Filter by:

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

Innovative Technology

A well-diversified portfolio focused on high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology along with increased exposure to risk.

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

Social Impact

Provides broad diversified exposure with a greater focus on companies actively working toward minority empowerment and gender diversity as part of your long-term strategy.

Cash Reserve

A 100% cash account that earns 4.00% APY (variable)*, carries no-fee on your balance, and is FDIC-insured up to $2 million at our program banks ($4 million for joint accounts)†.

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

Goldman Sachs Tax-Smart Bonds

Gives higher-income individuals a personalized bond portfolio to generate additional after-tax yield.

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

Crypto ETF

Tap the market moves of the two largest and widely traded cryptocurrencies, Bitcoin and Ethereum, with this fully automated ETF portfolio.

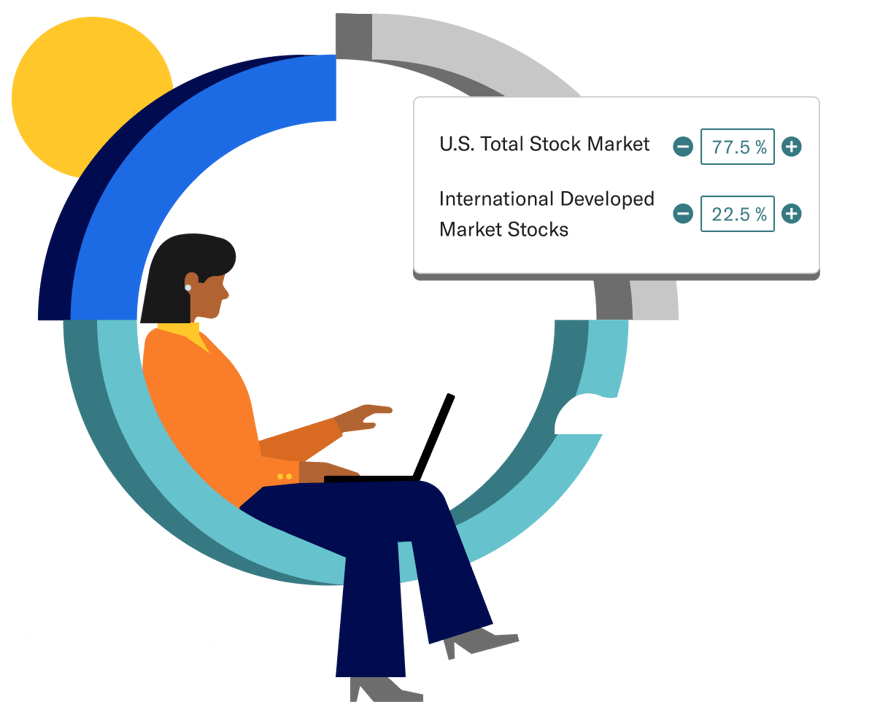

Customize your portfolio.

If you’re an experienced investor looking for more control, a Flexible portfolio lets you adjust individual asset class weights based on your preferences.

Learn more

Invested with benefits.

-

Tax savings.

Automated and optimized tax strategies designed to help minimize tax impact on returns.

-

Lower costs.

Keep more money in your portfolio with low-cost exchange-traded funds (ETFs) and our transparent pricing.

-

Adjusts automatically.

Your investments are rebalanced as the market moves once at the minimum account balance, with dividends getting reinvested.

Frequently asked questions

-

Unlike a traditional retirement plan or options provided by an online brokerage, Betterment doesn’t make you choose your own funds. Instead, we recommend a basket of funds that’s diversified to seek performance without unnecessary risks—that’s a portfolio. For every goal you set a Betterment, we’ll let you choose the kind of portfolio you want and recommend a specific stock-to-bond ratio. For Betterment’s Core portfolio strategy and socially responsible investing options, we provide 101 possible stock-to-bond allocations, giving you a portfolio tailored to your goal.

-

An exchange-traded fund (ETF) is a security that tracks an index, a commodity or a basket of assets just like an index fund, but trades like a stock on an exchange. Betterment uses ETFs in both our stock and bond portfolios because of the low management fees and tax-efficiency they offer. Learn more about the advantages of ETF-based portfolios.

-

Each of your goals’ portfolios will see different performance, depending on the stock-to-bond allocation you choose, any changes you make over time, your choice of portfolio strategy, and market volatility. We recommend your investment portfolio’s allocation based on the time horizon of your goal and what kind of goal you have. If your goal is short-term, we’ll recommend a more conservative portfolio with lower expected returns with less volatility, and if your goal is longer term, we’ll likely recommend a more aggressive portfolio with higher expected long-term returns with higher volatility.

-

Yes, you can have multiple portfolio strategies within your Betterment account because you can set a different portfolio strategy (and a different portfolio allocation) for each of your goals. For example, your retirement goal can use the Betterment Core Portfolio, while your safety net goal could invest with a socially responsible investing strategy.

-

Yes—far from unusual, downturns are a normal part of even the highest returning investments. Investors often worry and react with panic in response to market drops, even if they are invested properly for their long-term goals, but interim losses are to be expected even during the best investment periods.

-

Log in or sign up to set your goals, choose a portfolio strategy, and see the holdings at any stock-to-bond allocation you choose. You can also review the list of funds in the Betterment Core Portfolio strategy or browse our expert commentary on investments.