Filter by:

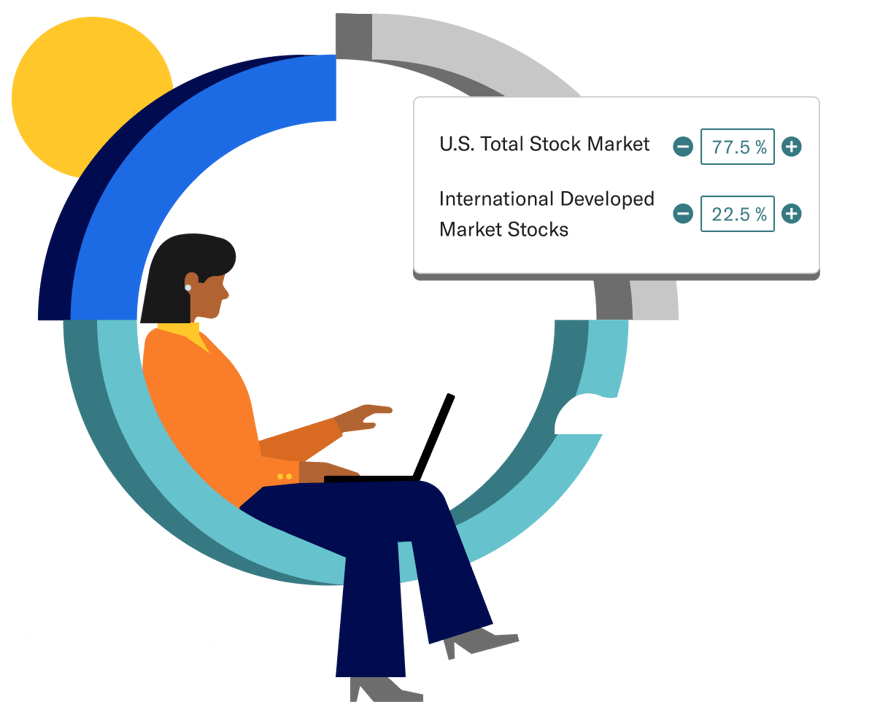

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

Innovative Technology

A well-diversified portfolio focused on high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology along with increased exposure to risk.

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

Social Impact

Provides broad diversified exposure with a greater focus on companies actively working toward minority empowerment and gender diversity as part of your long-term strategy.

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

Invested with benefits.

-

Smart strategies built for better outcomes.

Our personalized advice and easy-to-use platform was created to help manage risk with the objective of delivering meaningful returns.

-

Automated investment techniques.

We automatically integrate a number of sophisticated strategies for applicable goals, including automatic rebalancing and auto-adjust.

-

Increased tax efficiency.

At no extra cost, employees using Traditional and Roth 401(k) accounts can use Tax Coordination, which optimizes the location of assets for tax efficiency.