Level up your investing strategy

Whether you want to build a budget, pay off debt, or invest in new goals, we’ve got you covered with expert-backed resources and insights.

← Financial planning hub Level up your investing strategy

Explore sophisticated tools and expert guidance to help you grow your savings and build the retirement you deserve.

Haven’t claimed your 401(k) account yet? Get started now

Featured articles

Maximize your 401K

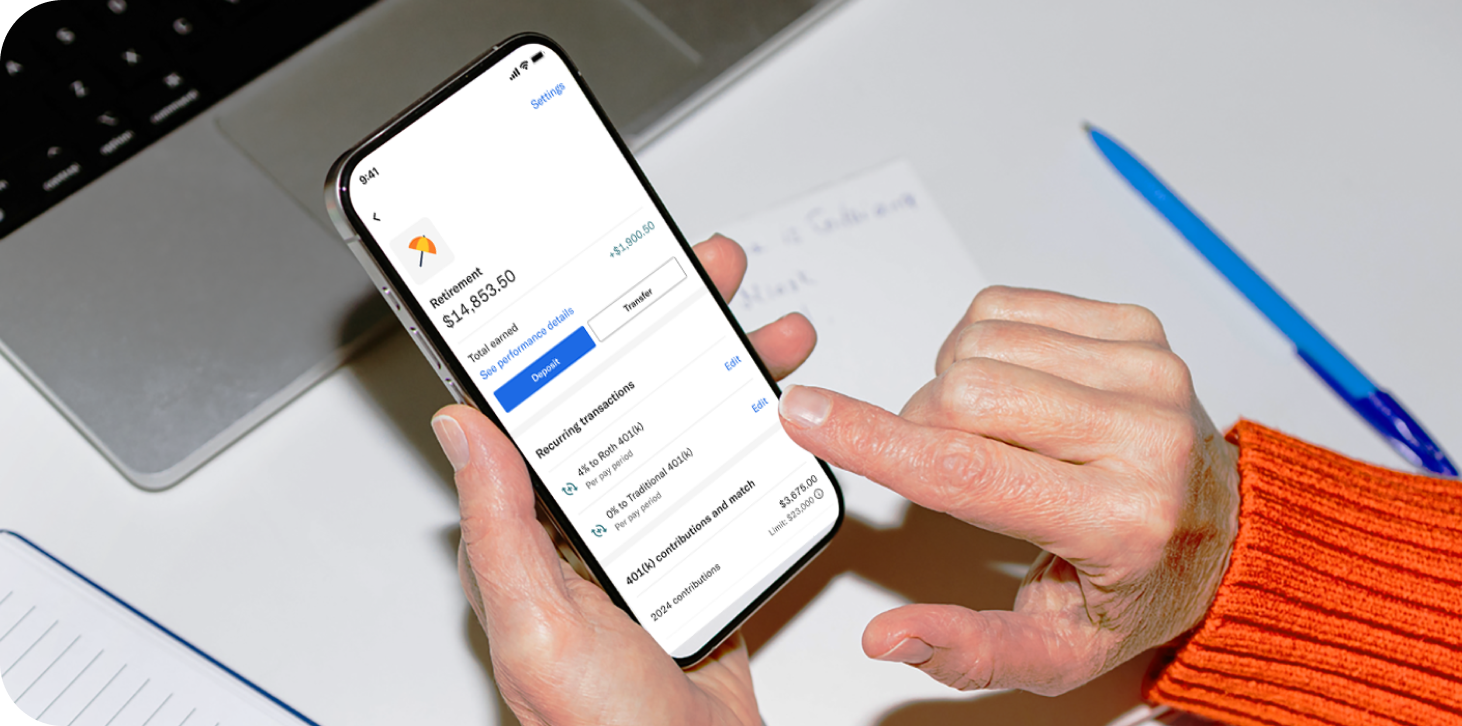

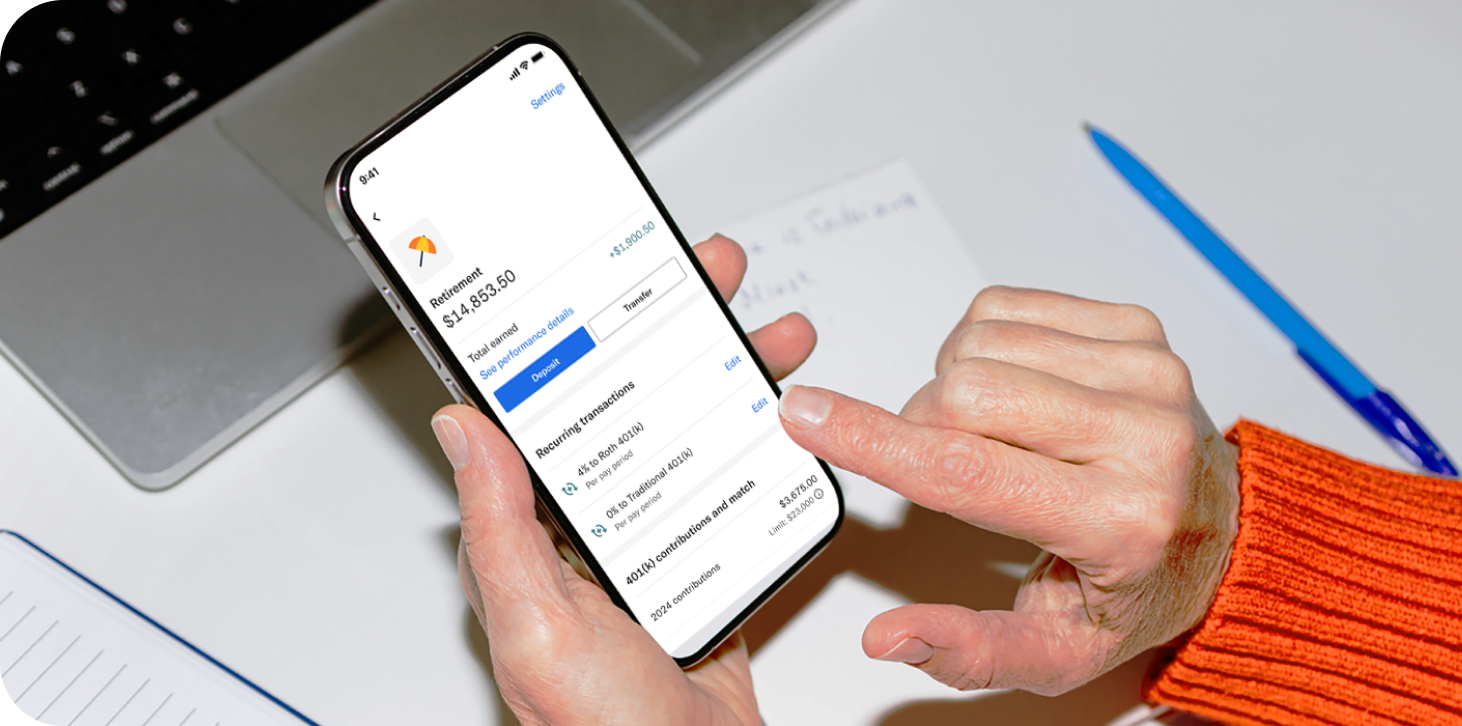

Getting started with your Betterment 401(k) Your employer chose Betterment as its 401(k) provider - so come on in and be invested for your future. Traveling around the world. Taking up a new hobby. Spending more time with family and friends. Whatever your retirement dreams are, a 401(k) can help you make them a reality. And luckily for you, your employer chose Betterment to manage its 401(k) plan. Top 3 perks of a 401(k) Participating in your employer’s 401(k) plan is a good idea for many reasons – here are the top three. With a 401(k), you can: Contribute via convenient, automatic payroll deductions (one less thing to think about!). Save on taxes, whether those savings happen today with a traditional 401(k) or at retirement with a Roth 401(k) (and the cool thing is that you can use both!). Invest more than with other retirement vehicles (individual retirement accounts (IRAs) have lower caps on how much you can put in). All said, saving for retirement with a 401(k) is basically a no-brainer. Without a regular paycheck in retirement, you’re going to rely on your own savings. And we’re not talking about cash-under-the-mattress savings or even safe-in-the-bank savings - but invested savings, which is what you get with a 401(k). (Why is it so critical to invest for long-term goals, rather than simply