Your plan for a better 401(k)

Easily integrate Gusto with a modern, user-friendly 401(k) through Betterment at Work.

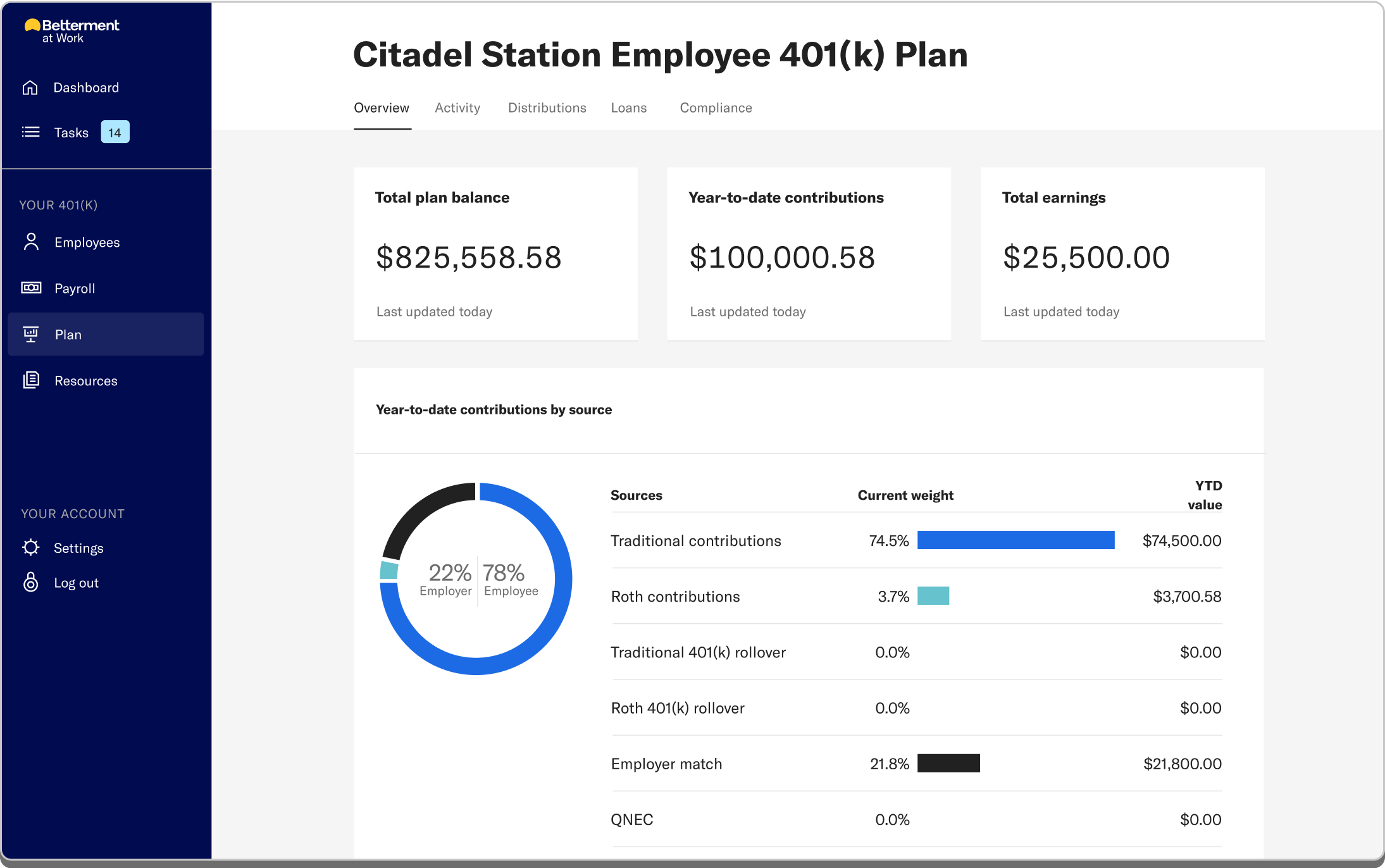

Manage your 401(k) with ease.

With a 360 degree Gusto and Betterment at Work integration, the only regular administration your team needs to do is a quick review each pay period. And setting up that integration? It’s straightforward too.

Our integration with Gusto will automatically create accounts for your employees who are eligible for your 401(k) and will also handle offboarding for employees who leave your company.

Image is hypothetical.

Service and support at every step.

-

Plans that match your budget.

Bypass most 401(k) compliance testing with Safe Harbor 401(k) or elect budget flexibility with a traditional discretionary match. -

Flexible plan features.

Design a plan that fits your organization's goals, from eligibility requirements, vesting schedule, profit sharing—and much more. -

Automatic enrollment and auto-escalation.

Drive plan participation by enrolling and raising employee contribution rates automatically. -

Optional 401(k) match on student loan payments.

Increase plan participation by encouraging employees to pay down qualified student loans with a 401(k) match.