Your future-proof 401(k)

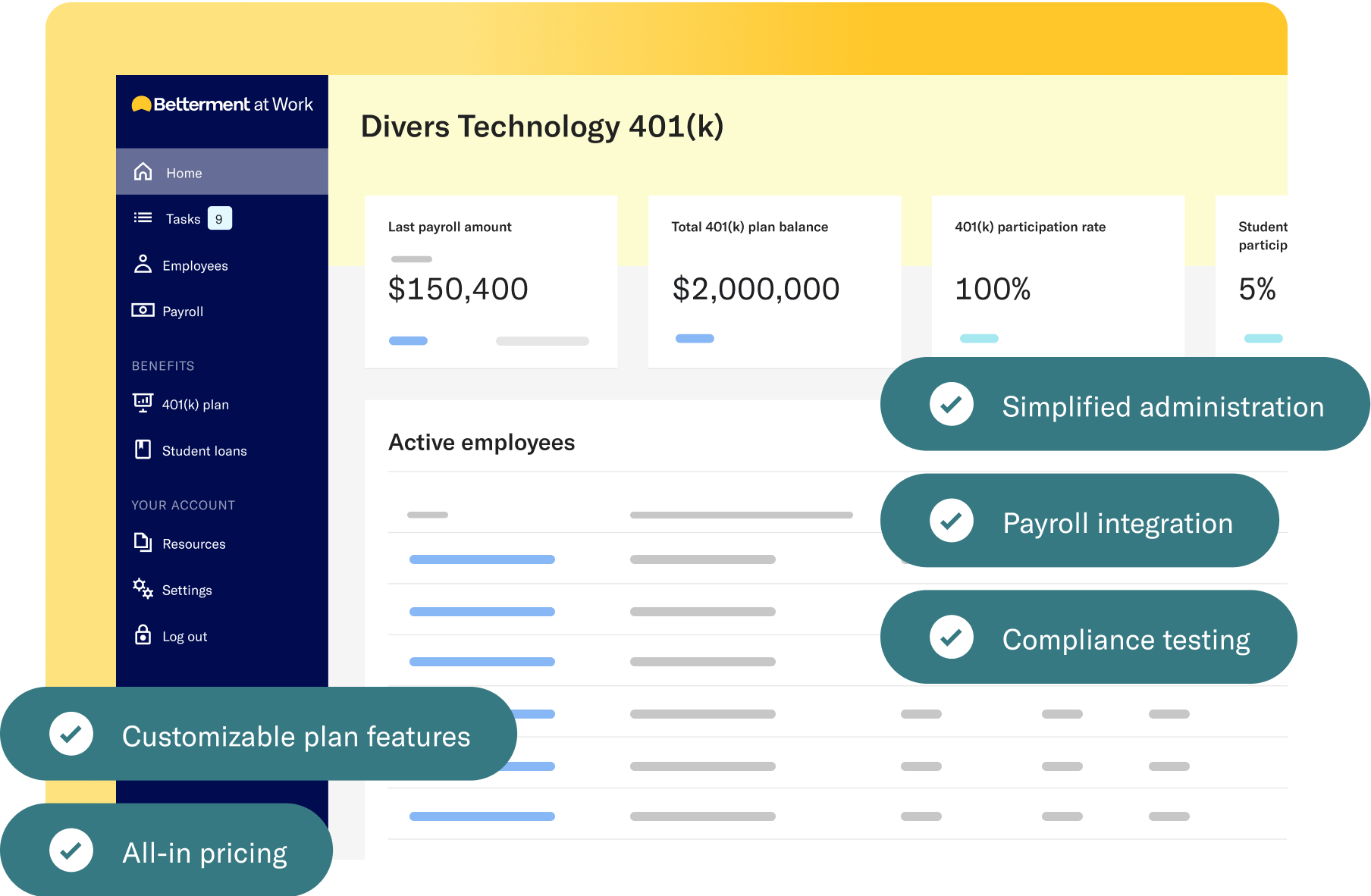

Betterment makes it easy for small and mid-market businesses to provide a scalable retirement plan. With a Betterment 401(k), you get:

- Simplified administration, payroll integration, fiduciary support, and compliance testing

- Customizable plan features and optional employee benefits

- Service and support at every step

- All-in pricing with no hidden fees

Powered by Betterment, the largest independent digital investment advisor.

