Employer Resources

Keeping you informed and up-to-date on 401(k) plans and employee financial wellness

Go to topic

Most Recent Posts

-

Is it time to unplug from your PEO?

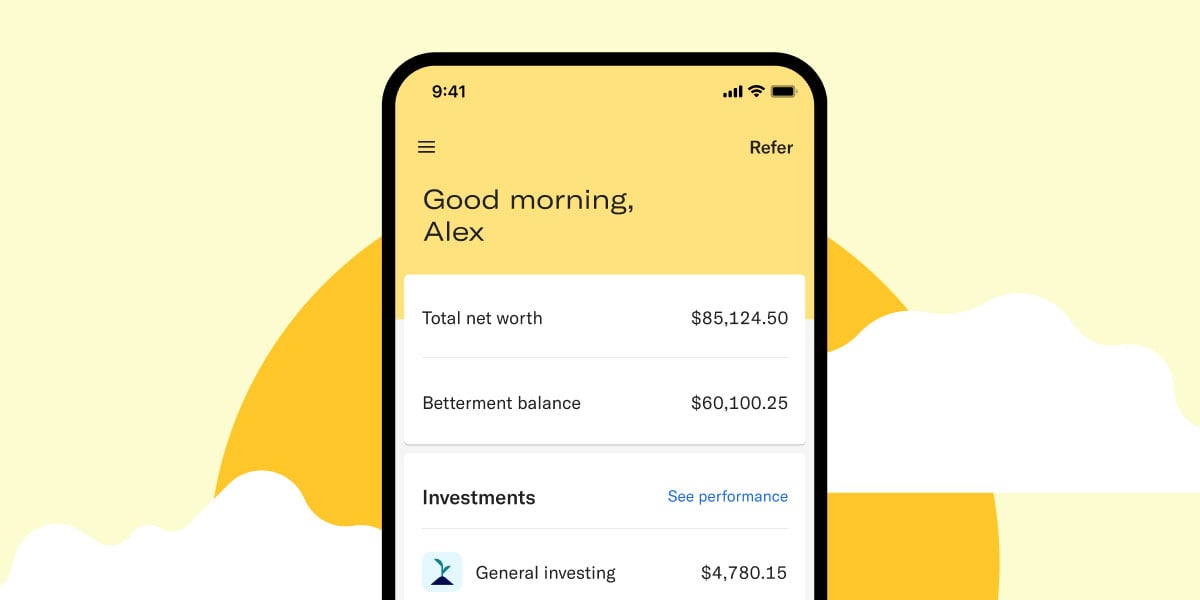

Is it time to unplug from your PEO? Thinking about leaving your PEO’s 401(k)? Learn when to opt out, how to switch, and why a standalone plan may better fit your growing business. Overseeing employee benefits can be a lot to manage—especially with a business to run. That’s why many growing businesses outsource to a Professional Employer Organization (PEO) — streamlined benefits, simplified payroll, and less administrative overhead. But as your business grows, so do your needs—and what once felt like flexibility might now feel more like a constraint. If your benefits options feel limited, costs are hard to decipher, or you’re craving more control over your retirement plan and broader HR strategy, you might be ready to explore other options for your business. Below, we’ll dig into how PEOs work—and why you don’t have to sacrifice flexibility when it comes to your company’s retirement plan. What is a PEO? A PEO is a third-party organization that enters into a co-employment relationship with your business, in which the PEO will: administer payroll and taxes offer benefits like health insurance, 401(k) plans, and more manage HR compliance and risk mitigation For small and medium-sized businesses, this can be a game-changer—helping employers provide benefits without having to build out a full HR team, which takes time and money. How does a PEO 401(k) work? In general, PEOs offer access to a Multiple Employer Plan (MEP) or a Pooled Employer Plan (PEP). These structures group multiple businesses into a single retirement plan. By joining forces, small businesses may be able to access better pricing—and outsource plan administration. However, MEPs and PEPs may involve certain trade-offs—such as a limited investment menu, plan design restrictions, and less transparency into fees—since decisions are made at the pooled level. Employers who oversee their own 401(k) plan retain full control over investment selection, plan features, service providers, and participant support—allowing for a more tailored and strategic approach. If you’d like to learn more MEPs and PEPs, check out our in-depth guide. Can you pick your own 401(k) provider if you’re using a PEO? In short: yes. While PEOs often offer a default retirement plan, you can choose to set up and sponsor your own 401(k)—even if you continue using the PEO for other services like payroll, benefits, and HR support. This is called an “opt-out 401(k)" or a "standalone 401(k)." You’re still using the PEO for everything else, but your retirement plan stands on its own. Keep in mind that as a 401(k) plan sponsor, you would take on additional responsibilities, such as overseeing plan compliance and filing Form 5500. However, many modern 401(k) providers can handle much of the heavy lifting for you. Why businesses choose to go independent Companies often choose to set up their own 401(k) outside of a PEO for a few key reasons: More flexibility. You can design a plan tailored to your employees’ needs, with features like Roth contributions, automatic enrollment, or customized vesting schedules. Greater investment choice. You often have more options—and lower-cost options— when it comes to the fund lineup. Better fee transparency. Standalone plans typically provide clearer visibility into fees and plan costs. Greater employee engagement. Modern providers tend to offer more intuitive, digital experiences, better education tools, and more personalized retirement advice for employees. Ultimately, it’s about choosing a 401(k) that’s truly aligned with your team—and your business goals. Thinking about opting out of your PEO’s 401(k)? If you’re currently with a PEO but wondering if your retirement plan could be doing more for your employees, it may be time to explore a new 401(k) option. The good news: transitioning doesn’t have to be complicated—with the right support. Betterment at Work can help you design a flexible, easy-to-manage 401(k) plan that’s tailored to your business.

