Dana Karlson

Meet our writer

Dana Karlson

Sr. Manager Copy & Content

Dana Karlson oversees content for Betterment at Work and Betterment Advisor Solutions. She joined Betterment in 2021, beginning on the Retail team before expanding her leadership across Betterment at Work and Betterment Advisor Solutions. She brings more than 20 years of experience in journalism and marketing. Previously, she was a senior editor at Condé Nast and British Sky Broadcasting in London, and has worked with finance and consumer brands on content strategy and brand storytelling.

Articles by Dana Karlson

-

![]()

More than 50% of employees think employers should offer this benefit

More than 50% of employees think employers should offer this benefit Feb 26, 2026 12:30:00 PM Our recent survey of 1,000 full-time U.S. workers found that nearly half of employees agreed employers should focus on one thing. Let’s see what that is…. In our 2025 Retirement Readiness Annual Report, we surveyed 1,000 full-time U.S. workers to learn more about how retirement readiness and financial well-being have evolved over the last year. One theme stood out to us: Employees want more help from their employers with student loan debt. In fact, 54% of employees believe that employers should play a role in helping them pay off their student loan debt — this was felt most strongly among Gen Z (67%) That’s something to consider: Nearly half of employees think their companies should offer a benefit helping to pay student loans. It’s clear, employees want student loan benefits And there’s a good reason for this: 66–70% of student debt holders cite their loans as a cause of financial anxiety. Check out the breakdown of student loans by by generation: Gen Z: 61% Millennials: 43% Gen X: 28% Baby Boomers: 10% So, what should employers do? Talk to your employees about their needs Before you jump into offering a new student loan benefit, first take a step back to gain a wider view of your employee’s needs. Ask your employees what they want in terms of a financial benefits package. A simple approach is to have employees rank benefits in order of most likely to use to least likely, and give them a chance to submit open-ended comments. You can start with a list of benefits, like this, for your employees to rank: 401(k) retirement plan 401(k) employer match 401(k) match on student loan payments Access to a financial advisor 529 college savings plan If you already offer some of these benefits, it’s still good to have employees rank their perceived value of them. Additionally, add other benefits to the list that you may consider offering. After you step back and look at the data, you can implement financial benefits that make sense for your company. Betterment at Work offers a variety of benefits to help you meet your employees’ needs Once you’re ready to implement new benefits for your employees, we’ve got you covered. And if you need help deciding what’s best, our team can talk you through the decision. You’ve got options. 401(k) match on student loan payments: When it comes to alleviating student loan debt, Betterment offers a 401(k) match for qualified student loan payments. We’ve found that it solves a larger problem when we help employees save in a 401(k) while at the same time they pay down their student loans. Employees don’t have to choose between reducing their debt and saving for retirement. (See it in action: Watch our video to learn how you can offer a 401(k) match based on an employee's student loan payments.) 529 education savings plan: Forward-thinking employers can take it a step further and provide a state-sponsored 529 to save up for higher education costs. Many younger parents are doing three things at once: paying down their student loan debt, saving for their retirement, and saving for college for their kids. That’s a lot to balance. We offer a tax-advantaged 529 savings plan to help your employees tackle rising education costs. Access to a financial advisor: Take your Betterment 401(k) to the next level with Financial Coaching. Offer a benefits package that includes 1:1 financial guidance to help every employee better achieve their goals in and out of work. Award-winning 401(k) for small businesses: Get an affordable and customizable retirement plan designed to scale with you. After all, a 401(k) plan with an employer match is the most wanted benefit among employees. Plus, we’re trusted by some great companies Here are some of the many companies with a Betterment at Work 401(k)... Ready to offer financial benefits your employees want? Betterment at Work makes it easy for small and mid-market businesses to provide a scalable 401(k) plan with an employer match. Plus, our platform empowers you to offer additional benefits like 529 plans, student loan payment 401(k) matches, and 1:1 advice from our financial advisors. Set up a call today to learn more. -

![]()

