Jump to Section

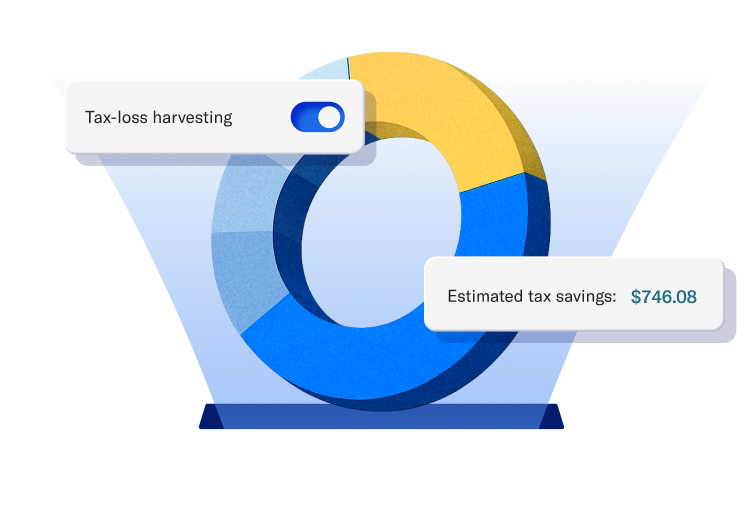

The secret sauce to boost your returns?Tax-loss harvesting.

We turn a market dip into a potential tax benefit by selling assets that have lost value, which you can use to lower your taxes. We then reinvest the money in a similar asset to help you stay on track—and keep more of what you earn.

How tax-loss harvesting helps your bottom line:

Savings can cover your fees.

Nearly 70% of customers using tax-loss harvesting covered their taxable advisory fees through estimated tax savings.

-

It can save you on taxes

-

It can cover your fees

Assets are located to save you on taxes.

We coordinate the location of your investments across accounts (high-tax bonds in IRAs and low-tax stocks in taxable investing) to help reduce your overall tax burden and save you more.

Know the tax impact before you act.

We show you estimated taxes upfront when you transfer, change your allocation, or withdraw—so you can make tax-informed decisions.

Even more ways we’re working to lower your tax bill.

We help you pick the right accounts for lower taxes.

Traditional, Roth, and taxable accounts are taxed differently. We recommend the accounts that make the most sense for your money and your future tax bill.

We invest your money in low-fee funds.

Your portfolio is designed to keep your tax bill low with ETFs (exchange-traded funds) that are more tax-efficient and lower-cost than mutual funds.

We aim to minimize your taxes when you withdraw.

We automatically sell assets in a tax-efficient order: starting with losses, then short-term gains, and finally long-term gains.