Buying A Home: Down Payments, Mortgages, And Saving For Your Future

Your home may be the largest single purchase you make during your lifetime. That can make it both incredibly exciting and nerve wracking.

Purchasing a primary residence often falls in the gray area between a pure investment (meant to increase one’s capital) and a consumer good (meant to increase one’s satisfaction). Your home has aspects of both, and we recognize that you may purchase a home for reasons that are not strictly monetary, such as being in a particular school district or proximity to one’s family. Those are perfectly valid inputs to your purchasing decision.

However, this guide will focus primarily on the financial aspects of your potential home purchase: We’ll do this by walking through the five tasks that should be done before you purchase your home:

- Build your emergency fund

- Choose a fixed-rate mortgage

- Save for a down payment and closing costs

- Think long-term

- Calculate your monthly affordability

Build your emergency fund

Houses are built on top of foundations to help keep them stable. Just like houses, your finances also need a stable foundation. Part of that includes your emergency fund. We recommend that, before purchasing a home, you should have a fully-funded emergency fund. Your emergency fund should be a minimum of three months’ worth of expenses.

How big your emergency fund should be is a common question. By definition, emergencies are difficult to plan for. We don’t know when they will occur or how much they will cost. But we do know that life doesn’t always go smoothly, and thus that we should plan ahead for unexpected emergencies.

Emergency funds are important for everyone, but especially so if you are a homeowner. When you are a renter, your landlord is likely responsible for the majority of repairs and maintenance of your building. As a homeowner, that responsibility now falls on your shoulders. Yes, owning a home can be a good investment, but it can also be an expensive endeavor. That is exactly why you should not purchase a home before having a fully-funded emergency fund.

And don’t forget that your monthly expenses may increase once you purchase your new home. To determine the appropriate size for your emergency fund, we recommend using what your monthly expenses will be after you own your new home, not just what they are today.

Choose a fixed-rate mortgage

If you’re financing a home purchase by way of a mortgage, you have to choose which type of mortgage is appropriate for you. One of the key factors is deciding between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage (FRM).

Betterment generally recommends choosing a fixed-rate mortgage, because while ARMs usually—but not always—offer a lower initial interest rate than FRMs, this lower rate comes with additional risk. With an ARM, your monthly payment can increase over time, and it’s difficult to predict what those payments will be. This may make it tough to stick to a budget and plan for your other financial goals.

Fixed-rate mortgages, on the other hand, lock in the interest rate for the lifetime of the loan. This stability makes budgeting and planning for your financial future much easier. Locking in an interest rate for the duration of your mortgage helps you budget and minimizes risk.

Most home buyers do choose a fixed-rate mortgage. According to 2021 survey data by the National Association of Realtors®, 92% of home buyers who financed their home purchase used a fixed-rate mortgage, and this was very consistent across all age groups. Research by the Urban Institute also shows FRMs have accounted for the vast majority of mortgages over the past 2 decades.

Save for a down payment and closing costs

You’ll need more than just your emergency fund to purchase your dream home. You’ll also need a down payment and money for closing costs. Betterment recommends making a down payment of at least 20%, and setting aside about 2% of the home purchase for closing costs.

It’s true that you’re often allowed to purchase a home with down payments far below 20%. For example:

- FHA loans allow down payments as small as 3.5%.

- Fannie Mae allows mortgages with down payments as small as 3%.

- VA loans allow you to purchase a home with no down payment.

However, Betterment typically advises putting down at least 20% when purchasing your home. A down payment of 20% or more can help avoid Private Mortgage Insurance (PMI). Putting at least 20% down is also a good sign you are not overleveraging yourself with debt.

Lastly, a down payment of at least 20% may help lower your interest rate. This is acknowledged by the CFPB and seems to be true when comparing interest rates of mortgages with Loan-to-Values (LTVs) below and above 80%.

Depending on your situation, it may even make sense to go above a 20% down payment. Just remember, you likely should not put every spare dollar you have into your home, as that could mean you don’t have enough liquid assets elsewhere for things such as your emergency fund and other financial goals like retirement.

Closing Costs

In addition to a down payment, buying a home also has significant transaction costs. These transaction costs are commonly referred to as “closing costs” or “settlement costs.”

Closing costs depend on many factors, such as where you live and the price of the home.

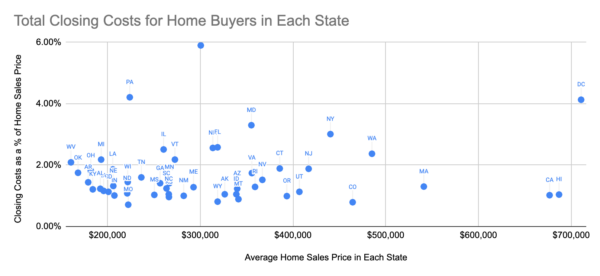

ClosingCorp, a company that specializes in closing costs and services, conducted a study that analyzed 2.9 million home purchases throughout 2020. They found that closing costs for buyers averaged 1.69% of the home’s purchase price, and ranged between states from a low of 0.71% of the home price (Missouri) up to a high of 5.90% of the home price (Delaware). The chart below shows more detail.