-

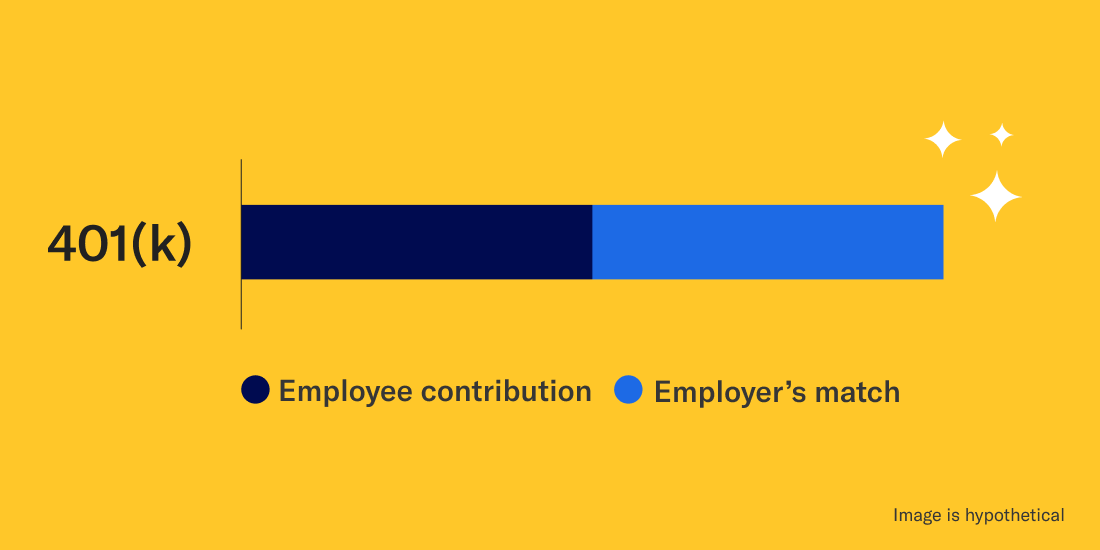

The Importance and Benefits of Offering Employer Match

The Importance and Benefits of Offering Employer Match Some employees resist saving because they feel retirement is too far away, can’t afford it, or can’t grasp the benefit. You can help change that mentality by offering a 401(k) employer match. A 401(k) does more than attract talent—it can spark real savings habits across your workforce. Still, some employees might hesitate, thinking retirement’s too far off or their budget’s too tight. However, as a 401(k) plan sponsor, you can help change that mentality by offering a 401(k) employer matching contribution. What is a 401(k) employer matching contribution? With an employer match, a portion or all of an employee’s 401(k) plan contribution will be “matched” by the employer. Common matching formulas include: Dollar-for-dollar match: Carla works for ABC Company, which runs payroll on a semi-monthly basis (two times a month = 24 pay periods a year). Her gross pay every period is $2,000. She has decided to defer 4% of her pre-tax pay every pay period, or $80 (4% x $2,000). The ABC Company 401(k) plan generously offers a dollar-for-dollar match up to 4% of compensation deferred. With each payroll, $80 of Carla’s pay goes to her 401(k) account on a pre-tax basis, and ABC Company also makes an $80 matching contribution to Carla’s 401(k) account. At a 4% contribution rate, Carla is maximizing the employer contribution amount. If she reduces her contribution to 3%, her company matching contribution would also drop to 3%; but if she increases her contribution to 6%, the formula dictates that her employer would only contribute 4%. Partial match (simple): Let’s take the same scenario as above, but ABC Company 401(k) plan matches 50% on the first 6% of compensation deferred. This means that it will match half of the 401(k) contributions. If Carla contributes $80 to the 401(k) plan, ABC Company will contribute $40 on top of her contribution as the match. Tiered match: By applying different percentages to multiple tiers, employers can encourage employees to contribute to the plan while controlling their costs. For example, ABC Company could match 100% of deferrals up to 3% of compensation and 50% on the next 3% of deferrals. Carla contributes 4% of her pay of $2,000, which is $80 per pay period. Based on their formula, ABC Company will match her dollar-for-dollar on 3% of her contribution ($60 = 3% x $2,000), and 50 cents on the dollar on the last 1% of her contribution for a total matching contribution of $70 or 3.5%. The plan’s matching formula is chosen by the company and specified in the plan document or may be defined as discretionary, in which case the employer may determine not only whether or not to make a matching contribution in any given year, but also what formula to use. Is there a limit to how much an employer can match? The IRS limits annual 401(k) contributions, and these limits change from year to year. It’s also important to note that the IRS caps annual compensation that’s eligible to be matched. Potential Benefits of Providing an Employer Match Attract talent: In Betterment at Work annual Retirement Readiness Report, 57% of employees said better benefits would entice them to switch jobs. The most appealing benefit? An employer match (55%). What’s more, 75% of employees who have a 401(k) also receive an employer match, underlining the rising importance of this benefit in today’s job market. Boost 401(k) plan participation: Unlike other types of employer contributions, a matching contribution requires employees to contribute their own money to the plan. In fact, 90% of those with a match contribute enough to receive the match. In other words, the existence of the match drives plan participation up, encouraging employee engagement and increasing the likelihood of having your plan pass certain compliance tests. Financial well-being of employees: A matching contribution shows employees that you care about their financial well-being and are willing to make an investment in their future. In fact, 52% of employees said their company showed strong levels of commitment to supporting their financial wellness, compared to just 41% in 2023. Improved retention: An employer match is a valuable part of an employee’s total compensation—one that’s hard to walk away from. And by applying a vesting schedule to the employer match, you can incentivize employees to stay longer with your company to gain the full benefits of the 401(k) plan. Employer tax deduction: Matching contributions are tax deductible, which means you can deduct them from your company’s income so long as they don’t exceed IRS limits. Offering a 401(k) plan is already a huge step forward in helping your employees save for their retirement. Providing a 401(k) matching contribution enhances that benefit for both your employees and your organization. Ready for a better 401(k) solution? Whether you’re considering a matching contribution or not, Betterment is here to help. We offer an all-in-one dashboard that seeks to simplify plan administration, at one of the lowest costs in the industry., Our dedicated onboarding team, and support staff are here to help you along the way. Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. Betterment is not a tax advisor, nor should any information herein be considered tax advice. Please consult a qualified tax professional.

-

ETFs and managed portfolios as options in your 401(k) Plan

ETFs and managed portfolios as options in your 401(k) Plan At Betterment, we use exchange-traded funds (ETFs) to build our managed portfolios. Learn about the different types of investment vehicles and how Betterment crafts our investment solutions. Mutual funds have historically dominated the retirement investment landscape. Over time, exchange-traded funds (ETFs) have received more attention due to their cost-effectiveness and flexibility. Here at Betterment, we use them to build our diversified managed ETF portfolios. Learn about the differences between the investment vehicles and the ways investments can be managed. What is active vs. passive (Indexing) investing? People often associate active or passive investing with certain investment vehicles (e.g. ETFs or mutual funds). However, active and passive are really two different management strategies. Characteristics Active Passive (indexing approach) Portfolio managers/team use their investment expertise in an attempt to outperform their benchmark or specified market index. x Portfolio managers/team seeks to match the performance of their benchmark, usually a market index such as the S&P 500. x Usually has relatively high turnover (meaning they will buy/sell securities more frequently) x Usually has low turnover x Tends to have higher management fees x Tends to have lower management fees x Higher tracking error (Greater volatility in returns as they deviate from the index to drive outperformance) x Lower tracking error (Lower volatility in returns as they try to replicate the index they are tracking and invest in the same securities) x Exchange-traded funds are: x x Mutual funds are: x x From the table above, notice how both ETFs AND mutual funds can be actively or passively managed. What’s the difference between mutual funds and ETFs? ETFs and mutual funds do have qualities in common. Both consist of a mix of many different assets, which helps investors easily diversify their portfolios. However, they have a few key differences: Mutual Funds ETFs Both Most are actively managed Tend to have higher fees, sales charges Less transparent, holdings typically disclosed monthly or quarterly Trades once per day, bought and sold directly with the mutual fund provider Mutual funds still remain the dominant investments in 401(k) plans Most are passively managed, but can be active Relatively lower fees Have clear goals and mandates Transparent Liquid, trades throughout the day (like a stock) ETFs are growing quickly Unique product structure with creation/redemption mechanism Easy diversification Easily access a variety of exposures, eg. stocks, bonds, commodities, alternatives, themes, etc. Costs have reduced over time Mutual funds are traditionally known for their active approach. It is a key reason why mutual funds tend to have higher fees and higher expense ratios than ETFs. Costs are also higher in instances where smaller retirement plans do not have access to institutional share classes. However, Index mutual funds, which are passively managed and lower in costs, have continued to become more popular. ETFs, on the other hand, are usually passively managed. More differentiated ETFs however, that are actively managed or use other fundamentals like factors (smart beta), have emerged over the years. Most ETFs are transparent, meaning you can see the underlying holdings daily. Mutual funds either report their holdings monthly or quarterly. ETFs can be traded like stocks whereas mutual funds may only be purchased at the end of each trading day based on a calculated price. ETFs have a unique share creation and redemption mechanism, which provides efficiencies such as reducing trade costs incurred by the fund, allowing tighter tracking to the index. Differences in costs between mutual funds and ETFs Another difference to highlight is costs. Both mutual funds and ETFs have some form of implicit and explicit costs. Here’s a breakdown of the different types: Types of Costs Mutual Funds ETFs Management fee Both include a stated management fee Trading costs N/A May trade at a price slightly more or less than NAV Transaction costs May include sales loads, redemption fees Similar to stocks, may be subject to brokerage commissions Revenue sharing agreements Agreements among 401(k) plan providers and mutual fund companies include: 12(b)-1 fees, which are disclosed in a fund’s expense ratios and are annual distribution or marketing fees Sub Transfer Agent (Sub-TA) fees for maintaining records of a mutual fund’s shareholders Revenue sharing agreements often appear as conflicts of interests. Soft-dollar arrangements These commission arrangements, sometimes called excess commissions, exacerbate the problem of hidden expenses because the mutual fund manager engages a broker-dealer to do more than just execute trades for the fund. These services could include nearly anything—securities research, hardware, or even an accounting firm’s conference hotel costs. These are the different types of costs that can ultimately drive the “all-in” mutual funds fees experience to be different from ETFs. What else didn’t I realize about mutual funds? Conflicts of interest Often, there are conflicts of interest with mutual funds. Some service providers are, at their core, mutual fund companies. And therefore, some investment advisors are incentivized to promote certain funds. This means that the fund family providing 401(k) services and the advisor who sells the plans may have a conflict of interest. Some mutual funds invest in a portfolio of ETFs Target-date funds have evolved to now include ETFs, so it is important to understand the way your TDFs are constructed and that ETFs are also being considered for a traditional mutual fund product like TDFs. Why is it unusual to see ETFs in 401(k)s? The 401(k) market is largely dominated by players who are incentivized to offer certain mutual funds. Plans are often sold through distribution partners, which can include brokers, advisors, recordkeepers or third-party administrators. The fees embedded in mutual funds help offset expenses and facilitate payment of every party involved in the sale. However, it’s challenging for employers and employees because the fees aren’t easy to understand even with the mandated disclosure requirements. Existing technology limitations prevent traditional recordkeeping systems from supporting ETFs. Most 401(k) recordkeeping systems were built decades ago and designed to handle once-per-day trading, not intra-day trading (the way ETFs are traded)—so these systems can’t handle ETFs on the platform (at all). How Betterment manages your investments Betterment combines managed ETF portfolios with personalized, unbiased advice to create an easy solution for today’s retirement savers. At Betterment, we use ETFs as the building blocks for our managed portfolios where you have the ability to choose from a menu of portfolio strategies that are managed over time. To select the ETFs that we use to construct our portfolios, we use our proprietary unbiased investment selection methodology that is based on qualitative and quantitative factors, always serving your employees’ best interest. Many retirement plans use target-date funds because they are often viewed as a one-stop solution. While having specific retirement date funds (2045 Fund, 2050 Fund, etc.) may satisfy most investors, it is important to consider options for those whose circumstances have changed (if someone decides to retire early, for example) and require flexibility. Betterment can tailor our advice to the exact year your employees want to retire. Our retirement advice adapts to your employees’ desired retirement timeline and can be customized for their risk appetite if they want to be more conservative or aggressive. Betterment can also tell your employees if they‘re on or off track, factoring in all of their retirement savings, Social Security, pensions, and more. Employees can also link outside investments, savings accounts, IRAs—even spousal/partner assets—to create a real-time holistic snapshot of their finances. It can make saving for retirement (and any other short- or long-term goals) even easier. At Betterment, we believe in providing investment options and retirement advice that allows for customization and flexibility in a cost-effective way. Interested in bringing a Betterment 401(k) to your organization? Get in touch today at 401k@betterment.com.

