Portfolios: Managed and customizable options

Expert-managed portfolios with personalized glide paths, plus customizable options for employees who want more control—all built with globally diversified ETFs. Employees can invest in what interests them, from sustainability to innovative technology.

Mutual fund lineup

A curated selection of low-cost mutual funds, including target-date and asset-class-based funds. See our mutual fund lineup

Advisor-enabled lineup

We partner with advisors to design and manage custom fund lineups tailored to client needs.

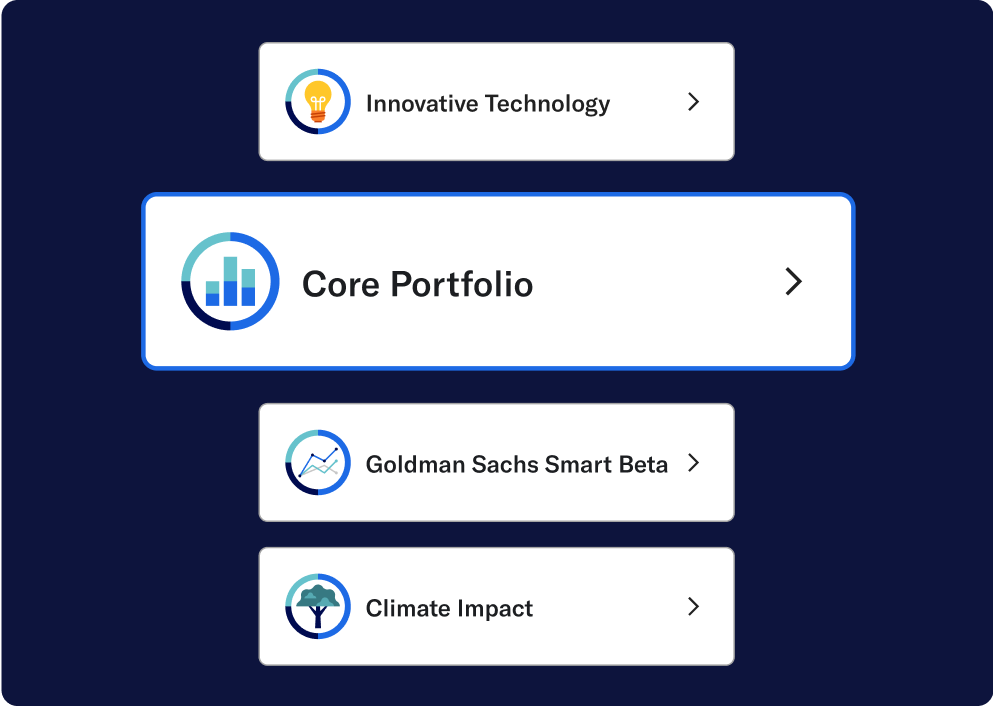

Explore our curated investing options.

