Our Socially Responsible Investing portfolios methodology

Learn how we construct our Socially Responsible Investing (SRI) portfolios.

Table of Contents

- Introduction

- How do we define SRI?

- The Challenges of SRI Portfolio Construction

- How is Betterment’s Broad Impact portfolio constructed?

- How is Betterment’s Climate Impact portfolio constructed?

- How is Betterment’s Social Impact portfolio constructed?

- Conclusion

Introduction

Betterment launched its first Socially Responsible Investing (SRI) portfolio in 2017, and has widened the investment options under that umbrella since then. Within Betterment’s SRI options, we currently offer a Broad Impact portfolio and two additional, more focused SRI portfolio options: a Social Impact SRI portfolio (focused on social empowerment) and a Climate Impact SRI portfolio (focused on climate-conscious investments). These portfolios represent a diversified, relatively low-cost solution constructed using exchange traded funds (ETFs), which will be continually improved upon as costs decline, more data emerges, and as a result, the availability of SRI funds broadens.

How do we define SRI?

Our approach to SRI has three fundamental dimensions that shape our portfolio construction mandates:

- Reducing exposure to investments involved in unsustainable activities and environmental, social, or governmental controversies.

- Increasing exposure to investments that work to address solutions for core environmental and social challenges in measurable ways.

- Allocating to investments that use shareholder engagement tools, such as shareholder proposals and proxy voting, to incentivize socially responsible corporate behavior.

SRI is the traditional name for the broad concept of values-driven investing (many experts now favor “sustainable investing” as the name for the entire category).

Our SRI approach uses SRI mandates based on a set of industry criteria known as “ESG,” which stands for Environmental, Social and Governance. ESG refers specifically to the quantifiable dimensions of a company’s standing along each of its three components. Betterment’s approach expands upon the ESG-investing framework with exposure to investments that use complementary shareholder engagement tools.

Betterment does not directly select companies to include in, or exclude from, the SRI portfolios. Rather, Betterment identifies ETFs that have been classified as ESG or similar by third-parties and considers internally developed “SRI mandates” alongside other qualitative and quantitative factors to select ETFs to include in its SRI portfolios.

Using SRI Mandates

One aspect of improving a portfolio’s ESG exposure is reducing exposure to companies that engage in certain activities that may be considered undesirable because they do not align with specific values. These activities may include selling tobacco, military weapons, civilian firearms, as well as involvement in recent and ongoing ESG controversies. However, SRI is about more than just adjusting your portfolio to minimize companies with a poor social impact.

For each Betterment SRI portfolio, the portfolio construction process considers one or more internally developed “SRI mandates.” Betterment’s SRI mandates are sustainable investing objectives that we include in our portfolios’ exposures.

|

SRI Mandate |

Description |

Betterment SRI Portfolio Mapping |

|

ESG Mandate |

ETFs tracking indices which are constructed with reference to some form of ESG optimization, which promotes exposure to Environmental, Social, and Governance pillars. |

Broad, Climate, Social Impact Portfolios |

|

Fossil Fuel Divestment Mandate |

ETFs tracking indices which are constructed with the aim of excluding stocks in companies with major fossil fuels holdings (divestment). |

Climate Impact Portfolio |

|

Carbon Footprint Mandate |

ETFs tracking indices which are constructed with the aim of minimizing exposure to carbon emissions across the entire economy (rather than focus on screening out exposure to stocks primarily in the energy sector). |

Climate Impact Portfolio |

|

Green Financing Mandates |

ETFs tracking indices focused on financing environmentally beneficial activities directly. |

Climate Impact Portfolio |

|

Gender Equity Mandate |

ETFs tracking indices which are constructed with the aim of representing the performance of companies that seek to advance gender equality. |

Social Impact Portfolio |

|

Social Equity Mandate |

ETFs managed with the aim of obtaining exposures in investments that seek to advance vulnerable, disadvantaged, or underserved social groups. The Gender Equity Mandate also contributes to fulfilling this broader mandate. |

Social Impact Portfolio |

Shareholder Engagement Mandate

In addition to the mandates listed above, Betterment’s SRI portfolios are constructed using a shareholder engagement mandate. One of the most direct ways a shareholder can influence a company’s decision making is through shareholder proposals and proxy voting. Publicly traded companies have annual meetings where they report on the business’s activities to shareholders. As a part of these meetings, shareholders can vote on a number of topics such as share ownership, the composition of the board of directors, and executive level compensation. Shareholders receive information on the topics to be voted on prior to the meeting in the form of a proxy statement, and can vote on these topics through a proxy card. A shareholder can also make an explicit recommendation for the company to take a specific course of action through a shareholder proposal.

