An affordable, easy-to-manage platform with you in mind.

-

Transparent Pricing

We'll create a pricing plan that scales with your business. Our pricing structure unbundles key offerings and assigns a fee to each service. -

Easy to set up and maintain

Our guided onboarding gets your plan up and running quickly, and our simplified administration makes your plan easy to maintain. -

Integrated financial picture

Our intuitive Betterment investment platform ensures that employees can get advice on all of their financial goals, all in one place. -

Expert advice

Betterment provides 3(16) and 3(38) support and consultation to help you manage all aspects of your plan.

350+ payroll integrations.

We sync with top payroll providers and can create custom integrations to help automate away 401(k) hassle. See all our payroll integrations.

_

_

_

_

_

_

_

_

_

Apex, Paychex, and UltiPro are 3rd-party-facilitated integrations. All logos above are trademarks of their respective companies.

Helping employees make the most of their retirement savings.

We guide employees through a personalized retirement plan, with recommendations on how much to save and which accounts to use. They can set realistic goals for retirement and can set up additional goals if they’re saving for something else.

401(k) plans designed to fit your needs.

-

Traditional 401(k) and Roth 401(k)

Let your employees decide when to pay income taxes on amounts contributed. -

Safe Harbor 401(k)

Remove the uncertainties around 401(k) compliance testing. -

Automatic enrollment

Help more employees save for their 401(k) and potentially increase the size of their retirement account more quickly. -

Profit-sharing

Retain flexibility associated with your employer contribution.

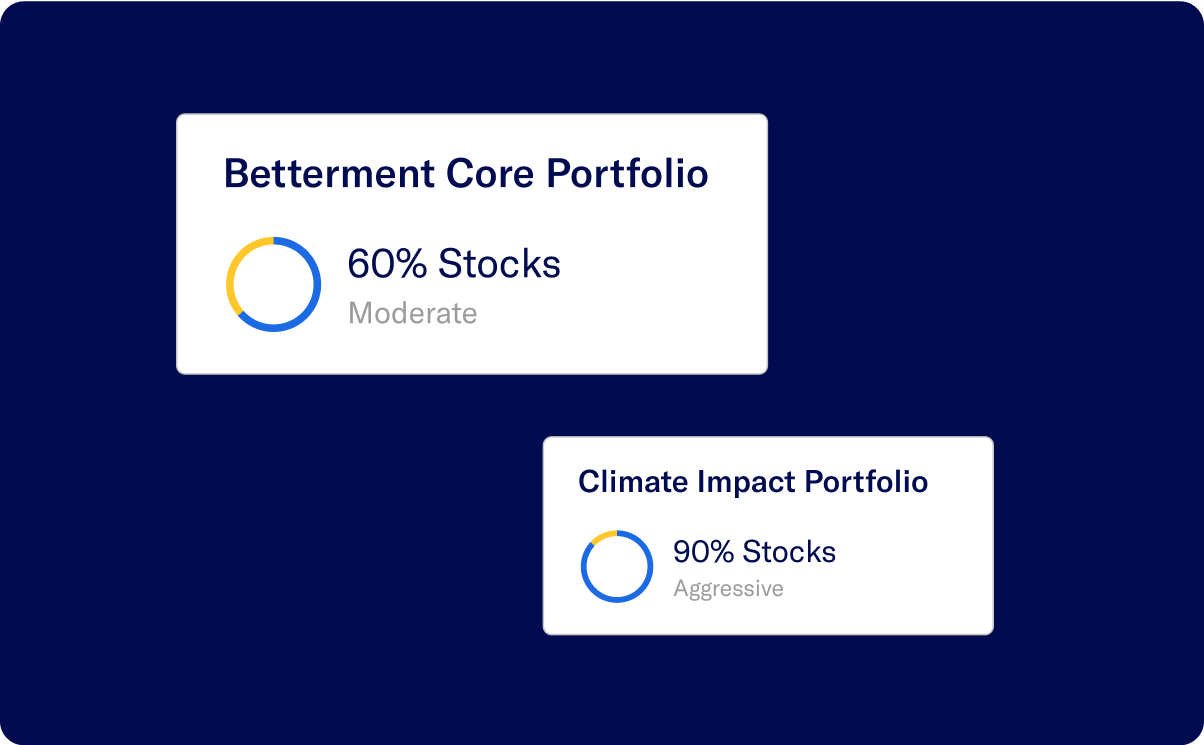

More robust investments.

Low costs don't mean making compromises on the investments your employees have access to. We offer personalized and customizable investment solutions, including a socially responsible portfolio, and comprehensive advice.