterment user. More tailored investing guidance: Tell us your goal, and we’ll recommend the best path to get there. A faster, more user-friendly Betterment experience. To better fit your financial needs, we’ve separated account data from goal-based advice to give you more control and a better sense of ownership over your account. Whether you're planning for retirement, building an emergency fund, or simply growing your wealth through automated investing, Betterment is now better built for how you’ll manage your money. Smarter tools, personalized advice, and goal-based investing—all working together for you. -

![]()

Inside the investing kitchen, part 3

Inside the investing kitchen, part 3 Aug 15, 2025 12:00:00 PM Order up! See how we handle thousands of trades each day to keep customers’ portfolios humming. When a chef plates a meal, they typically send it off, never to be seen again. But serving up an investing portfolio is an ongoing affair. Deposits come in. Withdrawals go out. Asset classes grow and shrink as the market moves. Rebalancing takes place on the regular. All of this requires daily trading. And this buying and selling of securities is among the most intricate and highly-regulated pieces of our operations. So while the first two parts of this series cover the recipes and ingredients behind our investing, our final course focuses on the team—and tech—behind every transaction. What happens when you hit "deposit" Cara Daly is an adventurer at heart. An avid surfer and the daughter of a flight attendant, she racks up air miles chasing waves and visiting family in Ireland. So naturally, she's gravitated toward one of the more thrill-seeking roles on our Investing team: Capital Markets. From the minute markets open each day, Cara and team monitor the action, making sure our customers' orders go smoothly. These trades can amount to hundreds of millions of dollars in a single day, and the system that executes them all is in many ways our secret sauce. It's custom-built (a rarity in the industry) and plays the role of Mission Control. When a customer clicks "deposit," for example, that single click gets translated into a series of purchases. These in turn get bundled up with other purchases of a like-kind and turned into orders, which are then executed at calibrated intervals as a part of our managed trading strategy. This sort of intentional trading is incredibly important because of the scale of our operations. We manage $65 Billion+ of assets, making us the largest independent robo-advisor out there. We may not "make" markets, but our trading volume is big enough to potentially influence them. So we need to be mindful of how and when our trades get executed. “Say the market trades $10 million of a hypothetical security on any given day,” Cara says. “If our customers happen to want $20 million of it, meeting all that demand without minding the bigger context could drive up the price.” To navigate these executional challenges, we deploy multiple strategies as needed (see below for a few examples), evaluating and calibrating each on a continuous basis. Taken altogether, they help ensure our customers' purchases and sales get treated fairly in the market. Waiting out the first half hour after markets open before starting our trading. This helps sidestep some of the volatility that's common early in the day. Trading periodically throughout the day, and randomizing when customers’ orders are processed. It's possible that prices can loosely correlate with certain times of the day, so we don't want that to consistently affect any one customer. Briefly holding back on “system-generated” trading (proactive rebalancing, for example) for any particular fund if its trading reaches a certain threshold relative to its average daily volume. This helps make sure “user-directed” trading (when customers make deposits or withdrawals, to name a few examples) can continue regardless. Partnering with industry experts like Apex to route and execute orders across multiple firms, helping us stay at the forefront of the evolving market landscape. This access to different execution venues also helps seek out the most favorable terms for customers—whether that’s price, speed, or overall execution quality. Switching gears from execution to tax optimization, we also use both primary and secondary funds for most of our asset classes. These backup “tickers” come into play during times of heightened volatility in markets. Moments that can make or break an investing strategy. Acing the stress test of market volatility More often than not, it's business as usual on our Capital Markets team, and that's by design. But during stretches of extreme volatility, when trading volume really picks up and prices can swing wildly from hour to hour, it's all hands on deck. Cara and company monitor our trading system for signs that additional oversight may be needed. They ease emerging bottlenecks in real time and keep things running smoothly, at times enlisting the support of our Trading Engineering team. Cara Daly (left) helps make sure customers’ daily trading goes smoothly. Take April of 2025 for example. Early in the month, the Trump administration caught investors off guard by announcing a series of tariffs way higher and way earlier than expected. The announcement, and the inconsistent messaging that followed, set off a wild, weeks-long stretch of trading. Prices of some securities cratered in the morning only to recover by day's end. Our systems not only weathered this storm, but capitalized on it, taking advantage of small windows of time to harvest tens of millions of dollars in temporary losses for customers before prices recovered. This strategy of tax loss harvesting helps sprinkle tax advantages on a portion of customers' taxable investing, and it wouldn’t be possible without the help of those aforementioned secondary tickers. These funds help reduce “wash sales” while maintaining customers’ desired exposures and risk levels. Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more. Something delicious is simmering The image of a golden harvest is an apt one, considering this series looks at our Investing team's work through a culinary lens. Many of our customers come to us not necessarily for a single serving of returns, but to plant the seeds for self-sustaining, long-term wealth. A harvest that supports a more-fulfilling life. Cara and the rest of our Capital Markets experts are a big part of that lifecycle, tending to thousands of daily trades that optimize our customers’ portfolios over and over again. That's the beauty of using technology as a tool to expand our own capabilities and deliver results at scale. It's a people-led process. We became a trusted leader in automated money management not because of our tech, but because of the people who build and use it each day. Specialists like Cara, Josh, and Jamie—They're our secret ingredient, working in service of customers hungry for a better way to invest. Bon appétit. -