Our library built for employers

Plan Admin

-

![]()

Crypto in 401(k) Plans: The Department of Labor’s Guidance

Crypto in 401(k) Plans: The Department of Labor’s Guidance The US Department of Labor (DOL) released fresh guidance on cryptocurrency investments for fiduciaries of retirement plans. This article describes the DOL’s guidance and its implications for retirement plans. The U.S. Department of Labor (DOL) announced on May 28, 2025, that it has rescinded its 2022 guidance on cryptocurrency in 401(k) plans, jettisoning principles that discouraged fiduciaries from including crypto options in retirement plans. Citing risks associated with crypto investing, the Biden administration’s DOL had previously issued directions to plan fiduciaries to apply “extreme care” when considering crypto options in its Compliance Assistance Release No. 2022-01 note. The current administration appears more neutral about plan fiduciaries that decide to include crypto. However, courts also play a role in enforcing fiduciary duties—and their decisions don’t always match the DOL’s views. What does the DOL note say? The DOL’s news release reverses the previous administration’s stricter stance, saying it strayed from the Employee Retirement Income Security Act’s “historically neutral, principled-based” approach to evaluating investment suitability by warning against crypto specifically. The announcement explains that its newly established “neutral stance” means that it is “neither endorsing, nor disapproving of, plan fiduciaries who conclude that the inclusion of cryptocurrency in a plan’s investment menu is appropriate.” What does this mean for Betterment at Work? 401(k) plans that Betterment administers as a 3(38) investment fiduciary currently do not offer crypto investment options. Betterment regularly reviews investments on an ongoing basis to ensure we’ve performed our due diligence and fiduciary duty in selecting investments suitable for participants' desired investing objectives. While the DOL’s guidance has changed, we continue to prefer not including crypto as an option within plans, given we favor seeing consistency over time in the DOL’s messaging and in the risk profile of crypto before making it available. We will continue to monitor both the evolution of the crypto market as well as industry and regulator news. Betterment will always rigorously select and monitor investment options as a fiduciary, while seeking to provide the flexibility in investment options that plan sponsors and participants desire. We will continue to monitor ongoing developments and keep you informed. The above material and content should not be considered to be a recommendation. Investing in digital assets is highly speculative and volatile, and only suitable for investors who are able to bear the risk of potential loss and experience sharp drawdowns. Digital assets are not legal tender and are not backed by the U.S. government. Digital assets are not subject to FDIC insurance or SIPC protections. -

![]()