saving money in the bank? To tackle one word: Inflation.) Top Betterment features Betterment offers several features to help you pursue your retirement goals: Goal based – Your 401(k) will automatically be a “Retirement” goal on the Betterment platform (you could add additional goals for other things if you want). Our goal-based platform looks at your timeline until retirement and the desired amount you want to save, to help you invest in an expert-built portfolio. Low cost – Our approach uses low-cost exchange-traded funds (ETFs) so more of your money stays invested in your account. High tech –Certain portfolio strategies and goal types are automatically rebalanced and adjusted over time, and our tax-smart tools are available to you at no added management fee. Personalized – Betterment helps you work towards your long- and short-term financial goals with personalized advice. It’s easy to get started Betterment will contact you via email to set up your account via a secure link that’s unique to you. If you haven’t received an invitation from us to set up your account, please contact us. Once you’ve set up your account, be sure to set a contribution rate to help you pursue your goals (although starting with anything is far better than nothing!) and you’ll want to initiate a rollover of any old 401(k)s into your new Betterment 401(k). Were you automatically enrolled in your plan? If so, you still need to set up your account with a username and password. If your employer has determined an automatic contribution rate for your organization, know that you can adjust this in your account at any time. Betterment strives to make saving and investing for retirement easy. But we know you still might have questions, so we’re here to help: Explore our 401(k) employee resources Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET

Getting started with your Betterment 401(k) Your employer chose Betterment as its 401(k) provider - so come on in and be invested for your future. Traveling around the world. Taking up a new hobby. Spending more time with family and friends. Whatever your retirement dreams are, a 401(k) can help you make them a reality. And luckily for you, your employer chose Betterment to manage its 401(k) plan. Top 3 perks of a 401(k) Participating in your employer’s 401(k) plan is a good idea for many reasons – here are the top three. With a 401(k), you can: Contribute via convenient, automatic payroll deductions (one less thing to think about!). Save on taxes, whether those savings happen today with a traditional 401(k) or at retirement with a Roth 401(k) (and the cool thing is that you can use both!). Invest more than with other retirement vehicles (individual retirement accounts (IRAs) have lower caps on how much you can put in). All said, saving for retirement with a 401(k) is basically a no-brainer. Without a regular paycheck in retirement, you’re going to rely on your own savings. And we’re not talking about cash-under-the-mattress savings or even safe-in-the-bank savings - but invested savings, which is what you get with a 401(k). (Why is it so critical to invest for long-term goals, rather than simply saving money in the bank? To tackle one word: Inflation.) Top Betterment features Betterment offers several features to help you pursue your retirement goals: Goal based – Your 401(k) will automatically be a “Retirement” goal on the Betterment platform (you could add additional goals for other things if you want). Our goal-based platform looks at your timeline until retirement and the desired amount you want to save, to help you invest in an expert-built portfolio. Low cost – Our approach uses low-cost exchange-traded funds (ETFs) so more of your money stays invested in your account. High tech –Certain portfolio strategies and goal types are automatically rebalanced and adjusted over time, and our tax-smart tools are available to you at no added management fee. Personalized – Betterment helps you work towards your long- and short-term financial goals with personalized advice. It’s easy to get started Betterment will contact you via email to set up your account via a secure link that’s unique to you. If you haven’t received an invitation from us to set up your account, please contact us. Once you’ve set up your account, be sure to set a contribution rate to help you pursue your goals (although starting with anything is far better than nothing!) and you’ll want to initiate a rollover of any old 401(k)s into your new Betterment 401(k). Were you automatically enrolled in your plan? If so, you still need to set up your account with a username and password. If your employer has determined an automatic contribution rate for your organization, know that you can adjust this in your account at any time. Betterment strives to make saving and investing for retirement easy. But we know you still might have questions, so we’re here to help: Explore our 401(k) employee resources Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET

Strategies for your 401k contribution rate: Front-loading versus Dollar cost averaging

Investing tools [PDF]