Understanding 401(k) Annual Compliance Testing

Understanding 401(k) Annual Compliance Testing Dec 23, 2025 9:00:00 AM These yearly required tests are meant to ensure everyone is benefiting from your 401(k) plan. If your company has a 401(k) plan—or if you’re considering starting one in the future—you may have heard about annual compliance testing, also known as nondiscrimination testing. But what is it really? And how can you help your plan pass these important compliance tests? Read on for our explanation. What is annual compliance testing? Mandated by ERISA, annual compliance testing helps ensure that 401(k) plans benefit all employees—not just business owners or highly compensated employees. Because the government provides significant tax benefits through 401(k) plans, it wants to ensure that these perks don’t disproportionately favor high earners. We’ll dive deeper into nondiscrimination testing, but let’s first discuss an important component of 401(k) compliance: contribution limits. What contribution limits do I need to know about? Because of the tax advantages given to 401(k) plan contributions, the IRS puts a limit on the amount that employers and employees can contribute. Here’s a quick overview: Limit What is it? Notes for 2025 plan year Employee contribution limits (“402g”) Limits the amount a participant may contribute to the 401(k) plan. The personal limit is based on the calendar year.1 Note that traditional (pre-tax) and Roth (post-tax) contributions are added together (there aren’t separate limits for each). $23,500 is the maximum amount participants may contribute to their 401(k) plan for 2025. Participants age 50 or older during the year may defer an additional $7,500 in “catch-up” contributions if permitted by the plan. Participants age 60-63 have a different catch-up contribution limit, $11,250. Total contribution limit (“415”) Limits the total contributions allocated to an eligible participant for the year. This includes employee contributions, all employer contributions and forfeiture allocations. Total employee and employer contributions cannot exceed total employee compensation for the year. $70,0002 plus up to $7,500 or $11,250 in catch-up contributions (if permitted by the plan) for 2025. Cannot exceed total compensation. Employer contribution limit Employers’ total contributions (excluding employee deferrals) may not exceed 25% of eligible compensation for the plan year. N/A This limit is an IRS imposed limit based on the calendar year. Plans that use a ‘plan year’ not ending December 31st base their allocation limit on the year in which the plan year ends. This is different from the compensation limits, which are based on the start of the plan year. Adjusted annually; see most recent Cost of Living Adjustments table here. What is nondiscrimination testing designed to achieve? Essentially, nondiscrimination testing has three main goals: To measure employee retirement plan participation levels to ensure that the plan isn’t “discriminating” against lower-income employees. To ensure that people of all income levels have equal access to—and awareness of—the company’s retirement plan. To encourage employers to be good stewards of their employees’ futures by making any necessary adjustments to level the playing field (such as matching employees’ contributions) Where do I begin? Before you embark on annual compliance testing, you’ll need to categorize your employees by income level and employee status. Here are the main categories (and acronyms): Highly compensated employee (HCE)—According to the IRS, an employee who meets one or more of the following criteria: Prior (lookback) year compensation—For plan years ending in 2025, earned over $155,000 in the preceding plan year; some plans may limit this to the top 20% of earners (known as the top-paid group election), which would be outlined in your plan document; or Ownership in current or prior year—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation Non-highly compensated employee (NHCE)—Someone who does not meet the above criteria. Key employee—According to the IRS, an employee who meets one or more of the following criteria during the plan year: Ownership over 5%—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation. Ownership over 1%—Owns more than 1% of the stock, voting power, capital, or profits, and earned more than $150,000. Officer—An officer of the employer who earned more than $220,000 for 2024; this may be limited to the lesser of 50 officers or the greater of 3 or 10% of the employee count. Non-key employee—Someone who does not meet the above criteria. What are the tests that need to be performed? Below are the tests typically performed for 401(k) plans. Betterment will perform each of these tests on behalf of your plan and inform you of the results. 1. 410(b) Coverage Tests—These tests determine the ratios of employees eligible for and benefitting from the plan to show that the plan fairly covers your employee base. Specifically, these tests review the ratio of HCEs benefitting from the plan against the ratio of NHCEs benefitting from the plan. Typically, the NHCE percentage benefitting must be at least 70% or 0.7 times the percentage of HCEs considered benefitting for the year, or further testing is required. These annual tests are performed across different contribution types: employee contributions, employer matching contributions, after-tax contributions, and non-elective (employer, non-matching) contributions. 