Everything You Need to Know about Form 5500

Everything You Need to Know about Form 5500 If you’d like to get a general idea of what it takes to file a Form 5500 for a 401(k) plan, here are the top five things you need to know. As you can imagine, the Internal Revenue Service (IRS) and the Department of Labor (DOL) like to keep tabs on employee benefit plans to make sure everything is running smoothly and there are no signs of impropriety. One of the ways they do that is with Form 5500. You may be wondering: What is Form 5500? Well, Form 5500—otherwise known as the Annual Return/Report of Employee Benefit Plan—discloses details about the financial condition, investments, and operations of the plan. Not only for retirement plans, Form 5500 must be filed by the employer or plan administrator of any pension or welfare benefit plan covered by ERISA, including 401(k) plans, pension plans, medical plans, dental plans, and life insurance plans, among others. If you’re a Betterment client, you don’t need to worry about many of these Form 5500 details because we do the heavy lifting for you. But if you’d like to get a general idea of what it takes to file a Form 5500 for a 401(k) plan, here are the top five things you need to know. 1. There are three different versions of Form 5500—each with its own unique requirements. Betterment drafts a signature-ready Form 5500 on your behalf. But if you were to do it yourself, you would select from one of the following form types based on your plan type: Form 5500-EZ – If you have a one-participant 401(k) plan —also known as a “solo 401(k) plan”—that only covers you (and your spouse if applicable), you can file this form. Have a solo 401(k) plan with less than $250,000 in plan assets as of the last day of the plan year? No need to file a Form 5500-EZ (or any Form 5500 at all). Lucky you! Form 5500-SF– If you have a small 401(k) plan—which is generally defined as a plan that covers fewer than 100 participants on the first day of the plan year—you can file a simplified version of the Form 5500 if it also meets the following requirements: It satisfies the independent audit waiver requirements established by the DOL. It is 100% invested in eligible plan assets—such as mutual funds and variable annuities—with determinable fair values. It doesn’t hold employer securities. Form 5500– If you have a large 401(k) plan—which is generally defined as a plan that covers more than 100 participants with assets in the plan—or a small 401(k) plan that doesn’t meet the Form 5500-EZ or Form 5500-SF filing requirements, you must file a long-form Form 5500. Unlike Form 5500-EZ and Form 5500-SF, Form 5500 is not a single-form return. Instead, you must file the form along with specific schedules and attachments, including: Schedule A -- Insurance information Schedule C -- Service provider information Schedule D -- Participating plan information Schedule G -- Financial transaction schedules Schedule H or I -- Financial information (Schedule I for small plan) Schedule R -- Retirement plan information Independent Audit Report Certain forms or attachments may not be required for your plan. Is your plan on the cusp of being a small (or large) plan? If your plan has between 80 and 120 participants on the first day of the plan year, you can benefit from the 80-120 Rule. The rule states that you can file the Form 5500 in the same category (i.e., small or large plan) as the prior year’s return. That’s good news, because it makes it possible for large retirement plans with between 100 and 120 participants to classify themselves as “small plans” and avoid the time and expense of completing the independent audit report. 2. You must file the Form 5500 by a certain due date (or file for an extension). You must file your plan’s Form 5500 by the last business day of the seventh month following the end of the plan year. For example, if your plan year ends on December 31, you should file your Form 5500 by July 31 of the following year to avoid late fees and penalties. If you’re a Betterment client, you’ll receive your signature-ready Form 5500 with ample time to submit it. Plus, we’ll communicate with you frequently to help you meet the filing deadline. But if you need a little extra time, Betterment can file for an extension on your behalf using Form 5558—but you have to do it by the original deadline for the Form 5500. The extension affords you another two and a half months to file your form. (Using the prior example, that would give you until October 15 to get your form in order.) What if you happen to miss the Form 5500 filing deadline? If you miss the filing deadline, you’ll be subject to penalties from both the IRS and the DOL: The IRS penalty for late filing is $250 per day, up to a maximum of $150,000. The DOL penalty for late filing can run up to $2,259 per day, with no maximum. There are also additional penalties for plan sponsors that willfully decline to file. That said, through the DOL’s Delinquent Filer Voluntary Compliance Program (DFVCP), plan sponsors can avoid higher civil penalty assessments by satisfying the program’s requirements. Under this special program, the maximum penalty for a single late Form 5500 is $750 for small 401(k) plans and $2,000 for large 401(k) plans. The DFVCP also includes a “per plan” cap, which limits the penalty to $1,500 for small plans and $4,000 for large plans regardless of the number of late Form 5500s filed at the same time. 3. The Form 5500 filing process is done electronically in most cases. For your ease and convenience, Form 5500 and Form 5500-SF must be filed electronically using the DOL’s EFAST2 processing system (there are a few exceptions). EFAST2 is accessible through the agency’s website or via vendors that integrate with the system. To ensure you can file your Form 5500 quickly, accurately, and securely, Betterment facilitates the filing for you. Whether you file electronically or via hard copy, remember to keep a signed copy of your Form 5500 and all of its schedules on file. Once you file Form 5500, your work isn’t quite done. You must also provide your employees with a Summary Annual Report (SAR), which describes the value of your plan’s assets, any administrative costs, and other details from your Form 5500 return. The SAR is due to participants within nine months after the end of the plan year. (If you file an extension for your Form 5500, the SAR deadline also extends to December 15.) For example, if your plan year ends on December 31 and you submitted your Form 5500 by July 31, you would need to deliver the SAR to your plan participants by September 30. While you can provide it as a hard copy or digitally, you’ll need participants’ prior consent to send it digitally. In addition, participants may request a copy of the plan’s full Form 5500 return at any time. As a public document, it’s accessible to anyone via the DOL website. 4. It’s easy to make mistakes on the Form 5500 (but we aim to help you avoid them). As with any bureaucratic form, mistakes are common and may cause issues for your plan or your organization. Mistakes may include: Errors of omission such as forgetting to indicate the number of plan participants Errors of timing such as indicating a plan has been terminated because a resolution has been filed, yet there are still assets in the plan Errors of accuracy involving plan characteristic codes and reconciling financial information Errors of misinterpretation or lack of information such as whether there have been any accidental excess contributions above the federal limits or failure to report any missed contributions or late deposits Want to avoid making errors on your Form 5500? Betterment prepares the form on your behalf, so all you need to do is review, sign, and submit—it’s as simple as that. 5. Betterment drafts a signature-ready Form 5500 for you, including related schedules When it comes to Form 5500, Betterment does nearly all the work for you. Specifically, we: Prepare a signature-ready Form 5500 that has all the necessary information and related schedules Remind you of the submission deadline so you file it on time Guide you on how to file the Form 5500 (it only takes a few clicks) and make sure it’s accepted by the DOL Provide you with an SAR that’s ready for you to distribute to your participants Ready to learn more about how Betterment can help you with your Form 5500 (and so much more)? Let’s talk. -

![]()

