AI-driven markets and what advisors should watch in 2026

Key market trends advisors should keep an eye on in 2026, including AI-driven valuations, monetary policy shifts, and macro risks affecting stocks and bonds.

Key takeaways

Markets rallied in 2025, led by AI-driven mega-cap technology stocks, as valuations moved closer to historically elevated levels.

- Rising price-to-earnings ratios suggest investor optimism is increasingly tied to future AI profits rather than current earnings.

AI-driven market differentiation favored Google (+30% in Q4) while penalizing Oracle (-30%) and Meta (-10%) over execution concerns.

Gradual monetary easing and potential rate cuts in 2026 could support risk assets, provided inflation continues to cool.

Policy risks—particularly around their impact on employment and bond yields—remain the most significant threats to the current market narrative.

U.S. markets closed out 2025 with strong headline returns, driven largely by continued enthusiasm around artificial intelligence and a small group of mega-cap technology companies. At the same time, familiar late-cycle questions resurfaced: Are valuations running ahead of fundamentals? And how much patience will markets have for profits that remain more theoretical than realized?

Below, we look at what impacted performance in the fourth quarter of 2025 and what financial advisors should be watching in 2026. We cover elevated AI valuations, evolving monetary policy expectations, and the key macro risks that could reshape the outlook for both equities and bonds.

AI-driven returns dominated markets in Q4

Stocks rallied in 2025, driven largely by Big Tech companies racing to develop transformative AI. However, that enthusiasm increasingly reflects expectations about future profitability rather than earnings today.

And all of those businesses’ investments in AI infrastructure have turned up the volume on talks of an emerging AI bubble.