The 401(k) built to keep up with your growth.

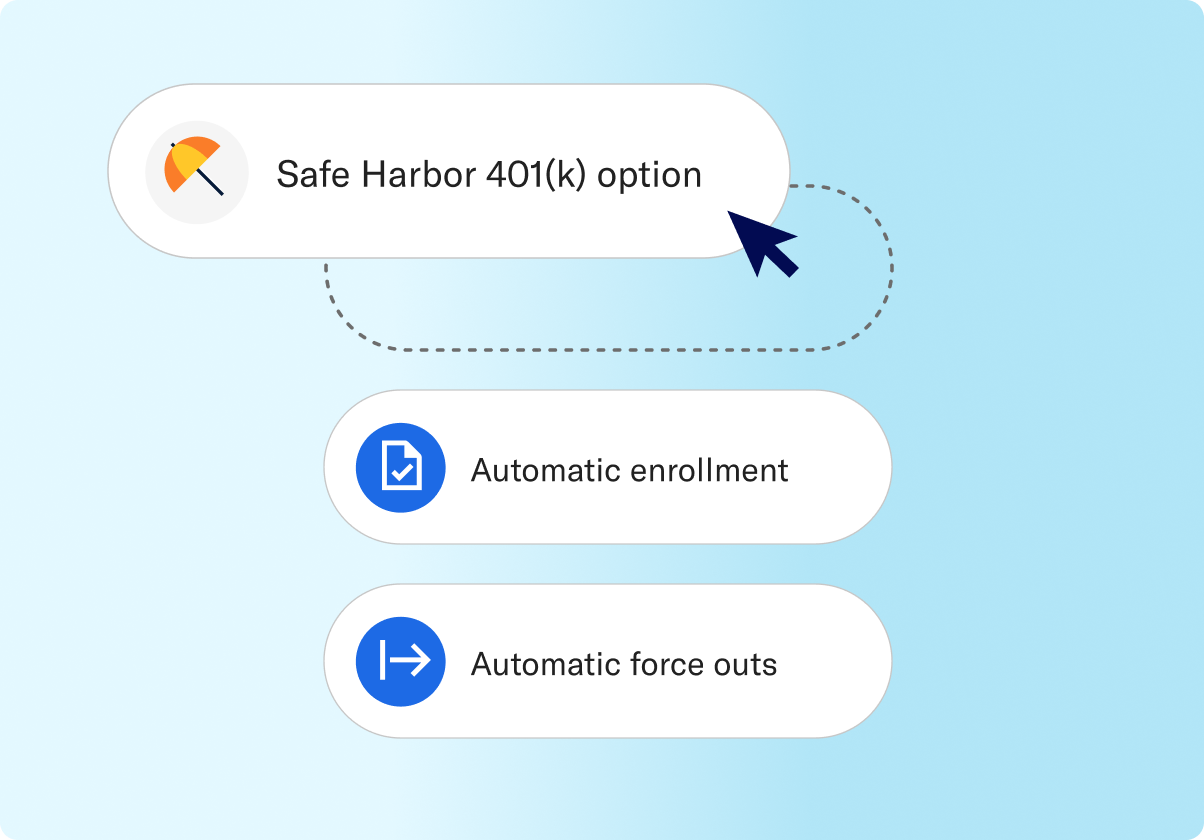

Customizable plan design to fit your needs.

Whether you're starting or leveling up your 401(k), our flexible plan features let you achieve your business goals while supporting your employees.