ETF shareholders themselves do not vote in the proxy voting process of underlying companies, but rather the ETF fund issuer participates in the proxy voting process on behalf of their shareholders. As investors signal increasing interest in ESG engagement, more ETF fund issuers have emerged that play a more active role engaging with underlying companies through proxy voting to advocate for more socially responsible corporate practices. These issuers use engagement-based strategies, such as shareholder proposals and director nominees, to engage with companies to bring about ESG change and allow investors in the ETF to express a socially responsible preference. For this reason, Betterment includes a Shareholder Engagement Mandate in its SRI portfolios.

|

Mandate |

Description |

Betterment SRI Portfolio Mapping |

|

Shareholder Engagement Mandate |

ETFs which aim to fulfill one or more of the above mandates, not via allocation decisions, but rather through the shareholder engagement process, such as proxy voting. |

Broad, Climate, Social Impact Portfolios |

The Challenges of SRI Portfolio Construction

For Betterment, three limitations have a large influence on our overall approach to building an SRI portfolio:

1. Many existing SRI offerings in the market have serious shortcomings.

Many SRI offerings today sacrifice sufficient diversification appropriate for investors who seek market returns, and/or do not provide investors an avenue to use collective action to bring about ESG change.

Betterment’s SRI portfolios do not sacrifice global diversification. Consistent with our core principle of global diversification and to ensure both domestic and international bond exposure, we’re still allocating to some funds without an ESG mandate, until satisfactory solutions are available within those asset classes. Additionally, all three of Betterment’s SRI portfolios include a partial allocation to an engagement-based socially responsible ETF using shareholder advocacy as a means to bring about ESG-change in corporate behavior. Engagement-based socially responsible ETFs have expressive value in that they allow investors to signal their interest in ESG issues to companies and the market more broadly, even if particular shareholder campaigns are unsuccessful.

2. Integrating values into an ETF portfolio may not always meet every investor’s expectations.

For investors who prioritize an absolute exclusion of specific types of companies above all else, certain approaches to ESG will inevitably fall short of expectations. For example, many of the largest ESG funds focused on US Large Cap stocks include some energy companies that engage in oil and natural gas exploration, like Hess. While Hess might not meet the criteria of the “E” pillar of ESG, it could still meet the criteria in terms of the “S” and the “G.”

Understanding that investors may prefer to focus specifically on a certain pillar of ESG, Betterment has made three SRI portfolios available. The Broad Impact portfolio seeks to balance each of the three dimensions of ESG without diluting different dimensions of social responsibility. With our Social Impact portfolio, we sharpen the focus on social equity with partial allocations to gender diversity and veteran impact focused funds. With our Climate Impact portfolio, we sharpen the focus on controlling carbon emissions and fostering green solutions.

3. Most available SRI-oriented ETFs present liquidity limitations.

While SRI-oriented ETFs have relatively low expense ratios compared to SRI mutual funds, our analysis revealed insufficient liquidity in many ETFs currently on the market. Without sufficient liquidity, every execution becomes more expensive, creating a drag on returns. Median daily dollar volume is one way of estimating liquidity. Higher volume on a given asset means that you can quickly buy (or sell) more of that asset in the market without driving the price up (or down). The degree to which you can drive the price up or down with your buying or selling must be treated as a cost that can drag down on your returns.

To that end, Betterment reassesses the funds available for inclusion in these portfolios regularly. In balancing cost and value for the portfolios, the options are limited to funds of certain asset classes such as US stocks, Developed Market stocks, Emerging Market stocks, US Investment Grade Corporate Bonds, US High Quality bonds, and US Mortgage-Backed Securities.

How is Betterment’s Broad Impact portfolio constructed?

