Sort by:

-

![]()

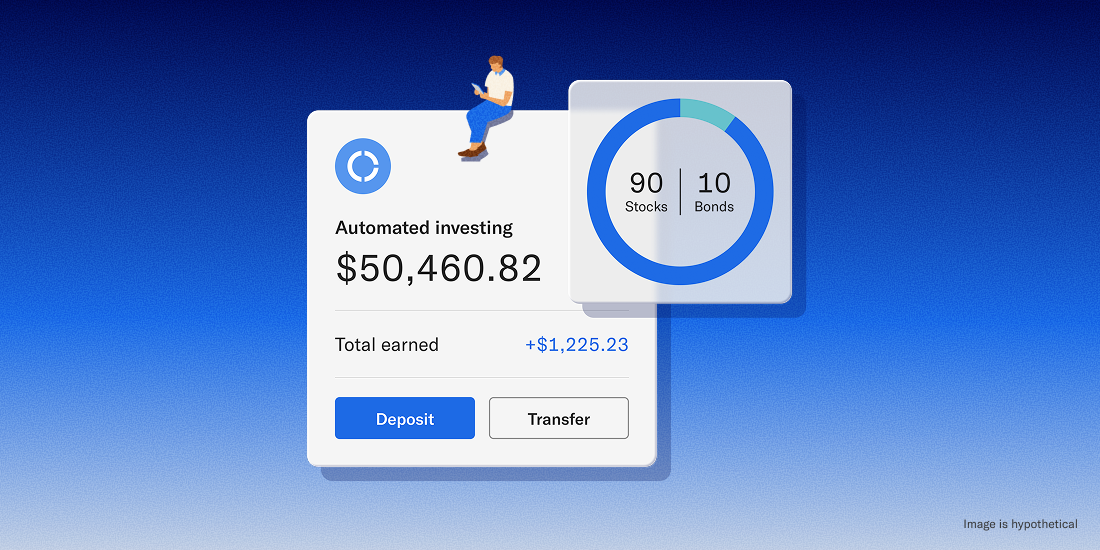

How Betterment’s tech helps you manage your money

How Betterment’s tech helps you manage your money Feb 19, 2026 8:30:00 AM Our human experts harness the power of technology to help you reach your financial goals. Here’s how. When you’re trying to make the most of your money and plan for the future, there are some things humans simply can’t do as well as algorithms. The big idea: Here at Betterment, we’re all about automated investing—using technology with human experts at the helm—to manage your money smarter and help you meet your financial goals. How does it work? Robo-advisors use algorithms and automation to optimize your investments faster than a human can. They do the heavy lifting behind the scenes, managing all the data analysis and adapting investment expertise to fit your circumstances. All you need to do is fill in the gaps with details about your financial goals. The result: you spend less time managing your finances and more time enjoying your life, while Betterment focuses on your specific reasons for saving, adjusting your risk based on your timeline and target amount. Plus, robo-advisors cost less to operate. While the specific fees vary from one robo-advisor to the next, they all tend to be a fraction of what it costs to work with a traditional investment manager, which translates to savings for you. Learn more about how much it costs to save, spend and invest with Betterment. A winning combination of human expertise and technology: Automation is what Betterment is known for. But our team of financial experts is our secret sauce. They research, prototype, and implement all the advice and activity that you see in your account. Our algorithms and tools are built on the expertise of traders, quantitative researchers, tax experts, CFP® professionals, behavioral scientists, and more. Four big benefits (just for starters): Less idle cash: We automatically reinvest available dividends, even purchasing fractions of shares on your behalf, so you don’t miss out on potential market returns. A focus on the future: Nobody knows the future. And that makes financial planning tough. Your situation can change at any time but our tools and advice can help you see how various changes could affect your goals. We show you a range of potential outcomes so you can make more informed decisions. Anticipating taxes: We may not be able to predict future tax rates, but we can be pretty sure that certain incomes and account types will be subject to some taxes. This becomes especially relevant in retirement planning, where taxes affect which account types are most valuable to you. Factoring in inflation: We don’t know how inflation will change, but we can reference known historical ranges, as well as targets set by fiscal policy. The most important thing is to factor in some inflation because we know it won’t be zero. We currently assume a 2% inflation rate in our retirement planning advice and in our safe withdrawal advice, which is what the Fed currently targets. Additional advice is always available: At Betterment, we automate what we can and complement our automated advice with access to our financial planning experts through our Premium plan, which offers unlimited calls and emails with our team of CFP® professionals. You can also schedule a call with an advisor to assist with a rollover or help with your initial account setup. Whether you need a one-time consultation or ongoing support, you can always discuss your unique financial situations with one of our licensed financial professionals Managing your money with Betterment: Our mission is to empower you to make the most of your money, so you can live better. Sometimes the best way to do that is with human creativity and critical thought. Sometimes it’s with machine automation and precision. Usually, it takes a healthy dose of both. -

