The 401(k) built to keep up with your growth.

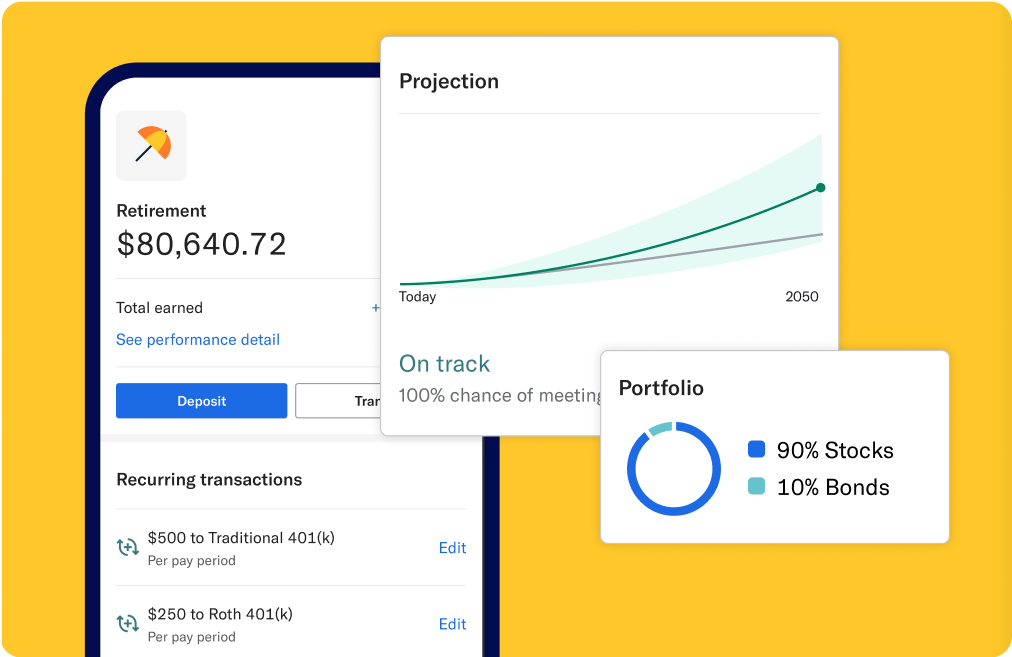

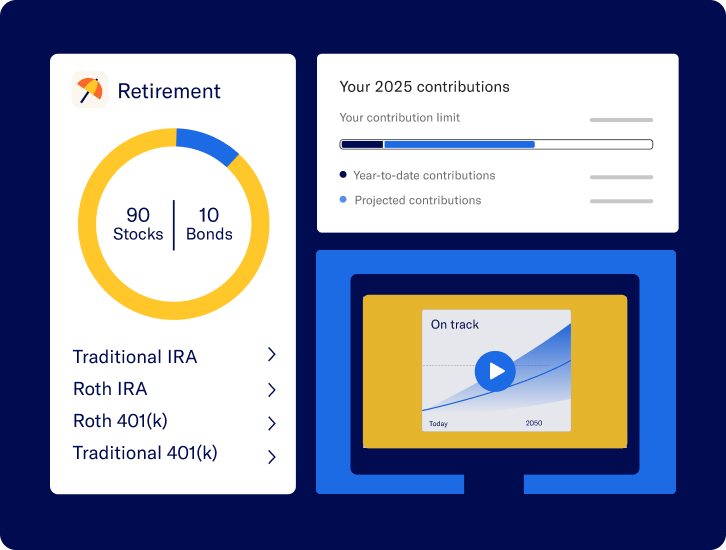

Leverage our proven track record to deliver a better retirement plan. Provide everything from expert-built, curated portfolios to customizable investment options, giving employees the flexibility to save on their terms.