Understanding 401(k) Annual Compliance Testing

Understanding 401(k) Annual Compliance Testing These yearly required tests are meant to ensure everyone is benefiting from your 401(k) plan. If your company has a 401(k) plan—or if you’re considering starting one in the future—you may have heard about annual compliance testing, also known as nondiscrimination testing. But what is it really? And how can you help your plan pass these important compliance tests? Read on for our explanation. What is annual compliance testing? Mandated by ERISA, annual compliance testing helps ensure that 401(k) plans benefit all employees—not just business owners or highly compensated employees. Because the government provides significant tax benefits through 401(k) plans, it wants to ensure that these perks don’t disproportionately favor high earners. We’ll dive deeper into nondiscrimination testing, but let’s first discuss an important component of 401(k) compliance: contribution limits. What contribution limits do I need to know about? Because of the tax advantages given to 401(k) plan contributions, the IRS puts a limit on the amount that employers and employees can contribute. Here’s a quick overview: Limit What is it? Notes for 2024 plan year Employee contribution limits (“402g”) Limits the amount a participant may contribute to the 401(k) plan. The personal limit is based on the calendar year.1 Note that traditional (pre-tax) and Roth (post-tax) contributions are added together (there aren’t separate limits for each). $23,000 is the maximum amount participants may contribute to their 401(k) plan for 2024. Participants age 50 or older during the year may defer an additional $7,500 in “catch-up” contributions if permitted by the plan. Total contribution limit (“415”) Limits the total contributions allocated to an eligible participant for the year. This includes employee contributions, all employer contributions and forfeiture allocations. Total employee and employer contributions cannot exceed total employee compensation for the year. $69,0002 plus up to $7,500 in catch-up contributions (if permitted by the plan) for 2024. Cannot exceed total compensation. Employer contribution limit Employers’ total contributions (excluding employee deferrals) may not exceed 25% of eligible compensation for the plan year. N/A This limit is an IRS imposed limit based on the calendar year. Plans that use a ‘plan year’ not ending December 31st base their allocation limit on the year in which the plan year ends. This is different from the compensation limits, which are based on the start of the plan year. Adjusted annually; see most recent Cost of Living Adjustments table here. What is nondiscrimination testing designed to achieve? Essentially, nondiscrimination testing has three main goals: To measure employee retirement plan participation levels to ensure that the plan isn’t “discriminating” against lower-income employees. To ensure that people of all income levels have equal access to—and awareness of—the company’s retirement plan. To encourage employers to be good stewards of their employees’ futures by making any necessary adjustments to level the playing field (such as matching employees’ contributions) Where do I begin? Before you embark on annual compliance testing, you’ll need to categorize your employees by income level and employee status. Here are the main categories (and acronyms): Highly compensated employee (HCE)—According to the IRS, an employee who meets one or more of the following criteria: Prior (lookback) year compensation—For plan years ending in 2024, earned over $150,000 in the preceding plan year; some plans may limit this to the top 20% of earners (known as the top-paid group election), which would be outlined in your plan document; or Ownership in current or prior year—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation Non-highly compensated employee (NHCE)—Someone who does not meet the above criteria. Key employee—According to the IRS, an employee who meets one or more of the following criteria during the plan year: Ownership over 5%—Owns more than 5% of (1) outstanding corporate stock, (2) voting power across corporate stock, or (3) capital or profits of an entity not considered a corporation. Ownership over 1%—Owns more than 1% of the stock, voting power, capital, or profits, and earned more than $150,000. Officer—An officer of the employer who earned more than $220,000 for 2024; this may be limited to the lesser of 50 officers or the greater of 3 or 10% of the employee count. Non-key employee—Someone who does not meet the above criteria. What are the tests that need to be performed? Below are the tests typically performed for 401(k) plans. Betterment will perform each of these tests on behalf of your plan and inform you of the results. 1. 410(b) Coverage Tests—These tests determine the ratios of employees eligible for and benefitting from the plan to show that the plan fairly covers your employee base. Specifically, these tests review the ratio of HCEs benefitting from the plan against the ratio of NHCEs benefitting from the plan. Typically, the NHCE percentage benefitting must be at least 70% or 0.7 times the percentage of HCEs considered benefitting for the year, or further testing is required. These annual tests are performed across different contribution types: employee contributions, employer matching contributions, after-tax contributions, and non-elective (employer, non-matching) contributions. 2. Actual deferral percentage (ADP) test—Compares the average salary deferral of HCEs to that of non-highly compensated employees (NHCEs). This test includes pre-tax and Roth deferrals, but not catch-up contributions. Essentially, it measures the level of engagement of HCEs vs. NHCEs to make sure that high income earners aren’t saving at a significantly higher rate than the rest of the employee base. Specifically, two percentages are calculated: HCE ADP—The average deferral rate (ADR) for each HCE is calculated by dividing the employee’s elective deferrals by their salary. The HCE ADP is calculated by averaging the ADR for all eligible HCEs (even those who chose not to defer). NHCE ADP—The average deferral rate (ADR) for each NHCE is calculated by dividing the employee’s elective deferrals by their salary. The NHCE ADP is calculated by averaging the ADR for all eligible NHCEs (even those who chose not to defer). The following table shows how the IRS limits the disparity between HCE and NHCE average contribution rates. For example, if the NHCEs contributed 3%, the HCEs can only defer 5% (or less) on average. NHCE ADP HCE ADP 2% or less → NHCE% x 2 2-8% → NHCE% + 2 more than 8% → NHCE% x 1.25 3. Actual contribution percentage (ACP) test—Compares the average employer contributions received by HCEs and NHCEs. (So this test is only required if you make employer contributions.) Conveniently, the calculations and breakdowns are the same as with the ADP test, but the average contribution rate calculation includes both employer matching contributions and after-tax contributions. 4. Top-heavy determination—Evaluates whether or not the total value of the plan accounts of “key employees” is more than 60% of the value of all plan assets. Simply put, it analyzes the accrued benefits between two groups: Key employees and non-Key employees. A plan is considered top-heavy when the total value (account balance with adjustments related to rollovers, terminated accounts, and a five-year lookback of distributions) of the Key employees’ plan accounts is greater than 60% of the total value (also adjusted as noted above) of the plan assets, as of the end of the prior plan year. (Exception: The first plan year is determined based on the last day of that year). If the plan is considered top-heavy for the year, employers must make a contribution to non-key employees. The top-heavy minimum contribution is the lesser of 3% of compensation or the highest percentage contributed for key employees. However, this can be reduced or avoided if no key employee makes or receives contributions for the year (including forfeiture allocations). What happens if my plan fails these tests? If your plan fails the ADP and ACP tests, you’ll need to fix the imbalance by returning 401(k) plan contributions to your HCEs or by making additional employer contributions to your NHCEs. If you have to refund contributions, that money may be subject to state and federal taxes. Plus, if you don’t correct the issue in a timely manner, there could also be a 10% penalty fee and other serious ramifications. Why is it common to fail testing? Small and mid-size businesses may struggle to pass if they have a relatively high number of HCEs. If HCEs contribute a lot to the plan, but non-highly compensated employees (NHCEs) don’t, there’s a chance that the 401(k) plan will not pass nondiscrimination testing. It’s actually easier for large companies to pass the tests because they have many employees at varying income levels contributing to the plan. How can I help my plan pass the tests? It pays to prepare for nondiscrimination testing. Here are a few tips that can make a difference: Add automatic enrollment —By adding an auto-enrollment feature to your 401(k) plan, you can automatically deduct elective deferrals from your employees’ wages unless they opt out. It’s a simple way to boost participation rates and help your employees start saving. In fact, the government is getting more behind auto-enrollment; SECURE 2.0 mandates plans that launched after Dec. 29, 2022 add automatic enrollment to the plan by Jan. 1, 2025. Add a Safe Harbor provision to your 401(k) plan—Safe Harbor plan design typically makes compliance testing easier to pass. Make it easy to enroll in your plan—Is your 401(k) plan enrollment process confusing and cumbersome? If so, it might be stopping employees from enrolling. Consider partnering with a tech-savvy provider like Betterment that can help your employees enroll quickly and easily—and support them on every step of their retirement saving journey. Learn more now. Encourage your employees to save—Whether you send emails or host employee meetings, it’s important to get the word out about saving for retirement through the plan. That’s because the more NHCEs that participate, the better chance you have of passing the nondiscrimination tests. (Plus, you’re helping your team save for their future.) Add automatic escalation - By adding automatic escalation, you can ensure that participants who are automatically enrolled in the plan continue to increase their deferral rate by 1% annually until a cap is reached (generally 15%). It’s a great way to increase your employees retirement savings and to engage them in the plan. How can Betterment help? Nondiscrimination testing and many other aspects of 401(k) plan administration can be complex. That’s why we do everything in our power to help make it easier for you as a plan sponsor. We help with year-end compliance testing, including ADP/ACP testing, top-heavy testing, annual additions testing, deferral limit testing, and coverage testing. With our intuitive online platform, you can better manage your plan and get the support you need along the way. Ready to learn more? Let's talk. Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. The information contained in this article is meant to be informational only and does not constitute investment or tax advice.

Plan Setup

-

![]()

The Importance and Benefits of Offering Employer Match

The Importance and Benefits of Offering Employer Match Some employees resist saving because they feel retirement is too far away, can’t afford it, or can’t grasp the benefit. You can help change that mentality by offering a 401(k) employer match. A 401(k) does more than attract talent—it can spark real savings habits across your workforce. Still, some employees might hesitate, thinking retirement’s too far off or their budget’s too tight. However, as a 401(k) plan sponsor, you can help change that mentality by offering a 401(k) employer matching contribution. What is a 401(k) employer matching contribution? With an employer match, a portion or all of an employee’s 401(k) plan contribution will be “matched” by the employer. Common matching formulas include: Dollar-for-dollar match: Carla works for ABC Company, which runs payroll on a semi-monthly basis (two times a month = 24 pay periods a year). Her gross pay every period is $2,000. She has decided to defer 4% of her pre-tax pay every pay period, or $80 (4% x $2,000). The ABC Company 401(k) plan generously offers a dollar-for-dollar match up to 4% of compensation deferred. With each payroll, $80 of Carla’s pay goes to her 401(k) account on a pre-tax basis, and ABC Company also makes an $80 matching contribution to Carla’s 401(k) account. At a 4% contribution rate, Carla is maximizing the employer contribution amount. If she reduces her contribution to 3%, her company matching contribution would also drop to 3%; but if she increases her contribution to 6%, the formula dictates that her employer would only contribute 4%. Partial match (simple): Let’s take the same scenario as above, but ABC Company 401(k) plan matches 50% on the first 6% of compensation deferred. This means that it will match half of the 401(k) contributions. If Carla contributes $80 to the 401(k) plan, ABC Company will contribute $40 on top of her contribution as the match. Tiered match: By applying different percentages to multiple tiers, employers can encourage employees to contribute to the plan while controlling their costs. For example, ABC Company could match 100% of deferrals up to 3% of compensation and 50% on the next 3% of deferrals. Carla contributes 4% of her pay of $2,000, which is $80 per pay period. Based on their formula, ABC Company will match her dollar-for-dollar on 3% of her contribution ($60 = 3% x $2,000), and 50 cents on the dollar on the last 1% of her contribution for a total matching contribution of $70 or 3.5%. The plan’s matching formula is chosen by the company and specified in the plan document or may be defined as discretionary, in which case the employer may determine not only whether or not to make a matching contribution in any given year, but also what formula to use. Is there a limit to how much an employer can match? The IRS limits annual 401(k) contributions, and these limits change from year to year. It’s also important to note that the IRS caps annual compensation that’s eligible to be matched. Potential Benefits of Providing an Employer Match Attract talent: In Betterment at Work annual Retirement Readiness Report, 57% of employees said better benefits would entice them to switch jobs. The most appealing benefit? An employer match (55%). What’s more, 75% of employees who have a 401(k) also receive an employer match, underlining the rising importance of this benefit in today’s job market. Boost 401(k) plan participation: Unlike other types of employer contributions, a matching contribution requires employees to contribute their own money to the plan. In fact, 90% of those with a match contribute enough to receive the match. In other words, the existence of the match drives plan participation up, encouraging employee engagement and increasing the likelihood of having your plan pass certain compliance tests. Financial well-being of employees: A matching contribution shows employees that you care about their financial well-being and are willing to make an investment in their future. In fact, 52% of employees said their company showed strong levels of commitment to supporting their financial wellness, compared to just 41% in 2023. Improved retention: An employer match is a valuable part of an employee’s total compensation—one that’s hard to walk away from. And by applying a vesting schedule to the employer match, you can incentivize employees to stay longer with your company to gain the full benefits of the 401(k) plan. Employer tax deduction: Matching contributions are tax deductible, which means you can deduct them from your company’s income so long as they don’t exceed IRS limits. Offering a 401(k) plan is already a huge step forward in helping your employees save for their retirement. Providing a 401(k) matching contribution enhances that benefit for both your employees and your organization. Ready for a better 401(k) solution? Whether you’re considering a matching contribution or not, Betterment is here to help. We offer an all-in-one dashboard that seeks to simplify plan administration, at one of the lowest costs in the industry., Our dedicated onboarding team, and support staff are here to help you along the way. Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Betterment or its authors endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. Betterment is not a tax advisor, nor should any information herein be considered tax advice. Please consult a qualified tax professional. -