2. Actual deferral percentage (ADP) test—Compares the average salary deferral of HCEs to that of non-highly compensated employees (NHCEs). This test includes pre-tax and Roth deferrals, but not catch-up contributions. Essentially, it measures the level of engagement of HCEs vs. NHCEs to make sure that high income earners aren’t saving at a significantly higher rate than the rest of the employee base. Specifically, two percentages are calculated: HCE ADP—The average deferral rate (ADR) for each HCE is calculated by dividing the employee’s elective deferrals by their salary. The HCE ADP is calculated by averaging the ADR for all eligible HCEs (even those who chose not to defer). NHCE ADP—The average deferral rate (ADR) for each NHCE is calculated by dividing the employee’s elective deferrals by their salary. The NHCE ADP is calculated by averaging the ADR for all eligible NHCEs (even those who chose not to defer). The following table shows how the IRS limits the disparity between HCE and NHCE average contribution rates. For example, if the NHCEs contributed 3%, the HCEs can only defer 5% (or less) on average. NHCE ADP HCE ADP 2% or less → NHCE% x 2 2-8% → NHCE% + 2 more than 8% → NHCE% x 1.25 3. Actual contribution percentage (ACP) test—Compares the average employer contributions received by HCEs and NHCEs. (So this test is only required if you make employer contributions.) Conveniently, the calculations and breakdowns are the same as with the ADP test, but the average contribution rate calculation includes both employer matching contributions and after-tax contributions. 4. Top-heavy determination—Evaluates whether or not the total value of the plan accounts of “key employees” is more than 60% of the value of all plan assets. Simply put, it analyzes the accrued benefits between two groups: Key employees and non-Key employees. A plan is considered top-heavy when the total value (account balance with adjustments related to rollovers, terminated accounts, and a five-year lookback of distributions) of the Key employees’ plan accounts is greater than 60% of the total value (also adjusted as noted above) of the plan assets, as of the end of the prior plan year. (Exception: The first plan year is determined based on the last day of that year). If the plan is considered top-heavy for the year, employers must make a contribution to non-key employees. The top-heavy minimum contribution is the lesser of 3% of compensation or the highest percentage contributed for key employees. However, this can be reduced or avoided if no key employee makes or receives contributions for the year (including forfeiture allocations). What happens if my plan fails these tests? If your plan fails the ADP and ACP tests, you’ll need to fix the imbalance by returning 401(k) plan contributions to your HCEs or by making additional employer contributions to your NHCEs. If you have to refund contributions, that money may be subject to state and federal taxes. Plus, if you don’t correct the issue in a timely manner, there could also be a 10% penalty fee and other serious ramifications. Why is it common to fail testing? Small and mid-size businesses may struggle to pass if they have a relatively high number of HCEs. If HCEs contribute a lot to the plan, but non-highly compensated employees (NHCEs) don’t, there’s a chance that the 401(k) plan will not pass nondiscrimination testing. It’s actually easier for large companies to pass the tests because they have many employees at varying income levels contributing to the plan. How can I help my plan pass the tests? It pays to prepare for nondiscrimination testing. Here are a few tips that can make a difference: Add automatic enrollment —By adding an auto-enrollment feature to your 401(k) plan, you can automatically deduct elective deferrals from your employees’ wages unless they opt out. It’s a simple way to boost participation rates and help your employees start saving. In fact, the government is getting more behind auto-enrollment; SECURE 2.0 mandates plans that launched after Dec. 29, 2022 add automatic enrollment to the plan by Jan. 1, 2025. Add a Safe Harbor provision to your 401(k) plan—Safe Harbor plan design typically makes compliance testing easier to pass. Make it easy to enroll in your plan—Is your 401(k) plan enrollment process confusing and cumbersome? If so, it might be stopping employees from enrolling. Consider partnering with a tech-savvy provider like Betterment that can help your employees enroll quickly and easily—and support them on every step of their retirement saving journey. Learn more now. Encourage your employees to save—Whether you send emails or host employee meetings, it’s important to get the word out about saving for retirement through the plan. That’s because the more NHCEs that participate, the better chance you have of passing the nondiscrimination tests. (Plus, you’re helping your team save for their future.) Add automatic escalation - By adding automatic escalation, you can ensure that participants who are automatically enrolled in the plan continue to increase their deferral rate by 1% annually until a cap is reached (generally 15%). It’s a great way to increase your employees retirement savings and to engage them in the plan. How can Betterment help? Nondiscrimination testing and many other aspects of 401(k) plan administration can be complex. That’s why we do everything in our power to help make it easier for you as a plan sponsor. We help with year-end compliance testing, including ADP/ACP testing, top-heavy testing, annual additions testing, deferral limit testing, and coverage testing. With our intuitive online platform, you can better manage your plan and get the support you need along the way. Ready to learn more? Let's talk. -