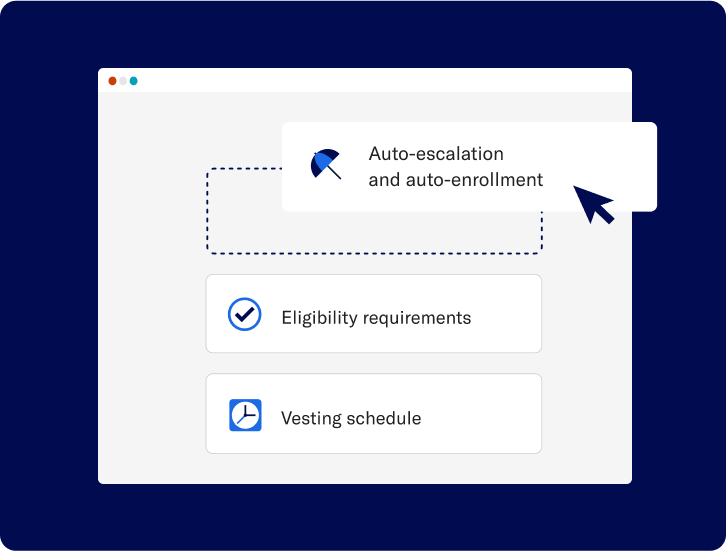

Design a plan that fits your needs, from auto-escalation and auto-enrollment to eligibility requirements, vesting schedule, profit sharing—and much more.

Trade compliance complexity for certainty with our team of specialists who handle annual testing, calculate contributions, and prepare signature-ready Form 5500 to help your plan stay compliant.

Employees can access a wealth of educational resources, including videos, webinars, and articles to answer questions and help them level up their finances. We also engage employees with in-app retirement advice and customized emails covering a range of 401(k)-related topics.

Dedicated service and expert operational support.

Ongoing support for plan sponsors

Employee support team

Specialists are available via call, email, or chat to resolve the specific needs of employees.

An onboarding specialist by your side

Quickly set up your new or conversion plan with support from a dedicated onboarding specialist.

350+ payroll integrations.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Everything was easy: setup. Payroll integration. Compliance. I was surprised at how easy a 401(k) could be. We needed a modern 401(k) option. We moved to Betterment once their 401(k) product was available in MA. Personally, I have been using Betterment since 2018, so I was familiar with how things worked. I was happy when we migrated both our payroll to a new provider (Gusto) and 401(k) from ADP to Betterment. That was a lot to take on at one time, but Betterment was easy to get set up."

"Very easy to manage 401k plan for small business. This was a great decision for our small business. Betterment integrates with our payroll service so it is easy to setup and manage. Our employees love having the retirement benefit and it makes our small business more attractive when hiring new employees.Our small business is just big enough to be required to offer a retirement benefit, but not big enough to have a dedicated staff member to set it up and manage it. As the CEO, I found it very easy to set up and maintain for current, and new, employees."

"Betterment is easy to use, reasonably priced, and provides a great benefit for our businessBetterment is easy to manage as a business owner, is good value for the money, connects to our payroll platform, and provides a variety of investment and matching options for our employees. I love that it integrates with Gusto, our payroll provider, so it's super easy to use. It's easy to set up matching within Betterment, and they give good reminders about compliance tasks."

"Great for those who aren't experts!I handle HR for our company and am not too familiar with 401K platforms. Betterment is very user friendly and their system is very smart. I also appreciate that their customer service is quick to answer and help ( with a real human! ) Our employees have positive things to say as well, it seems to be user friendly both on the employee and the employer side.It allows us to have a more competitive benefit package to offer our employees. This benefits us with retention and recruiting."

"The Best User-Friendly Benefits Provider. Sure, other providers can go very in-depth (to the point where not everything is clear at first glance), but Betterment can accomplish the same tasks in an efficient and easy-to-understand manner."

All-in pricing with no hidden fees.

-

Control plan eligibility.

Decide who can participate or be excluded from your plan, like seasonal or part-time workers. -

Automatic force outs.

Automatically remove terminated employees with low balances from your plan. -

Fee flexibility.

Decide what employees pay for and what your business covers. Transfer certain plan expenses back to former employees. -

Only pay for active participants.

Reduce fees by only paying for participants who fund their 401(k)s.

Still have questions?

We have answers.

-

FAQs

Get instant answers to common questions.

-

Book a demo

Get a demonstration of our 401(k)

in action. -

Resources

Go in-depth on specific topics.

-

What is Betterment at Work?

Learn more about what we have to offer.