![]()

Three ways it can pay to automate your investing

Three ways it can pay to automate your investing Jan 30, 2026 6:00:00 AM Our managed offering adds value beyond a DIY approach. Here’s how. Key takeaways Portfolio construction is just the beginning. Betterment’s automated investing is designed to help you manage risk, maximize returns, and minimize leg work. Tax-smart features help you keep more of what you earn. Fully-automated Tax Coordination and tax-loss harvesting seek out efficiencies hard to replicate by hand. Navigation helps keep your goals on track. Automated rebalancing, effortless glide paths, and recurring deposits make it easier to stay the course through market ups and downs. Peace of mind is part of the return. Automation frees up time and headspace, letting you live your life instead of worrying about your portfolio. With the arrival of self-directed investing at Betterment, you can choose from thousands of individual stocks and ETFs on your own, including the very same funds we research and select for our curated portfolios. So if you can now buy the same low-cost investments, why pay someone (i.e., us) to manage them for you? It’s a fair question, and to help answer it, it helps to understand why our portfolio construction is just the beginning of the story. It's not just the Betterment portfolio you see today, but the one you see tomorrow (and in the weeks, months, and years that follow) that captures the full value of our expertise and technology. The ongoing optimization and evolution of your portfolio, in other words, is where our automated investing really shines. Sometimes the benefits are tangible. Sometimes they’re emotional. But regardless of how you frame it, we’re constantly working in the background to deliver value in three big ways. Tax savings: keeping more of what you earn Navigation: keeping your investing on-track Calm: keeping your sanity—and your spare time 1. Tax savings: keeping more of what you earn One of the most reliable ways to increase your returns is lowering the taxes owed on your investments. And here's the first way Betterment’s managed portfolios can pay off. Our trading algorithms take tax optimization to a level that’s practically impossible to replicate on your own. Take our Tax Coordination feature, which uses the flexibility of our portfolios to locate assets strategically across Betterment traditional IRAs/401(k)s, Roth IRAs/401(k)s, and taxable accounts. This mathematically-rigorous spin on asset location can help more of your earnings grow tax-free. Then there’s our fully-automated tax-loss harvesting, a feature designed to free up money to invest that would've otherwise gone to Uncle Sam. Our technology regularly scans accounts to identify harvesting opportunities, then goes to work. It’s how we harvested nearly $60 million in losses for customers during the tariff-induced market volatility of Spring 2025. Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more. It’s also a big reason why nearly 70% of customers using our tax-loss harvesting feature had their taxable advisory fee covered by likely tax savings.1 And with the upcoming addition of direct indexing to Betterment’s automated investing, our harvesting capabilities will only continue to grow. 1Based on 2022-2023. Tax Loss Harvesting (TLH) is not suitable for all investors. Consider your personal circumstances before deciding whether to utilize Betterment’s TLH feature. Fee coverage and estimated tax savings based on Betterment internal calculations. See more in disclosures. 2. Navigation: keeping your investing on-track It’s easy to veer off-course when managing your own investing. Life happens, calendars fill up, and the next thing you know, your portfolio starts to drift. When you pay for automated investing, however, you not only get our guidance upfront, you benefit from technology designed to get you to your destination with less effort. As markets ebb and flow, for example, we automatically rebalance your portfolio to maintain your desired risk level. And the “glide path” that automatically lowers your risk as your goal nears? It just happens in eligible portfolios. No research or calendar reminders needed. Our management also helps steer your investing toward a time-tested path to long-term wealth. Most of our portfolios are globally diversified so you take advantage when overseas markets outperform. And we encourage recurring deposits so you buy more shares when prices are low. Recent research by Morningstar helps quantify the value of this “dollar-cost averaging” approach. They found investors lost out on roughly 15% of the returns their funds generated due in large part to jumping in and out of the market. Betterment customers using recurring deposits, meanwhile, earned nearly ~4% higher annual returns.2 It turns out it’s easier to stay the course with a little help. 2Based on Betterment’s internal calculations for the Core portfolio over 5 years. Users in the “auto-deposit on” groups earned an additional 0.6% over the last year and 1.6% annualized over 10 years. See more in disclosures. 3. Calm: Keeping your sanity—and your spare time Our automation can save you time—two hours for each rebalance alone3—but the value of automating your investing is more than just time saved. It’s quality time spent. How much of your finite energy, in other words, are you spending worrying about your money? We can’t erase all of your anxiety, but our team and our tech can empower you to build wealth with confidence and ease, with an emphasis on the ease. 3Based on internal data for a client with one account subject to Betterment’s TaxMin methodology and no other tax features enabled. Betterment will not automatically rebalance a portfolio until it meets or exceeds the required account balance. Between market volatility and a constant barrage of scary headlines, the world is stressful enough right now. There’s little need to add portfolio optimization and upkeep to the list. That is, of course, unless you enjoy it. But many of us don’t. The majority of Betterment customers we surveyed said they hold most of their assets in managed accounts, with self-directed investing serving as a side outlet for exploration. That’s why we offer both ways to invest at Betterment. The payoff is personal Investing performance and price are often measured down to the hundredth of a percentage point. That’s “zero point zero one percent” (0.01%), also known as a “basis point" or "bip" for short. Here at Betterment, it’s our mission to make every one of the 25 bips we most commonly charge worth it. We measure our portfolio’s performance after those fees, so you see what you’ve really earned. And we don’t stop there. With direct indexing and fully paid securities lending coming soon to automated investing, you’ll get even more ways to make your money work harder. -