Betterment’s Broad Impact portfolio invests assets in socially responsible ETFs to obtain exposure to both the ESG and Shareholder Engagement mandates, as highlighted in the table above. It focuses on ETFs that consider all three ESG pillars, and includes an allocation to an engagement-based SRI ETF. Broad ESG investing solutions are currently the most liquid, highlighting their popularity amongst investors. In order to maintain geographic and asset class diversification and to meet our requirements for lower cost and higher liquidity in all SRI portfolios, we continue to allocate to some funds that do not reflect SRI mandates, particularly in bond asset classes.

How is Betterment’s Climate Impact portfolio constructed?

Betterment offers a Climate Impact portfolio for investors that want to invest in an SRI strategy more focused on the environmental pillar of “ESG” rather than focusing on all ESG dimensions equally. Betterment’s Climate Impact portfolio invests assets in socially responsible ETFs and is constructed using the following mandates that seek to achieve divestment and engagement: ESG, carbon footprint reduction, fossil fuel divestment, shareholder engagement, and green financing. The Climate Impact portfolio was designed to give investors exposure to climate-conscious investments, without sacrificing proper diversification and balanced cost. Fund selection for this portfolio follows the same guidelines established for the Broad Impact portfolio, as we seek to incorporate broad based climate-focused ETFs with sufficient liquidity relative to their size in the portfolio.

How can the Climate Impact portfolio help to positively affect climate change?

The Climate Impact portfolio is allocated to iShares MSCI ACWI Low Carbon Target ETF (CRBN), an ETF which seeks to track the global stock market, but with a bias towards companies with a lower carbon footprint. By investing in CRBN, investors are actively supporting companies with a lower carbon footprint, because CRBN overweights these stocks relative to their high-carbon emitting peers. One way we can measure the carbon impact a fund has is by looking at its weighted average carbon intensity, which measures the weighted average of tons of CO2 emissions per million dollars in sales, based on the fund's underlying holdings. Based on weighted average carbon intensity data from MSCI, Betterment’s 100% stock Climate Impact portfolio has carbon emissions per unit sales that are more than 47% lower than Betterment’s 100% stock Core portfolio as of March 12, 2025.

Additionally, a portion of the Climate Impact portfolio is allocated to fossil fuel reserve funds. Rather than ranking and weighting funds based on a certain climate metric like CRBN, fossil fuel reserve free funds instead exclude companies that own fossil fuel reserves, defined as crude oil, natural gas, and thermal coal. By investing in fossil fuel reserve free funds, investors are actively divesting from companies with some of the most negative impact on climate change, including oil producers, refineries, and coal miners such as Chevron, ExxonMobile, BP, and Peabody Energy.

Another way that the Climate Impact portfolio promotes a positive environmental impact is by investing in bonds that fund green projects. The Climate Impact portfolio invests in iShares Global Green Bond ETF (BGRN), which tracks the global market of investment-grade bonds linked to environmentally beneficial projects, as determined by MSCI. These bonds are called “green bonds.” The green bonds held by BGRN fund projects in a number of environmental categories defined by MSCI including alternative energy, energy efficiency, pollution prevention and control, sustainable water, green building, and climate adaptation.

How is Betterment’s Social Impact portfolio constructed?

Betterment offers a Social Impact portfolio for investors that want to invest in a strategy more focused on the social pillar of ESG investing (the S in ESG).

Betterment’s Social Impact portfolio invests assets in socially responsible ETFs and is constructed using the following mandates: ESG, gender equity, social equity, and shareholder engagement. The Social Impact portfolio was designed to give investors exposure to investments which promote social empowerment without sacrificing proper diversification and balanced cost. Fund selection for this portfolio follows the same guidelines established for the Broad Impact portfolio discussed above, as we seek to incorporate broad based ETFs that focus on social empowerment with sufficient liquidity relative to their size in the portfolio.

How does the Social Impact portfolio help promote social empowerment?