![]()

401(k) Glossary of Terms

401(k) Glossary of Terms Whether you're offering a 401(k) for the first time or need a refresh on important terms, these definitions can help you make sense of industry jargon. 3(16) fiduciary: A fiduciary partner hired by an employer to handle a plan’s day-to-day administrative responsibilities and ensure that the plan remains in compliance with Department of Labor regulations. 3(21) fiduciary: An investment advisor who acts as co-fiduciary to review and make recommendations regarding a plan’s investment lineup. This fiduciary provides guidance but does not have the authority to make investment decisions. 3(38) fiduciary: A codified retirement plan fiduciary that’s responsible for choosing, managing, and overseeing the plan’s investment options. 401(k) administration costs: The expenses involved with the various aspects of running a 401(k) plan. Plan administration includes managing eligibility and enrollment, coordinating contributions, processing distributions and loans, preparing and delivering legally required notices and forms, and more. 401(k) committee charter: A document that describes the 401(k) committee’s responsibilities and authority. 401(k) compensation limit: The maximum amount of compensation that’s eligible to draw on for plan contributions, as determined by the IRS. 401(k) contribution limits: The maximum amount that a participant may contribute to an employer-sponsored 401(k) plan, as determined by the IRS. 401(k) force-out rule: Refers to a plan sponsor’s option to remove a former employee’s assets from the retirement plan. The sponsor has the option to “force out” these assets (into an IRA in the former employee’s name) if the assets are less than $5,000. 401(k) plan: An employer-sponsored retirement savings plan that allows participants to save money on a tax-advantaged basis. 401(k) plan fees: The various fees associated with a plan. These can include fees for investment management, plan administration, fiduciary services, and consulting fees. While some fees are applied at the plan level — that is, deducted from plan assets — others are charged directly to participant accounts. 401(k) plan fee benchmarking: The process of comparing a plan’s fees to those of other plans in similar industries with roughly equal assets and participation rates. This practice can help to determine if a plan’s fees are reasonable per ERISA requirements. 401(k) set-up costs: The expenses involved in establishing a 401(k) plan. These costs cover plan documents, recordkeeping, investment management, participant communication, and other essential aspects of the plan. 401(k) withdrawal: A distribution from a plan account. Because a 401(k) plan is designed to provide income during retirement, a participant generally may not make a withdrawal until age 59 ½ unless he or she terminates or retires; becomes disabled; or qualifies for a hardship withdrawal per IRS rules. Any other withdrawals before age 59 ½ are subject to a 10% penalty as well as regular income tax. 404(a)(5) fee disclosure: A notice issued by a plan sponsor that details information about investment fees. This notice, which is required of all plan sponsors by the Department of Labor, covers initial disclosure for new participants, new fees, and fee changes. 404(c) compliance: Refers to a participant’s (or beneficiary’s) right to choose the specific investments for 401(k) plan assets. Because the participant controls investment decisions, the plan fiduciary is not liable for investment losses. 408(b)(2) fee disclosure: A notice issued by a plan service provider that details the fees charged by the provider (and its affiliates or subcontractors) and reports any possible conflicts of interest. The Department of Labor requires all plan fiduciaries to issue this disclosure. Actual contribution percentage (ACP) test: A required compliance test that compares company matching contributions among highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). Actual deferral percentage (ADP) test: A required compliance test that compares employee deferrals among highly compensated employees (HCEs) and non-highly compensated employees (NHCEs). Annual fee disclosure: A notice issued by a plan sponsor that details the plan’s fees and investments. This disclosure includes plan and individual fees that may be deducted from participant accounts, as well as information about the plan’s investments (performance, expenses, fees, and any applicable trade restrictions). Automated Clearing House (ACH): A banking network used to transfer funds between banks quickly and cost-efficiently. Automatic enrollment (ACA): An option that allows employers to automatically deduct elective deferrals into the plan from an employee’s wages unless the employee actively elects not to contribute or to contribute a different amount. Beneficiary: The person or persons who a participant chooses to receive the assets in a plan account if he or she dies. If the participant is married, the spouse is automatically the beneficiary unless the participant designates a different beneficiary (and signs a written waiver). If the participant is not married, the account will be paid to his or her estate if no beneficiary is on file. Blackout notice: An advance notice of an upcoming blackout period. ERISA rules require plan sponsors to notify participants of a blackout period at least 30 days in advance. Blackout period: A temporary period (three or more business days) during which a 401(k) plan is suspended, usually to accommodate a change in plan administrators. During this period, participants may not change investment options, make contributions or withdrawals, or request loans. Catch-up contributions: Contributions beyond the ordinary contribution limit, which are permitted to help people age 50 and older save more as they approach retirement. You can check the allowances for catch-up contributions here. Compensation: The amount of pay a participant receives from an employer. For purposes of 401(k) contribution calculations, only compensation is considered to be eligible. The plan document defines which form, for example the W-2, is referred to in determining the compensation amount. Constructive receipt: A payroll term that refers to the impending receipt of a paycheck. The paycheck has not yet been fully cleared for deposit in the employee’s bank account, but the employee has access to the funds. Deferrals: Another term for contributions made to a 401(k) account. Defined contribution plan: A tax-deferred retirement plan in which an employee or employer (or both) invest a fixed amount or percentage (of pay) in an account in the employee’s name. Participation in this type of plan is voluntary for the employee. A 401(k) plan is one type of tax-deferred defined contribution plan. Department of Labor (DOL): The federal government department that oversees employer-sponsored retirement plans as well as work-related issues including wages, hours worked, workplace safety, and unemployment and reemployment services. Distributions: A blanket term for any withdrawal from a 401(k) account. A distribution can include a required minimum distribution (RMD), a loan, a hardship withdrawal, a residential loan, or a qualified domestic relations order (QDRO). Docusign: A third-party platform used for exchanging signatures on documents, especially during plan onboarding. EIN: An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Eligible automatic enrollment arrangement (EACA): An automatic enrollment (ACA) plan that applies a default and uniform deferral percentage to all employees who do not opt out of the plan or provide any specific instructions about deferrals to the plan. Under this arrangement, the employer is required to provide employees with adequate notice about the plan and their rights regarding contributions and withdrawals. ERISA: Refers to the Employee Retirement Income Security Act of 1974, a federal law that requires individuals and entities that manage a retirement plan (fiduciaries) to follow strict standards of conduct. ERISA rules are designed to protect retirement plan participants and secure their access to benefits in the plan. Excess contributions: The amount of contributions to a plan that exceed the IRS contribution limit. Excess contributions made in any year (and their earnings) may be withdrawn without penalty by the tax filing deadline for that year, and the participant is then required to pay regular taxes on the amount withdrawn. Any excess contributions not withdrawn by the tax deadline are subject to a 6% excise tax every year they remain in the account. Exchange-traded fund (ETF): Passively managed index funds that feature low costs and high liquidity. ETFs make it easy to manage portfolios efficiently and effectively. All of Betterment’s 401(k) investment options are ETFs. Fee disclosure: Information about the various fees related to a 401(k) plan, including plan administration, fiduciary services, and investment management. Fee disclosure deadline: The date by which a plan sponsor must provide plan and investment-related fee disclosure information to participants. The DOL requires