Valuations highlight growing reliance on future AI profits

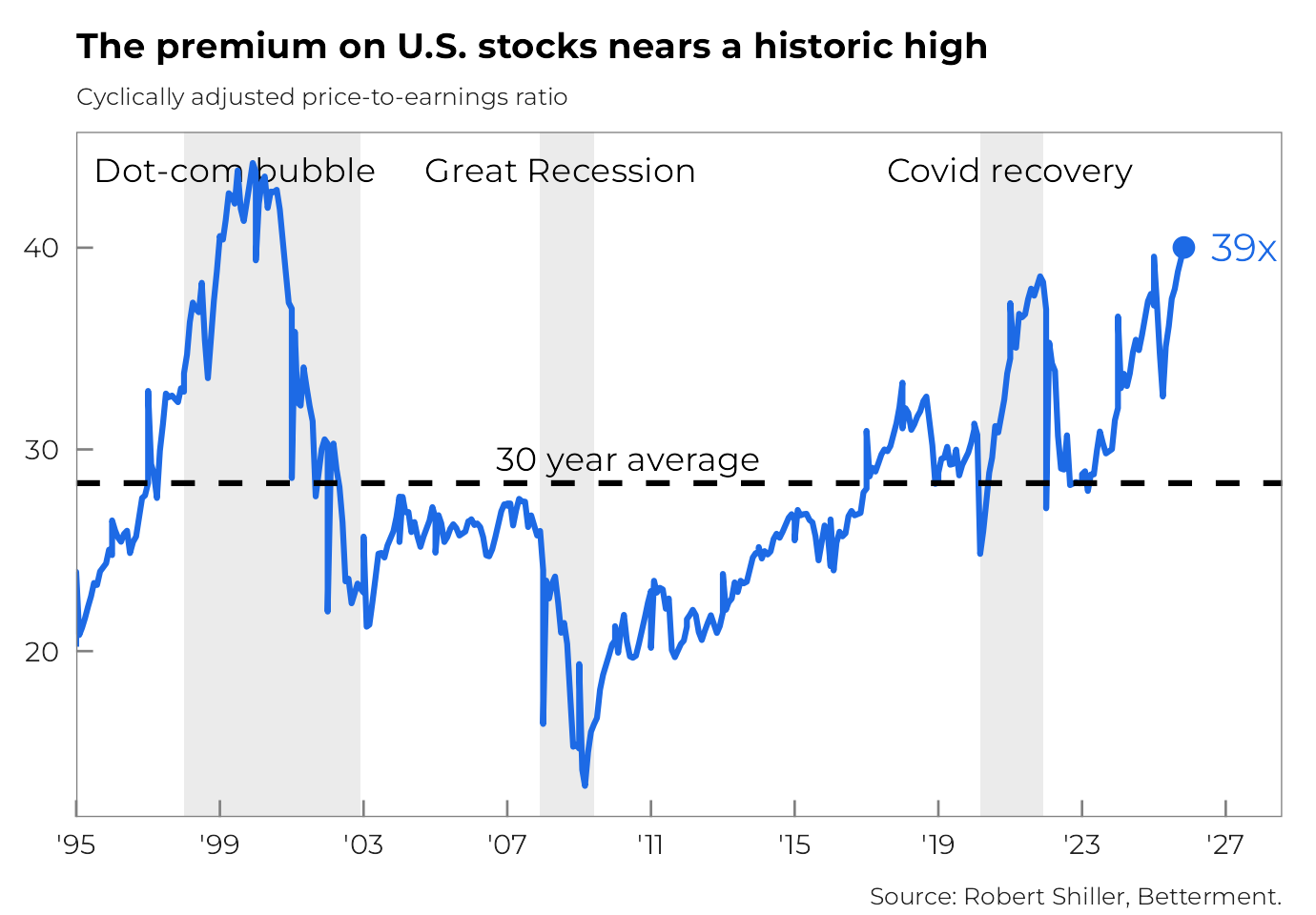

One of the clearest signals of elevated market expectations is the price-to-earnings (P/E) ratio, which compares current prices to current profits. How much are people paying to own the market, in other words, relative to its current profits?

If this ratio gets high enough, investors start to ask themselves whether such a steep cost is worth it for a piece of those earnings. Sometimes investors seek out better relative value—one reason international stocks outperformed in 2025—and sometimes they continue paying a premium for growth. But that dynamic becomes increasingly pinned on hopes of hypothetically larger profits down the road, not the earnings generated today.

So just how big are those AI hopes right now, and how relatively expensive is it for a share of the U.S. stock market’s earnings? We’re not at dot-com bubble levels, but we’re getting close.

AI investment spending is reshaping market leadership

Companies are committing enormous capital to expand their computing capacity, betting that scale and infrastructure will be critical to realizing AI’s long-term potential. As those investments have played out, the market has begun to highlight certain players, rewarding firms seen as better positioned to translate spending into durable earnings while penalizing those facing execution challenges. In the fourth quarter, shares of Google rose by nearly 30%, while Oracle and Meta declined by roughly 30% and 10%, respectively.

While AI dynamics explain much of recent equity performance, monetary policy remains a critical backdrop for markets in 2026.

