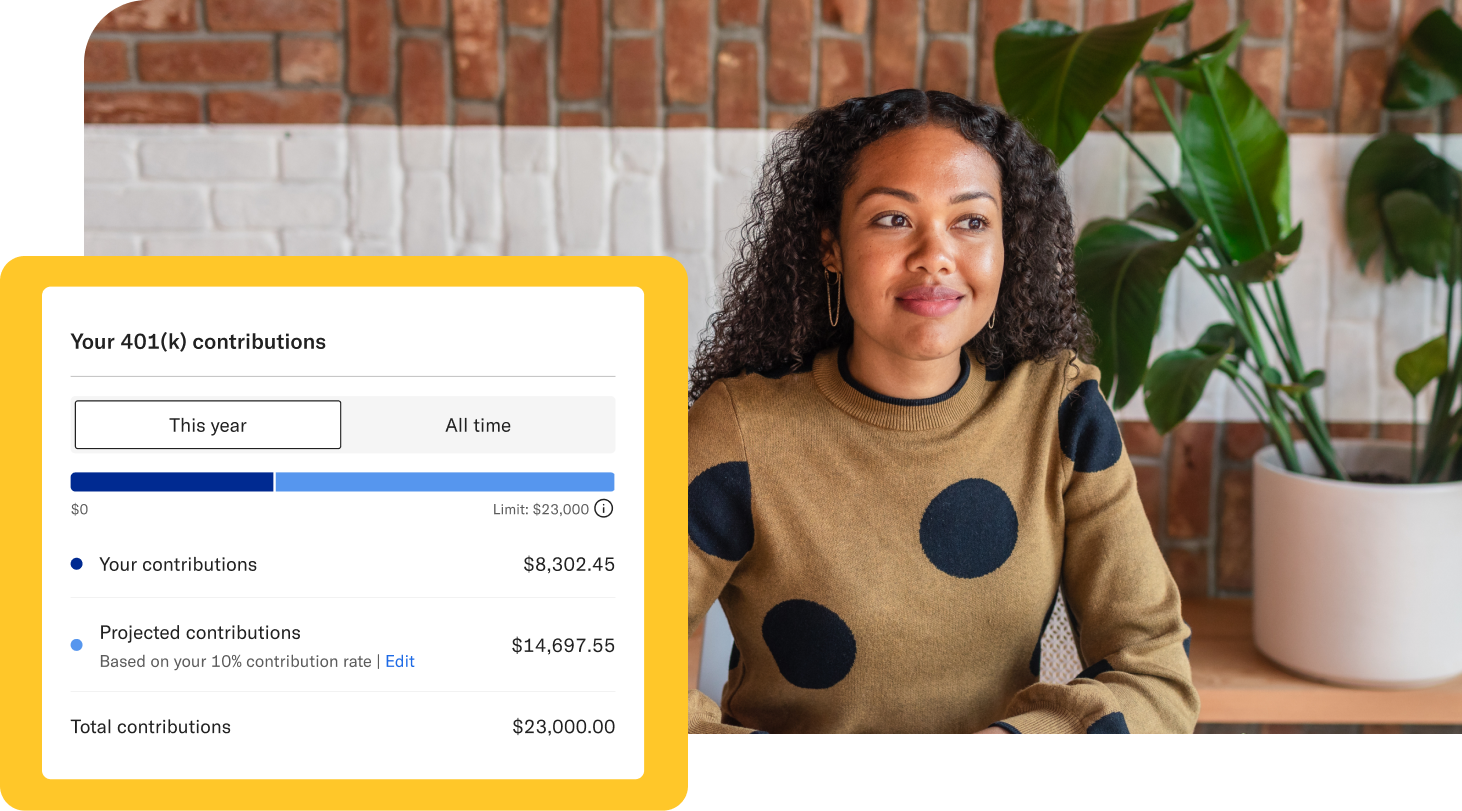

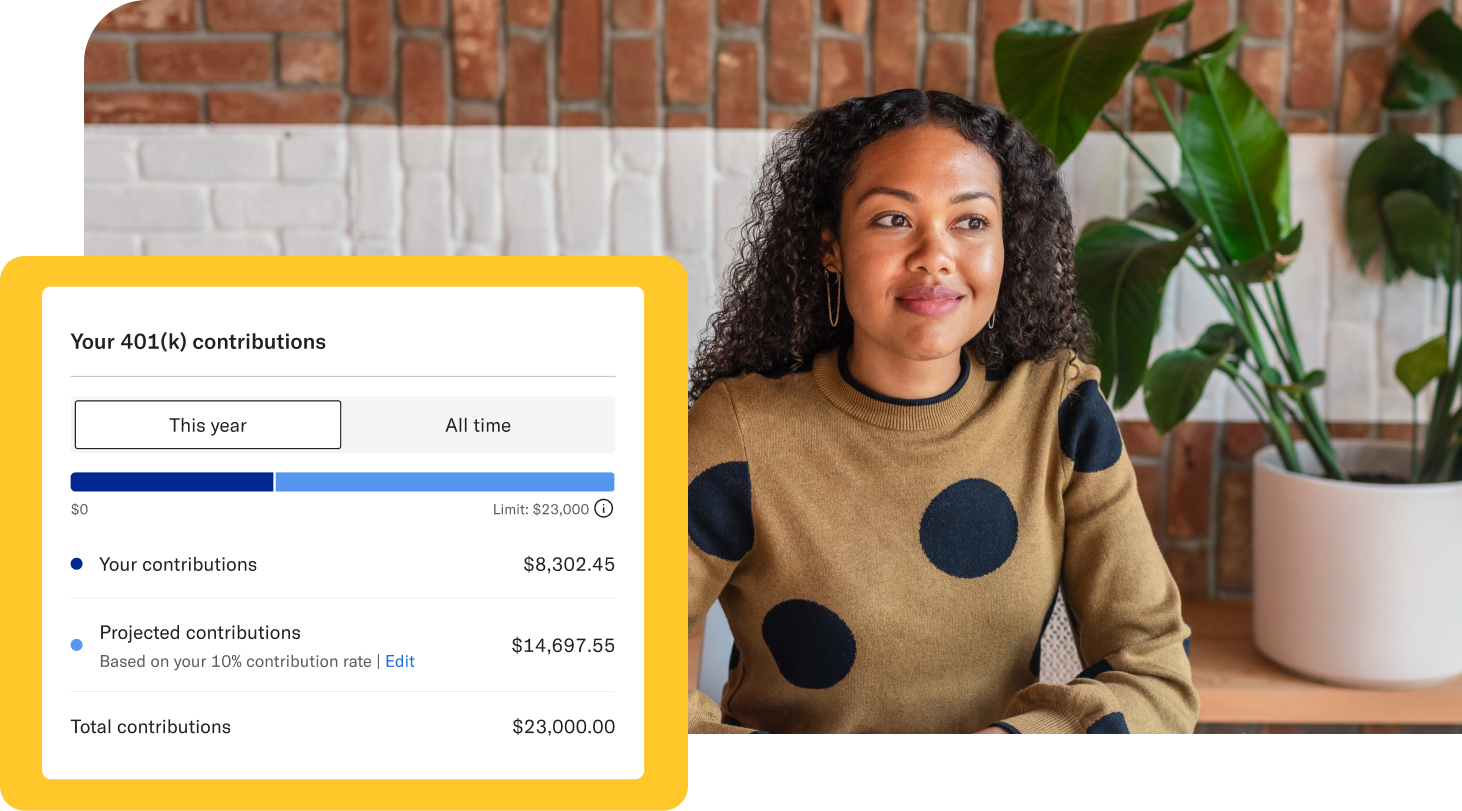

My 401(k).

My future.

Whether you’re just getting started with your retirement savings journey or looking to do more with your money, we’re here to help. Explore resources from Betterment designed to make saving for retirement easier—and help you feel more confident about your financial future.

Financial planning hub My 401(k).

My future.

Whether you’re just getting started with your retirement savings journey or looking to do more with your money, we’re here to help. Explore resources from Betterment designed to make saving for retirement easier—and help you feel more confident about your financial future.

Haven’t claimed your 401(k) account yet? Get started now

Start planning with expert tips, insights, and videos

-

Setting up your account

New to 401(k)s? These resources break down the basics and walk you through how to get started.

-

Building a financial foundation

From emergency savings to high-yield cash accounts, learn how you can strengthen your financial footing.

-

Leveling up your investing

Learn more about traditional and Roth 401(k)s, IRAs, and smart steps to take as you work towards your long-term financial goals.

-

Approaching retirement

Get guidance on healthcare, Social Security, and how to turn your retirement savings into retirement income.

Most-watched videos

-

Why you should invest in your 401(k)

-

Investment options for your 401(k)

-

More than a 401(k) provider

Our team is

here for you.

Email:

support@betterment.com

Call:

718-400-6898

Mon - Fri, 9:00am - 8:00pm ET

support@betterment.com

Call:

718-400-6898

Mon - Fri, 9:00am - 8:00pm ET