Customer story

Invictus Capital Partners streamlines HR tech stack

Invictus developed siloed HR processes across its three entities and used eight separate software systems to manage its workforce. With Rippling and Betterment at Work, the company unified its people operations, saved money, and reclaimed benefits ownership.

.jpg?width=674&name=Stocksy_5898726%20(2).jpg)

Quick Facts

Invictus Capital Partners is a financial services company that specializes in asset management for real estate-backed loans and securities.

Industry: Finance

# of employees: 224

Pain points

-

Scattered systems

Invictus’ three distinct business entities accumulated an excess of software systems for different HR and payroll functions. -

Lackluster support

Invictus wanted better customer service than its prior PEO and 401(k) providers could offer which came with hefty price tags. -

Inaccessible data

The company found it cumbersome to access employee pay data and 401(k) contribution rates.

Challenge

Becki Wolfram joined Invictus Capital Partners as Chief HR Officer in 2019 to revamp the people function across all three of the company’s business entities. It became clear, in her early discovery, that Invictus relied on out-of-date technology and challenging-to-use HR systems. Invictus also used a scattered array of single-use solutions for payroll, 401(k) management, and other administrative HR functions.

Becki spent time interviewing finance and accounting team members, people managers, senior leadership, and individual employees. Teams wanted systems that automated previously challenging tasks and came with a user experience better aligned with its culture of self service.

Overall, Invictus sought to simplify its tech stack, provide a more engaging user experience, and access trustworthy customer support as needed.

Solution

With the goal of consolidating Invictus’ tech stack, Becki trialed alternative solutions before discovering Rippling ASO and its 401(k) integration with Betterment at Work.

“There's nothing that we lost since we made the transition to Betterment at Work and Rippling,” she said. “It’s all been gains.”

-

A unified platform...

Invictus ditched its cumbersome sprawl of single- use systems in favor of Rippling ASO, which now handles payroll, tax registration, and compliance support on the company’s behalf.

“In that one system, we manage all of our FSAs, COBRA, ACA, filing, and reporting,” Becki said “It feeds out to our performance management system and a number of other things that make our job a lot easier.”

And since Rippling ASO allows businesses to maintain ownership of their benefits programs, Invictus moved off its PEO and saved money—all while automating time-consuming busywork that once strained its back office. “[Rippling] took work off our plate, freeing up our capacity to do other things,” Becki said. “We've gone off a PEO and there's a net savings of time without having to add people. That's a big win.

-

with a powerful 401(k) integration

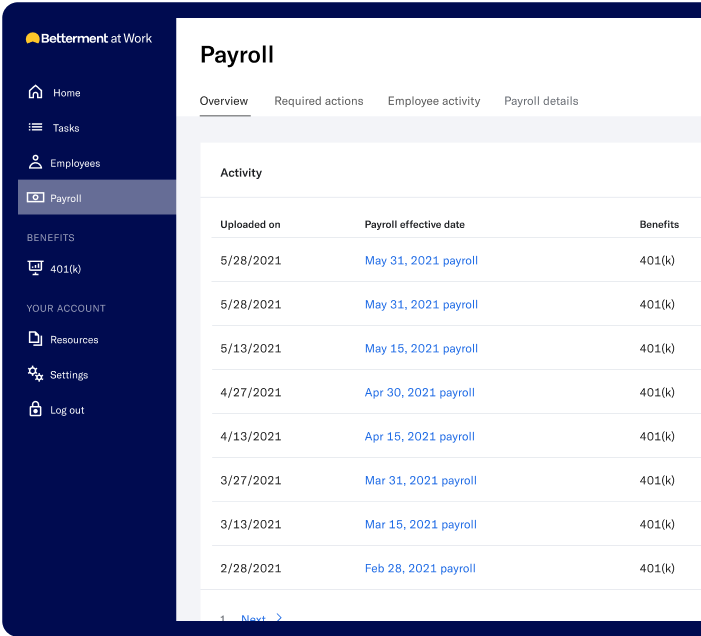

Invictus was also in search of a 401(k) solution, and chose Betterment at Work for its compliance support and friendly user experience. And with Betterment at Work’s 360 integration with Rippling, the company enhanced its ability to manage payroll alongside retirement contributions across all of the company’s business entities.

“Coming off so many systems, I couldn't imagine how we would have been successful without that Rippling Betterment partnership,” Becki said. “The two systems operate individually and together–all the pieces fit together.

-

Tireless, trustworthy customer support

Betterment at Work provided Invictus with white glove support that enhanced the employee experience and kept team members in the loop with their retirement contributions. “Employee response was overwhelmingly positive,” Becki said. “Betterment did a great job jumping on, doing training videos, and being accessible for employees. Every person that I've spoken to at Betterment has just been really sharp and knowledgeable and I think that's really important when you're talking about managing large sums of money.”

Becki also praised Rippling’s support infrastructure. “Rippling gave us a lot of materials to educate our employees and they continue to add to that library all the time. Plus, for new hires, their ability to set up and navigate is instant.”

-

Easy access to crucial data

While Invictus once found its 401(k) and payroll data difficult to access across its three distinct entities, Betterment at Work and Rippling unified the company’s operations. “We can view our entities separately or together as one and decide what makes sense. Now, we have that flexibility.”

The integration ensures Becki has all the employee information she needs to make accurate contributions and compliantly submit tax forms. “I filed our Form 5500 a couple of days ago and Betterment at Work made sure all the data I needed was delivered on time and it looked good,” she said. “And I didn't have to do anything other than review and sign. As the person who has to be responsible and sign on the line, I feel good knowing that it is managed by a company that's doing the work and paying attention.”

"I don't view Rippling or Betterment at Work as vendors. They are an extension of my HR team."

Chief HR Officer at Invictus Capital Partners

Impact

-

Consolidated systems

Invictus previously paid for eight separate HR solutions. Now it only has two handling all the same administrative functions with more automations. -

Cost savings

With Rippling and Betterment at Work, Invictus saved $55,000 in its first year. “The per participant savings is exponential as we grow,” Becki said. -

Full benefits ownership

Invictus moved off its pricey PEO and has autonomy to make benefits decisions that align with employee and company values.