How Betterment’s expanded model marketplace helps advisors scale

Betterment’s expanded model marketplace pairs expert-built strategies with tax-smart automation to help advisors customize portfolios and scale efficiently.

Key takeaways

As advisory firms grow, model portfolios help standardize portfolio execution without sacrificing advisor control.

Expanding the model marketplace gives advisors more flexibility to invest based on client needs and preferences.

Betterment’s tax-smart automation fills the gap models alone can’t address by handling rebalancing, transitions, and capital gains considerations.

Integrating tax tools directly into model portfolios allows advisors to scale efficiently while staying focused on outcomes rather than upkeep.

As technology absorbs more operational work, advisors can spend more time on strategy, planning, and client relationships.

As advisory firms evolve from launch to scale, portfolio implementation can become a source of friction. Research, trading, rebalancing, and tax work all take time, pulling focus away from planning and client relationships. As a result, more advisors are turning to model portfolios to standardize execution and operate more efficiently—without giving up control or quality.

That shift is what fuels Betterment Advisor Solutions’ continued expansion of its model marketplace. By adding more model options from industry-leading asset managers, the marketplace unlocks deeper investment solutions based on advisor and client preferences. Paired with Betterment’s native tax-smart automation, these curated models help advisors save time, compress costs, and access top-tier strategies across exposures—resulting in less busywork, greater consistency, and more freedom to deliver the outcomes you envision for every client.

Where tax-smart automation enables personalization at scale

Model portfolios streamline portfolio construction, but they don’t address tax complexity on their own. Rebalancing, transitions, and capital gains management still require care—especially in taxable accounts.

Betterment’s tax-smart automation bridges that gap by integrating our tax tools directly into model portfolios. Advisors can take advantage of tax-loss harvesting on eligible models while keeping portfolios aligned to their target allocation, rebalance with sophisticated drift controls, simulate trades before execution, and get real-time insights into factors that could impact capital gains. The result is a more intuitive approach to tax management—one that makes it easier to personalize portfolios through model selection and risk alignment, while keeping implementation efficient and focused on outcomes—not upkeep.

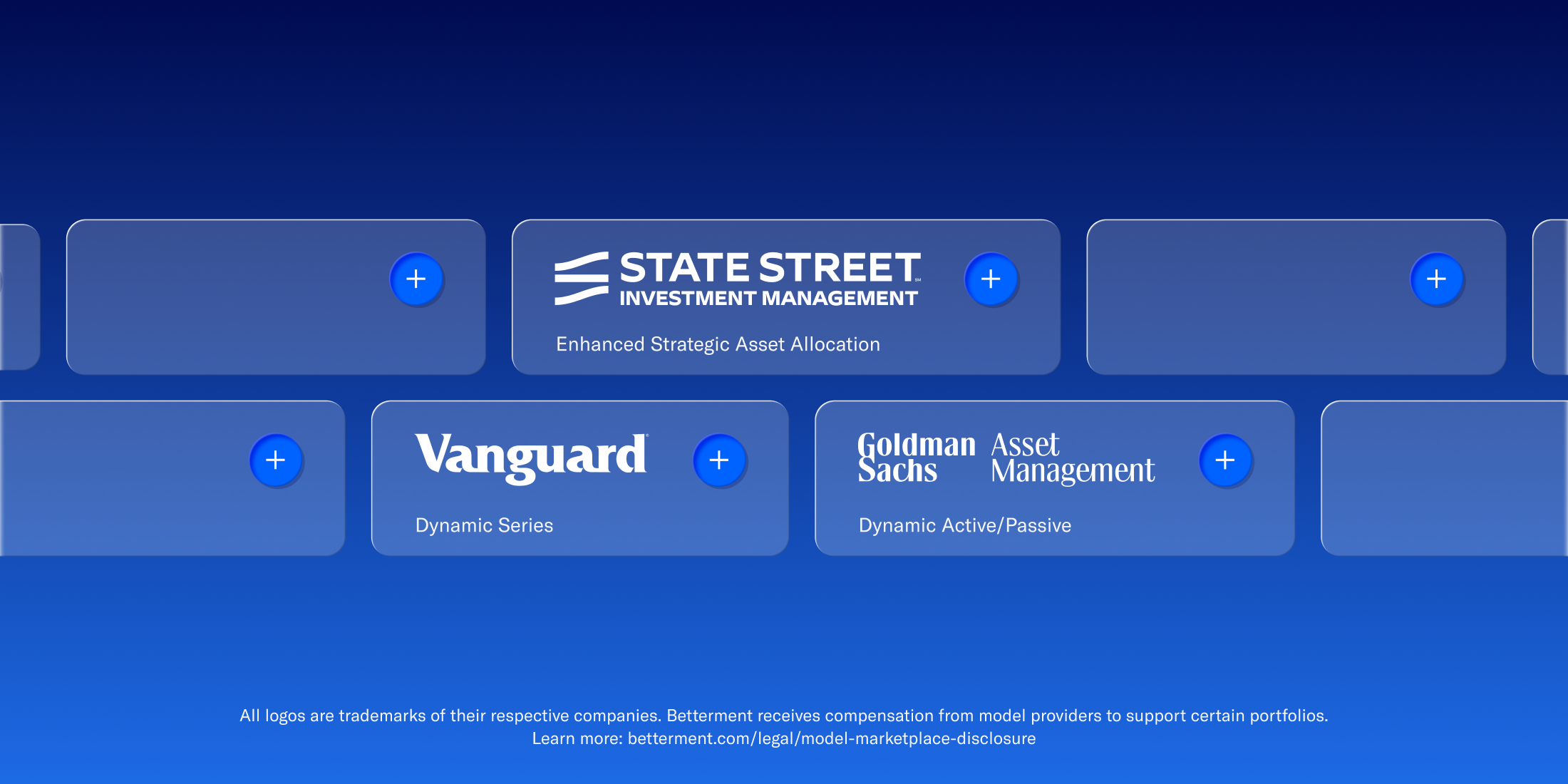

Power your portfolios with third-party model options

We partner with top providers across the industry so you can spend less time managing investments and more time with clients.

Designed to enable greater diversification and personalization, strategies from industry-leading asset managers help unlock a new level of portfolio management. Together with Betterment’s tax-smart automation, these models help you scale intelligently and bring expert-built models to every client. Learn more

What this means for the future of advisory work

As technology takes on more of the operational burden, the role of the advisor continues to evolve. You define strategy, risk, and outcomes, while technology handles the mechanics. Platforms that combine models with automation allow firms to grow without compromising quality, consistency, or personalization—making it easier to scale thoughtfully while staying focused on what matters most to clients.

Visit our model marketplace.

And don’t miss our upcoming webinar series featuring three of our top model providers. Betterment thought leaders and industry partners will share new strategies and practical ways to optimize portfolios for your firm. Save your spot here.