Most like target-date funds Curated, expert-built portfolios.

Diversified exchange-traded fund (ETF) portfolios offer a more personalized glide path than traditional target-date funds. Employees can invest in what interests them, from sustainability to innovative technology.

Most like a fund lineup Build-your-own portfolios.

Flexible fund allocations allow employees to adjust their investments to match their individual risk tolerance. They can adjust their portfolio over time and we’ll provide guidance by rating the diversification and relative risk.

Custom plan menu Bespoke investments.

Advisors can access nearly 10,000 ETFs, mutual funds, and target-date funds backed by our portfolio management capabilities. Our open architecture platform can be leveraged to create a specific fund-lineup based on your employees’ needs.

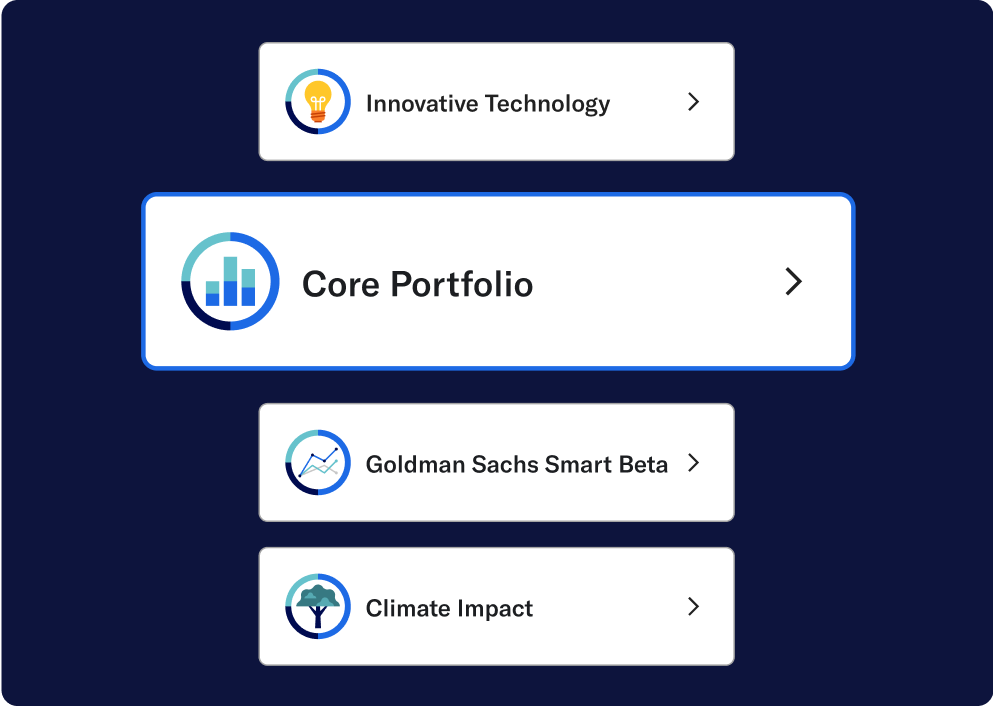

Explore our curated portfolio options.

