-

Assets under management

-

-

-

Some of the many companies with a Betterment at Work 401(k).

-

-

-

-

-

--

-

-

Customizable plan design to fit your needs.

-

Plans that match your budget.

Bypass most 401(k) compliance testing with Safe Harbor 401(k) or elect budget flexibility with a traditional discretionary match. -

Flexible plan features.

Design a plan that fits your organization's goals, from eligibility requirements, vesting schedule, profit sharing—and much more. -

Automatic enrollment and auto-escalation.

Drive plan participation by enrolling and raising employee contribution rates automatically. -

Optional 401(k) match on student loan payments.

A first-to-market offering: Increase plan participation by encouraging employees to pay down qualified student loans with a 401(k) match.

Service and support at every step.

-

Dedicated onboarding specialist.

Your single point of contact to set up your new plan or convert your existing one. -

Ongoing support for your plan.

Get 401(k) administration help and answers from our Plan Support Team or a dedicated Client Success Manager whenever you need it. -

Employee support team.

Specialists are available via call, email, or chat to help resolve participant-specific needs. -

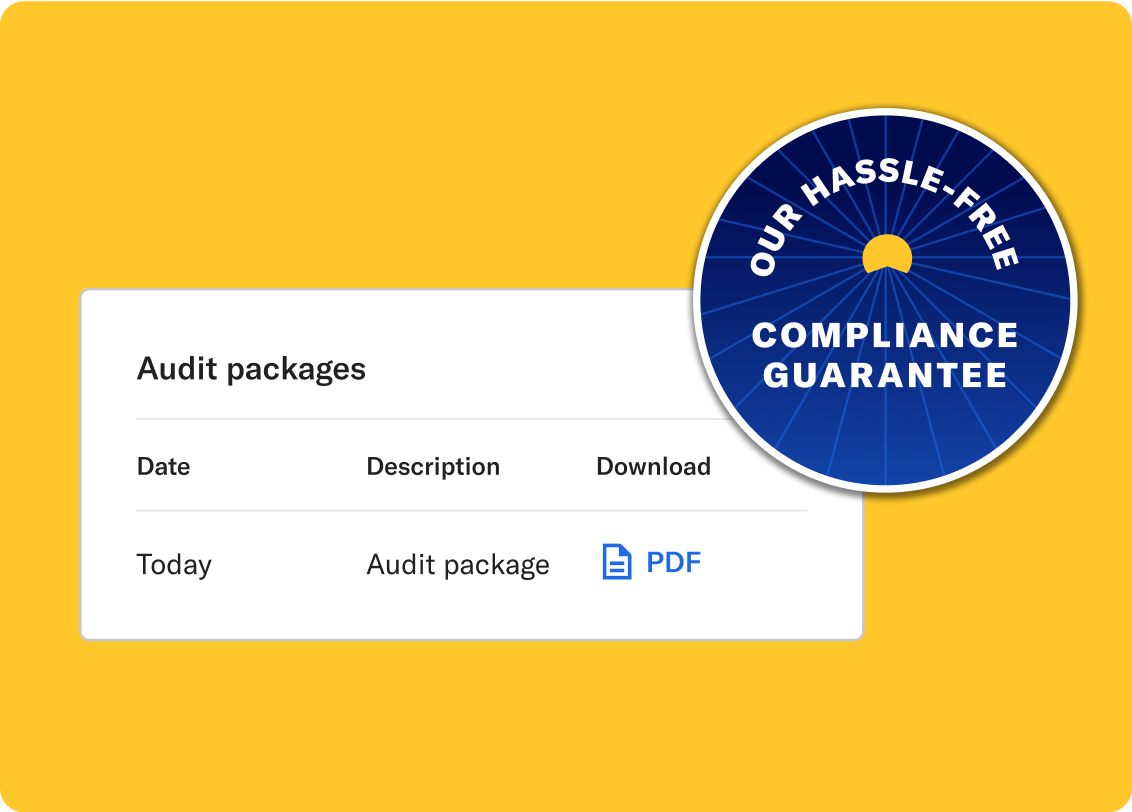

Leave your 401(k) compliance to the experts.

Our team handles annual testing, calculates contributions, and prepares signature-ready Form 5500 to help your plan stay compliant.

350+ payroll integrations.

We sync with top payroll providers and can create custom integrations, reducing your administrative burden. Find your provider here.