![]()

What today’s financial stress means for your 2026 benefits strategy

What today’s financial stress means for your 2026 benefits strategy Dec 16, 2025 9:00:00 AM Betterment’s 2025 Retirement Readiness Report reveals the tension shaping the modern workforce—and what plan sponsors should prepare for next. The paradox shaping today’s workforce Our fifth annual Retirement Readiness Report reveals a workforce that has learned to navigate contradictions with a dash of optimism. Although American employees report growing financial anxiety, they’re also feeling more “retirement ready,” highlighting the growing distance between the financial reality of today and projections for their future selves. 90% of full-time employees reported feeling stressed about their finances, while 71% remain confident they’ll have enough saved for the future. Employers are doing more than ever to help workers engage with their retirement savings, but the data shows that long-term optimism alone isn’t enough. To boost productivity and overall well-being, workers also need support for the short-term financial pressures they carry into the workplace every day. We’ve rounded up 11 key insights to help employers meet their teams where they are in 2026. Here’s a preview of the findings. Retirement expectations are rising faster than confidence One of the strongest signals this year is that employees believe they will need more to retire comfortably. Nearly half now expect to need over $1 million, a sharp increase from last year’s expectations. For employers, this creates a widening gap between what employees think they’ll need and the strategies they’re using to get there. Your retirement plan design—and how you communicate it—can help bridge that divide. "Employees’ financial situations have improved as we move past the pandemic economy, and we're seeing that when they have more access to financial support and education—whether that’s through benefits education from HR, online resources, or advice from AI—they feel more stable." – Dan Egan, VP of Behavioral Finance & Investing, Betterment Emergency savings are becoming essential—not optional Short-term financial stability is beginning to carry as much weight as long-term retirement security. More employees now have an emergency fund than at any point in the past five years, and interest in short-term safety nets continues to climb. 68% of employees report having an emergency fund, marking a five-year high and signaling growing interest in short-term financial stability. It’s a clear message from workers: Retirement savings alone won’t ease today’s financial strain. Employers who pair retirement benefits with short-term tools can help reduce stress, increase productivity, and build trust. As one respondent shared, “Employers need to understand that employees want more than just a paycheck. They want benefits that build long-term financial security.” Generational needs are diverging—and reshaping benefit expectations The year’s report makes it abundantly clear that generations are not simply at different life stages, but are operating in different financial ecosystems altogether. Across Gen Z, Millennials, Gen X, and Boomers, Betterment found: 88% of Gen Z feel they have enough saved for retirement 64% of Millennials say they would switch jobs for stronger financial benefits 54% of Gen X have considered delaying retirement 28% of Boomers rank market volatility among their top financial stressors When taken together, these trends show that a one-size-fits-all benefits strategy is not enough for today’s workforce. Employers who adjust their communication and benefit offerings to these generational differences will better position themselves to support employee engagement and retention. How plan sponsors can turn insight into action Across every trend we studied, one through-line emerged: Employees want more than a paycheck. They want support structures that help them feel secure today and confident about tomorrow. For employers, that may mean: Creating benefits experiences tailored to generational and work-style differences. Expanding financial wellness offerings to address short-term pressures. Enhancing education around benefits to close literacy gaps. These themes scratch the surface of the 11 key insights that emerged in this year’s data. See all 11 insights shaping your workforce Our fifth annual Retirement Readiness Report goes deeper into the changing expectations, behaviors, and financial realities of today’s workforce—and what it means for your 2026 HR strategy. -

![]()

