What’s new from Betterment Advisor Solutions

Explore the latest updates designed to give you more control, transparency, and efficiency across your workflows.

Table of contents

Portfolio management

- NEW: Tax impact preview when you adjust rebalancing and drift settings

- The 2026 T3/Inside Information Software Survey

- Position-level trading

Advisor experience

Retirement

Top content

- Generational approaches to modern advisory services

- Scaling tax efficiency for every household in 2026

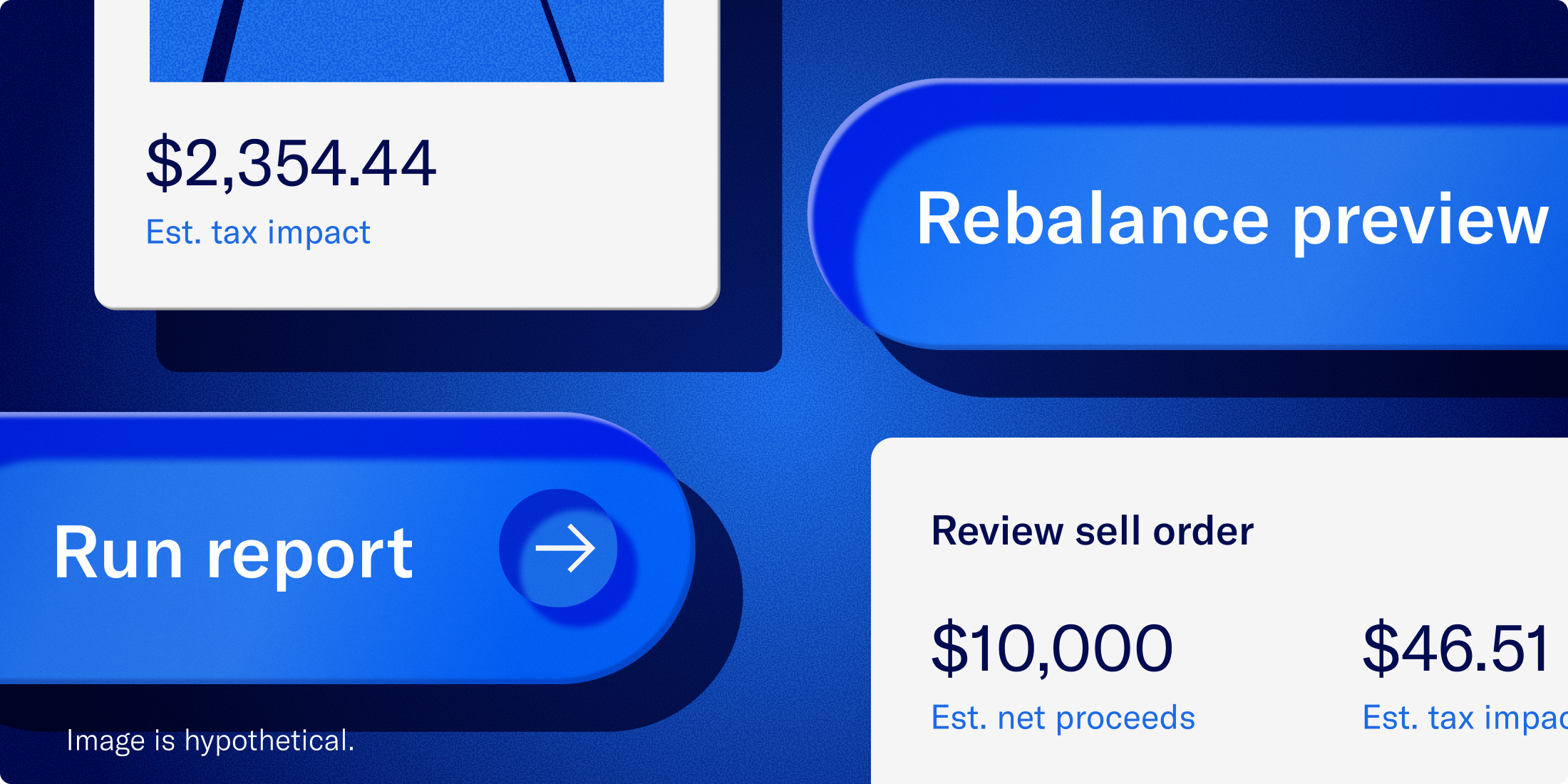

See the tax impact before you act

Evaluate the tax impact of portfolio changes before rebalancing—now integrated into more actions than ever.