you to send your participant fee disclosure notice at least once in any 14-month period without regard to whether the plan operates on a calendar-year or fiscal-year basis. Fidelity bond: Also known as a fiduciary bond, this bond protects the plan from losses due to fraud or dishonesty. Every fiduciary who handles 401(k) plan funds is required to hold a fidelity bond. Fiduciary: An individual or entity that manages a retirement plan and is required to always act in the best interests of employees who save in the plan. In exchange for helping employees build retirement savings, employers and employees receive special tax benefits, as outlined in the Internal Revenue Code. When a company adopts a 401(k) plan for employees, it becomes an ERISA fiduciary and takes on two sets of fiduciary responsibilities: “Named fiduciary” with overall responsibility for the plan, including selecting and monitoring plan investments “Plan administrator” with fiduciary authority and discretion over how the plan is operated Most companies hire one or more outside experts (such as an investment advisor, investment manager, or third-party administrator) to help manage their fiduciary responsibilities. Form 5500: An informational document that a plan sponsor must prepare to disclose the identity of the plan sponsor (including EIN and plan number), characteristics of the plan (including auto-enrollment, matching contributions, profit-sharing, and other information), the numbers of eligible and active employees, plan assets, and fees. The plan sponsor must submit this form annually to the IRS and the Department of Labor, and must provide a summary to plan participants. Smaller plans (less than 100 employees) may instead file Form 5500-SF. Hardship withdrawal: A withdrawal before age 59 ½ intended to address a severe and immediate need (as defined by the IRS). To qualify for a hardship withdrawal, a participant must provide the employer with documentation (such as a medical bill, a rent invoice, funeral expenses) that shows the purpose and amount needed. If the hardship withdrawal is authorized, it must be limited to the amount needed (adjusted for taxes and penalties), may still be subject to early withdrawal penalties, is not eligible for rollover, and may not be repaid to the plan. Highly compensated employee (HCE): An employee who earned at least $155,000 in compensation from the plan sponsor during 2024, or owned more than 5% interest in the plan sponsor’s business at any time during the current or previous year (regardless of compensation). Inception to date (ITD): Refers to contribution amounts since the inception of a participant’s account. Internal Revenue Service (IRS): The U.S. federal agency that’s responsible for the collection of taxes and enforcement of tax laws. Most of the work of the IRS involves income taxes, both corporate and individual. Investment advice (ERISA ruling): The Department of Labor’s final ruling (revised in 2020) on what constitutes investment advice and what activities define the role of a fiduciary. Investment policy statement (IPS): A plan’s unique governing document, which details the characteristics of the plan and assists the plan sponsor in complying with ERISA requirements. The IPS should be written carefully, reviewed regularly, updated as needed, and adhered to closely. Key employee: An employee classification used in top-heavy testing. This is an employee who meets one of the following criteria: Ownership stake greater than 5% Ownership stake greater than 1% and annual compensation greater than $150,000 Officer with annual compensation greater than $200,000 (for 2022) Non-discrimination testing: Tests required by the IRS to ensure that a plan does not favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs). Non-elective contribution: An employer contribution to an employee’s plan account that’s made regardless of whether the employee makes a contribution. This type of contribution is not deducted from the employee’s paycheck. Non-highly compensated employee (NHCE): An employee who does not meet any of the criteria of a highly compensated employee (HCE). Plan sponsor: An organization that establishes and offers a 401(k) plan for its employees or members. Qualified default investment alternative (QDIA): The default investment for plan participants who don’t make an active investment selection. All 401(k) plans are required to have a QDIA. For Betterment’s 401(k), the QDIA is the Core Portfolio Strategy, and a customized risk level is set for each participant based on their age. Qualified domestic relations order (QDRO): A document that recognizes a spouse’s, former spouse’s, child’s, or dependent’s right to receive benefits from a participant’s retirement plan. Typically approved by a court judge, this document states how an account must be split or reassigned. Plan administrator: An individual or company responsible for the day-to-day responsibilities of 401(k) plan administration. Among the responsibilities of a plan administrator are compliance testing, maintenance of the plan document, and preparation of the Form 5500. Many of these responsibilities may be handled by the plan provider or a third-party administrator (TPA). Plan document: A document that describes a plan’s features and procedures. Specifically, this document identifies the type of plan, how it operates, and how it addresses the company’s unique needs and goals. Professional employer organization (PEO): A firm that provides small to medium-sized businesses with benefits-related and compliance-related services. Profit sharing: A type of defined contribution plan in which a plan sponsor contributes a portion of the company’s quarterly or annual profit to employee retirement accounts. This type of plan is often combined with an employer-sponsored retirement plan. Promissory note: A legal document that lays out the terms of a 401(k) loan or other financial obligation. Qualified non-elective contribution (QNEC): A contribution that a plan is required to make if it’s found to be top-heavy. Required minimum distribution (RMD): Refers to the requirement that an owner of a tax-deferred account begin making plan withdrawals each year starting at age 72. The first withdrawal must be made by April 1 of the year after the participant reaches age 72, and all subsequent annual withdrawals must be made by December 31. Rollover: A retirement account balance that is transferred directly from a previous employer’s qualified plan to the participant’s current plan. Consolidating accounts in this way can make it easier for a participant to manage and track retirement investments, and may also reduce retirement account fees. Roth 401(k) contributions: After-tax plan contributions that do not reduce taxable income. Contributions and their earnings are not taxed upon withdrawal as long as the participant is at least age 59½ and has owned the Roth 401(k) account for at least five years. You can check annual limits here. Roth vs. pre-tax contributions: Pre-tax contributions reduce a participant’s current income, with taxes due when funds are withdrawn (typically in retirement). Alternatively, Roth contributions are deposited into the plan after taxes are deducted, so withdrawals are tax-free. Safe Harbor: A plan design option that provides annual testing exemptions. In exchange, employer contributions on behalf of all employees are required. Saver’s credit: A credit designed to help low- and moderate-income taxpayers further reduce their taxes by saving for retirement. The amount of this credit — 10%, 20%, or 50% of contributions, based on filing status and adjusted gross income — directly reduces the amount of tax owed. Stock option: The opportunity for an employee to purchase shares of an employer’s stock at a specific (often discounted) price for a limited time period. Some companies may offer a stock option as an alternative or a complement to a 401(k) plan. Summary Annual Report (SAR): A summary version of Form 5500, which a plan sponsor is required to provide to participants every year within two months after the Form 5500 deadline – September 30 or December 15 (if there was an extension given for Form 5500 filing). Summary Plan Description (SPD): A comprehensive document that describes in detail how a 401(k) plan works and the benefits it provides. Employers are required to provide an SPD to employees free of charge. Third-party administrator (TPA): An individual or company that may be hired by a 401(k) plan sponsor to help run many day-to-day aspects of a retirement plan. Among the responsibilities of a TPA are compliance testing, generation and maintenance of the plan document, and preparation of Form 5500. Traditional contributions: Pre-tax plan contributions that reduce taxable income. These contributions and their earnings are taxable upon withdrawal, which is typically during retirement. Vesting: Another word for ownership. Participants are always fully vested in the contributions they make. Employer contributions, however, may be subject to a vesting schedule in which participant ownership builds gradually over several years. -

![]()

What is a 401(k) QDIA?