Easing monetary policy could support markets in 2026

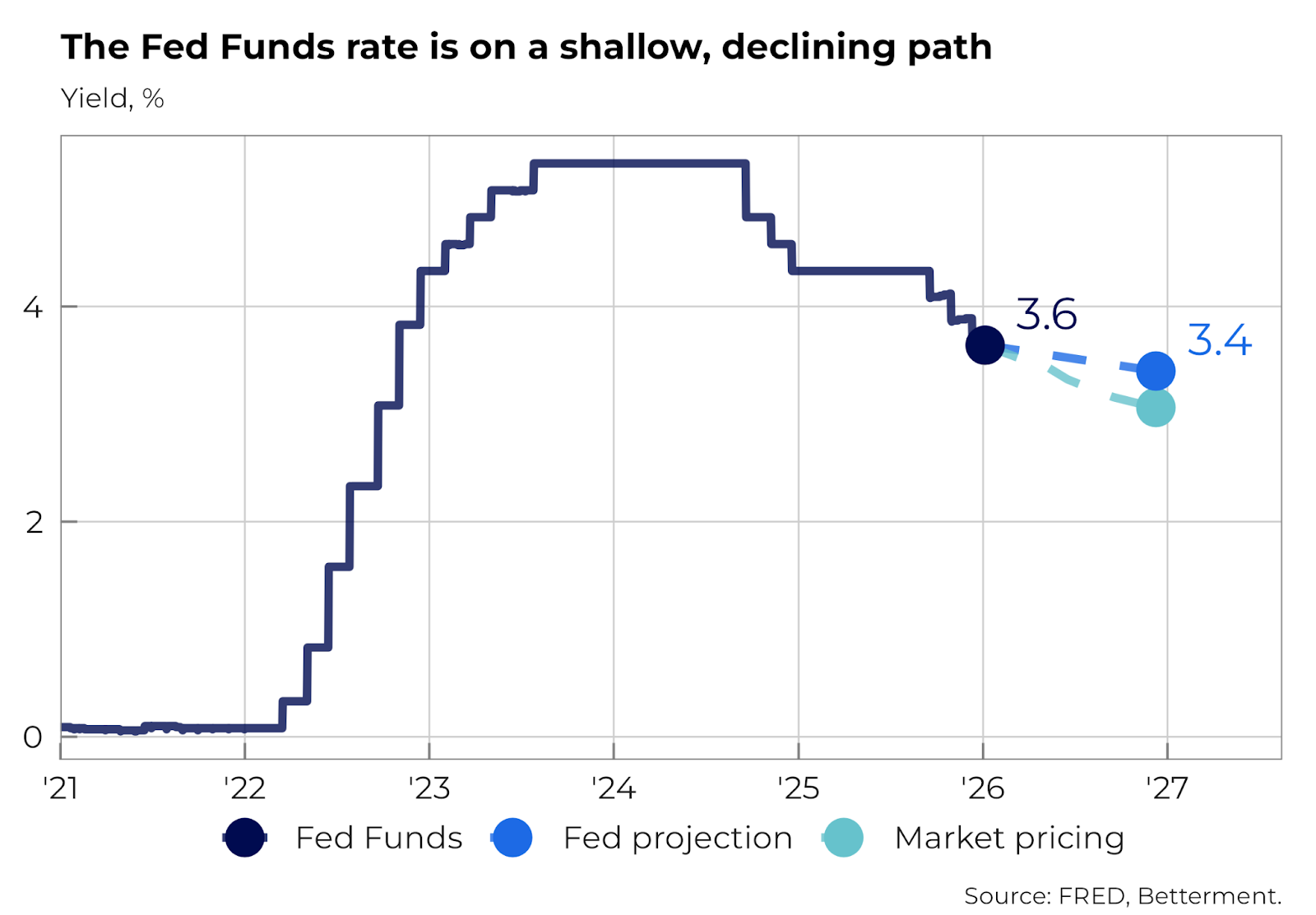

As labor market conditions and inflation have slowed, gradually easing interest rates may help cushion the market. The Federal Reserve cut its policy rate by 0.25% in December, and may do so again in 2026. The chart below illustrates the expected path of the federal funds rate based on both the median projection of members of the Federal Open Market Committee and rates implied by the pricing of market futures contracts.

Beyond rate policy, the Fed has also taken steps to support market liquidity. In December, the Fed announced that it will purchase short-term securities to ensure bank reserves are ample, supporting the smooth functioning of the financial system. Kevin Hassett, Director of the National Economic Council, appears likely to be tapped soon as Chair Jerome Powell’s replacement. Hassett would likely lean into a monetary policy accommodative to the economy and markets.

Why the macro backdrop remains constructive—but fragile

An outlook of continued economic growth, incrementally more accommodative financial conditions, and resilient corporate earnings offer a favorable backdrop for stocks in the first half of 2026. While valuations appear stretched in certain parts of the market, the last quarter has seen overall price action cool off, potentially setting the stage for further gains.

The impact of tariffs will likely continue to fade as we approach the one-year anniversary of “Liberation Day.” The Trump administration will take a more cautious approach to instigating surprises in the trade war in 2026, fearful of worsening affordability and market volatility in a midterm election year. Geopolitical developments involving President Maduro of Venezuela have already injected geopolitical uncertainty this year, yet we would expect the market impact to be muted overall, with effects, if any, showing up in oil prices.

Key risks that could disrupt the market in 2026

Despite a constructive baseline outlook, several downside risks warrant close attention. The main risk for markets lies in currently weak but stable job growth deteriorating significantly. A sharp rise in the unemployment rate would bring with it a downturn in consumer spending and a vicious cycle of more anemic demand leading to further job cuts.

A second, related risk involves financial conditions tightening rather than easing. A higher cost of borrowing and increased rates on safer securities could undermine the prices of riskier financial assets.