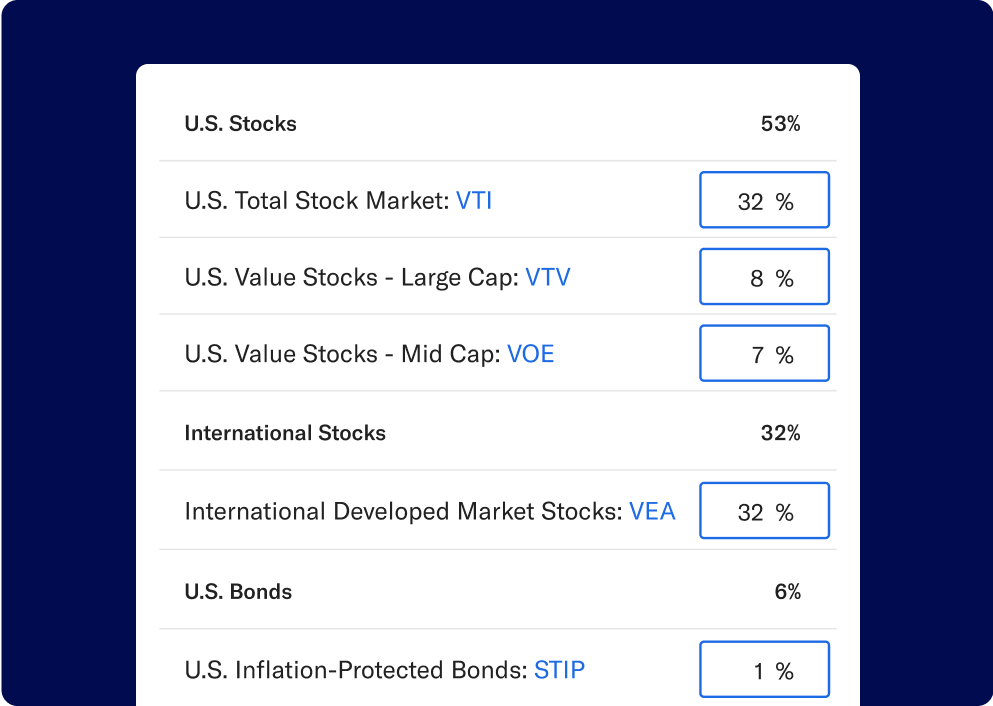

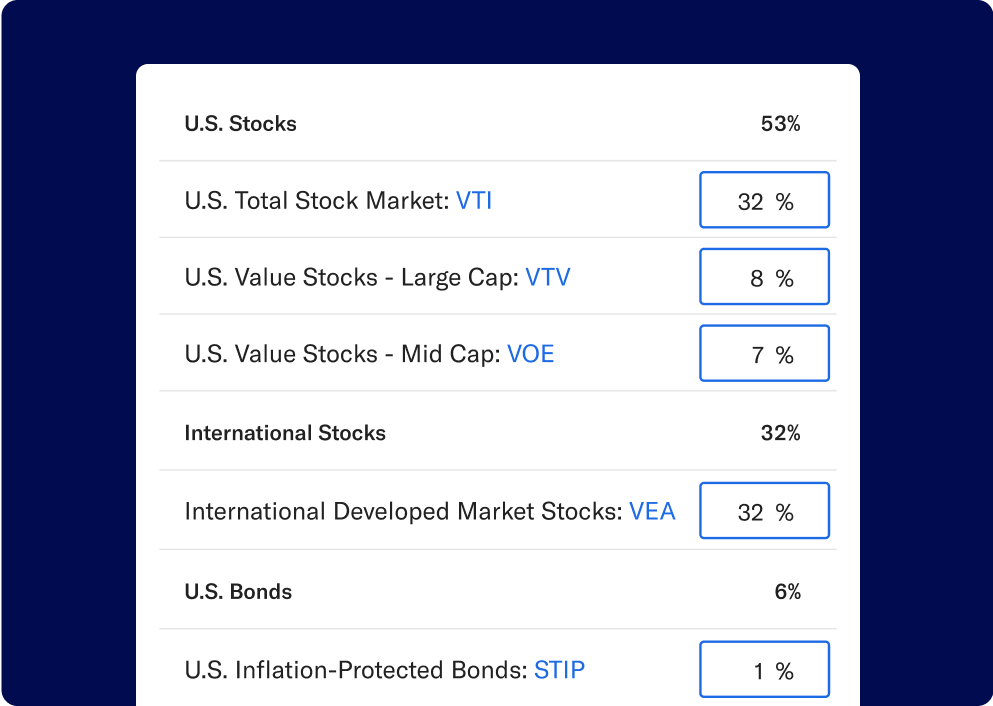

Core

Well-diversified, low-cost, and built for long-term investing. Features a broad collection of exchange-traded funds (ETFs) made of thousands of stocks and bonds from around the world.

Innovative Technology

A well-diversified portfolio focused on high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology along with increased exposure to risk.

Broad Impact

Invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria without compromising potential long-term performance.

Climate Impact

Invests in companies with lower carbon emissions and the funding of green projects while still helping you achieve potential long-term growth.

Social Impact

Provides broad diversified exposure with a greater focus on companies actively working toward minority empowerment and gender diversity as part of your long-term strategy.

Goldman Sachs Smart Beta

Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, but with higher exposure to risk.

BlackRock Target Income

A 100% bond portfolio with different income yields to help protect you against stock market volatility.

Value Tilt

Invest in a globally diverse portfolio that tilts toward undervalued U.S. companies, for investors who understand the potential benefits and risks of investing more heavily in value stocks.

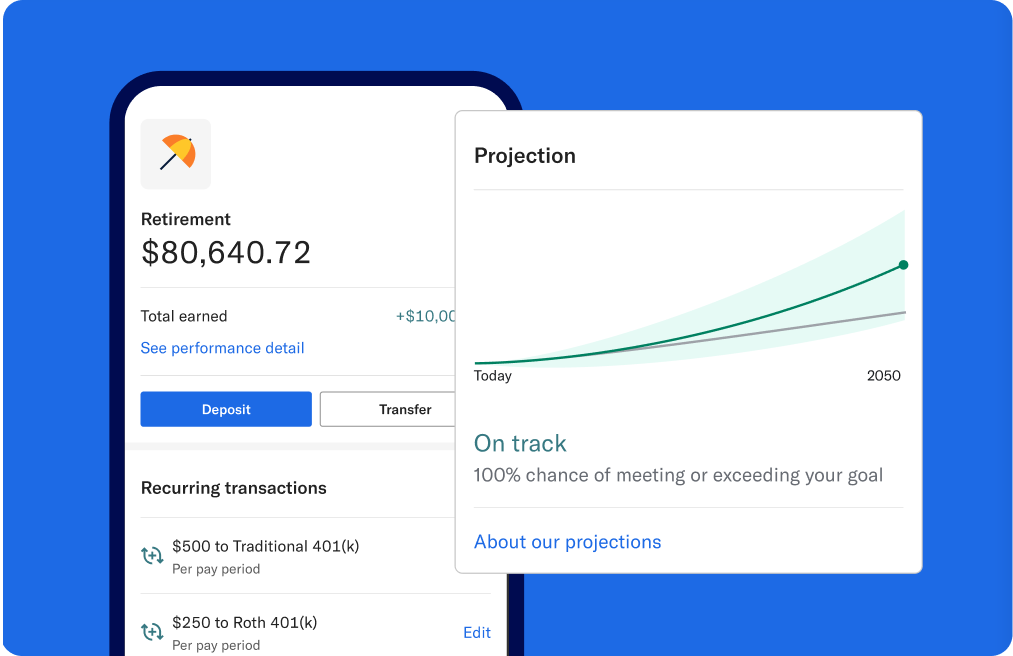

Investing backed by technology to support your employees.

Risk management through rebalancing

Tax-efficient investing