![]()

Making sense of market volatility

Making sense of market volatility Jan 29, 2026 6:00:00 AM During times of market turbulence, it may be tempting to move your money to safer ground. But it’s important to consider the long-term impact of your decisions. As we've seen recently, the stock market can experience significant fluctuations, rising one day and declining the next. With market swings, tariff announcements, and policy changes flying about, you may be wondering what to do and whether now is the time to take action. You’ll hear from many financial advisors, including Betterment, that volatility is natural and often something you simply need to ride out. Which is true. While the temptation to move your money to safer ground is understandable, it’s important to consider the long-term impact of your decisions. You could miss out on growth opportunities or trigger a larger tax bill. Instead of taking immediate action, take a moment to think through your investing strategy, your financial needs, and potential next steps. Start with this question: When will I need my money? It’s impossible to time the market perfectly. But having a clear timeline for your financial goals allows you to prepare for volatile moments and even take advantage of them. A longer time horizon means you can afford to ride out downturns, while a shorter one may require different considerations. We’ll walk through four different scenarios based on time horizon and how you can align your volatility strategy with your financial goals. Staying invested at every stage in life If you’re not yet in the market: Waiting for the “perfect” time to invest often leads to missed opportunities. The best time to start is now, with a diversified portfolio that aligns with your goals. If you don’t need the money for decades: Whether we’re talking retirement, education savings, or just a healthy investing portfolio, if you’ve got decades to go, time is your greatest asset. Market volatility is normal, even if it feels chaotic. Staying invested and making consistent contributions over time will allow you to benefit from long-term growth and compounding. If you need the money in the next five to 10 years: Your investments still have time to recover from a downturn, but start thinking ahead. Make sure your portfolio reflects your risk tolerance while maintaining a focus on growth. As you get closer to your end goal, you may want to plan to shift toward a more conservative allocation of stocks to bonds, or even move money into a high-yield cash account. If you’re retired or nearly retired: In this retirement-specific case, you’re already drawing down on your investments (or will soon begin to). Remember that even though you’re “using” this money, you’ll be retired for a while, so you don’t want to miss out on growth entirely. “Have a plan that includes a mix of safe and growth-oriented investments. A cash or bond ‘bucket’ can cover short-term needs, while equities can support long-term growth,” says Betterment financial planner, Corbin Blackwell, CFP®. How Betterment can help you mitigate volatility While you can’t avoid market volatility altogether, you can take proactive steps to manage your money and financial needs during market downturns. Establishing a thoughtful investing strategy now will pay dividends in the future. Here are three things to consider as you determine your approach: Invest in a well-diversified portfolio: By investing in a diversified portfolio, your money isn’t riding the wave of any individual stock, asset type, or even a country’s performance. For example, the Betterment Core portfolio is globally diversified and has delivered ~10% in composite annual-weighted returns after fees since its launch1. Consider enabling tax loss harvesting: One silver lining strategy during market downturns is tax loss harvesting—a tax-saving tool that Betterment automates. TLH is the process of selling an asset at a loss (which can happen especially during market downturns) primarily to offset taxes owed on capital gains or income. Build and maintain an emergency fund: You should work to maintain 3-6 months of expenses. These funds should be stored in an account that’s relatively liquid but still can provide some level of growth to help keep up with inflation. Depending on your preferences for risk, growth, and liquidity, we offer a few options: Emergency Fund, our investment allocation built specifically for this use case, with 30% stocks and 70% bonds BlackRock Target Income, our 100% bond portfolios Cash Reserve, our 100% high-yield cash account Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. FDIC insurance provided by Program Banks, subject to certain conditions. Learn more. The big picture If you remember nothing else, remember this: The most important thing you can do is avoid making rash decisions based on short-term market movement. Betterment is here with you every step of the way, helping ensure you make the most of your money, whether the market’s up or down. -

![]()

