Betterment at Work simplifies data sharing so we can handle the heavy lifting.

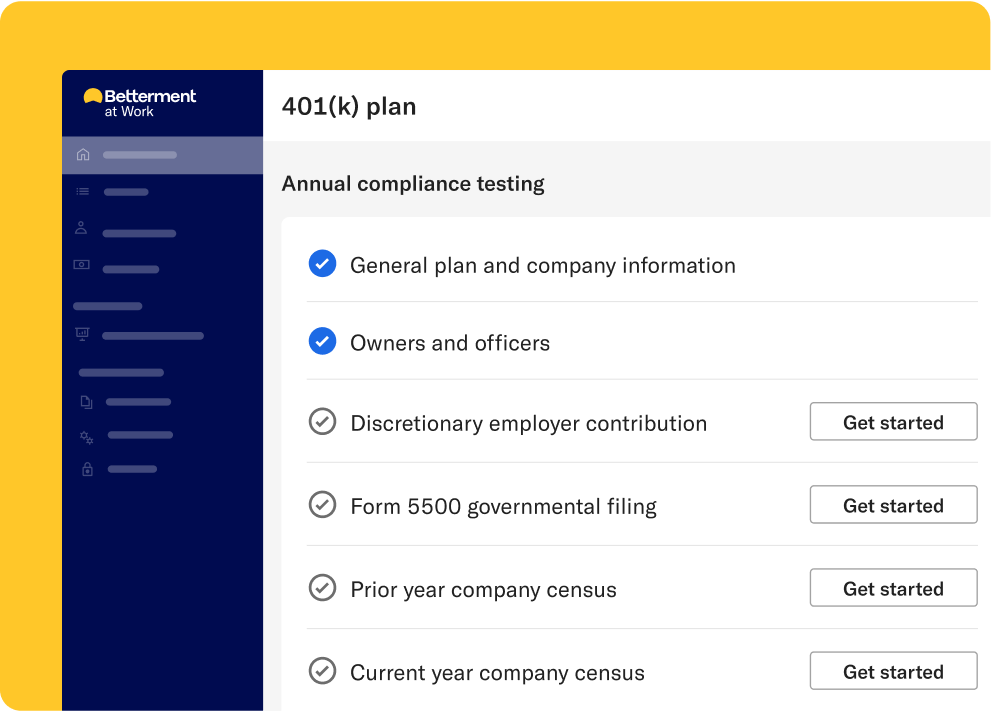

Our custom-made compliance hub puts everything you need in one convenient place. Review and upload your information and we'll take care of reviewing, testing, and reporting on your 401(k) plan.

We’re your partners in compliance.

No more stressing over deadlines or handling reporting by yourself. We take care of your annual testing, daily monitoring, and complicated paperwork to confirm your 401(k) plan is compliant and up-to-date.