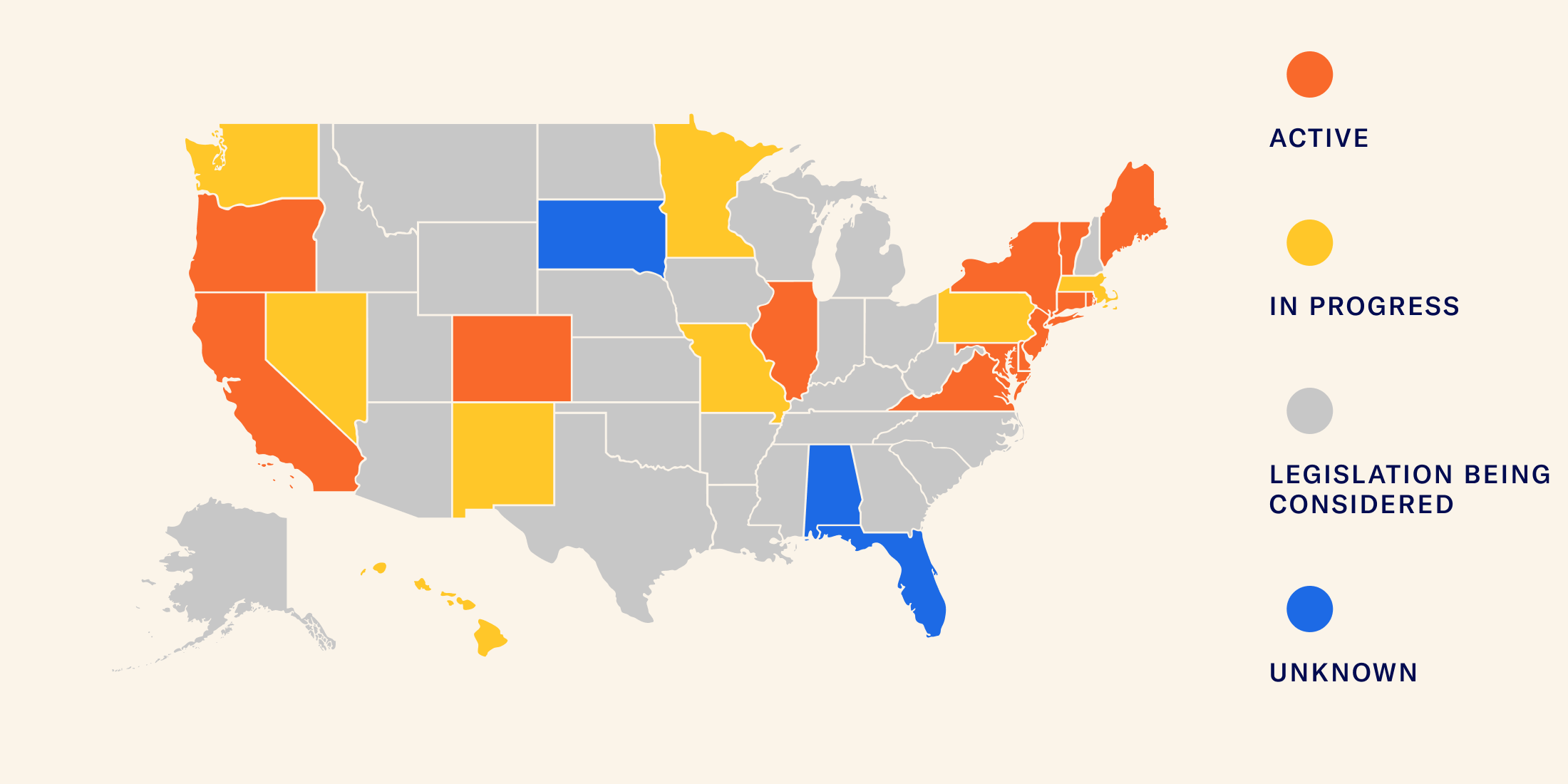

A 50-state guide to state-mandated retirement plans [2025]