- Eligibility requirements

- Vesting schedule

- Profit-sharing

- Safe Harbor 401(k) option

- Automatic enrollment

- Automatic escalation

- Automatic force outs

- 401(k) match on student loan payments Learn more

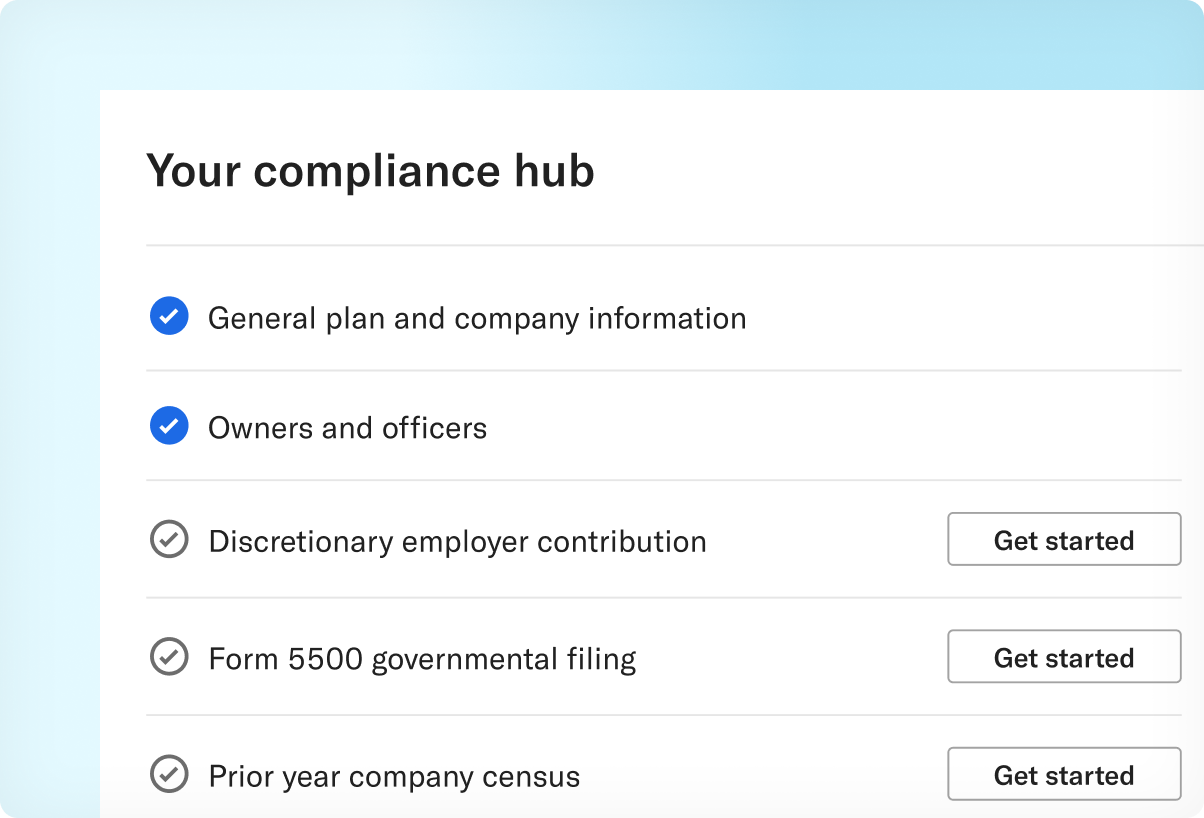

Administrative and compliance support at every step.

We handle regulatory filings and monitor your plan to help resolve any potential compliance issues.

