The key factors holding back your employees’ retirement readiness

And how the types of benefits you offer can help.

Broadly speaking, the economy did alright in 2023. Inflation slowed, stocks rallied, and employment remained strong.

But you wouldn’t know it by looking at the current mood of American workers. According to our latest annual survey of 1,000 full-time employees, their levels of financial wellness trended down in 2023 at the same time their financial anxiety climbed by seven percentage points.

So what gives? We sifted through the data and saw several trendlines emerge. Explore them in full detail in our Retirement Readiness annual report – and keep reading below for a preview.

Inflation’s ripple effect on retirement

Inflation slowed significantly in 2023, but that’s not to say that all prices fell. The average American household spent $709 more per month in 2023 compared to 2021 on things like rent, groceries, and gas. Until wage growth catches back up to inflation, workers will continue to feel their paychecks pinched, and two casualties are taking shape as a result:

- Emergency funds: Although more than half (52%) of employees reported currently having an emergency fund, that’s a 7% drop from 2022, and 14% decrease from 2021.

- Retirement savings: A worrisome 3 in 10 workers tapped into retirement savings in the past year to pay for short-term expenses, a significant setback for their long-term goals.

All of this has left workers feeling stressed. More than half (58%) went so far as to say the anxiety makes it hard for them to focus at work. But our research shows that some employer support and benefits can go a long way toward calming the waters.

The growing role of financial benefits in retention

If short-term expenses are depleting workers’ savings, it’s no surprise that a strong 401(k) and financial wellness benefits program remains at the top of workers’ wish lists. The importance of these benefits continues to grow as well, with 70% of workers saying financial wellness benefits are more important now than a year ago. A growing percentage of workers (60%) even say they’d be enticed to leave their job for better financial benefits.

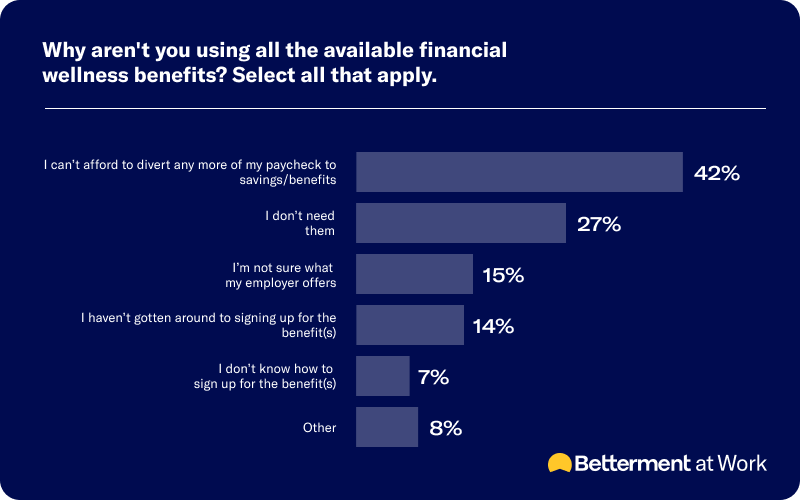

Student loan debt, however, continues to prevent the adoption of financial benefits for many. 64% of workers said student loan debt impacts their ability to save for retirement, and when asked why they don’t take advantage of their employer’s benefits, by far the most common reason was their paycheck simply won’t stretch that far.

On this front, good news is just around the corner. Thanks to the SECURE 2.0 Act, employers will soon be able to offer a 401(k) match on their employees’ qualifying student loan payments, helping workers tackle two goals at once.