A 50-state guide to state-mandated retirement plans [2025] Oct 29, 2025 9:00:00 AM All but three states have either active mandates in place or are working towards implementing mandated retirement programs. Check your state to see how your business may be impacted. Table of contents: All active state mandate programs In-progress state mandate programs States with legislation being considered Unknown state mandate programs The retirement landscape is changing rapidly, with many Americans living longer but saving less for their golden years. One of the most significant developments in this space has been the rise of state-mandated retirement plans. These plans are designed to provide essential benefits to workers who may not have access to them through their employer. With a growing number of private workers not having access to these crucial benefits, states are increasingly requiring businesses to provide retirement plans to employees. In 2015, the Department of Labor (DOL) issued guidance to support the states' efforts to help promote retirement benefits within their respective states. What exactly are state-mandated retirement plans? In recent years, more states have passed legislation requiring businesses to provide retirement benefits for their employees. In these states, employers have the choice between enrolling their workers in the state-sponsored program or establishing their own workplace retirement plan through providers like Betterment. A state-sponsored plan usually involves an Individual Retirement Account (IRA) set up by the employer for participants to contribute. However, certain features may vary between states, so it's a good idea to research your state's specific program to ensure compliance. All but three states are currently working on legislation to implement these plans, which means that more and more Americans will have access to the retirement benefits they need. However, it's important to stay up-to-date on these changes, as failing to comply with the new rules could result in hefty fines. For more details on how state-mandated plans could impact you, read: What state-mandated plans could mean for your small business. All active state mandate programs The following states have enacted legislation and have either implemented or are in the process of implementing a state-mandated program. California Plan Name: CalSavers Status: Mandate in place Deadlines: Deadline passed for 5+ employees; December 31, 2025, for 1-4 employees Details: Not all employers are required to participate. Only employers who do not sponsor a retirement plan and have one or more California employees must join CalSavers. Fines: $250 per eligible employee Illinois Plan Name: Illinois Secure Choice Status: Mandate in place Deadlines: Deadline passed for 5+ employees Details: Not all employers are eligible. Only private-sector employers who do not offer a qualified retirement plan, had at least five employees in every quarter of the previous calendar year, and have been in business for at least two years must facilitate Illinois Secure Choice. Fines: $250 per employee for the first calendar year the employer is non-compliant Oregon Plan Name: OregonSaves Status: Mandate in place Deadlines: Deadline passed for 1+ employees Details: All Oregon employers are required by law to facilitate OregonSaves if they don’t offer a retirement plan for their employees. Fines: $100 per affected employee, with a $5,000 maximum fine per year Connecticut Plan Name: MyCTSavings Status: Mandate in place Deadlines: Deadline passed for 5+ employees Details: Eligible Connecticut businesses are required to facilitate MyCTSavings if they don’t offer a retirement plan and have 5 or more employees. Fines: Penalties may be imposed. Bill is currently in the legislature. Colorado Plan Name: Colorado SecureSavings Program Status: Mandate in place Deadlines: Deadline passed for 5+ employees Details: All Colorado employers who have been in business for at least 2 years, have 5 or more employees, and don’t offer a qualified retirement plan for their employees are required by law to facilitate Colorado SecureSavings. Fines: $100 per affected employee with $5,000 maximum fine per year Maine Plan Name: Maine Retirement Savings Program Status: Mandate in place Deadlines: Deadline passed for 5+ employees Details: Every Maine employer with 5 or more employees will need to facilitate the program if they don’t already offer their own qualified retirement savings plan. Fines: Penalties for failing to enroll employees go into effect on July 1, 2025, as follows: $20 per employee from July 1, 2025, to July 30, 2026 $50 per employee from July 1, 2026, to July 30, 2027 $100 per employee on or after July 1, 2027 Virginia Plan Name: RetirePath Status: Mandate in place Deadlines: Deadline passed for 25+ employees Details: State law requires Virginia employers with 25 or more eligible employees who have operated for 2 or more years and not offered a qualified, employer-sponsored retirement plan must now register and facilitate RetirePath. Fines: $200 per eligible employee New Jersey Plan Name: RetireReady NJ Status: Mandate in place Deadlines: Deadline passed for 40+ employees; November 15, 24 for 25+ employees Details: Every New Jersey employer with 25 or more employees will need to register with the program if they don't already offer their own qualified retirement savings plan. Fines: Businesses that don’t follow state-mandated retirement legislation within one year will receive a written warning. Each following year of non-compliance will result in fines of: 2nd year: $100 per employee 3rd and 4th years: $250 per employee 5th year and beyond: $500 per employee Delaware Plan Name: Delaware EARNS Status: Mandate in place Deadlines: October 15, 2024 for 5+ employees Details: Every Delaware employer with five or more employees will need to facilitate the program if they don’t already offer their own tax-qualified retirement plan. Fines: $250 per affected employee, with $5,000 maximum fine per year Maryland Plan Name: Maryland Saves Status: Mandate in place Deadlines: December 31, 2024 for 1+ employees Details: Businesses are required to register if they have been in operation for at least 2 calendar years, have at least one employee over the age of 18, and use an automated payroll system. Fines: Maryland does not impose a penalty, instead, they use an incentive, offering businesses that enroll $300 per year, waiving the annual filing fee for Maryland businesses. Vermont Plan Name: Vermont Saves Status: Mandatory for Vermont employers with 5+ employees who do not offer a qualified retirement plan. Deadlines: March 1, 2025 for 5+ employees Details: Employees are automatically enrolled in a Roth IRA with a default contribution rate of 5% that increases by 1% annually up to 8%, unless they opt out or select a different rate. Employers are not required to contribute but must facilitate payroll deductions. The program is free for employers and integrates with existing payroll systems. Fines: $10 per employee before October 1, 2025, then $20 per employee until September 30, 2026. After October 1, 2026 employers could pay up to $75 per employee. New York Plan Name: New York State Secure Choice Savings Program Status: Mandatory for eligible employers