Beyond the 401(k): strategies for building long-term wealth

How an IRA can fit into your investment strategy

Why diversify outside of the US? The outperformance of US stocks in recent history has led some investors to question whether they should invest outside the US at all, yet there remains compelling reasons to diversify globally. US investors often think of the S&P 500 Index (an index of the largest companies in the US by market capitalization) when referring to the performance of the stock market. This is not surprising to hear as most US based investors exhibit a “home bias”, where they focus their investing domestically and less on international. In a Vanguard 2020 study, households they surveyed had 81% of their portfolio allocations invested in the US. On top of that, US stocks have set a high bar for performance globally, outpacing the gains in stocks across Europe, Japan, and emerging markets over the last decade. It’s become natural to ask, “Can’t I get better returns just sticking with US stocks? Why would my Betterment portfolio have any allocation to companies outside of the US?” Currently, Betterment’s Core portfolio strategy in the 100% stock allocation has a target allocation of more than 40% in international equities. Below, this piece will cover reasons diversifying internationally makes sense, including: The global market portfolio is a starting point for asset allocation There’s no guarantee that US stocks will continue to outperform Diversification creates the potential for more consistent returns Investing in the global market portfolio The short answer is that Betterment constructs all of our portfolios to be representative of the makeup of global investable assets as a whole, and you’ll find that around 40% of the world’s equity assets are invested outside of the US. International investments play an important role in reducing the risk of concentration in any one particular country within your portfolio. There’s no guarantee of continued US outperformance We’ve all heard the phrase “past performance is not indicative of future results.” For instance, stocks of one region can string together multiple years of outperformance relative to others before that trend reverses and it enters a period of underperformance. The chart below illustrates this tug of war between US and international developed stocks. While the outperformance experienced by US stocks over the last decade is striking, international developed stocks dominated in the wake of the dot com bubble in the decade before that. “International stocks” is represented by the MSCI EAFE Index. “US stocks” is represented by the MSCI US Index. Past performance is not indicative of future results. You cannot invest directly in the index. Going back further into history, in the ‘80s international developed stocks actually outperformed US stocks to the same extent that US stocks have outperformed since 2009. We believe, and many on Wall Street will admit, that trying to time these cycles can be extremely difficult and a more consistent return may be achieved by holding exposure to each geographical region’s stocks over the long-term. Before US stocks’ strong run in recent history, investors may have been tempted to allocate more to emerging market stocks based on their momentum during the 2000s. Emerging market stocks had higher returns than US equities in eight of the ten years before 2011. If an investor piled into emerging market stocks in 2011 because of their decade long track record of outperformance, they would have largely missed out on the strong gains in the US over the following 10 years. There also may be reason to believe that markets outside the US have the potential to post strong gains over the next decade. Based on certain valuation metrics, US stocks appear more expensive than their global peers. For example, companies in places such as emerging markets source much of their revenue from quickly growing economies, which may enhance profitability in the future. Diversification helps avoid drawdowns and creates the potential for consistent returns International markets are not perfectly correlated with the US, meaning they do not move in lockstep. Allocating to markets around the world therefore promotes diversification, helping buffer portfolios from the heightened volatility of individual markets. The chart below ranks the returns of Betterment’s tenured Core portfolio strategy against different regions and asset classes across calendar years, illustrating diversification in action. The Core portfolio, with a 90% allocation to stocks and 10% allocation to bonds, consistently avoided losses compared to the poorest performing assets of recent history. This was also evident in 2020 where diversification provided downside protection as the US fell into a short recession and battled a pandemic. Investors focused on using the S&P 500 Index to benchmark performance will highlight that the index outperformed our Core portfolio in the time periods displayed. And while the strength of the US market is undeniable, it is important to not overlook the fact that our Core portfolio still has a sizable allocation to the US. Having a strategic, well-diversified portfolio allows investors to obtain exposure to not only markets that outperform like the US, but also to international stock markets and other asset classes that can dampen the downside in years where US stocks underperform. S&P 500” (US Large Caps) is represented by the S&P 500 Index. “EM” (emerging markets) is represented by the MSCI Emerging Markets Index. “US Small Caps” is represented by the Russell 2000 Index. “EAFE” (international developed markets) is represented by the MSCI EAFE Index. “US REITs” is represented by the MSCI US REIT Index. “US High Yield” is represented by the Bloomberg US Corporate High Yield Index. “Global Agg bonds” is represented by the Bloomberg Barclays Global Aggregate Bond Index. “Commodities” is represented by the Bloomberg Commodity Index. “BMT Core 90/10” represents the Betterment Core Portfolio strategy in the 90% stocks/ 10% bonds taxable allocation. Performance information for the Betterment allocation is based on the time-weighted returns of Betterment taxable portfolios with primary tickers that are at the target allocation every market day (this assumes portfolios are rebalanced daily at market closing prices). Dividends are assumed to be reinvested in the fund from which the dividend was distributed. Betterment allocations reflect portfolio holdings as of periods stated and include an annual 0.25% management fee. This does not include deposits or withdrawals over the performance period. These allocations are not representative of the performance of any actual Betterment account and actual client experience may vary because of factors including, individual deposits and withdrawals, secondary tickers associated with tax loss harvesting, allowed portfolio drift, transactions that do not occur at close of day prices, and differences in holdings between IRA and taxable portfolios. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Market conditions can and will impact performance. Past performance is not indicative of future results. Market performance information is based on the returns of indexes tracked by Betterment, using returns data from sources and time periods listed. Performance is provided for illustrative purposes to represent broad market returns for asset classes that may not be used in all Betterment portfolios. The asset class performance is not attributable to any actual Betterment portfolio nor does it reflect any specific Betterment performance. As such, it is not net of any management fees. The performance of specific funds used for each asset class in the Betterment portfolio will differ from the performance of the broad market index returns reflected here. Past performance is not indicative of future results. You cannot invest directly in the index. At Betterment, we build portfolios and provide advice on portfolio allocations that should be suitable for each investor’s risk tolerance to help them reach their investment goals. Diversifying across stock markets, whether in the US or elsewhere in the world, helps in that continuous effort. It may be tempting to chase the high returns that US stocks have posted in recent history, anticipating that the US equity market will continue to outperform, but investors should recognize that future outperformance is near impossible to predict and that they should position themselves for a wide range of possible outcomes accordingly. This is why as a foundation of Betterment’s portfolio construction process, we start with a diversified global market portfolio.