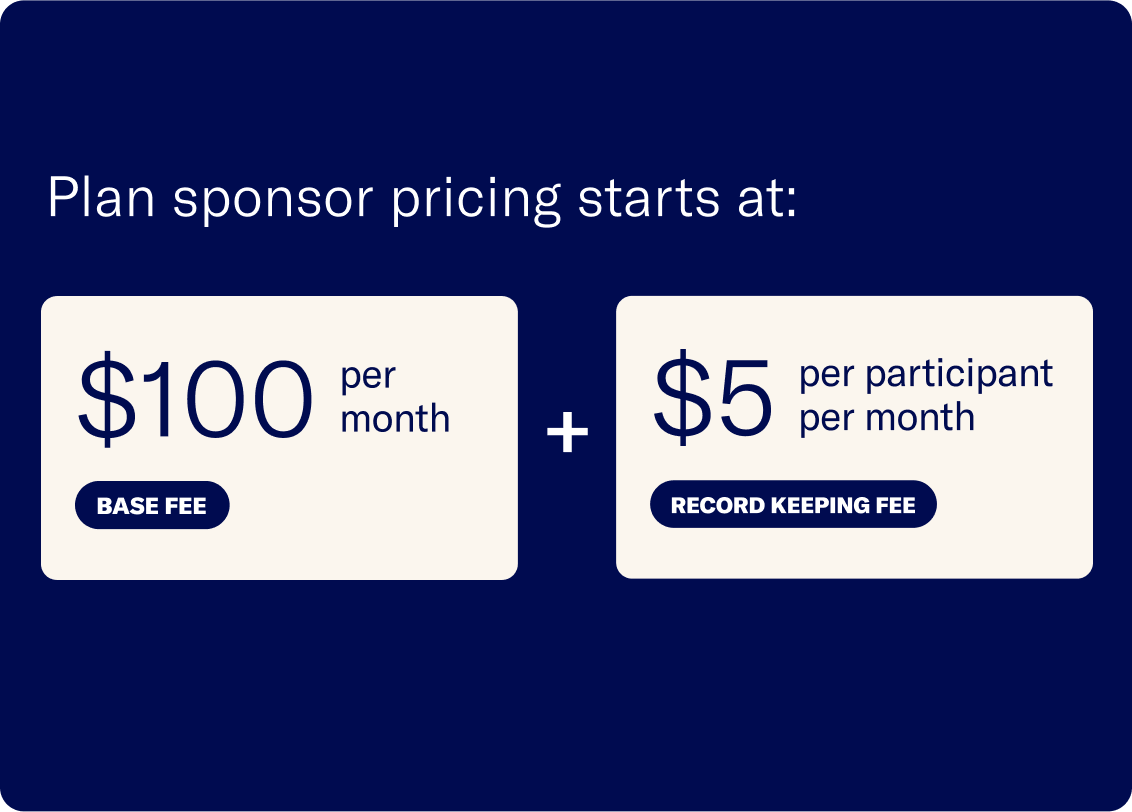

All-in pricing with no hidden fees.

With SECURE 2.0, many businesses can now take advantage of various tax credits. For new plans, this legislation can cover most of your costs for the first year.

-

Control plan eligibility.

Decide who can participate or be excluded from your plan, like seasonal or part-time workers. -

Automatic force outs.

Automatically remove terminated employees with low balances from your plan. -

Fee flexibility.

Decide what employees pay for and what your business covers. Transfer certain plan expenses back to former employees. -

Only pay for active participants.

Reduce fees by only paying for participants who fund their 401(k)s. Participants will pay a typical management fee of 0.25%.

Put 14+ years of investment expertise behind your 401(k).

Our curated, expert-built portfolios make investing easy for employees. They can choose the portfolio that interests them, from sustainability to innovative technology.

If they’re an experienced investor looking for more control, a Flexible portfolio lets them adjust individual asset class weights based on their preferences.

Frequently asked questions:

-

A 3(16) fiduciary is responsible for managing day-to-day administrative work for a 401(k) plan. Betterment will partner with you to perform administrative duties including preparing Form 5500, processing force outs, drafting and amending plan documents, and more.

A 3(38) fiduciary is an investment manager. Betterment will be responsible for selecting, managing, monitoring, and benchmarking the investment offerings of your 401(k) plan.

Learn more about how Betterment partners with you to fulfill fiduciary responsibilities here. -

Offering a company-sponsored 401(k) plan can introduce several tax advantages, such as tax deductions for certain expenses and employer contributions.

With the increasing focus on retirement legislation—particularly the passage of SECURE 2.0—many businesses are now eligible for various tax credits:

- Startup Tax Credit: provides businesses with less than 100 employees a three-year tax credit for up to 50% of the plan’s start-up costs.

- Employer Contribution Credit: employers with fewer than 50 employees can receive up to $1,000 for each eligible employee (those earning less than $100,000) when they offer a match contribution.

- Automatic Enrollment Credit: $500 tax credit for employers who add automatic enrollment.

-

Betterment will serve as your partner in plan design, and offer guidance to help you create a plan that fits the needs of your business. Our flexible 401(k) plan design lets you control eligibility requirements, enrollment, employer contributions, vesting, and more. Learn more about plan design at Betterment here.

-

With a Betterment 401(k), you do not need to pay for all plan expenses. Many of the fees can be passed to plan participants if preferred. Also, you only have to pay for employees who fund their 401(k)s and participate in your plan—not for those who do not utilize it.

-

Automatic enrollment is a plan design feature that enables participants to automatically contribute to their 401(k) plan. The plan will automatically deduct funds for their 401(k) accounts. Employers set the default contribution rate, and employees can adjust or opt-out at any time.

Automatic escalation takes the contribution rate a participant starts with and increases the rate by 1% every year until they hit a maximum cap of 15%.

Both of these 401(k) features are extremely important given the recent SECURE 2.0 legislation. It mandates that beginning in 2025, new 401(k) plans must have both auto-enrollment & auto-escalation.

-

Active participants are charged 0.25% annual asset management fee.