- 3(16) and 3(38) fiduciary responsibility

- Prepare Form 5500 for compliance

- Service and live support for you and your employees

partners in compliance

The Hassle-Free Compliance Guarantee

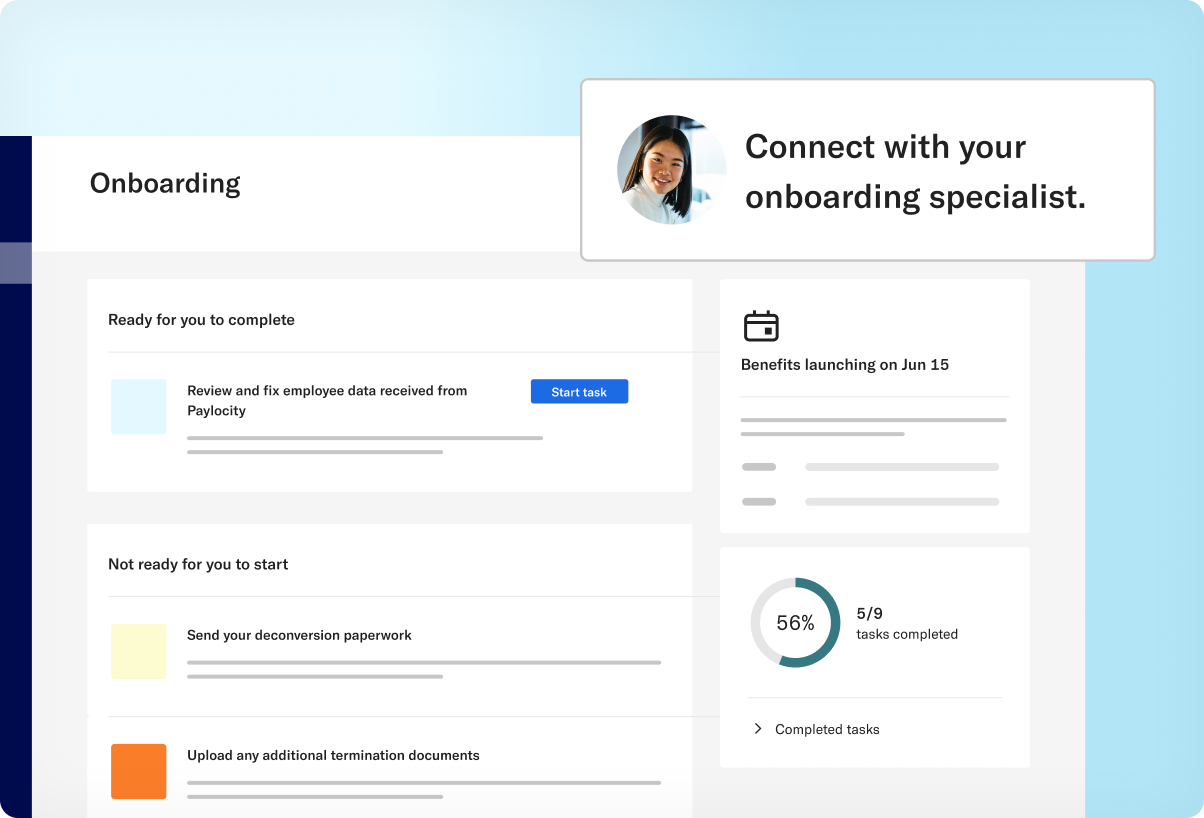

Dedicated onboarding support.

Set up your new or conversion plan with the help of an onboarding specialist.

-

15%

faster plan conversion onboarding with Betterment compared to the industry average.

Payroll integrations.

Betterment at Work was a no-brainer. Administratively, it’s incredibly user-friendly. New employees are able to set up their 401(k) immediately and it syncs with the payroll platform, saving us time.

An easy experience for you and your employees.

