How Tax Impact Preview works

Betterment continues to make investing more transparent and tax-efficient, and empowers you to make smarter financial decisions.

Selling securities has tax implications. Typically, these announce themselves the following year, when you get your tax statement.

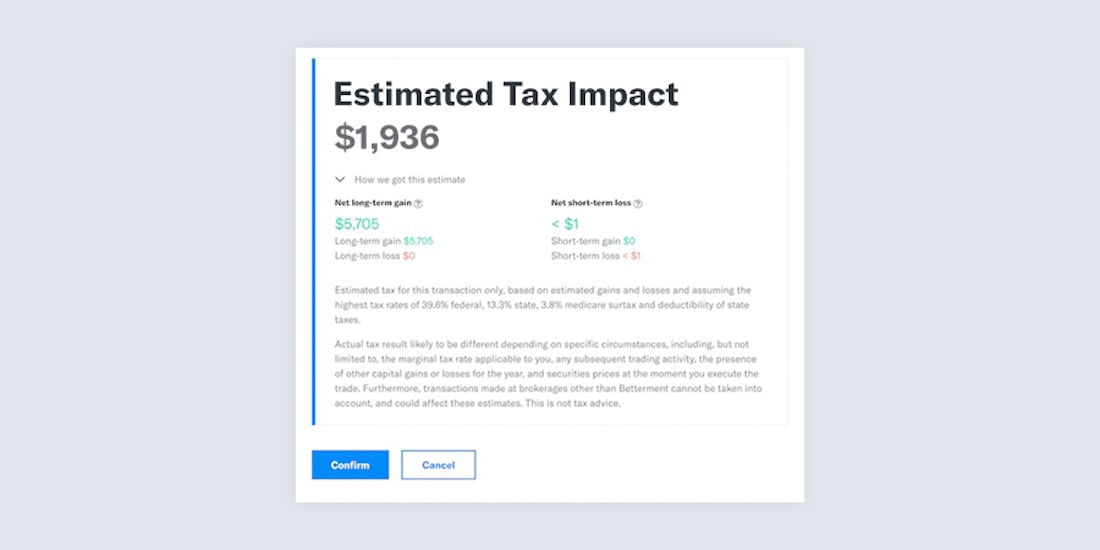

Betterment’s Tax Impact Preview feature provides a real-time tax estimate for a withdrawal or allocation change before you confirm the transaction. Tax Impact Preview potentially lowers your tax bill by showing you key information to make an informed decision. Tax Impact Preview is available to all Betterment customers at no additional cost.

How It Works

When you initiate a sale of securities (a withdrawal or allocation change), our algorithms first determine which ETFs to sell (rebalancing you in the process, by first selling the overweight components of your portfolio). Within each ETF, our lot selection algorithm, which we call TaxMin, is designed to select the most tax-efficient lots, selling losses first, and short-term gains last.

To use Tax Impact Preview, select the “Estimate tax impact” button when you initiate an allocation change or withdrawal, which will give you detailed estimates of expected gains and/or losses, breaking them down by short and long-term. If your transaction results in a net gain, we estimate the maximum tax you might owe.

Why Estimated?

The tax owed is an estimate because the precise tax owed depends on many circumstances specific to you, including your tax bracket and the presence of past and future capital gains or losses for the year across all of your investment accounts. We use the highest applicable rates, to give you an upper-bound estimate.

The gains and losses are also estimates as these depend on the exact price that the various ETFs will sell at. If the estimate is done after market close, the prices are sure to move a bit by the time the market opens. Even during the day, a few minutes will pass between the preview and the trades, and prices will shift some, so the estimates will no longer be 100% accurate.

Finally, while we are able to factor in wash sale implications from prior purchases in your Betterment account, the estimates could change substantially due to future purchases, and we do not factor in activity in non-Betterment accounts.

That is why every number we show you, while useful, is an estimate. Tax Impact Preview is not tax advice, and you should consult a tax professional on how these estimates apply to your individual situation.

Why You Should Avoid Short-Term Capital Gains

Smart investors take every opportunity to defer a gain from short-term to long-term—it can make a substantive difference in the return from that investment. To demonstrate, let’s assume a long-term rate of 20% and a short-term rate of 40%. A $10,000 investment with a 10% return—or $1,000—will result in a $400 tax if you sell less than a year (365 days or less) after you invested. But if you wait more than a year (366 days or more) to sell, the tax will be only $200.That’s the difference between a 6% and 8% after-tax return.

Market timing is usually not a good idea, and most of us know this. Betterment’s Tax Impact Preview is intended to put a real dollar cost on knee-jerk reactions to market volatility (such as withdrawals or allocation changes) to help investors reconsider the critical moment when they are about to deviate from their long-term plan.