Put investment expertise behind your 401(k)

Benefit from Betterment's investment track record to meet your needs and ambitions. We’re an RIA and a fiduciary, bringing decades of expertise to help you provide a better retirement for your employees.

-

1 Million+

Customers

-

$65 Billion+

Assets under management

Employees deserve expertise and choice for their retirement.

We understand you’re making an important decision for your employees and their financial futures. So we offer a range of investment options to help them build wealth the way they want.

-

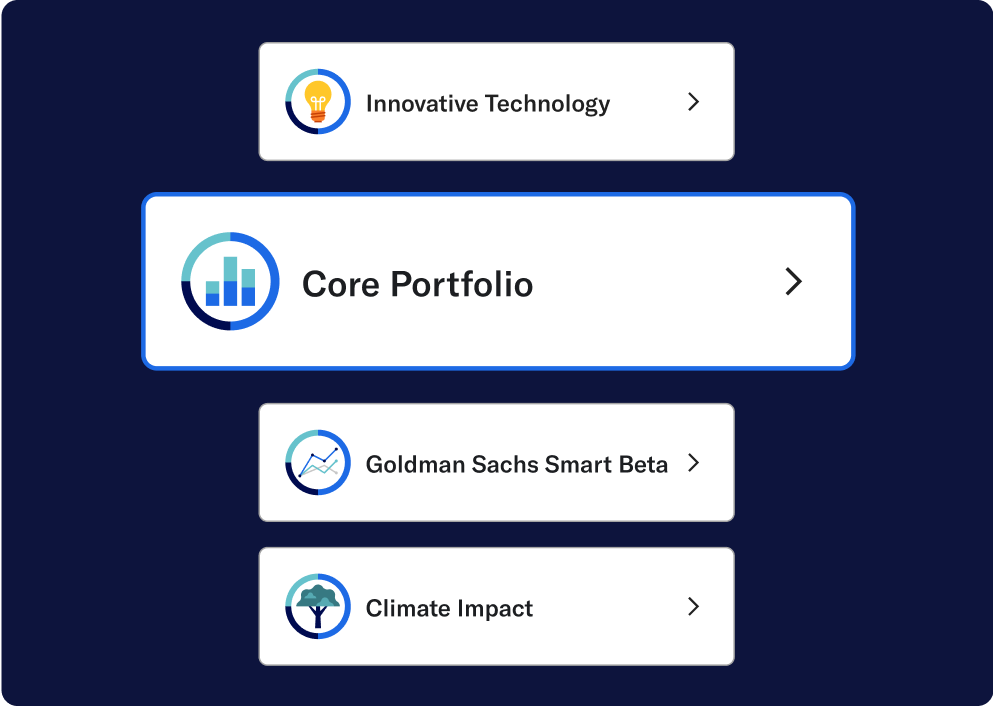

Managed portfolios

Globally diversified, exchange-traded fund (ETF) portfolios with personalized glide paths. Offers customization for employees who want to fine-tune their asset mix. Learn more

-

Mutual fund lineup

Curated, low-cost mutual fund lineup that includes target-date and asset-class funds from Vanguard, State Street, and more. See our mutual fund lineup

-

Advisor-enabled lineup

We partner with advisors to design and manage custom fund lineups tailored to client needs.

Our approach to investing.

It all starts with our team of investment experts with an average of over a decade of experience in the asset management industry. Meet the team.

-

A time-tested methodology

We blend traditional methodology and behavioral science to build globally diversified portfolios that offer a range of investment options for employees to choose from. -

Selecting the right assets

Our team chooses cost-efficient funds that aim to position your employees for long-term growth potential while managing risk.

-

Monitoring and adjusting investments

We actively manage and analyze investments, continuously reviewing holdings, performance, and risk to identify and implement improvements.