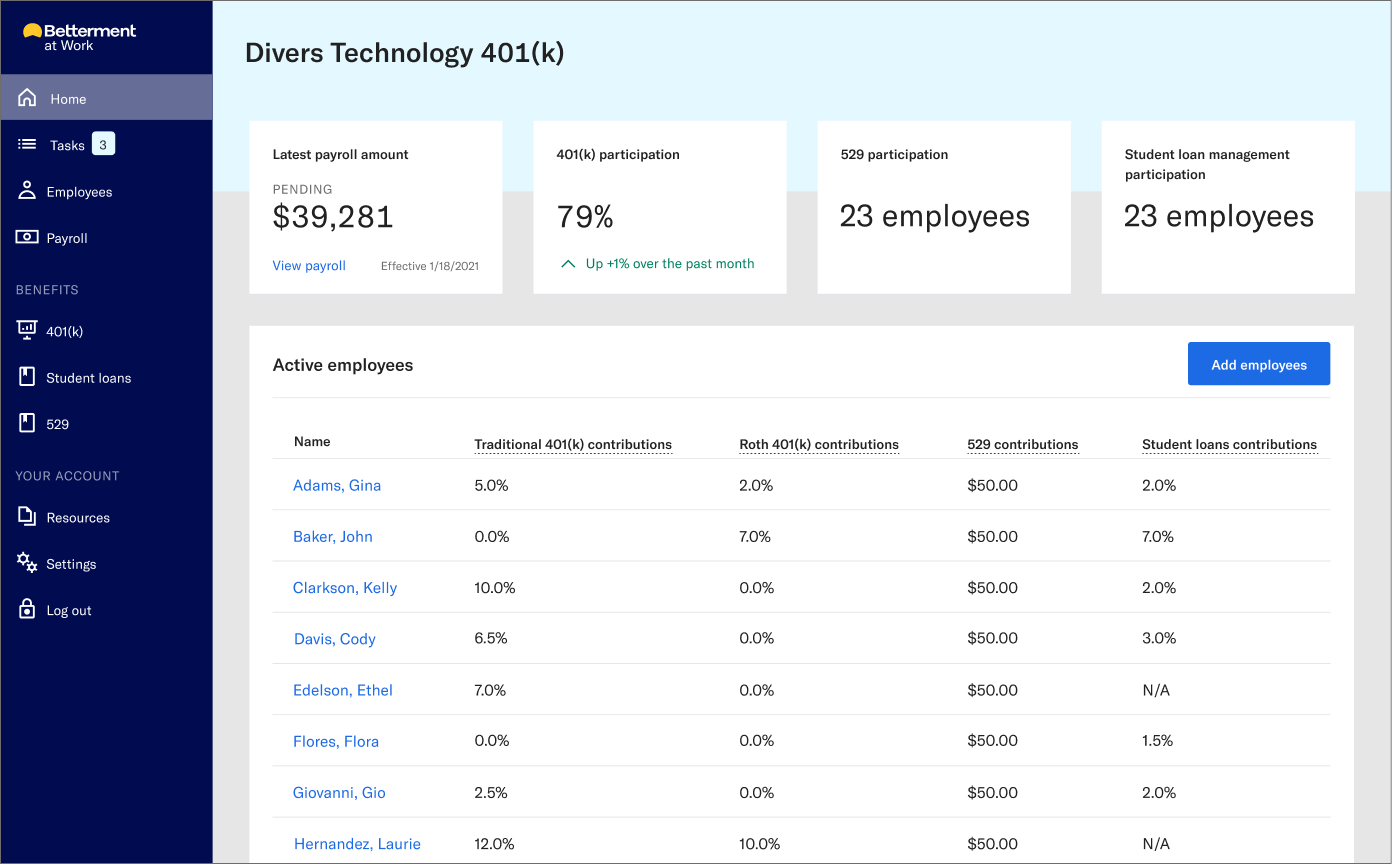

Seamlessly administer your 401(k) from an all-in-one dashboard.

- Real-time plan insights.

Track plan metrics, generate custom reports, and get participant-level data with just a few clicks. - Resources at your fingertips.

Access one-pagers, webinar registrations, articles, and videos for you and your employees. - Simplified compliance hub.

Actively monitor your plan’s compliance status and projected test results.

Engage and empower

your employees.