How we make market downturns less scary

How we make market downturns less scary Jan 29, 2026 4:30:00 AM And how it can benefit your investing’s bottom line. The recent round of tariffs and trade wars have roiled markets, offering the latest example of investing’s inherent volatility. The fact that market drops do happen, and happen with some regularity, means that managing them is not only possible but paramount. "It's not about whether you're right or wrong," the investor George Soros once quipped. "But how much money you make when you're right, and how much you lose when you're wrong." Mitigating losses, in other words, matters just as much as maximizing gains. And this is true for two important reasons: The bigger the loss, the more tempted you may be to sell assets and lock in those losses. The bigger the loss, the less fuel for growth you have when the market does rebound. Point A is psychological, while Point B is mathematical, so let’s take each one separately. In the process, we’ll explain how we build our portfolios to not only weather the storm, but soak up as many rays as possible when the sun shines again. Smoothing out your investing journey Imagine you’re given a choice of rides: one’s a hair-raising roller coaster, the other a bike ride through a series of rolling hills. Sure, thrill seekers may choose the first option, but we think most investors would prefer the latter, especially if the ride in question lasts for decades. So to smooth things out, we diversify. Owning a mix of asset types can help soften the blow on your portfolio when any one particular type underperforms. Our Core portfolio, for example, features a blend of asset types like U.S. stocks and global bonds. The chart below shows how those asset types have performed individually since 2018, compared with the blended approach of a 90% stocks, 10% bonds allocation of Core. As you can see, Core avoids the big losses that individual asset classes experience on the regular. That’s one reason why through all the ups and downs of the past 15 years, it’s delivered ~10% in composite annual-weighted returns after fees since its launch1. 1As of 12/31/2025, and inception date 9/7/2011. Composite annual time-weighted returns: 20.1% over 1 year, 9.3% over 5 years, and 10.1% over 10 years. Composite performance calculated based on the dollar-weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net of fees, includes dividend reinvestment, and excludes the impact of cash flows. Performance not guaranteed, investing involves risk. Core’s exposure to global bonds and international stocks has also helped its cause, given their outperformance relative to U.S. stocks year-to-date amidst the current market volatility of 2025. A smoother ride can take your money farther Downside protection is all the more important when considering the “math of losses.” We’ll be the first to admit it’s hard math to follow, but it boils down to this: as a portfolio’s losses rack up, the gains required to break even grow exponentially. The chart below illustrates this with losses in blue, and the gains required to be made whole in orange. Notice how their relationship is anything but 1-to-1. This speaks to the previously-mentioned Point B: The bigger your losses, the less fuel for growth you have in the future. Investors call this “volatility drag,” and it’s why we carefully weigh the risk of an investment against its expected returns. By sizing them up together, expressed as the Sharpe ratio, we can help assess whether the reward of any particular asset justifies its risk. This matters because building long-term wealth is a marathon, not a race. It pays to pace yourself. And yet, there will still be bumps in the road Because no amount of downside protection will get rid of market volatility altogether. It’s okay to feel worried during drops. But hopefully, with more information on our portfolio construction and automated tools like tax loss harvesting, you can ride out the storm with a little more peace-of-mind. And if you’re looking for even more reassurance, consider upgrading to Betterment Premium and talking with our team of advisors. -

![]()

The pitfalls of comparing portfolio returns