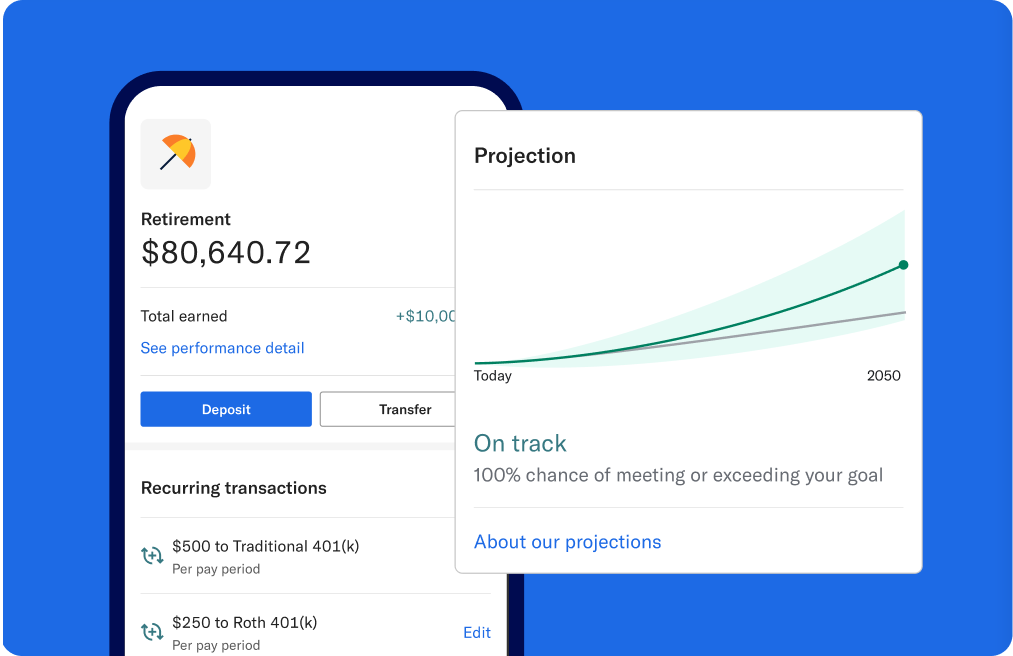

We deliver a more tailored glide path for retirement.

Betterment’s portfolios automatically adjust as employees approach retirement. Unlike traditional target-date funds, we customize the shift to each employee’s retirement age and adapt as their needs change.

-

Wealth creation

Employees with a longer time horizon can take on more risk, allowing for higher stock allocation to help build wealth while keeping enough bonds to cushion market downturns. -

Retirement transition

We gradually shift from growth-focused investments to those that generate income and protect capital.

-

Wealth preservation

Once the target retirement age is reached, the glide path continues into retirement. The portfolio gradually shifts more towards bonds and reduces stock exposure to manage risk. -

Decumulation

The portfolio shifts to its most conservative allocation, prioritizing income generation. We provide ongoing advice on a withdrawal rate to help savings last through retirement.

loading

Investing backed by technology to support your employees.

Risk management through rebalancing

We continually monitor and rebalance investments, keeping each employee aligned with their intended risk level.

Tax-efficient investing

Our portfolios feature tools like tax-loss harvesting and asset location, which help minimize employees’ taxes and maximize their returns.

Personalized retirement planning

Employees get in-app planning tools and tailored advice to help them determine how much and where to save for retirement.

Ongoing resources and support.

-

For plan sponsors

We offer quarterly investment webinars and engagement opportunities to update you on the market and our investment strategy. -

For employees

We offer a personalized retirement plan, recommending how much to save and which accounts to use. We also host webinars and provide educational resources on saving and investing. -

For advisors

If you work with a 401(k) advisor, we partner with them to provide you access to nearly 10,000 assets, as well as tools and resources specifically designed for them.

Meet the Betterment Investing Team.

Our expert team provides investment oversight to help you deliver a better retirement for your employees. As your 3(38) fiduciary, we’re legally bound to act in the best interest of your plan, your employees, and their beneficiaries.

-

Mychal Campos

Head of Investing

-

Mindy Yu, CIMA®

Sr. Director of Investing, Betterment at Work -

John Bentley

Director of Investing

-

Ben Bakkum, CFA, CFP®

Sr. Investment Strategist, Betterment at Work

-

Josh Shrair

Investment Strategist, Betterment at Work -

Jamie Lee

Director of Investing -

Josh Vieira

Lead Quantitative Researcher