Customer story

A decade of trust: InstantCard’s 401(k) story

Quick Facts

InstantCard creates ID badges for companies of all sizes, using a cloud-based ID badge printing system that allows for single-card-orders, sameday shipping, and easy import of employee data.

Industry: Tech, Manufacturing

Headquarters: Rockville, Maryland

Pain points

-

Poor user experience

As an entrepreneur and early tech adopter, it was important to David to offer himself and his employees a 401(k) platform with a modern user experience. -

Complicated investment options

David wanted to offer sophisticated, but understandable and curated investment options to employees to make saving for their 401(k) feel accessible. -

Cumbersome setup process

Other 401(k) providers required David to set up and administer his plan through various calls and emails. David sought a more self-guided option.

Challenge

After decades working professionally in the telecommunications industry in Europe, Stanford graduate and tech evangelist David Finkelstein set out on a new venture. His company, InstantCard, which provides a cloud-based ID printing system for companies of all sizes, started to take off and offering his employees a benefits package became a priority.

It was 2016, and knowing that automated investing had become a major disruptor in the retail investing space, David wanted to find a 401(k) provider that offered similar technology. Not only did he like how approachable companies like Betterment were making retail investing, but he also appreciated the quality of the user experience, which he believed would benefit his employees.

He interviewed a few “robo-advisors” about their 401(k) capabilities and found Betterment at Work. At the time, our solution was newly launched, and David, an eager early adopter of new technologies, signed up InstantCard as a beta tester.

Solution

David set up the company’s first 401(k) plan with Betterment at Work. While he believed in the experience that Betterment offered, he also knew that he was taking a leap of faith with a new product.

“Betterment was open with me, saying ‘we’re just getting this going.’ But that was fine—I'm an entrepreneur too, and I liked the new model for the 401(k), both for the employer and for the employee.” This allowed for David and Betterment at Work to kick off an almost 10 year long partnership that's still thriving today! When asked about the benefits he’s found along the way, David highlighted the following.

User Friendly Experience

David felt it was important to provide employees, who may be less experienced investors, with a way to get started with their retirement savings. But for him as an employer, there were also benefits to his early experiences with Betterment.