What is a 401(k) QDIA? A QDIA (Qualified Default Investment Alternative) is the plan’s default investment. When money is contributed to the plan, it’s automatically invested in the QDIA. What is a QDIA? A 401(k) QDIA (Qualified Default Investment Alternative) is the investment used when an employee contributes to the plan without having specified how the money should be invested. As a "safe harbor," a QDIA relieves the employer from liability should the QDIA suffer investment losses. Here’s how it works: When money is contributed to the plan, it’s automatically invested in the QDIA that was selected by the plan fiduciary (typically, the business owner or the plan sponsor). The employee can leave the money in the QDIA or transfer it to another plan investment. When (and why) was the QDIA introduced? The concept of a QDIA was first introduced when the Pension Protection Act of 2006 (PPA) was signed into law. Designed to boost employee retirement savings, the PPA removed barriers that prevented employers from adopting automatic enrollment. At the time, fears about legal liability for market fluctuations and the applicability of state wage withholding laws had prevented many employers from adopting automatic enrollment—or had led them to select low-risk, low-return options as default investments. The PPA eliminated those fears by amending the Employee Retirement Income Security Act (ERISA) to provide a safe harbor for plan fiduciaries who invest participant assets in certain types of default investment alternatives when participants do not give investment direction. To assist employers in selecting QDIAs that met employees’ long-term retirement needs, the Department of Labor (DOL) issued a final regulation detailing the characteristics of these investments. Learn more about what kinds of investments qualify as QDIAs below. Why does having a QDIA matter? When a 401(k) plan has a QDIA that meets the DOL’s rules, then the plan fiduciary is not liable for the QDIA’s investment performance. Without a QDIA, the plan fiduciary is potentially liable for investment losses when participants don’t actively direct their plan investments. Plus, having a QDIA in place means that employee accounts are well positioned—even if an active investment decision is never taken. If you select an appropriate default investment for your plan, you can feel confident knowing that your employees’ retirement dollars are invested in a vehicle that offers the potential for growth. Does my retirement plan need a QDIA? Yes, it’s a smart idea for all plans to have a QDIA. That’s because, at some point, money may be contributed to the plan, and participants may not have an investment election on file. This could happen in a number of situations, including when money is contributed to an account but no active investment elections have been established, such as when an employer makes a contribution but an employee isn’t contributing to the plan; or when an employee rolls money into the 401(k) plan prior to making investment elections. It makes sense then, that plans with automatic enrollment must have a QDIA. Are there any other important QDIA regulations that I need to know about? Yes, the DOL details several conditions plan sponsors must follow in order to obtain safe harbor relief from fiduciary liability for investment outcomes, including: A notice generally must be provided to participants and beneficiaries in advance of their first QDIA investment, and then on an annual basis after that Information about the QDIA must be provided to participants and beneficiaries which must include the following: An explanation of the employee’s rights under the plan to designate how the contributions will be invested; An explanation of how assets will be invested if no action taken regarding investment election; Description of the actual QDIA, which includes the investment objectives, characteristics of risk and return, and any fees and expenses involved Participants and beneficiaries must have the opportunity to direct investments out of a QDIA as frequently as other plan investments, but at least quarterly For more information, consult the DOL fact sheet. What kinds of investments qualify as QDIAs? The DOL regulations don’t identify specific investment products. Instead, they describe mechanisms for investing participant contributions in a way that meets long-term retirement saving needs. Specifically, there are four types of QDIAs: An investment service that allocates contributions among existing plan options to provide an asset mix that takes into account the individual’s age or retirement date (for example, a professionally managed account like the one offered by Betterment) A product with a mix of investments that takes into account the individual’s age or retirement date (for example, a life-cycle or target-date fund) A product with a mix of investments that takes into account the characteristics of the group of employees as a whole, rather than each individual (for example, a balanced fund) The fourth type of QDIA is a capital preservation product, such as a stable value fund, that can only be used for the first 120 days of participation. This may be an option for Eligible Automatic Contribution Arrangement (EACA) plans that allow withdrawals of unintended deferrals within the first 90 days without penalty. We’re excluding further discussion of this option here since plans must still have one of the other QDIAs in cases where the participant takes no action within the first 120 days. What are the pros and cons of each type of QDIA? Let’s breakdown each of the first three QDIAs: 1. An investment service that allocates contributions among existing plan options to provide an asset mix that takes into account the individual’s age or retirement date Such an investment service, or managed account, is often preferred as a QDIA over the other options because they can be much more personalized. This is the QDIA provided as part of Betterment 401(k)s. Betterment factors in more than just age (or years to retirement) when assigning participants their particular stock-to-bond ratio within our Core portfolios. We utilize specific data including salary, balance, state of residence, plan rules, and more. And while managed accounts can be pricey, they don’t have to be. Betterment’s solution, which is relatively lower in cost due to investing in exchange traded funds (ETFs) portfolios, offers personalized advice and an easy-to-use platform that can also take external and spousal/partner accounts into consideration. 2. A product with a mix of investments that takes into account the individual’s age or retirement date When QDIAs were introduced in 2006, target date funds were the preferred default investment. The concept is simple: pick the target date fund with the year that most closely matches the year the investor plans to retire. For example, in 2020 if the investor is 45 and retirement is 20 years away, the 2040 Target Date Fund would be selected. As the investor moves closer to their retirement date, the fund adjusts its asset mix to become more conservative. One common criticism of target date funds today is that the personalization ends there. Target date funds are too simple and their one-size-fits-all portfolio allocations do not serve any individual investor very well. Plus, target date funds are often far more expensive compared to other alternatives. Finally, most target date funds are composed of investments from the same company—and very few fund companies excel at investing across every sector and asset class. Many experts view target date funds as outdated QDIAs and less desirable than managed accounts. 3. A product with a mix of investments that takes into account the characteristics of the group of employees as a whole This kind of product—for example, a balanced fund—offers a mix of equity and fixed-income investments. However, it’s based on group demographics and not on the retirement needs of individual participants. Therefore, using a balanced fund as a QDIA is a blunt instrument that by definition will have an investment mix that is either too heavily weighted to one asset class or another for most participants in your plan. Better QDIAs—and better 401(k) plans Betterment provides tailored allocation advice based on what each individual investor needs. That means greater personalization—and potentially greater investment results—for your employees. At Betterment, we monitor plan participants’ investing progress to make sure they’re on track to reach their goals. When they’re not on target, we provide actionable advice to help get them back on track. As a 3(38) investment manager, we assume full responsibility for selecting and monitoring plan investments—including your QDIA. That means fiduciary relief for you and better results for your employees. The exchange-traded fund (ETF) difference Another key component that sets Betterment apart from the competition is our exclusive use of ETFs. Here's why we use them: Low cost—ETFs generally cost less than mutual funds, which means more money stays invested. Diversified—All of the portfolios used by Betterment are designed with diversification in mind, so that investors are not overly exposed to individual stocks, bonds, sectors, or countries—which may mean better returns in the long run. Efficient—ETFs take advantage of decades of technological advances in buying, selling, and pricing securities. Helping your employees live better Our mission is simple: to empower people to do what’s best for their money so they can live better. Betterment’s suite of financial wellness solutions, from our QDIAs to our user-friendly investment platform, is designed to give your employees a more personalized experience. We invite you to learn more about what we can do for you.

Provider Shopping

-

![]()

ETFs and managed portfolios as options in your 401(k) Plan