to offer a retirement plan or enroll workers in the state’s Secure Choice program. Deadlines: Employers with 30 employees must enroll by March 18, 2026 Employers with 15-29 employees must enroll by May 15, 2026 Employers with 10-14 employees must enroll by July 15, 2026 Details: If you’re an employer in New York, state laws require you to offer the Secure Choice Savings Program if you have had 10+ employees during the entire prior calendar year, have been in business for at least two years, and have not offered a qualified retirement plan during the prior two years. Fines: Information not available at this time. Rhode Island Plan Name: RISavers Status: Mandatory for employers with 5+ employees who do not offer a qualified retirement plan. Deadlines: Implementation in progress Details: Private-sector employers with five or more employees will be required to offer a qualified retirement plan or opt into the state-run program. Fines: Information not available at this time. In-progress state mandate programs Nevada Plan Name: Nevada Employee Savings Trust Status: Will be mandatory Deadlines: July 1, 2025 for 1,000+ employees; January 1, 2026 for 500-999 employees; July 1, 2026 for 100-499 employees; Jan 1, 2027 for <100 employees Details: In 2023, the Nevada legislature passed SB305 which mandates the establishment of a retirement savings program for private sector employees. Fines: Information not available at this time. Massachusetts Plan Name: Massachusetts Defined Contribution CORE Plan Status: Nonprofit mandatory only Deadlines: Currently effective, but no deadline yet Details: Massachusetts nonprofit organizations with 20 employees or fewer may be eligible to adopt the CORE Plan. The CORE Plan is structured as a 401(k) Multiple Employer Plan (MEP). The MEP structure allows each adopting employer to join the CORE Plan under one plan and trust by executing a Participation Agreement. Fines: Not applicable. Minnesota Plan Name: Minnesota Secure Choice Retirement Program Act Status: Will be mandatory Deadlines: Expected to launch by Jan 1, 2025 Details: On May 19, 2023, Governor Walz signed into law a bill establishing the Minnesota Secure Choice Retirement Program. Employers with 5 or more covered employees that do not sponsor a retirement plan for their employees are required to participate in the plan. Fines: Information not available at this time. Hawaii Plan Name: Hawaii Retirement Savings Program Status: Will be mandatory Deadlines: Implementation in progress Details: The Hawaii Retirement Savings Program is a state-facilitated payroll-deduction retirement savings plan where individuals can choose to opt into the program. Employers will be required to provide covered employees with written notice that they may opt into the program, withhold covered employees’ contribution amount from their salary or wages, and transmit covered employees’ payroll deduction contributions to the program. Fines: Information not available at this time. Washington Plan Name: Washington Saves Status: Will be mandatory Deadlines: Expected to launch Jan 1, 2027 Details: Employers must offer their employees access to a state-facilitated IRA if they don’t offer a retirement savings plan. Employees would be enrolled automatically unless they opt out. The program is slated to launch in 2027 and Washington will continue to offer its small-business retirement marketplace in the meantime. Fines: Penalties beginning after January 1, 2030. New Mexico Plan Name: New Mexico Work and Save IRA Status: Voluntary Deadlines: 7/1/24 deadline, but still voluntary Details: Work and Save is a voluntary savings program for private-sector and nonprofit employers and employees and the self-employed facilitated through a Roth Individual Retirement Account. Fines: Not applicable. Missouri Plan Name: Missouri Show-Me MyRetirement Savings Plan Status: Voluntary Deadlines: Expected to launch September 1, 2025 Details: Missouri introduced HB 1732 in 2022, which would create a voluntary MEP for small employers with 50 or fewer employees. Fines: Not applicable. Pennsylvania Plan Name: Keystone Saves Status: Will be mandatory Deadlines: To be determined pending bill passage by Pennsylvania State Senate Details: Employers will be required to offer a state-sponsored IRA or other qualified retirement plan. Employers do not have to participate if they have an established retirement program, have fewer than five employees, or have been in business less than 15 months. Fines: According to the current bill, covered employers shall not be subject to a penalty for not participating in the program. Georgia Plan Name: Peach State Saves Status: Voluntary Deadlines: To be determined pending bill passage Details: In February 2025, Georgia introduced SB 226, requiring businesses with 5+ employees and over one year in operation to offer a state-sponsored IRA or another retirement plan unless they already have one.The default payroll deduction is a Roth IRA with a 5% contribution rate. The state may add a traditional IRA option and adjust the contribution rate, increasing it annually by up to 1% (maximum 10%). Fines: Not applicable. States with legislation being considered The following states have legislation currently being considered for state-mandated reprograms: Alaska, Arizona, Arkansas, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nebraska, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, West Virginia, Wisconsin, Wyoming Unknown state mandate programs The following states have not yet made clear if they intend to mandate a state retirement program. We will actively update this article as legislation changes. Alabama Florida South Dakota What do state-mandated plans mean for your business? Now is the time to plan ahead if you do not offer a retirement plan for your employees, especially if you operate in a state with an upcoming mandate deadline. In most cases, you’ll have one of two options: Implement your state’s plan: You’ll need to follow your state’s procedures for enrolling and offering a retirement plan, usually an IRA, to your employees. Implement a 401(k) plan: A second option is to skip the state plan, and instead, offer a 401(k) plan from a private provider like Betterment at Work. The benefits of offering a 401(k) Offering a 401(k) has become a tablestakes benefit as employers attempt to attract and retain talent in today’s competitive environment. State mandated plans are designed by the government to address a lack of savings among employees. The purpose is admirable, but state mandated plans may lack some of the benefits of a modern, 401(k) plan, which include: Higher contributions limits to help people save more. A wider range of investment options depending on the number of funds available. The option to provide an employer matching contribution. (Did you know? A 401(k) employer match is the #2 most desired benefit among employees. Learn more.) Learn how to offer a modern 401(k) today At Betterment, we make it easy for small and mid-market businesses to provide a scalable retirement plan. With a Betterment 401(k), you get: Simplified administration, payroll integrations, fiduciary support, and compliance testing Customizable plan features and optional employee benefits Service and support at every step Learn more -