The pitfalls of comparing portfolio returns Jan 28, 2026 8:00:00 AM How to take stock of your stocks (and bonds)—here, there, everywhere. Investing can feel like a leap of faith. You pick a portfolio. You deposit money. Then, you wait. Trouble is, it takes a while for compound growth to do its thing. Using the Rule of 72 and historical stock returns, it takes roughly a decade for every dollar invested to double. That’s a lot of time for second-guessing. You may peek at your portfolio returns and wonder, “Could I be doing better?” Don’t worry; it’s normal to question whether we’re making the right choices with our money. But comparing different portfolios can be tricky. Variables abound. There’s the composition of the portfolios themselves, but also their fees and tax treatments. So whether you’re sizing us up with rival money managers, or with the stock indexes you see most often in the news, we’re here to help you level set. The ABCs of apples-to-apples comparisons Let’s start with a statistic we’re quite proud of: Since its launch, our Core portfolio’s average annual return has been ~10% after fees*. Those are the returns of real Betterment customers, minus fees, and taking the timing of deposits and withdrawals out of the equation. This helps focus more on the performance of the portfolio itself. *As of 12/31/2025, and inception date 9/7/2011. Composite annual time-weighted returns: 20.1% over 1 year, 9.3% over 5 years, and 10.1% over 10 years. Composite performance calculated based on the dollar-weighted average of actual client time-weighted returns for the Core portfolio at 90/10 allocation, net of fees, includes dividend reinvestment, and excludes the impact of cash flows. Performance not guaranteed, investing involves risk. So, is 10% good? Well, it depends on the comparison. Stock indexes like the S&P 500 and Dow Jones dominate the news, but they’re hardly comprehensive. For one, they exclude bonds, a lower-yield staple of many portfolios. There’s a reason why regardless of the portfolio, we recommend holding at least some bonds. They help temper market volatility and preserve precious capital. Secondly, popular indexes also largely ignore international markets. The S&P, for example, typically represents less than half the value of all investable stocks in the world. Our globally-diversified portfolios, meanwhile, spread things out in service of a smoother investing journey. We're built for the long run, and history has shown that American and International assets take turns outperforming each other every 10-15 years. So the modest amount of international exposure in many of our portfolios means this: you're in a better position to profit when the pendulum swings the other way. Now, taking all of this to heart isn't easy. Not when the S&P returns 20% in a given year. At moments like these, it’s perfectly normal to feel FOMO when looking at the returns of your globally-hedged investing. To keep the faith, it helps to keep the right benchmark(s) in mind. Not all diversification is created equal We’re not alone in offering globally-diversified portfolios. But two portfolios, even with similar stock-to-bond ratios, can take very different paths to the same end goal. Tax optimization, market timing, and fund fees can all impact your investing’s bottom line as well. Some investors compare providers by investing a little with each, waiting a few months, then comparing the balances. This sort of trialing, however, may not tell you much. When it comes to our portfolios, you can find better comparisons in two particular ETFs that seek to track a wide swath of the market: ACWI for stocks and AGG for bonds. See how your Betterment portfolio stacks up against them in the Performance section for any goal or account. Simply scroll down to “Portfolio returns,” click “Add comparison,” and pick from the available allocations of stocks and bonds. We show your “Total return” by default at Betterment, otherwise known as the portfolio’s total growth for a given time period. You can also see this expressed as an “Annualized” return, or the yearly growth rate you often see advertised with other investments. Putting your performance in perspective Comparison may be the thief of joy, but it’s okay, prudent even, to evaluate your investing returns on occasion. Once or twice a year is plenty. The key is to steer clear of common pitfalls along the way. Like comparing your globally-diversified apple to someone else’s all-U.S. orange. Or cherry-picking a small sample size instead of a longer, more-reliable track record. It’s easier said than done. That’s why we bake more relevant comparisons right into the Betterment app. It’s also why we produce content like this. Because if there’s a silver lining to the slow snowballing of compound growth, it’s that you have plenty of time to brush up on the basics. -