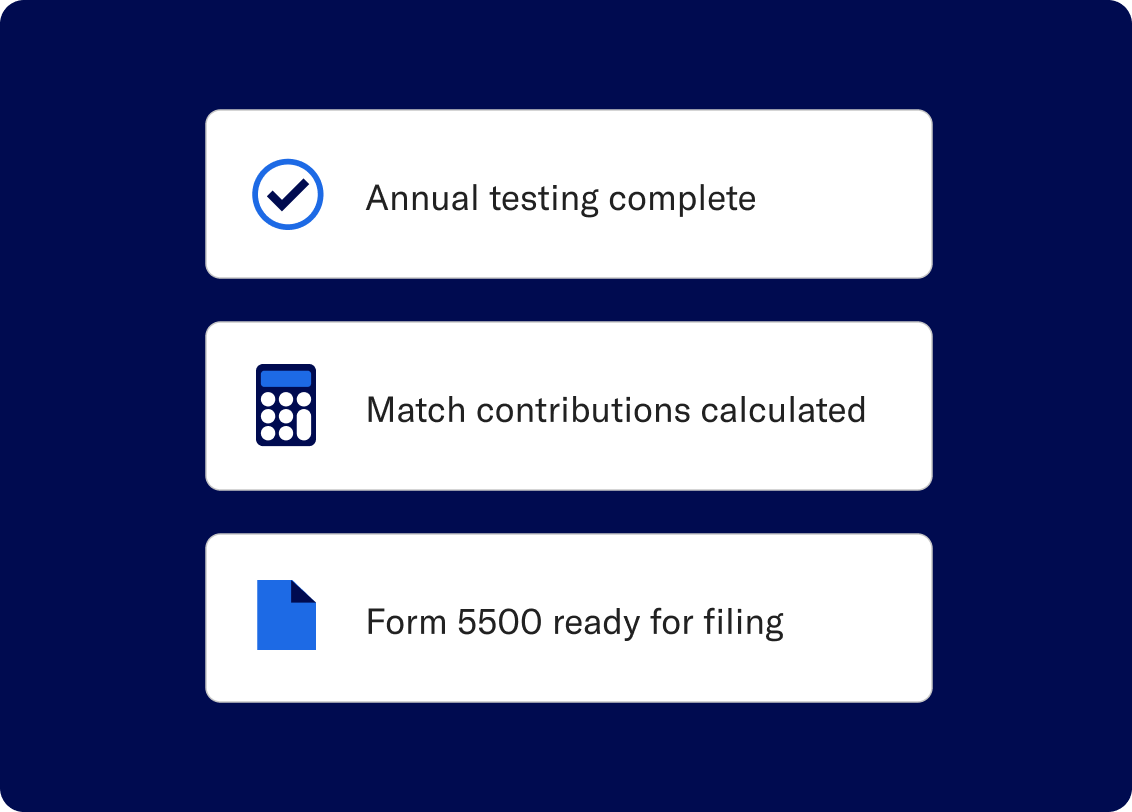

- Conduct required yearly testing, including 410(b), ADP/ACP, deferral limit, plan limit, and top-heavy determination

- Help with fiduciary responsibilities, which can include 3(16) and 3(38)

- Calculate employer contributions, including profit sharing, match, and complex strategies like new comparability

- Prepare Form 5500 for your filing purposes. For more questions check out our Form 5500 mythbuster

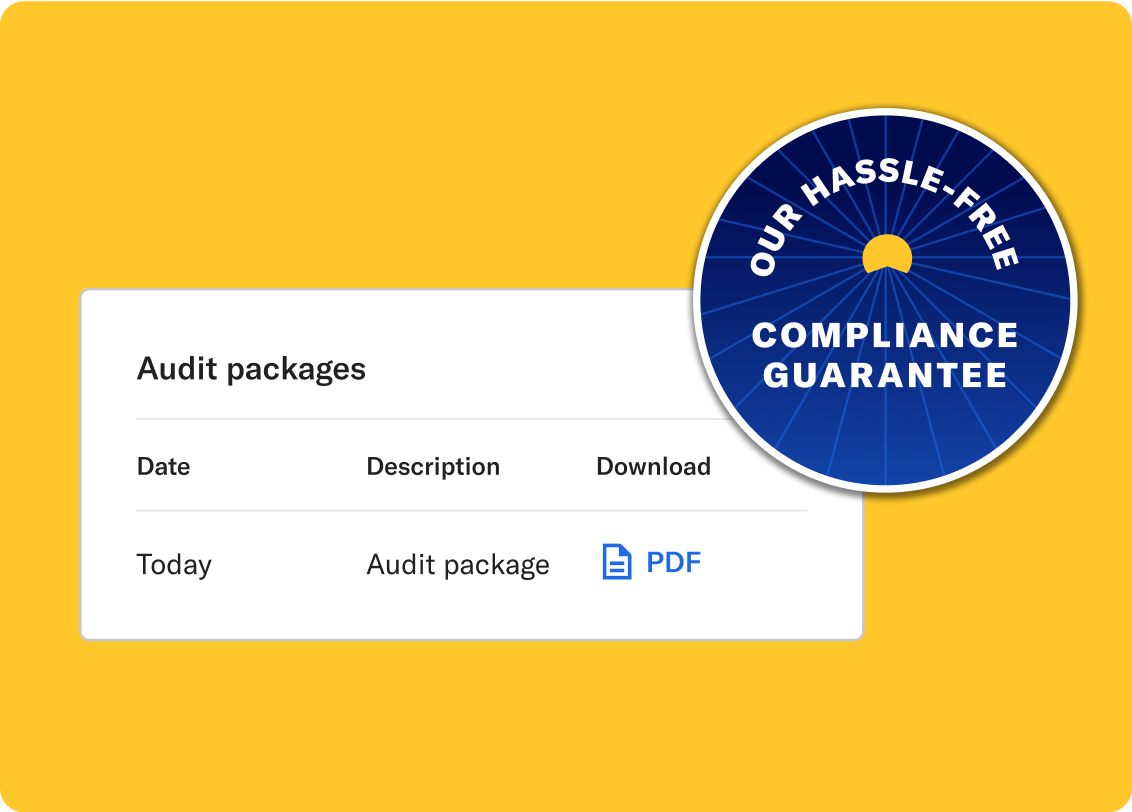

Our Hassle-Free

Compliance Guarantee.