![]()

Is it time to unplug from your PEO?

Is it time to unplug from your PEO? May 22, 2025 9:00:00 AM Thinking about leaving your PEO’s 401(k)? Learn when to opt out, how to switch, and why a standalone plan may better fit your growing business. Overseeing employee benefits can be a lot to manage—especially with a business to run. That’s why many growing businesses outsource to a Professional Employer Organization (PEO) — streamlined benefits, simplified payroll, and less administrative overhead. But as your business grows, so do your needs—and what once felt like flexibility might now feel more like a constraint. If your benefits options feel limited, costs are hard to decipher, or you’re craving more control over your retirement plan and broader HR strategy, you might be ready to explore other options for your business. Below, we’ll dig into how PEOs work—and why you don’t have to sacrifice flexibility when it comes to your company’s retirement plan. What is a PEO? A PEO is a third-party organization that enters into a co-employment relationship with your business, in which the PEO will: administer payroll and taxes offer benefits like health insurance, 401(k) plans, and more manage HR compliance and risk mitigation For small and medium-sized businesses, this can be a game-changer—helping employers provide benefits without having to build out a full HR team, which takes time and money. How does a PEO 401(k) work? In general, PEOs offer access to a Multiple Employer Plan (MEP) or a Pooled Employer Plan (PEP). These structures group multiple businesses into a single retirement plan. By joining forces, small businesses may be able to access better pricing—and outsource plan administration. However, MEPs and PEPs may involve certain trade-offs—such as a limited investment menu, plan design restrictions, and less transparency into fees—since decisions are made at the pooled level. Employers who oversee their own 401(k) plan retain full control over investment selection, plan features, service providers, and participant support—allowing for a more tailored and strategic approach. If you’d like to learn more MEPs and PEPs, check out our in-depth guide. Can you pick your own 401(k) provider if you’re using a PEO? In short: yes. While PEOs often offer a default retirement plan, you can choose to set up and sponsor your own 401(k)—even if you continue using the PEO for other services like payroll, benefits, and HR support. This is called an “opt-out 401(k)" or a "standalone 401(k)." You’re still using the PEO for everything else, but your retirement plan stands on its own. Keep in mind that as a 401(k) plan sponsor, you would take on additional responsibilities, such as overseeing plan compliance and filing Form 5500. However, many modern 401(k) providers can handle much of the heavy lifting for you. Why businesses choose to go independent Companies often choose to set up their own 401(k) outside of a PEO for a few key reasons: More flexibility. You can design a plan tailored to your employees’ needs, with features like Roth contributions, automatic enrollment, or customized vesting schedules. Greater investment choice. You often have more options—and lower-cost options— when it comes to the fund lineup. Better fee transparency. Standalone plans typically provide clearer visibility into fees and plan costs. Greater employee engagement. Modern providers tend to offer more intuitive, digital experiences, better education tools, and more personalized retirement advice for employees. Ultimately, it’s about choosing a 401(k) that’s truly aligned with your team—and your business goals. Thinking about opting out of your PEO’s 401(k)? If you’re currently with a PEO but wondering if your retirement plan could be doing more for your employees, it may be time to explore a new 401(k) option. The good news: transitioning doesn’t have to be complicated—with the right support. Betterment at Work can help you design a flexible, easy-to-manage 401(k) plan that’s tailored to your business.