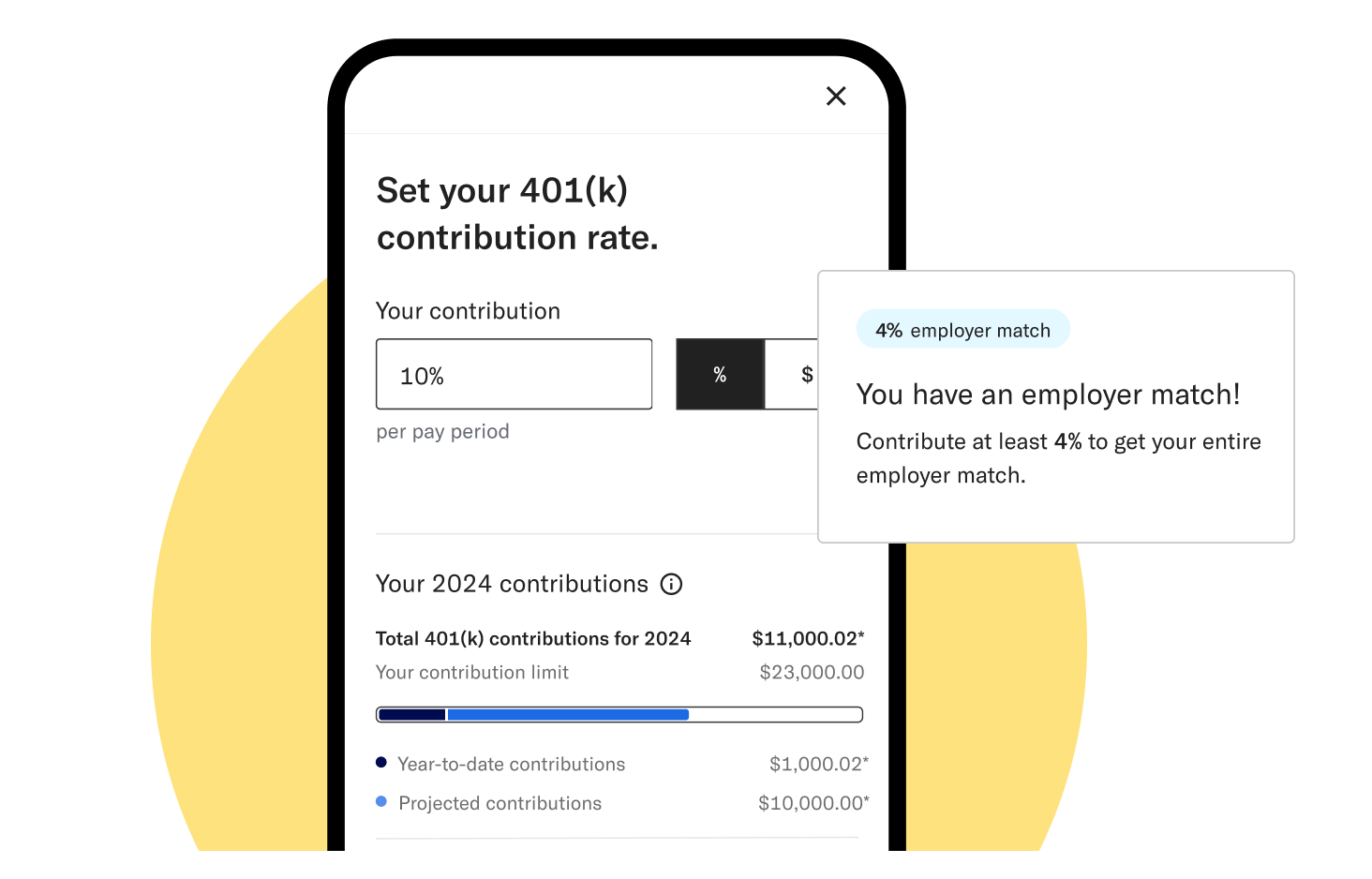

Get the technology and features to help employees achieve what they want with their money.

- Delightful and highly-rated app

- Access to tax-advantaged IRAs

- Support and educational resources

4.7 rating

60,500§ reviews

See full disclosures for award details.