In addition to showing up after a triggered rebalance, the rebalancing preview gives you a clear view of how adjusting rebalancing or drift thresholds may affect clients’ realized gains or losses, so you can act with confidence. The preview screen lets you view:

- Estimated short- and long-term gains

- Wash-sale warnings

- Projected trades

Shape the future of advisor technology

The annual T3/Inside Information Software Survey is live, and Betterment Advisor Solutions has been included in the trading, rebalancing, and tax-loss harvesting software category. This year, we’ve made tax efficiency even simpler for you and your clients—and we’d love to hear your thoughts.

Coming soon: Trade exact positions with ease

Quickly buy or sell specific stocks, ETFs, or mutual funds right from the platform to maintain alignment with each client’s long-term strategy. Trade positions to streamline transitions, offload legacy holdings, and move clients into investments that better fit your model. It’s a fast, efficient way to keep portfolios consistent, clean, and easy to manage at scale.

To come in 2026: Direct Indexing and UMAs, along with additional capabilities.

We heard your feedback, and have refreshed the advisor dashboard to make client management faster, clearer, and more aligned with how you work. Take a look:

We heard your feedback, and have refreshed the advisor dashboard to make client management faster, clearer, and more aligned with how you work. Take a look:

- Enhanced Household page: Get a consolidated view of all accounts and household performance. No more toggling or scrolling—just faster visibility across every relationship.

- NEW: Account Overview page: Access deeper insight with a single click. You can now view a detailed breakdown of holdings, allocation, drift, and other portfolio insights directly from your dashboard.

Together, these updates make it easier to manage portfolios at the household level, helping you move quickly from insight to client action.

Deliver more meaningful plan insights with improved reporting

Deliver more meaningful plan insights with improved reporting

Spend less time interpreting reports and more time advising. With improved navigation, expanded data fields, and faster access to trade information, it’s easier to provide the clarity sponsors expect.

These improvements can help you keep every plan stakeholder aligned, reduce back-and-forth, and provide reports that are simpler to interpret at a glance.

Discover all available reports

The state of retirement readiness in 2025

This year’s Retirement Readiness Report uncovers a striking contrast: Employees feel more financially stressed, yet more “retirement ready” than before—a disconnect that shapes how they show up at work.

This year’s Retirement Readiness Report uncovers a striking contrast: Employees feel more financially stressed, yet more “retirement ready” than before—a disconnect that shapes how they show up at work.

The report highlights 11 key insights about how workers save, spend, and engage with benefits. Advisors can use these findings to help plan sponsors strengthen both long-term retirement readiness and short-term financial wellness.

Generational approaches to modern advisory services

Generational approaches to modern advisory services

Our latest Advisor Survey highlights how RIAs are adapting to a rapidly changing landscape. Gen Z, Millennial, Gen X, and Baby Boomer clients all bring different expectations around communication, technology, and financial guidance.

Our latest Advisor Survey highlights how RIAs are adapting to a rapidly changing landscape. Gen Z, Millennial, Gen X, and Baby Boomer clients all bring different expectations around communication, technology, and financial guidance.

You’ll find insights on shifting workflows and the rise of tech-forward advisory models, as firms blend automation, AI, and personalized service to meet clients where they are.

Your 2026 tax game plan: From optimization to scale

In our upcoming webinar, Betterment thought leaders discuss how leading firms are systematizing tax efficiency at scale. Get practical ways to extend after-tax value across every household using Betterment’s automated portfolio management tools.

In our upcoming webinar, Betterment thought leaders discuss how leading firms are systematizing tax efficiency at scale. Get practical ways to extend after-tax value across every household using Betterment’s automated portfolio management tools.

If you’d like to take a look around with someone from our team, book a demo.