Everyone has retirement questions. We’re here to help.

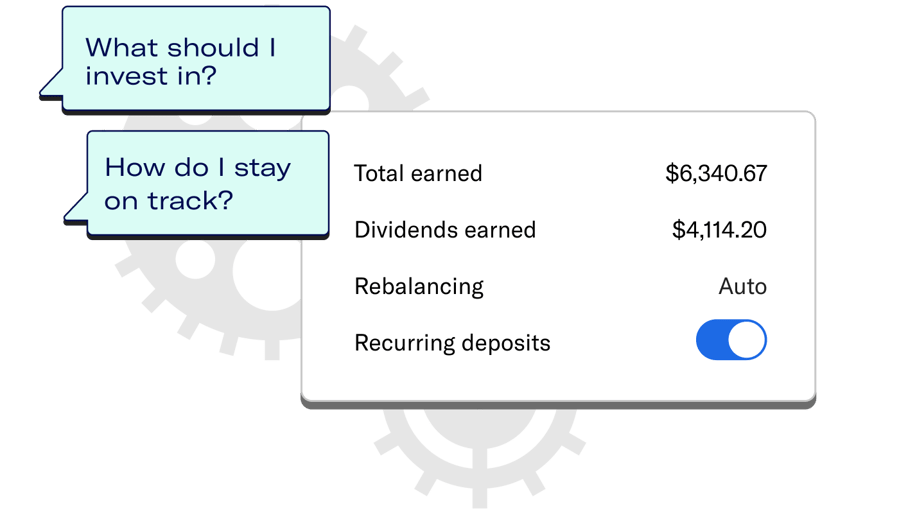

We automatically handle your retirement investing.

Take control of saving for tomorrow by putting it on autopilot. We make investing easy by automating it, handling the trading, rebalancing, and dividend reinvesting so you don’t have to.

We help you decide how much and where to save.

Everyone’s idea of retirement is different. Get personal advice on how much you’ll need and which accounts—like our tax-advantaged IRAs—to put your money in.

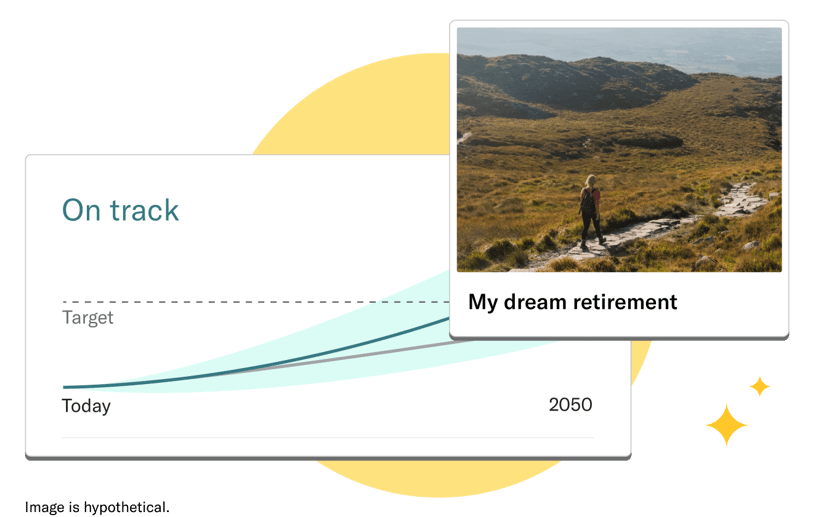

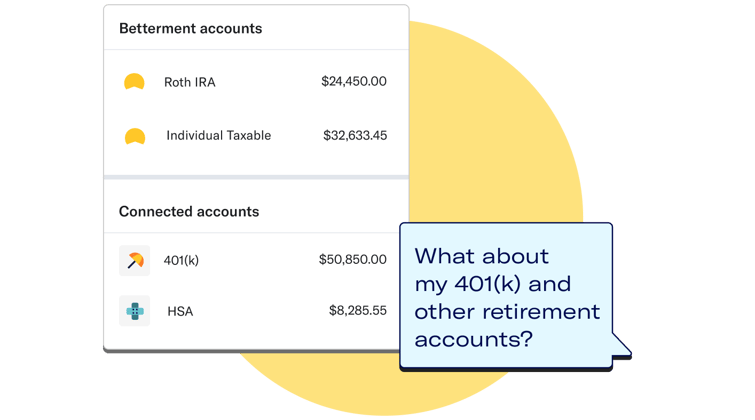

We give you a bird’s-eye-view of your retirement.

Connect your outside accounts to see all your retirement in one place. Get a detailed breakdown on just how your investments have performed, and see how our technology is working to help you build wealth.

There’s more to Betterment than just retirement.

We’re here to help you retire how you want.

We’re here to help you make smart retirement decisions: determining how much you’ll need, deciding which IRA, understanding how taxes and inflation impact your money.

The most important part of retirement is getting started. From there, we're with you all the way.