Recordkeepers promise to be your partner in compliance, but we go one step further—we guarantee it.

We guarantee that your prepared prior-year audit package will be delivered by May 31. If you are still waiting to receive it in time to file Form 5500, we'll refund you up to $1,000 off your annual base fee. See terms and eligibility

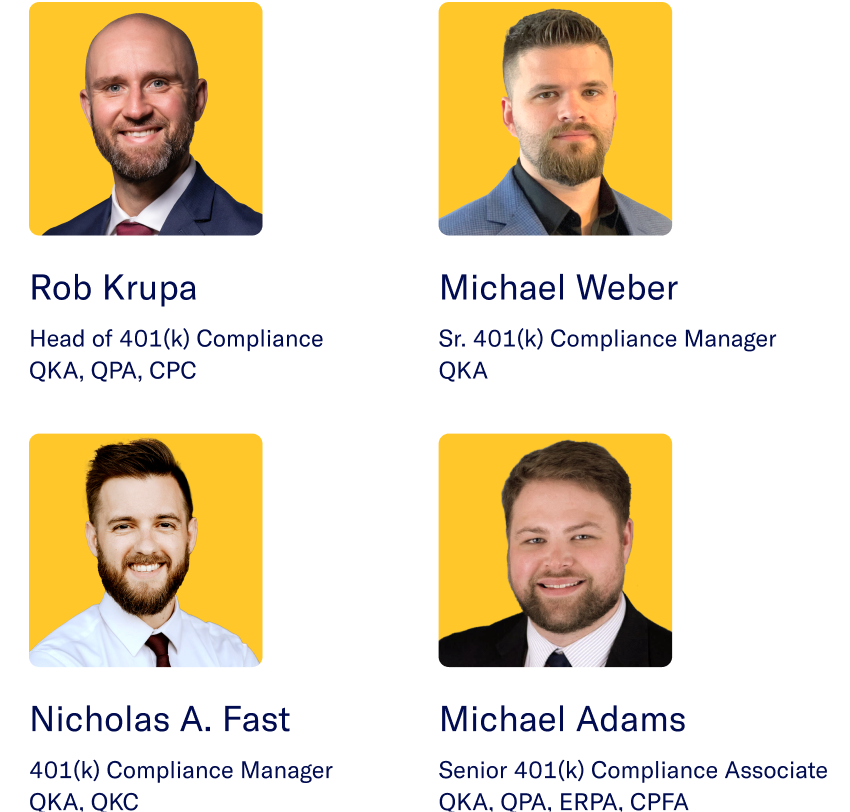

Expert support when you need it.

Managing compliance can feel overwhelming, with rules and regulations always changing. Our team of experts acts as an extension of your business, working with you through the entire compliance process from start to finish.

- 60+ years of combined ERISA compliance expertise

- ASPPA, NAPA, and IRS designations

We’re with you at every step.

-

Review your plan design.

Guide you in setting up your restated plan and confirm protected benefits are kept. -

Manage plan documents.

Draft plan document, make amendments, and support you with compliance and regulatory requirements. -

Map conversion data.

Match the conversion assets with data from the previous recordkeeper and set up all the details in our platform. -

Advise on mergers and acquisitions.

Offer guidance on how business transactions can impact your 401(k) plan and help you navigate any changes. -

Administrative troubleshooting.

Address any corrective actions necessary to keep your plan compliant and operating correctly. -

Advise on government legislation.

Help you understand and utilize new legislation like SECURE 2.0 Act to offer a better 401(k) plan for your workforce. Learn more

Still have questions?

We have answers.

-

Article

ArticleWhat to know about compliance testing.

These yearly required tests are meant to ensure everyone is benefiting from your 401(k) plan.

Learn more -

Article

ArticleDesigning a plan to fit your needs.

401(k) plan design can help motivate even reluctant retirement savers to start investing for their future.

Learn more -

Article

ArticleSafe Harbor vs. traditional

401(k) plan.How to weight the pros and cons of each plan before making a decision.

Learn more