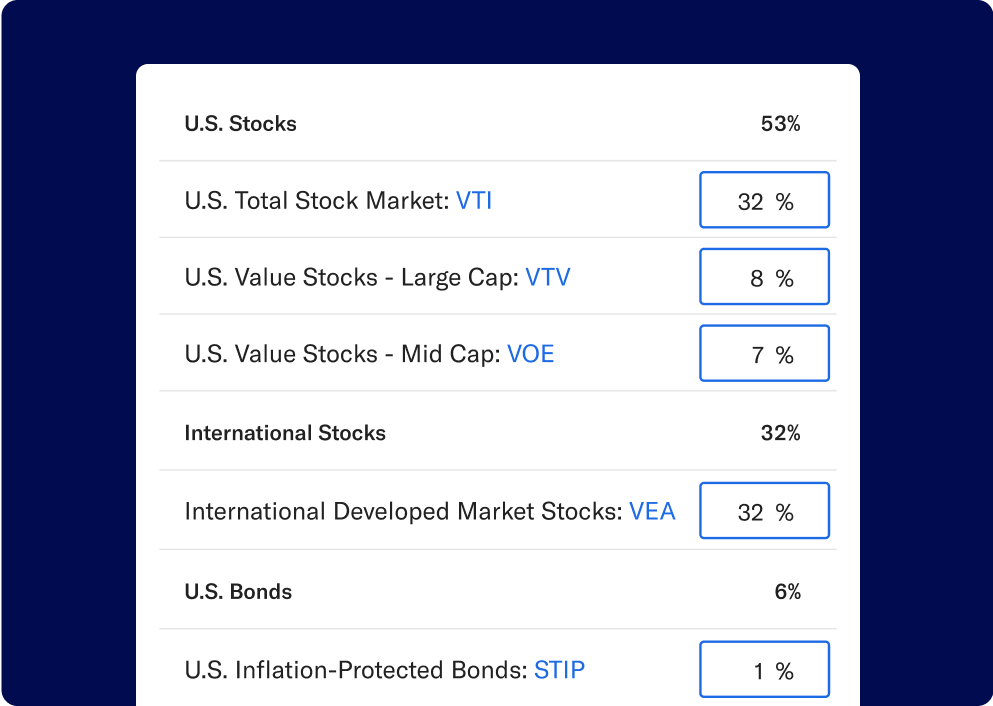

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

Innovative Technology

A well-diversified global portfolio focused on high-growth companies that use or develop emerging technologies, including artificial intelligence, alternative finance, clean energy, manufacturing, biotechnology and more.

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

Social Impact

Provides globally diversified exposure with a greater focus on companies actively working toward social equity and gender diversity as part of your long-term strategy.

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

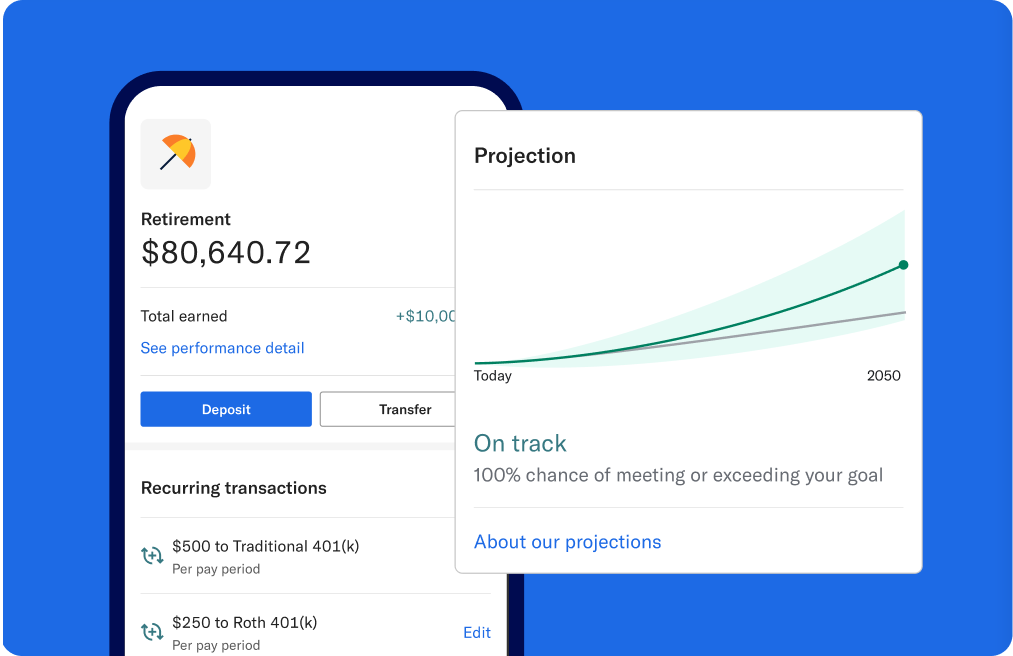

Investing backed by technology to support your employees.

Risk management through rebalancing

Tax-efficient investing