![]()

Inside the investing kitchen, part 1

Inside the investing kitchen, part 1 Jun 24, 2025 11:30:00 AM The recipe for a better portfolio, and the science behind a safer nest egg. Jamie Lee isn’t a Top Chef, but he knows his way around the kitchen. He dabbles in sous vide with the help of a sous chef (his 6-year-old daughter). He loves smoking salmon low and slow on a pair of pellet grills. And in some ways, his day job on the Betterment Investing team resembles the culinary world as well. He and his teammates work in a test kitchen of sorts, defining and refining the recipes for our low-cost, high-performing, and globally-diversified portfolios. They size up ingredients, pair flavors, and thoughtfully assemble the courses of each “meal.” All in service of customers with varying appetites for risk. It's highly-technical work, but we wouldn't be Betterment if we didn't make our methodologies as accessible as possible. So whether you're kicking the tires on our services, or you're already a customer and simply curious about the mechanics of your money machine, come along for a three-part, behind-the-scenes look at how we cook up a better portfolio. Here in part 1, we'll explore how we allocate your investing at a high level. In part 2, we'll zoom in to our process for selecting specific funds. And in part 3, we'll show you how we handle thousands of trades each day to keep our customers’ portfolios in tip-top shape. The science behind a safer nest egg Betterment customers rely on Jamie and team to do the heavy lifting of portfolio construction. They distill handfuls of asset classes, a hundred-plus risk levels, and thousands of funds into a simple yet eclectic menu of investment options. And underpinning much of this process is something called Modern Portfolio Theory, a framework developed by the late American economist Harry Markowitz. The theory revolutionized how investors think about risk, and led to Markowitz winning the Nobel Prize in 1990. Diversification lies at the heart of Modern Portfolio Theory. The more of it your investing has, the theory goes, the less risk you're exposed to. But that barely scratches the surface. One of the meatiest parts of building a portfolio (and by extension, diversifying your investing) is how much weight to give each asset class, also known as asset allocation. Broadly speaking, you have stocks and bonds. But you can slice up the pie in several other ways. There’s large cap companies or less established ones. Government debt or the corporate variety. And even more relevant as of late: American markets or international. Jamie came of age in South Korea during the late 90s. Back here in the States, the dot-com bubble was still years away from popping. But in South Korea and Asia more broadly, a financial crisis was well underway. And it changed the trajectory of Jamie’s career. His interest in and application of math shifted from computer science to the study of markets, and ultimately led to a PhD in statistics. Jamie Lee (right) helps optimize the weights of asset classes in Betterment portfolios. For Jamie, the interplay of markets at a global level is fascinating. So it’s only fitting that when optimizing asset allocations for customers, Jamie and team start with the hypothetical "global market portfolio," an imaginary snapshot of all the investable assets in the world. The current value of U.S. stocks, for example, represents about two-thirds the value of all stocks, so it's weighted accordingly in the global market portfolio. These weights are the jumping off point for a key part of the portfolio construction process: projecting future returns. Reverse engineering expected returns “Past performance does not guarantee future results.” We include this type of language in all of our communications at Betterment, but for quantitative researchers, or “quants,” like Jamie, it’s more than a boilerplate. It’s why our forecasts for the expected returns of various asset classes largely aren't based on historical performance. They're forward-looking. "Past data is simply too unreliable," says Jamie. "Look at the biggest companies of the 90s; that list is completely different from today.” So to build our forecasts, commonly referred to in the investing world as Capital Market Assumptions, we pretend for a moment that the global market portfolio is the optimal one. Since we know roughly how each of those asset classes performs relative to one another, we can reverse engineer their expected returns. This robust math is represented by a deceivingly short equation—μ = λ Σ ωmarket—which you can read more about in our full portfolio construction methodology. From there, we simulate thousands of paths for the market, factoring in both our forecasts and those of large asset managers like BlackRock to find the optimal allocation for each path. Then we average those weights to land on a single recommendation. This “Monte Carlo" style of simulations is commonly used in environments filled with variables. Environments like, say, capital markets. The outputs are the asset allocation percentages (refreshed each year) that you see in the holdings portion of your portfolio details At this point in the journey, however, our Investing team's work is hardly finished. They still need to seek out some of the most cost-effective, and just plain effective, funds that give you the intended exposure to each relevant asset class. For this, we need to head out of the test kitchen and into the market. So don’t forget your tote bag. -