The Social Impact portfolio shares many of the same holdings as Betterment’s Broad Impact portfolio. The Social Impact portfolio additionally looks to further promote the “social” pillar of ESG investing by allocating to the following ETFs:

- SPDR SSGA Gender Diversity Index ETF (SHE)

- Academy Veteran Impact ETF(VETZ)

- Goldman Sachs JUST U.S. Large Cap Equity ETF (JUST)

SHE is a US Stock ETF that allows investors to invest in more female-led companies compared to the broader market. In order to achieve this objective, companies are ranked within each sector according to their ratio of women in senior leadership positions. Only companies that rank highly within each sector are eligible for inclusion in the fund. By investing in SHE, investors are allocating more of their money to companies that have demonstrated greater gender diversity within senior leadership than other firms in their sector.

VETZ, the Academy Veteran Impact ETF, is a US Bond ETF and is the first publicly traded ETF to primarily invest in loans to U.S. service members, military veterans, their survivors, and veteran-owned businesses. A majority of the underlying assets consist of loans to veterans or their families. The fund primarily invests in Mortgage-Backed Securities that are guaranteed by government-sponsored enterprises, such as Ginnie Mae, Fannie Mae, and Freddie Mac. The fund also invests in pools of small business loans backed by the Small Business Administration (SBA).

JUST, Goldman Sachs JUST U.S. Large Cap Equity ETF, invests in U.S. companies promoting positive change on key social issues, such as worker wellbeing, customer privacy, environmental impact, and community strength, based on the values of the American public as identified by JUST Capital’s polling.

Investment in socially responsible ETFs varies by portfolio allocation; not all allocations include the specific ETFs listed above. For more information about these social impact ETFs, including any associated risks, please see our disclosures.

Should we expect any difference in an SRI portfolio’s performance?

One might expect that a socially responsible portfolio could lead to lower returns in the long term compared to another, similar portfolio. The notion behind this reasoning is that somehow there is a premium to be paid for investing based on your social ideals and values.

A white paper written in partnership between Rockefeller Asset Management and NYU Stern Center for Sustainable Business studied 1,000+ research papers published from 2015 to 2020 analyzing the relationship between ESG investing and performance. The primary takeaway from this research was that they found “positive correlations between ESG performance and operational efficiencies, stock performance, and lower cost of capital.” When ESG factors were considered in the study, there seemed to be improved performance potential over longer time periods and potential to also provide downside protection during periods of crisis. It’s important to note that performance in the SRI portfolios can be impacted by several variables, and is not guaranteed to align with the results of this study.

Dividend Yields Could Be Lower

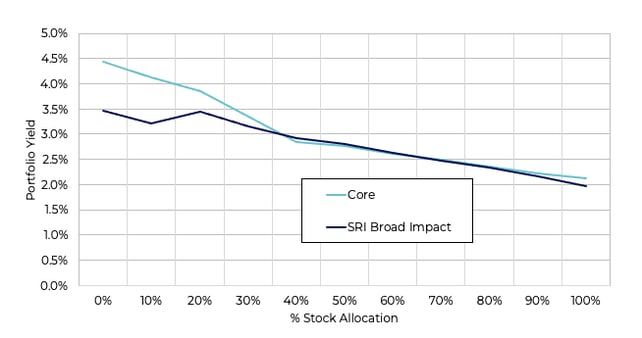

Using the SRI Broad Impact portfolio for reference, dividend yields over a one-year period ending March 31, 2025 indicate that SRI income returns at certain risk levels have been lower than those of the Core portfolio. Oil and gas companies like BP, Chevron, and Exxon, for example, currently have relatively high dividend yields, and excluding them from a given portfolio can cause its income return to be lower. Of course, future dividend yields are uncertain variables and past data may not provide accurate forecasts. Nevertheless, lower dividend yields can be a factor in driving total returns for SRI portfolios to be lower than those of Core portfolios.

Comparison of Dividend Yields

Source: Bloomberg, Calculations by Betterment for one year period ending March 31, 2025. Dividend yields for each portfolio are calculated using the dividend yields of the primary ETFs used for taxable allocations of Betterment’s portfolios as of March 2025.

Conclusion

Despite the various limitations that all SRI implementations face today, Betterment will continue to support its customers in further aligning their values to their investments. Betterment may add additional socially responsible funds to the SRI portfolios and replace other ETFs as the investing landscape continues to evolve.