How to transform your HSA into the ultimate investment vehicle

Get to know your portfolio options Betterment helps take the stress out of investing with a range of expert-built portfolio options, made of generally low-cost ETFs (exchange-traded funds). Given the breadth of available choices, it’s natural to wonder which portfolio is right for your financial situation. The good news is each option has been designed to help investors, like you, reach their financial goals. While all of our portfolios combining stocks and bonds possess similar expected risk and return profiles, Betterment will recommend an investment allocation for you, based on the time horizon and goal type you select. You can also adjust your diversification and risk preferences. For most portfolios that hold both stocks and bonds, our “auto-adjust” feature systematically glides your portfolio(s) to a lower overall risk level as you get closer to, enter, and progress through retirement. This feature is very similar to a “glidepath,” which is found in target-date funds (TDFs). It’s great for those that want to “set it, and forget it.” With that, let’s review your portfolio options. Core Well-diversified, low-cost, and built for long-term investing, the Core portfolio features a broad collection of ETFs made of thousands of stocks and bonds from around the world. This is the default investment option for those who do not specify a portfolio strategy. Innovative Technology A well-diversified portfolio allocated similarly to the Core portfolio, but with a subset of stocks allocated to high-growth potential companies such as clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology. This comes with increased exposure to risk. Value Tilt A well-diversified portfolio allocated similarly to the Core portfolio, but with a subset of the stocks allocation focused on potentially undervalued U.S. companies, according to certain financial metrics. Broad Impact A well-diversified portfolio that invests in companies that rank highly on environmental, social, and corporate governance (ESG) criteria. Climate Impact A well-diversified portfolio that invests in companies working to lower carbon emissions, fund green projects, and divest from holders of fossil fuel reserves—while still designed for potential long-term growth. Social Impact A well-diversified portfolio that invests in companies actively working toward minority empowerment and gender diversity as part of its long-term strategy. Goldman Sachs Smart Beta Targets companies that have potential to outperform the broader market over the long term. Diverse and relatively low-cost, this portfolio comes with higher exposure to risk. BlackRock Target Income A 100% bond portfolio with different income yields to help protect you against stock market volatility. This portfolio option is more suitable for investors with shorter time horizons, or for those that are seeking to generate income. Flexible portfolio A Flexible portfolio gives you more control over your investments, and allows you to modify the individual asset class weights to best fit your preferences. We’ll provide guidance on the risk exposure and diversification of your portfolio, based on your adjustments. See when using a Flexible portfolio might be right for you. After you make a portfolio selection, Betterment will handle the rest. Here are some things to keep in mind: All portfolios benefit from auto-rebalancing, which returns the value of all allocated funds back to the target weight (after the portfolio drifts with market movements). Rebalancing may be subject to a drift threshold and account balance minimum. Although changing a portfolio’s asset allocation and fund selection can cause changes in the portfolio’s performance, Betterment has designed each portfolio to be suitable in terms of its riskiness and return potential for a given time horizon and level of risk. Which is to say, you should feel comfortable choosing a portfolio based on your convictions and values. If you’re uncertain where to start, the Betterment Core portfolio is a great way to go—and it is the portfolio used by the majority of Betterment users. Keep in mind: As your investment fiduciary, Betterment monitors market action and portfolio performance, and will periodically update asset allocation or include more cost-efficient underlying funds to help optimize your portfolio performance. We’re here to help you make decisions that bring your goals into focus, and be invested in your future.