![]()

Inside the investing kitchen, part 2

Inside the investing kitchen, part 2 Jun 24, 2025 11:25:00 AM See how we source the higher-quality, lower-cost funds that fill up your portfolio. A lot goes into the making of a single Betterment portfolio. So much that we're spreading out this showcase of our Investing team's work over three parts. In part 1, we explore how we allocate customers’ investing at a high level, and in part 3, we show how we handle thousands of trades each day to keep their portfolios humming. And here in part 2, we zoom into a topic that may be a little more relatable for the everyday investor: picking the actual investments themselves. If asset allocation is like refining a recipe, then today's topic of fund selection is all about the sourcing of higher-quality, lower-cost ingredients. And for that, we turn our eye toward a market of another kind. Josh Shrair specializes in shopping capital markets here at Betterment, picking the funds that fill up your portfolio's respective allocations. His line of work looked a little different decades ago, back when his step dad was working as a trader on Wall Street. Back then, this level of attention to portfolio construction and fund selection was typically in service of only the ultra wealthy. But now, Josh and team navigate a rapidly-expanding universe of investments on behalf of everyday investors. Why shopping for funds isn't always so simple On one hand, the recent explosion of investment options has been great for investors. Increased competition drives down costs and opens up access to newer, more niche markets. But more choice also leads to more complexity. Take Exchange Traded Funds (ETFs), our preferred building block for portfolios thanks to their transparency, tax efficiency, and lower costs. They bundle up hundreds, and sometimes thousands, of individual stocks and bonds. But even ETFs are multiplying fast. In 2024 alone, 723 new ones launched, bringing the total to nearly 4,000. To illustrate this abundance, let's say your asset allocation calls for a heaping serving of “Large Cap” stocks, meaning companies valued at $10 billion or more. Nearly 500 ETFs populate this particular corner of the ETF universe. We can narrow that group down to 30 based on the specific exposure we’re looking for, like say U.S. Large Cap companies, or the S&P 500, a list or “index” of 500 of the biggest American companies. But the due diligence is hardly done. Some ETFs that track the S&P 500 follow it faithfully, while others put their own spin on it, which can open investors up to unintended exposure. Josh Shrair (second from left) helps navigate a rapidly-expanding universe of ETFs on behalf of Betterment customers. Just as crucially, their costs are all over the place, and higher fees can erode your returns in the long run. That's why the SPDR fund is currently our Core portfolio’s primary way of achieving U.S. Large Cap stock exposure. It offers both a low cost to hold (0.02%) and a low cost to trade (0.03% at the time of writing), making for a low overall cost of ownership. "Shopping for investments is a little like buying a car," Josh says. "The total cost is way more than the sticker price." How we calculate cost of ownership Part of our role as a fiduciary, someone who's legally obligated to act in their clients' best interests, is conducting a deep and unbiased evaluation of the ETFs used in our portfolios. The process Josh and team use is entirely "open architecture," meaning we’re not obligated to use funds from any particular provider. Instead, we strive to select the most optimal ones in terms of cost and exposure. It helps that Betterment itself doesn't make, manage, and sell funds, which means we avoid the inherent conflict of interest some advisors face when they also act as a fund manager. These firms can be tempted to steer customers toward their own funds, even when a better alternative exists. So we take pride in the due diligence behind our fund selection, and that begins with our "cost of ownership" scoring methodology. It factors in the two types of costs mentioned earlier: the cost to "hold" or own a fund, also known as its expense ratio, and the cost to trade it. As you'll see in part 3 of this series, a portfolio is hardly static. Deposits come in. Withdrawals go out. Rebalancing takes place on the regular. All of this requires daily trading, so the cost of those transactions matters to your investing's bottom line. The cost-to-trade is also known as the "bid-ask spread," or the markup that traders expect when selling a share. It's how they make money, and similar to wholesalers and retailers like Costco, the bigger the fund, the smaller the margins a trader can live with. Seeking out these value buys is how we're able to deliver globally-diversified portfolios at a fraction of the cost of alternatives on the market today. And we’re never done shopping. Our preferred funds are updated multiple times throughout the year. Primed for the purchase There's a lot more to our fund selection methodology, especially for funds that aren’t tied to a specific index, but are instead made from scratch. Some fund managers like Goldman Sachs, where Josh worked earlier in his career, also blend both approaches into a “smart beta” strategy. We offer one such portfolio alongside our Betterment-built collections. But for the sake of this series, let's pretend for a moment that our tote bags are full, and we're ready to check out. It’s time to meet the team behind every transaction at Betterment.