Tax tools built to exceed expectations.

Gain a competitive edge with automated tax-loss harvesting for every portfolio, using secondary tickers to keep clients in the right allocation while maximizing loss-harvesting benefits. For the majority of clients using TLH, estimated tax savings alone covered Betterment platform fees.

Based on Betterment clients with TLH enabled and platform fees incurred; excludes others. Reflects full account history, which varies by user. Estimated tax savings are illustrative and based on current tax rates—actual results may vary. Not guaranteed. Consult a tax advisor.

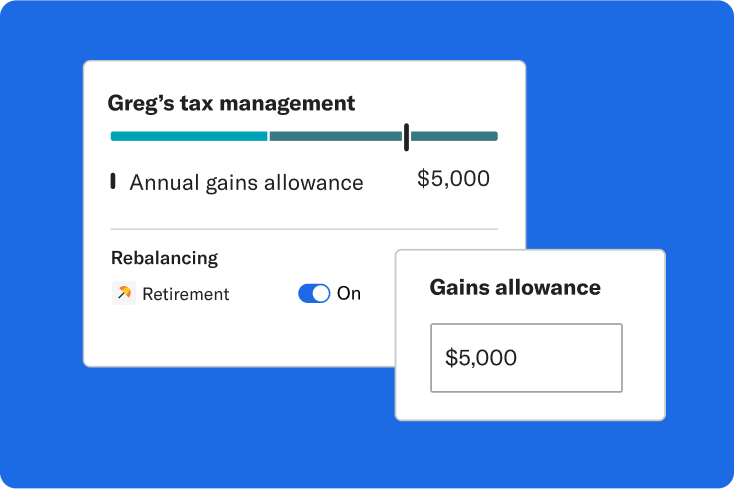

Keep portfolios on track with custom drift thresholds and the flexibility to turn drift-based rebalancing on or off as needed.

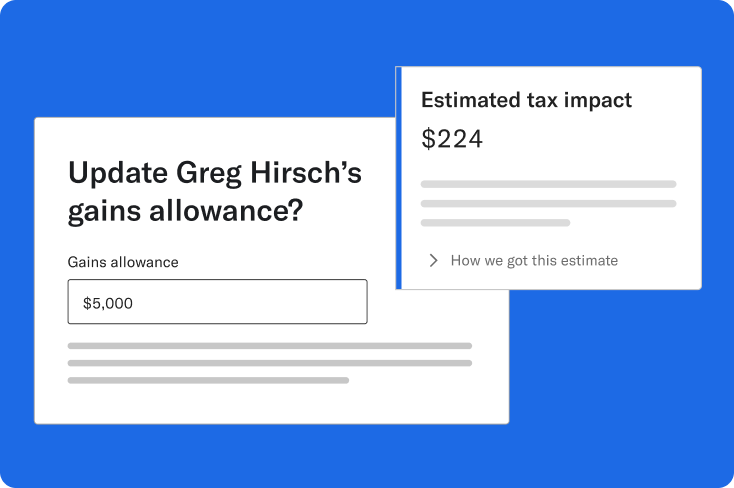

Set a capital gains budget and unwind your clients’ legacy securities over time. You can choose from three tax-aware migration strategies to complete a transition.

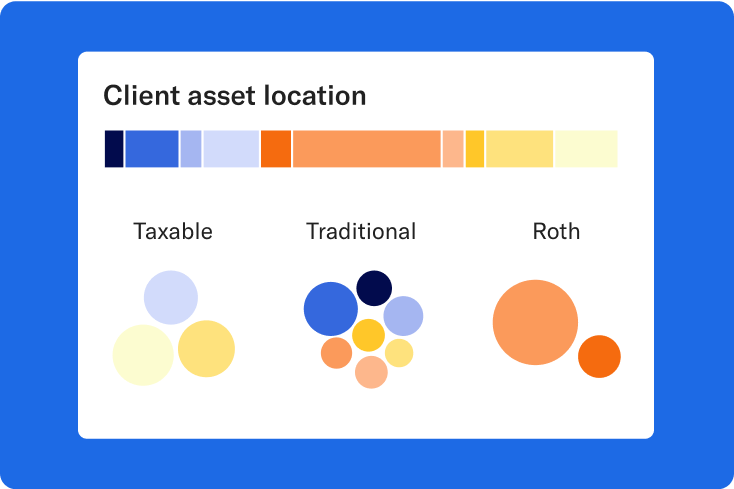

Deliver better client outcomes by combining traditional rebalancing with strategies to optimize tax efficiency across multiple accounts—all with a single click.

Help lower your clients’ tax bills with a tax minimization algorithm that ensures all securities sales are as tax-efficient as possible.