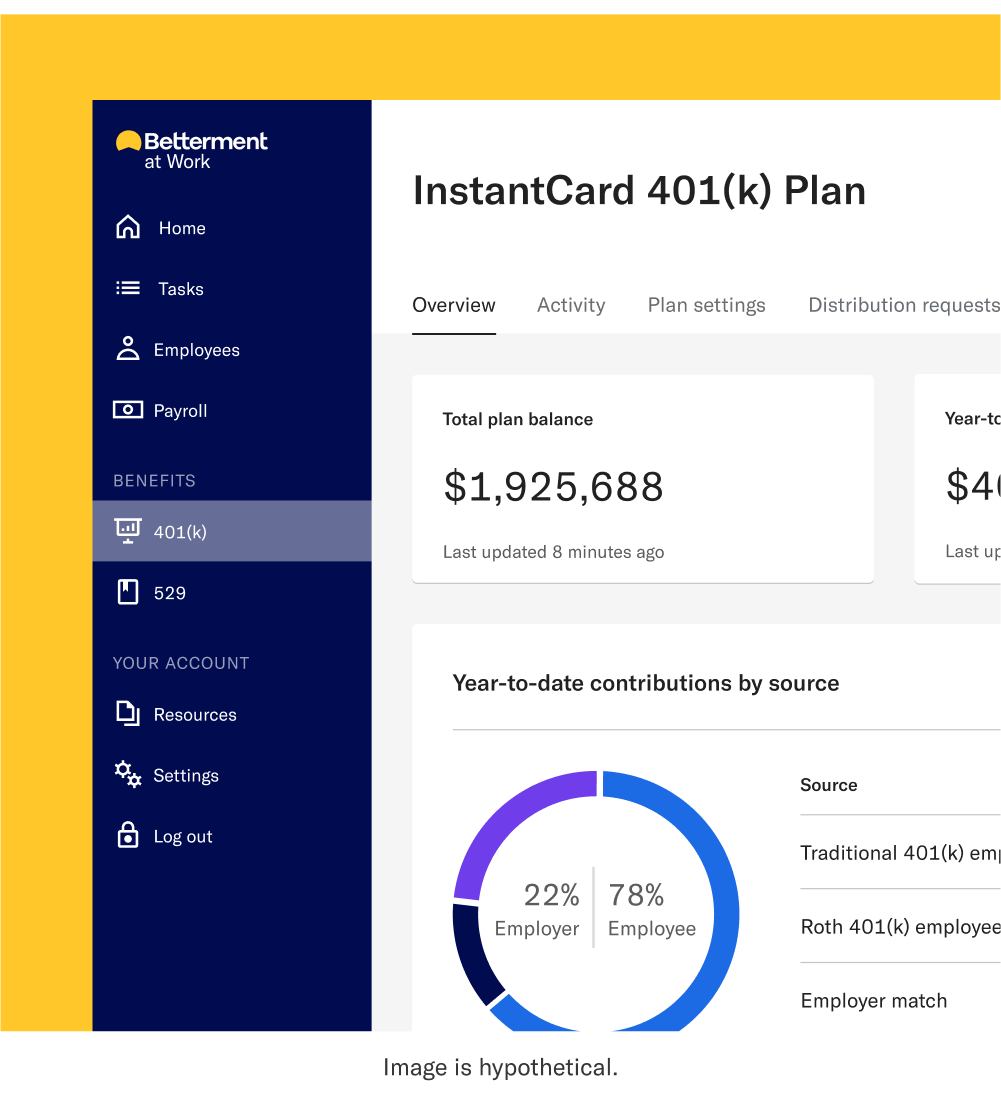

“It was structured so that the portal and the interface works for everyone. Even though I'm a fairly experienced investor, I know that some employees are not, and having something which is just set and forget is a great way to accumulate retirement funds. Plus, for me as an employer, we achieved this without a whole lot of fee structure, or people you have to talk to.”

With Betterment at Work, he was able to provide a 401(k) benefit that was accessible and easy-to-use for his employees, some of whom were working in the office every day, but others who were distributed and needed to be enabled to set up their 401(k) with less inperson support. This helped take the burden off of him as a new plan sponsor.

“I like the usability, and the fact that somebody can go in and look at their portfolio, drill down, see performance, reallocate in their portfolio, their risk profile and composition of the portfolio, and so forth. I can compare it with other financial investment tools that I use, and it's very nice. I really like your web design, your user interface. The UX is good.”

Trustworthy, professional tooling

From the beginning, David was impressed with Betterment at Work’s tooling. Despite being a beta tester of the product, he felt secure in his selection and had few challenges—even in the early days. He commented that at its core, the product has stayed consistent, in a positive way.

“Betterment wasn't an early-stage startup, but the 401(k) was new. It was always quite professional and I can't say that something has changed fundamentally since that time.”

And while David was a seasoned professional, this was the first 401(k) he was managing himself as a plan sponsor.

“This is the first 401(k) plan that I'm managing and running. And while, of course, I've had other 401(k) experiences [as a participant], they were more than 10 years ago. Hearkening back to previous experiences, they were run just completely differently and much less efficiently, of course.”

A long-term partner

Nearing ten years of partnership, InstantCard has grown its employee base, and Betterment at Work has grown with them. David acknowledged that he’s not felt a need to consider finding a new provider. When asked if he’s considered changing 401(k) recordkeepers, David said that there hasn’t been a reason to.

“No, to be honest, I haven't because I'm satisfied with the service and switching costs are high.”

Reflecting on the time working together, David said it has flown by. While there are notes of feedback he’s shared as a loyal client, overall he’s just as satisfied as he was on day one. “You guys got a good design from the beginning and it works.” Plus, as he puts together a succession plan for the business, he feels confident in handing over 401(k) management to his son, thanks to the simplicity that comes with managing our solution.

“A year ago, I handed over payroll to him. I travel a fair amount and I just didn't like the pressure at the end of every month having to make payroll. So now he's the one that actually manages that and with payroll went the 401(k).”

And a great retirement benefit was at the top of the list. It was both a market standard benefit that helped them compete for talent, but also an important benefit to provide for their employees’ overall well-being. Not only was their 401(k) benefit well-received, but response to Betterment at Work was positive across the board.

"I was impressed from the beginning that Betterment at Work didn't seem like it was a startup."

CEO and Founder at InstantCard

Impact

-

Employee experience

InstantCard found a solution with Betterment at Work that was easy to use for their employees, many of whom were not experienced investors. -

Cutting-edge, but professional

With Betterment at Work, InstantCard can align with its tech-forward values, but also feel like they are in good hands with a polished product. -

Reliability

As their first 401(k) plan, and partner for nearly 10 years, InstantCard has felt that the Betterment at Work experience has been dependable and consistent.