Source: ClosingCorp, 2020 Closing Cost Trends. Visualization of data by Betterment.

As a starting point, we recommend saving up about 2% of the home price (about the national average) for closing costs. But of course, if your state tends to be much higher or lower than that, you should plan accordingly.

In total, that means that you should generally save at least 20% of the home price to go towards a down payment, and around 2% for estimated closing costs.

With Betterment, you can open a Major Purchase goal and save for your downpayment and closing costs using either a cash portfolio or investing portfolio, depending on your risk tolerance and when you think you’ll buy your home.

Think long-term

We mentioned the closing costs for buyers above, but remember: There are also closing costs when you sell your home. These closing costs mean it may take you a while to break even on your purchase, and that selling your home soon after is more likely to result in a financial loss. That’s why Betterment doesn’t recommend buying a home unless you plan to own that home for at least 4 years, and ideally longer.

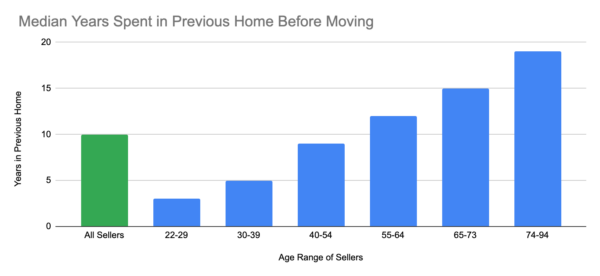

The below chart is built from 2020 survey data by the National Association of Realtors® and shows that most home sellers stay in their homes beyond this 4 year rule of thumb. Across all age groups, the median length of time was 10 years. That’s excellent. However, we can see that younger buyers, on average, come in well below the 10-year median, which indicates they are more at risk of not breaking even on their home purchases.

Source: National Association of Realtors®, 2020 Home Buyers and Sellers Generational Trends. Visualization of data by Betterment.

Some things you can do to help ensure you stay in your home long enough to at least break even include:

- If you’re buying a home in an area you don’t know very well, consider renting in the neighborhood first to make sure you actually enjoy living there.

- Think ahead and make sure the home makes sense for you four years from now, not just you today. Are you planning on having kids soon? Might your elderly parents move in with you? How stable is your job? All of these are good questions to consider.

- Don’t rush your home purchase. Take your time and think through this very large decision. The phrase “measure twice, cut once” is very applicable to home purchases.

Calculate your monthly affordability

The upfront costs are just one component of home affordability. The other is the ongoing monthly costs. Betterment recommends building a financial plan to determine how much home you can afford while still achieving your other financial goals. But if you don’t have a financial plan, we recommend not exceeding a debt-to-income (DTI) ratio of 36%.

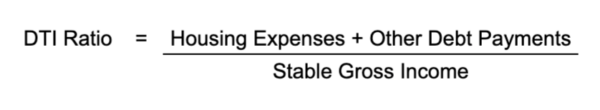

In other words, you take your monthly debt payments (including your housing costs), and divide them by your gross monthly income. Lenders often use this as one factor when it comes to approving you for a mortgage.

Debt income ratios

There are lots of rules in terms of what counts as income and what counts as debt. These rules are all outlined in parts of Fannie Mae’s Selling Guide and Freddie Mac’s Seller/Servicer Guide. While the above formula is just an estimate, it is helpful for planning purposes.

In certain cases Fannie Mae and Freddie Mac will allow debt-to-income ratios as high as 45%-50%. But just because you can get approved for that, doesn’t mean it makes financial sense to do so.

Keep in mind that the lender’s concern is your ability to repay the money they lent you. They are far less concerned with whether or not you can also afford to retire or send your kids to college. The debt to income ratio calculation also doesn’t factor in income taxes or home repairs, both of which can be significant.

This is all to say that using DTI ratios to calculate home affordability may be an okay starting point, but they fail to capture many key inputs for calculating how much you personally can afford. We outline our preferred alternative below, but if you do choose to use a DTI ratio, we recommend using a maximum of 36%. That means all of your debts—including your housing payment—should not exceed 36% of your gross income.

In our opinion, the best way to determine how much home you can afford is to build a financial plan. That way, you can identify your various financial goals, and calculate how much you need to be saving on a regular basis to achieve those goals. With the confidence that your other goals are on-track, any excess cash flow can be used towards monthly housing costs. Think of this as starting with your financial goals, and then backing into home affordability, instead of the other way around.

Wrapping things up

If owning a home is important to you, the five steps in this guide can help you make a wiser purchasing decision:

- Have an emergency fund of at least three months’ worth of expenses to help with unexpected maintenance and emergencies.

- Choose a fixed-rate mortgage to help keep your budget stable.

- Save for a minimum 20% down payment to avoid PMI, and plan for paying ~2% in closing costs.

- Don’t buy a home unless you plan to own it for at least 4 years. Otherwise, you are not likely to break even after you factor in the various costs of homeownership.

- Build a financial plan to determine your monthly affordability, but as a starting point, don’t exceed a debt-to-income ratio of 36%.