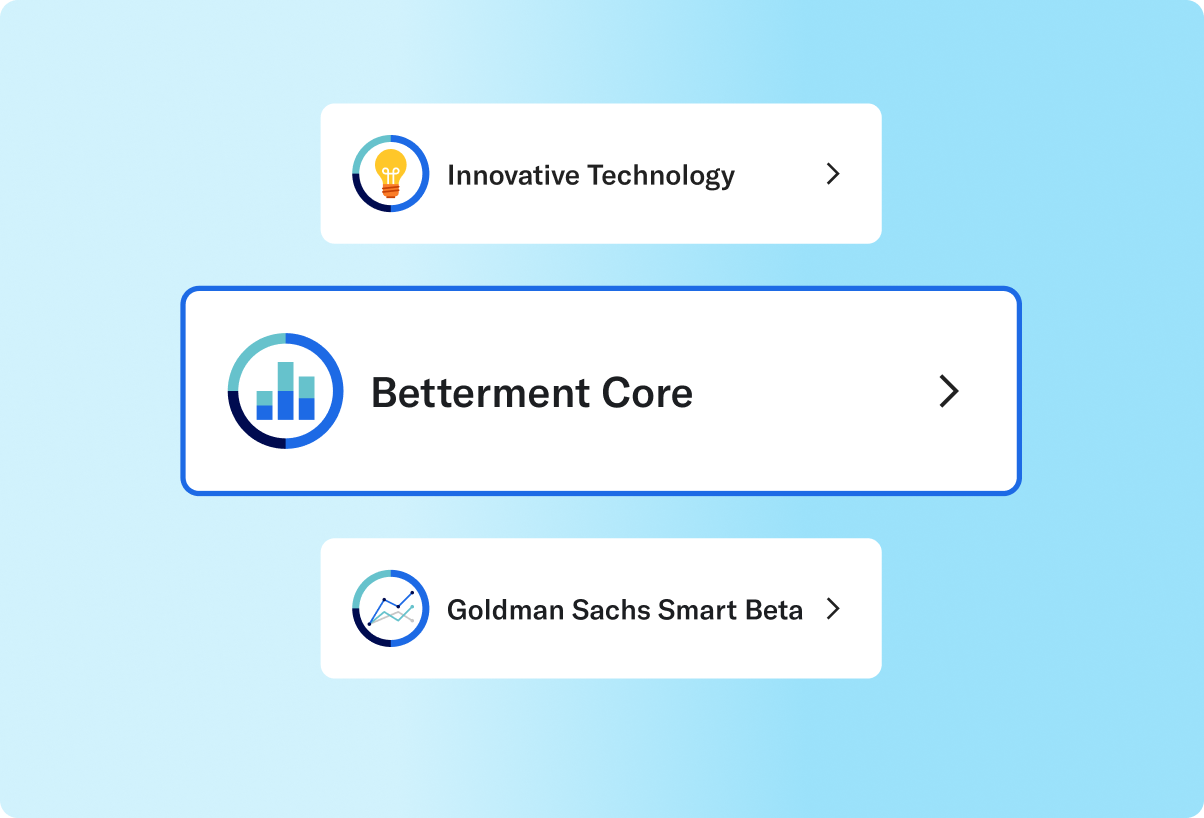

Curated, expert-built portfolios to invest in.

Our diversified portfolios make investing easy for employees. They can choose the portfolio that interests them, from sustainability to innovative technology.

More experienced investors can customize their asset class weights. All portfolios are built by experts using generally low-cost exchange-traded funds.

Take your plan further with optional employee benefits.

All-in pricing with no hidden fees.

-

Control plan eligibility.

Decide who can participate or be excluded from your plan, like seasonal or part-time workers. -

Automatic force outs.

Automatically remove terminated employees with low balances from your plan. -

Fee flexibility.

Decide what employees pay for and what your business covers. Transfer certain plan expenses back to former employees. -

Only pay for active participants.

Reduce fees by only paying for participants who fund their 401(k)s.

See how Betterment stacks up

against other providers.

| Betterment at Work | Legacy institutions | 401(k)-only providers | |

|---|---|---|---|

| Customizable plan features (including force-outs, profit-sharing, and eligibility requirements) |

|

|

|

| Expertise and support for SMBs |

|

|

|

| Transparent pricing |

|

|

|

| Additional employee financial products (IRA and more) |

|

|

|

| A user-friendly mobile experience for employees |

|

|

|

| Participant engagement and educational resources |

|

|

|

| Optional employee benefits (Financial Coaching, 529s, Student Loan Management, and more) |

|

|

|

Powered by Betterment.