-

How to invest during market highs Betterment experts weigh in on how to override anxiety, and be invested when the market climbs. While we invest for our own reasons, we get into the market to take advantage of potential price appreciation and income produced by financial assets. But anxiety can get the best of even the most eager investors. What if I buy when the market peaks, and then immediately declines? Sound familiar? As any investor knows, psychological aspects can cloud one’s judgment when it comes to money. We’re encouraged to minimize risk and maximize returns, whenever possible. So, a market that’s going up-up-up, can leave some investors feeling hesitant about paying premium prices—instead of opting for undervalued stocks, or lower price points. So how do we override the Fear of Purchasing at All-time Highs (or FOPAH, for short)? Is it best to dive in, or wait for a potential pullback? Our investment experts believe one of the best things you can do is face your fear, wading into the market. In practice, it can take a long time before that pullback comes, during which there may be further positive market returns. For instance, between 2012 and 2017, the S&P 500 did not experience a pullback greater than 12%. Oftentimes when a pullback does arrive, it’s not heralded as a positive outcome—but an ominous event, accompanied by scary headlines that spark new fears of further downturn. This can all lead to additional hesitancy around buying stocks. While there's no "perfect" time to invest, we can still be confident that choosing a diversified portfolio of investments is a smart way to help achieve long-term financial goals. To ease your fears, work out approximately how much time you’ll need to save up for your own goals. Long-term goals, like saving for college or a deposit on a house, can take time. And that’s a good thing! The longer your time horizon (the period of time you plan to keep your savings invested in the market), the more confident you can be that your money will grow by the point you want to withdraw it. Even if the market has already recently run up when you go to invest, a prolonged time horizon should help quell a pullback in the nearterm. Despite volatility, the stock market tends to trend upwards over longer periods. By maintaining a long-term perspective, you can position yourself to benefit from the market's long-term growth potential, which can outweigh short-term losses. Dating back to 1988, if you decided to invest on any given trading day, 65% of those days would have resulted in a positive investment return over the following month. The share of days with positive returns goes up as that trailing holding period extends. Historically, no matter when an investment was made between 1988 and 2009, the market was higher 100% the time just 15 years later. Short-term goals, like saving for a vacation or a home reno, have a shorter time horizon—meaning your money has less time to grow in the market. However, it's worth remembering that historically, investing at all-time highs has not resulted in lower future returns compared to investing on any other given day. After the S&P 500 reaches an all-time high, average returns tend to be slightly higher than during periods when the index has not soared so high. Practical steps to help ease your anxiety: Set up recurring deposits: When you commit to investing a fixed amount of money at set intervals over time, your losses could potentially be smaller if the market does dive in the near term. Plus, you will still have cash ready to buy at lower prices. While this comes with the risk of later buying at higher prices, it can help override the emotional pressure of trying to time the market. Diversify: Consider adding other asset classes, regions, and company sizes in your portfolio (as we do at Betterment). Our automated portfolio rebalancing is designed to maintain your investment portfolio's target asset allocation over time. Betterment continuously monitors your portfolio to see if the current allocation deviates from your target allocation—due to market fluctuations or changes in the value of your investments. Our auto-adjust feature can also help right-size the risk level of your portfolio by reducing the share of the portfolio allocated to more volatile stocks, and increasing the share allocated to bonds as your time horizon shortens.

Most watched

Keep the momentum going with these smart money moves

-

Adjust your 401(k) contributions

-

Roll over an old retirement account to Betterment

-

Open a Roth 401(k)

-

Explore the Personal Retirement Planner

-

Add beneficiaries to your 401(k)

-

Open an IRA