![]()

Save more, sweat less with recurring deposits

Save more, sweat less with recurring deposits Jan 28, 2026 5:00:00 AM How one click—and the power of dollar cost averaging—can boost your returns Healthy habits like exercising, eating well, and saving are hard for a reason. They take effort, and the results aren’t always immediate. Except in the case of saving, there’s a simple hack that lowers the amount of willpower needed: setting up recurring deposits. So kick off those running shoes, because you barely have to lift a finger to start regularly putting money into the market. $2, $200, it doesn’t matter. This one deposit setting, along with a little help from something called dollar cost averaging, can lead to better returns. Our own data shows it: Betterment customers using recurring deposits earned ~4% higher annual returns. Based on Betterment’s internal calculations for the Core portfolio over 5 years. Users in the “auto-deposit on” groups earned an additional 0.6% over the last year and 1.6% annualized over 10 years. See more in disclosures. Three big reasons they fared better than those who rarely used recurring deposits include: When you set something to happen automatically, it usually happens. It's relatively easy to skip a workout or language lesson. All you need to do is … nothing. But the beauty of recurring deposits is it takes more energy to stop your saving streak than sustain it. When you regularly invest a fixed amount of money, you're doing something called dollar cost averaging, or DCA. DCA is a sneaky smart investment strategy, because you end up buying more shares when prices are low and fewer shares when prices are high. A steady drip of deposits helps keep your portfolio balanced more cost-effectively. Instead of selling overweighted assets and triggering capital gains taxes, we use recurring deposits to regularly buy the assets needed to bring your portfolio back into balance. Now it’s time for an important caveat: The benefits of dollar cost averaging don't apply if you have a chunk of money lying around that’s ripe for investing. In this scenario, slowly depositing those dollars can actually cost you, and making a lump sum deposit may very well be in your best interest. But here’s the good news: While DCA and lump sum investing are often presented in either/or terms, you can do both! In fact, many super savers do. You can budget recurring deposits into your week-to-week finances—try scheduling them a day after your paycheck arrives so you’re less likely to spend the money. Then when you find yourself with more cash than you need on hand, be it a bonus or otherwise, you can invest that lump sum. Do both, and you may like what you see when you look at your returns down the road.