Start by setting your goals.

Everyone’s financial goals look different. No matter your starting point, set up a plan that’s right for you, whether that’s saving for a specific purchase or simply building wealth.

Bring your goals to life.

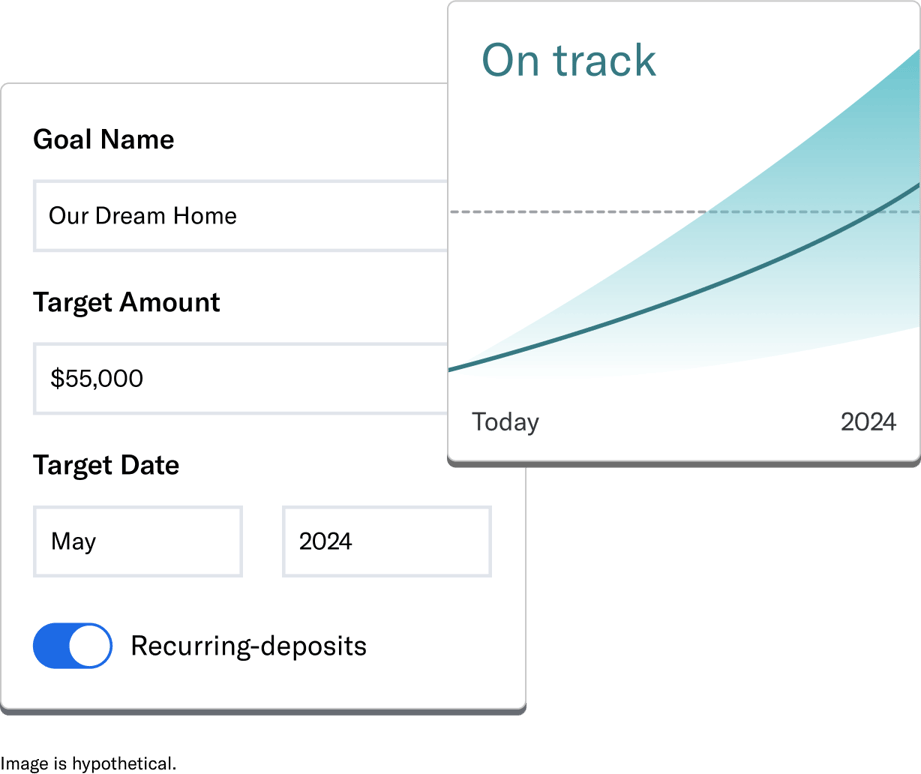

Let us know things like how much you want to save and by when, and we’ll help you set up a portfolio of stocks, bonds, or cash. Play around with our projections tool to see how changes affect your goal.

Use our savings tools to help you reach your goals.

- Connect outside accounts to plan holistically.

- Get advice on how to save: stock, bonds, or cash.

- Calculate how to reach your target with our goal forecaster.

- Schedule deposits with one-time or automatic deposits.

- Track your progress and make adjustments along the way.